NOWPayments vs CoinPayments vs Larecoin: Which Web3 Global Payments Solution Slashes Your Fees the Most?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

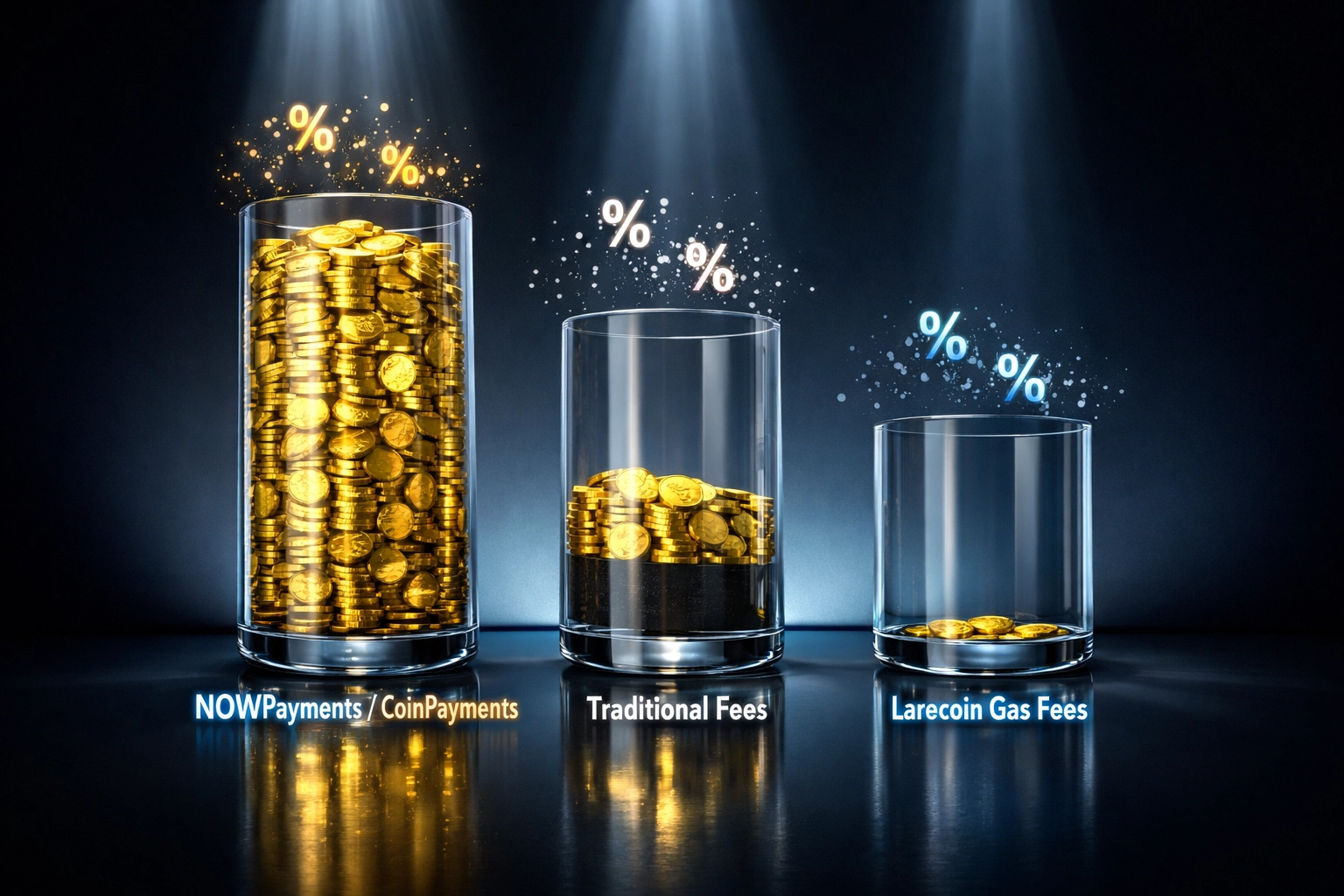

Merchant fees are bleeding businesses dry.

Traditional payment processors take 2-3% per transaction. Crypto gateways promise better rates. But do they deliver?

Let's cut through the noise. NOWPayments, CoinPayments, and Larecoin all claim low fees. Only one actually delivers gas-only pricing with zero platform cuts.

Here's the breakdown that'll make your CFO smile.

The Fee Structure Reality Check

Most crypto payment processors use the same playbook as legacy payment rails. They charge percentage-based fees. They add conversion spreads. They impose withdrawal minimums.

Sound familiar? It should. It's the same extraction model dressed in blockchain clothing.

NOWPayments Fee Structure:

0.5-1% per transaction

Variable network costs on top

Withdrawal fees apply

Currency conversion charges extra

Custodial model (they hold your funds)

CoinPayments Fee Structure:

0.5-1% per transaction

Separate network fees

Withdrawal thresholds and fees

Conversion spread markups

Custodial control of merchant funds

Larecoin Fee Structure:

0% platform fees

Solana gas only (~$0.00025 per transaction)

No withdrawal fees

No conversion charges

Self-custody from day one

The difference isn't subtle. It's structural.

Percentage-based models scale with your success. The more you process, the more they extract. Larecoin's gas-only approach flips this entirely.

Real Numbers From Real Businesses

Let's run the math on actual processing volumes.

At $500,000 Annual Processing:

NOWPayments/CoinPayments cost: $2,500-$5,000 in platform fees

Larecoin cost: Under $2,000 total (mostly network gas)

Your savings: 50-60%

At $1 Million Annual Processing:

NOWPayments/CoinPayments cost: $5,000-$10,000

Larecoin cost: Under $2,000

Your savings: 67-83%

At $5 Million Annual Processing:

NOWPayments/CoinPayments cost: ~$25,000

Larecoin cost: ~$5,000

Your savings: 50-80%

Notice the pattern? The gap widens as you scale.

Percentage models punish growth. Gas-only models reward it.

A cafe processing $50k monthly pays $250-$500 to NOWPayments. Same cafe on Larecoin? Under $15 monthly in gas fees.

That's $2,820-$5,820 saved annually. Enough to hire another barista. Upgrade equipment. Actually grow the business.

Why Gas-Only Beats Percentage Every Time

Solana processes transactions for fractions of a cent. That's the actual cost. Everything above that is margin extraction.

Traditional processors justify percentage fees with "risk management" and "fraud protection." In crypto, those costs don't exist the same way.

Blockchain transactions are irreversible. No chargebacks. No fraud vectors requiring insurance pools. The infrastructure cost is purely computational: gas fees.

Here's what you're NOT paying for with Larecoin:

Middleman platform fees

Custodial insurance premiums

Conversion spread markups

Withdrawal processing fees

Account maintenance charges

Volume-based tier penalties

You pay for the actual transaction. Nothing else.

Beyond Fees: Technical Advantages That Actually Matter

Price isn't everything. But when you're getting more features at lower cost, that's when smart merchants pay attention.

NFT Receipts for Accounting

Every Larecoin transaction can mint an NFT receipt. Immutable. Timestamped. Cryptographically verified.

Your accountant will thank you. Tax auditors can't dispute blockchain records. No more shoebox receipts. No more lost documentation.

NOWPayments and CoinPayments? Standard receipt systems. Nothing unique. Nothing immutable.

LUSD Stablecoin Integration

Larecoin supports LUSD: a decentralized, collateral-backed stablecoin. No central issuer. No freeze functions. True crypto stability without corporate control.

CoinPayments supports USDT and USDC: centralized stablecoins with blacklist functions. NOWPayments offers similar options.

When Tornado Cash addresses got sanctioned, USDC holders learned about centralized control the hard way. LUSD doesn't have that attack vector.

Self-Custody Merchant Accounts

This is the big one.

NOWPayments and CoinPayments hold your funds. You request withdrawals. They process when they want. Your money, their custody.

Larecoin gives you the keys. Literally.

Your wallet. Your funds. Your control. No withdrawal requests. No approval delays. No counterparty risk.

The Receivables Token Advantage

Larecoin isn't just a payment rail. It's a receivables management system.

Merchants can tokenize future receivables. Turn pending payments into liquid assets. Access capital without debt.

Try doing that with NOWPayments or CoinPayments. You can't. They're payment processors, not financial infrastructure.

This matters for cash flow. Big time.

Restaurant takes a catering deposit for an event three months out. With traditional systems, that money sits locked. With Larecoin, tokenize the receivable. Sell it at a discount for immediate liquidity. Buy ingredients now, deliver service later.

Supply chain businesses live and die on receivables management. Larecoin turns static payment data into dynamic financial tools.

Bank-Free Business Operations

Here's where Web3 payments prove they're not just cheaper: they're fundamentally different.

NOWPayments and CoinPayments still touch the banking system. They convert to fiat. They process withdrawals through traditional rails. Banks still have veto power.

Larecoin operates entirely on-chain. No bank accounts required. No intermediary approval needed.

This isn't theoretical. Businesses in 50+ countries face banking restrictions. Crypto-native operations. Cannabis dispensaries. Adult content creators. Export businesses in emerging markets.

Traditional payment processors: even crypto ones: require bank partnerships. Those partnerships impose restrictions.

Self-custody Web3 payments sidestep the entire structure.

The Custody Question Nobody Asks

When you use NOWPayments or CoinPayments, read the terms carefully.

They hold your funds. They process your withdrawals. They can freeze your account.

It's not paranoia. It's terms of service.

Every custodial platform has compliance requirements. AML checks. KYC verification. Transaction monitoring. Account freezes.

Larecoin's self-custody model eliminates this entirely. Your keys, your crypto, your control. No platform can freeze funds they never held.

Global Reach Without Global Fees

Cross-border payments expose the worst of percentage-based pricing.

Accept payment from Tokyo? NOWPayments and CoinPayments add conversion fees. Currency spread markups. International transaction surcharges.

Larecoin treats Tokyo and Toronto identically. Same gas fee. Same instant settlement. No conversion markup.

For businesses with international customers, this compounds fast.

E-commerce store with 40% international sales processing $2M annually. That's $800k in cross-border volume.

Traditional processors: 3-5% in combined fees = $24,000-$40,000

Crypto percentage processors: 1-2% = $8,000-$16,000

Larecoin: Gas only = ~$1,600

The math isn't close.

What This Actually Means For Your Business

Strip away the tech jargon. Ignore the blockchain hype.

Here's what matters:

You keep more of what you earn. Significantly more.

You control your funds. Completely.

You access financial tools legacy systems can't offer. NFT receipts. Receivables tokens. Self-custody accounts.

You operate globally without permission. No banks required.

That's not incremental improvement. That's structural advantage.

Making The Switch

Migration anxiety is real. Switching payment systems feels risky.

But the integration process is straightforward. API documentation at larecoin.com. Developer support included. Most merchants go live in under a week.

Start with partial integration. Run both systems parallel. Compare real results. Then scale Larecoin up as confidence grows.

The fee savings typically cover integration costs in the first month.

The Bottom Line

NOWPayments and CoinPayments improved on legacy payment rails. Lower fees than credit cards. Crypto acceptance. Decent platforms.

But they kept the percentage-based extraction model. They maintained custodial control. They added layers between merchants and their money.

Larecoin removes those layers entirely.

Gas-only pricing. Self-custody control. Web3-native infrastructure.

For merchants tired of giving away margin to middlemen, the choice is clear.

The question isn't whether to switch. It's how much longer you can afford not to.

Calculate your potential savings. Run your numbers. See what 50%+ fee reduction actually means for your bottom line.

Then make the call your CFO will love.

Comments