NOWPayments vs CoinPayments vs Larecoin: Which Slashes Your Merchant Fees Fastest?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Every Transaction Bleeds Money

You're processing crypto payments. Great.

But are you watching thousands drain away in platform fees?

Most merchants don't realize how percentage-based fees compound. Small percentages become massive costs at scale.

Let's break down exactly what NOWPayments, CoinPayments, and Larecoin actually charge: and which one stops bleeding your profits dry.

The Fee Structure Showdown

Here's where your money goes with each processor:

NOWPayments:

0.5% on single-currency payments

1% on multi-currency transactions

Network fees on top

Withdrawal fees baked in

Currency conversion spreads

CoinPayments:

0.5-1% transaction fees

Blockchain transfer costs

Conversion spreads

Withdrawal penalties

Hidden fees in exchange rates

Larecoin:

0% platform fees

Zero. None. Nothing.

Only Solana gas costs (pennies)

Self-custody = no withdrawal fees

Direct wallet-to-wallet transfers

Real Numbers: What You Actually Pay

Let's run the math on actual merchant volumes.

Processing $500K Annually:

NOWPayments: $2,500-$5,000 in fees

CoinPayments: $2,500-$5,000 in fees

Larecoin: Under $2,000 in gas costs

You save 50-60% immediately.

Processing $1.2M Annually:

NOWPayments: $9,000 in fees

CoinPayments: $6,000-$12,000 in fees

Larecoin: ~$2,000 in gas costs

You save 67-83% on processing.

Processing $5M Annually:

NOWPayments: $25,000+ in fees

CoinPayments: $25,000+ in fees

Larecoin: ~$5,000 in gas costs

You save 50-80% at enterprise scale.

Why Percentage Fees Destroy Margins

The traditional payment processor model is broken.

Percentage-based fees scale linearly with your success. The more you process, the more they take. It's a tax on growth.

Over 36 months processing $100K monthly:

NOWPayments bleeds ~$28,000 from your business

Larecoin costs ~$7,128 in total gas fees

That's $20,872 you keep. That's inventory. Marketing budget. Payroll. Expansion capital.

The gap widens exponentially as you grow.

At $500K monthly, percentage fees become suffocating. You're paying tens of thousands for... what exactly? Processing infrastructure you don't control. Custodial risk you can't eliminate. Withdrawal delays you can't avoid.

The Self-Custody Advantage

NOWPayments and CoinPayments hold your crypto. You request withdrawals. They approve them. Eventually.

That's not a payment processor. That's a custodian charging you rent.

Larecoin eliminates the middleman completely.

Payments land directly in your wallet. Your keys. Your crypto. Instant access. No withdrawal fees. No waiting periods. No permission required.

This isn't just about fees. It's about control.

Want to move funds at 2 AM? Do it. Need to pay suppliers immediately? Done. Want to stake your earnings? Your call.

Self-custody = merchant independence.

LUSD: Stability Without Volatility Risk

Accepting crypto is smart. Managing volatility is hard.

Larecoin's ecosystem includes LUSD: a stablecoin solution that shields you from price swings without conversion fees.

How it works:

Customer pays in any supported crypto

You receive LUSD (pegged 1:1 to USD)

Zero conversion spreads

Instant settlement

No intermediary holding your funds

NOWPayments and CoinPayments charge conversion fees when you swap to stablecoins. Every. Single. Time.

With Larecoin, conversion happens within the ecosystem. No extraction. No additional fees. Just stability when you need it.

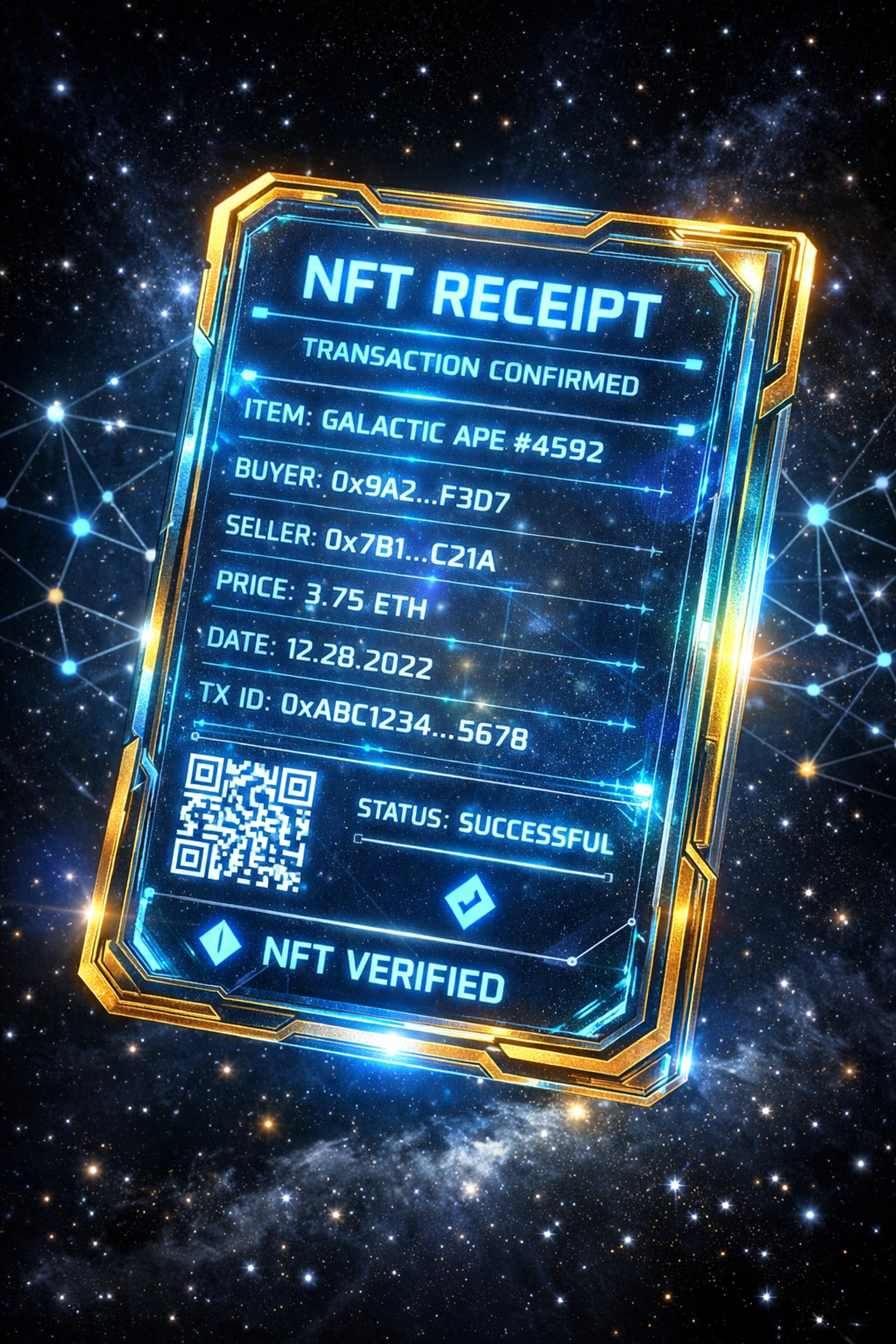

NFT Receipts: Every Transaction Is Trackable

Here's where Larecoin separates from legacy processors entirely.

Every payment generates an NFT receipt on Solana. Immutable proof of transaction. Permanent record. Blockchain-verified.

Why this matters:

Instant reconciliation

Audit trails that can't be altered

Proof of payment for warranty claims

Customer loyalty program integration

Collectible receipts for brand engagement

NOWPayments and CoinPayments send you... an email. Maybe a CSV file.

Larecoin gives you a blockchain-native record that doubles as a customer touchpoint.

Want to offer exclusive perks to customers who've purchased $X+ worth? Check their NFT receipt collection. Want to verify a transaction from six months ago? It's permanently on-chain.

This is Web3 infrastructure that actually adds value.

Hidden Costs of Centralized Processors

Let's talk about what NOWPayments and CoinPayments don't advertise.

Currency Conversion Spreads: They make money on exchange rates. The spread between market rate and what they give you is profit: extracted silently from every multi-currency transaction.

Withdrawal Delays: Your crypto sits in their custody. When you need it, you wait. Hours. Sometimes days. That's operational friction costing you opportunities.

Limited Control: They can freeze funds. Change terms. Adjust fees. You're at their mercy.

KYC/AML Overhead: Custodial services require compliance infrastructure. That means data collection, reporting requirements, and potential account restrictions.

Larecoin bypasses all of it. Self-custody means no one can freeze your funds. No waiting on withdrawals. No surprise fee increases.

The Math Is Brutally Clear

At every volume tier, Larecoin obliterates percentage-based fee models.

Small merchants ($50K/month): Save $300-600 monthly = $3,600-7,200 annually

Mid-size businesses ($250K/month): Save $1,500-3,000 monthly = $18,000-36,000 annually

Enterprise operations ($1M/month): Save $5,000-10,000 monthly = $60,000-120,000 annually

That's not rounding error. That's material impact on EBITDA.

For businesses operating on slim margins, fee savings translate directly to profitability. For growth-stage companies, it's capital that can fund expansion instead of feeding payment processors.

Merchant Freedom in the Web3 Era

NOWPayments and CoinPayments are Web2 companies offering crypto rails. They've bolted blockchain onto traditional payment infrastructure.

Larecoin is native Web3.

That means:

No custodial middleman

No permission required

No withdrawal limits

No account freezes

No "maintenance windows"

No terms that change overnight

You control your payment flow. Full stop.

This is the fundamental promise of crypto: disintermediation. Removing extractive middlemen. Enabling direct peer-to-peer value transfer.

Legacy processors reintroduce the very intermediaries blockchain was designed to eliminate.

Who Wins the Fee Battle?

If you process low volume and need extensive support, NOWPayments or CoinPayments might fit.

But if you want to actually keep your money, the answer is obvious.

Larecoin slashes fees faster than any competitor. Not by a little. By orders of magnitude.

Zero platform fees. Self-custody. NFT receipts. LUSD stability. Solana speed.

The question isn't whether Larecoin saves you money. It's how much you're willing to keep giving away to percentage-based processors.

Run the numbers on your volume.

Then decide if paying thousands in platform fees makes sense when a zero-fee alternative exists.

Explore the full Larecoin ecosystem at larecoin.com and see the complete breakdown of merchant savings in our Ultimate Guide to Web3 Global Payments.

The money you save isn't abstract. It's capital you control. Growth you fund. Independence you secure.

Stop paying rent to payment processors. Start keeping what you earn.

Comments