Reduce Merchant Interchange Fees by 50%: The Web3 Global Payments Revolution You Can't Ignore

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Your Payment Processor Is Quietly Bleeding You Dry

Let's do some math.

$500K in annual revenue. Sounds decent, right?

Traditional payment processors take 2.5% to 3.5% per transaction. That's $12,500 to $17,500 vanishing into thin air every single year.

Not into your pocket. Not reinvested into your business. Gone.

Banks, card networks, processors: they all take their cut. Layer after layer of intermediaries extracting fees while your business does the heavy lifting.

Web3 global payments flip this model on its head.

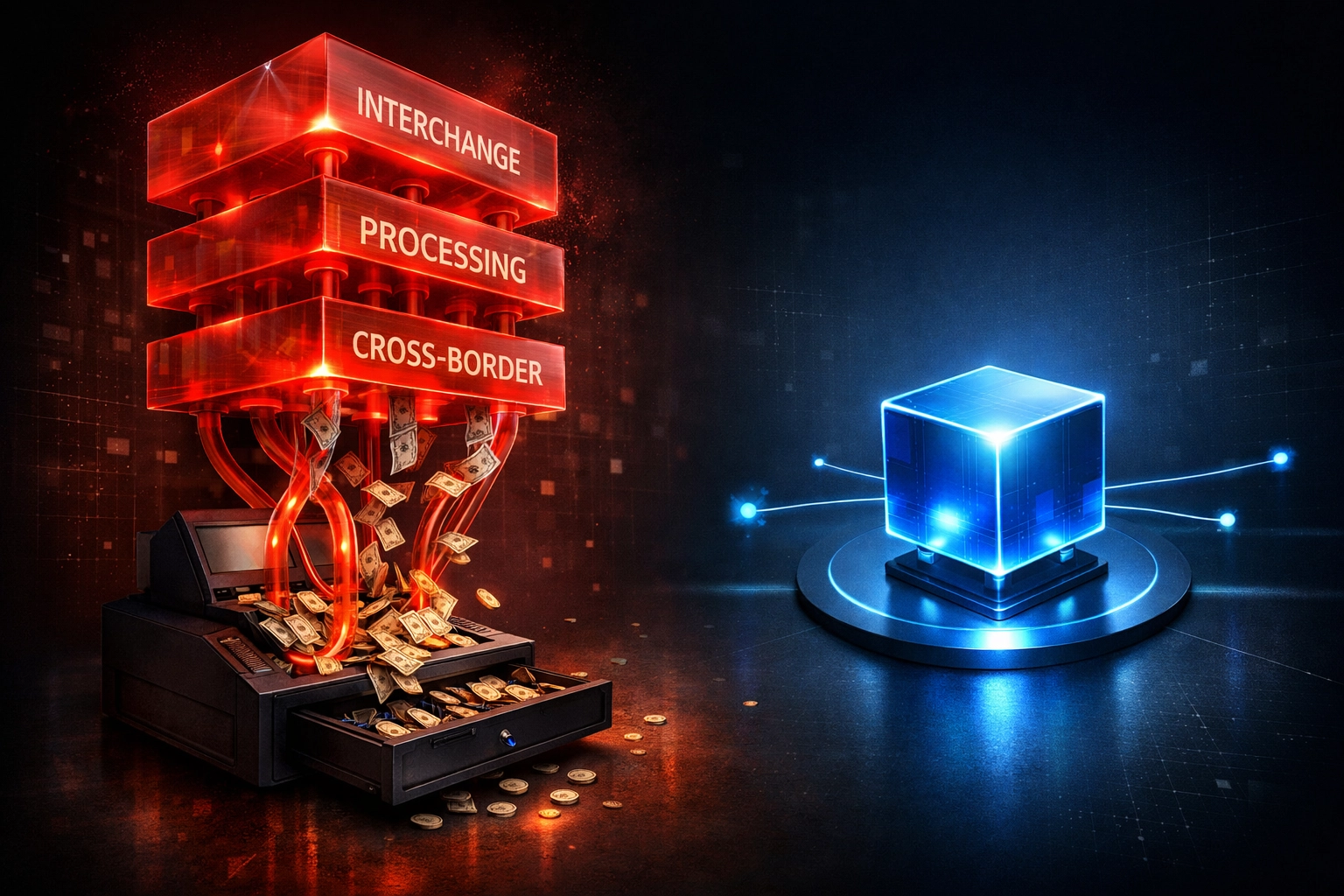

The Hidden Tax on Every Transaction

Here's what most merchants don't realize:

Traditional payment systems stack fees like a game of Jenga.

Interchange fees

Processing fees

Cross-border fees

Currency conversion charges

Settlement delays (2-7 business days)

Chargeback penalties

Monthly gateway fees

Each layer chips away at your margins. And for what? The privilege of accessing money that's already yours?

The system wasn't designed for merchants. It was designed to extract maximum revenue from merchants.

Enter Receivables Tokens: Your New Payment Infrastructure

Web3 global payments replace this entire broken system with programmable smart contracts.

Receivables tokens execute transactions directly on-chain. No banks. No processors. No card networks taking cuts.

Transaction costs stay constant regardless of size. A $100 payment costs the same to process as a $100,000 payment.

Traditional interchange fees? They scale with transaction volume. The more you make, the more they take.

Blockchain doesn't work that way.

Larecoin: Built Different From Day One

Most crypto payment processors are just traditional systems with a blockchain veneer.

Larecoin was architected from the ground up as a Web3-native payment solution.

Self-custody merchant accounts mean you control your funds. Always. No bank freezes. No processor holds. No "under review" status on YOUR money.

NFT receipts for accounting turn every transaction into a verifiable, immutable record. Tax time? Export your transaction history with one click. Every receipt, every detail, cryptographically secured.

LUSD stablecoin benefits eliminate volatility concerns. Accept payments in crypto, hold value in a decentralized stablecoin backed by real collateral. No exposure to corporate treasury risk like centralized stablecoins.

The Competitor Reality Check

Let's talk alternatives.

NOWPayments charges 0.5% per transaction. Better than traditional processors, sure. But you're still renting their infrastructure. Still trusting them with custody. Still waiting for withdrawals.

CoinPayments takes 0.5% plus network fees. Same custody model. Same withdrawal limitations. Same centralized control.

Triple-A offers merchant services but locks you into their ecosystem. Limited self-custody options. Fewer blockchain integrations.

Larecoin? Gas-only transfers. You pay network fees: that's it. No percentage cuts. No withdrawal fees. No platform taking their slice.

Real Numbers, Real Impact

Blockchain-based B2B cross-border payments hit $4.4 trillion in 2024. That's 11% of total B2B cross-border volume.

This isn't experimental anymore. This is production-scale adoption.

80% of Web3 global payments settle instantly. Another 88% settle within 24 hours. Zero correspondent banking hops.

Traditional systems? 3-5 intermediary hops per transaction. Each one extracting fees. Each one adding delays.

Your competitor using Larecoin gets their funds same-day. You're waiting 5 business days with traditional processors.

Who moves faster in their market?

Setup Takes 10 Minutes, Not 10 Days

Traditional merchant accounts:

Credit checks

Bank approval processes

Integration complexity

Multi-week onboarding

Larecoin merchant setup:

Configure self-custody wallet

Set up merchant portal

Generate payment links

Accept first payment

Time elapsed? Under 10 minutes. First transaction settles the same day.

No credit checks. No bank approval. No waiting.

The Crypto POS System for Small Business That Actually Works

Brick-and-mortar? Larecoin's contactless POS accepts crypto payments at the point of sale.

Your customer taps their phone. Transaction executes on-chain. Settlement happens in seconds.

Your old POS system batches transactions overnight. Larecoin settles before your customer walks out the door.

Cash flow improvement? Immediate.

Bank-Free Business Operations Are Here

Financial sovereignty isn't a buzzword anymore. It's a competitive advantage.

Larecoin merchants operate without traditional banking infrastructure. Over 70 countries now have live instant payment schemes connecting to blockchain networks.

Your business goes global without correspondent banking relationships. Without currency conversion fees. Without cross-border wire delays.

One wallet. Multiple chains. Universal access.

The Tech Stack That Matters

Receivables token architecture enables conditional settlements. Delivery confirmation? Funds release automatically. Multiple-party splits? Built into the smart contract. Escrow functionality? Native to the protocol.

Traditional payment systems can't do this. They're rails for moving money. They're not programmable.

Web3 payments are programmable money.

NFT receipts aren't just accounting tools. They're proof of transaction history that travels with you. Switch accounting software? Your receipts remain accessible on-chain forever.

LUSD stablecoin integration means stability without centralized counterparty risk. No single company can freeze LUSD. No treasury can collapse and take your holdings with it.

Stop Renting, Start Owning

Every percentage point you save compounds over time.

Cut fees from 3% to 1.5%? That's 50% savings immediately.

Cut fees to gas-only with Larecoin? That's 98%+ savings for many transactions.

On $500K annual revenue, you're keeping an extra $15,000+ per year. On $5M? That's $150,000 back in your business.

Scale matters. Fee structure matters more.

The Migration Path Is Simpler Than You Think

You don't need to flip a switch overnight.

Run Larecoin alongside your existing payment processor. Test with a few customers. See the difference in settlement speed and fees.

As you build confidence, shift more volume to Web3 global payments.

Eventually? Traditional processors become your backup, not your primary.

Join the Revolution

Web3 global payments aren't coming. They're here.

Over $4 trillion processed in 2024. Growing double-digits year over year.

Your competitors are already exploring this. Some have already switched.

The question isn't whether Web3 payments become standard. The question is whether you adopt early enough to benefit from the competitive advantage.

Reduce merchant interchange fees by 50%+. Get instant settlement. Maintain self-custody. Accept payments globally.

Start with Larecoin today.

The revolution won't wait for permission.

Comments