Stop Wasting Money on Interchange Fees: 7 Quick Hacks to Reduce Merchant Costs with Web3 Global Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Interchange fees are bleeding your business dry.

Every swipe. Every tap. Every online checkout.

Visa takes 2.4%. Mastercard takes 2.6%. Add in acquiring banks, payment processors, currency conversion spreads, and you're looking at 4-6% per transaction for cross-border payments.

That ends today.

Web3 global payments slash merchant costs by 50-86% compared to traditional card networks. No intermediaries. No correspondent banks. No multi-day settlement delays.

Just direct, peer-to-peer value transfer with fees under 1%.

Here's how Larecoin merchants are saving $42,000-$50,000 annually on a $2 million processing volume. Seven actionable hacks you can deploy this week.

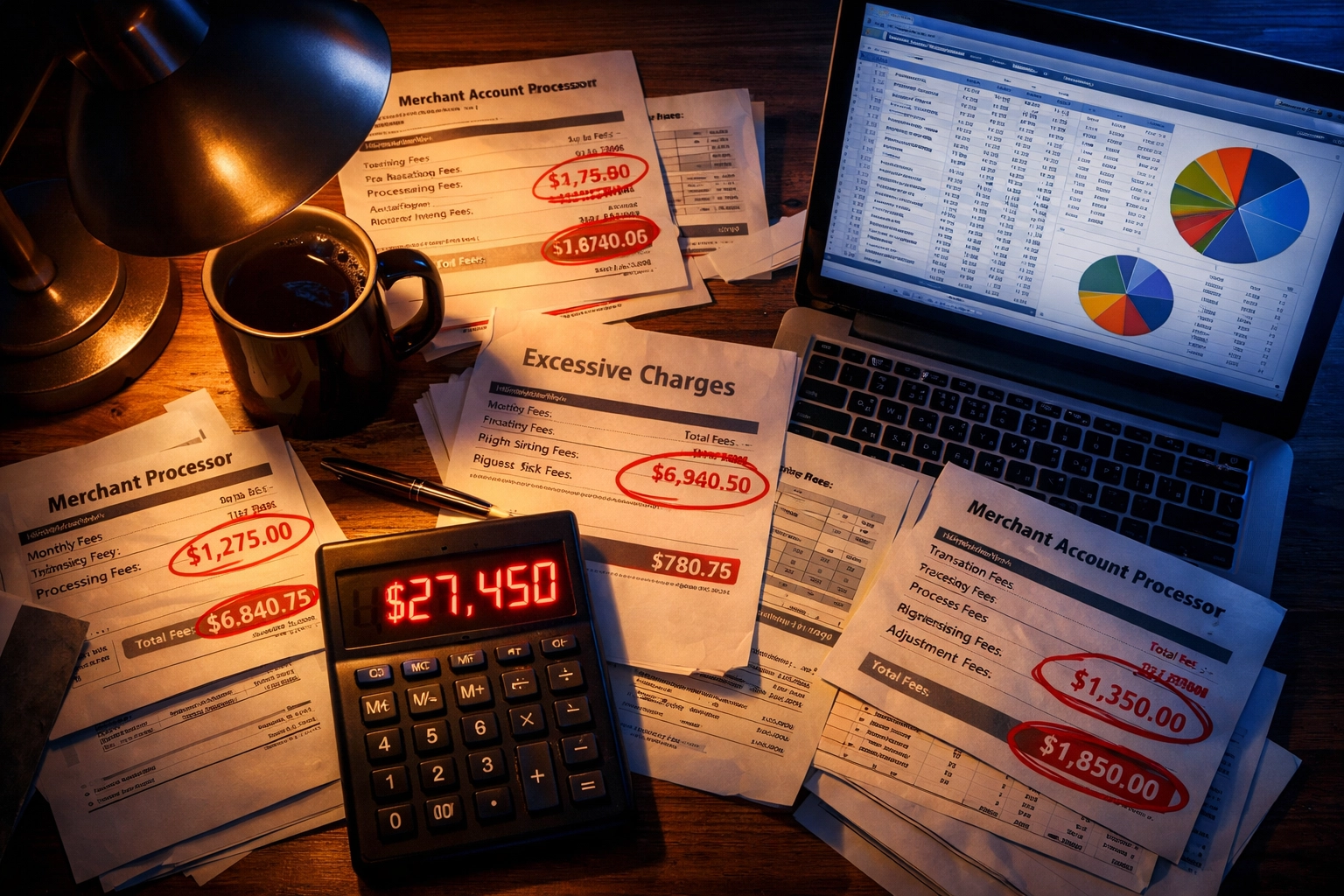

Hack #1: Audit Your Real Payment Stack Costs

Pull your last 90 days of processing statements.

Calculate your true effective rate: not the advertised rate your processor promised you.

Include:

Base interchange fees

Assessment fees

Processor markup

Monthly minimums

PCI compliance fees

Chargeback fees

FX conversion spreads (the hidden killer)

Settlement delay opportunity cost

Most merchants discover they're paying 3-5% total. Cross-border? Add another 1-3%.

Real numbers: A business processing $500,000 annually pays $15,000-$30,000 in total payment costs. That's a down payment on a Tesla. Or three new hires. Or pure profit margin expansion.

Benchmark this against Web3 rails where total costs drop to 0.5-1.2%.

Hack #2: Integrate Stablecoin Checkout with LUSD

Stablecoins eliminate interchange entirely.

No Visa. No Mastercard. No banks. Just direct wallet-to-wallet settlement on public blockchain infrastructure.

Why LUSD specifically?

Larecoin's native stablecoin (LUSD) offers:

Full USD peg stability

Zero volatility risk during checkout

Instant settlement (5-minute finality vs. 3-7 day ACH)

Self-custody compatible

Rigorous US compliance framework (MSB registered, state MTL strategy)

Start with international customers where savings are most dramatic. A $10,000 cross-border transaction:

Traditional Rails:

Fee: $330+ (3.3%)

Settlement: 3-7 business days

FX spread: additional 2-4%

LUSD on Larecoin:

Fee: $66 (0.66%)

Settlement: 5 minutes

No FX spread (USD-denominated)

You just saved $264 per transaction. Scale that across hundreds of payments monthly.

NOWPayments and CoinPayments offer crypto checkout, but lack native stablecoin infrastructure with US regulatory compliance. Larecoin built LUSD from the ground up for merchant use cases: not as an afterthought.

Hack #3: Activate Self-Custody Settlement

Traditional payment processors hold your funds hostage.

Reserve requirements. Rolling reserves. Settlement delays. Arbitrary account freezes.

Self-custody changes the game.

With Larecoin, merchants maintain direct control of receivables in their own Web3 wallets. No intermediary custody. No processor holding your working capital for 72 hours.

Payment arrives → Instantly in your wallet → Deploy capital immediately.

This isn't just philosophical. It's financial efficiency.

Calculate opportunity cost: If you process $2 million annually with 3-day settlement delays, you have ~$16,400 perpetually locked up. At 8% cost of capital, that's $1,312 in annual drag.

Self-custody eliminates that entirely.

CoinPayments requires custodial wallets for certain transaction types. NOWPayments offers non-custodial options but lacks the integrated ecosystem Larecoin provides with LareBlocks/LareScan for transparent transaction verification.

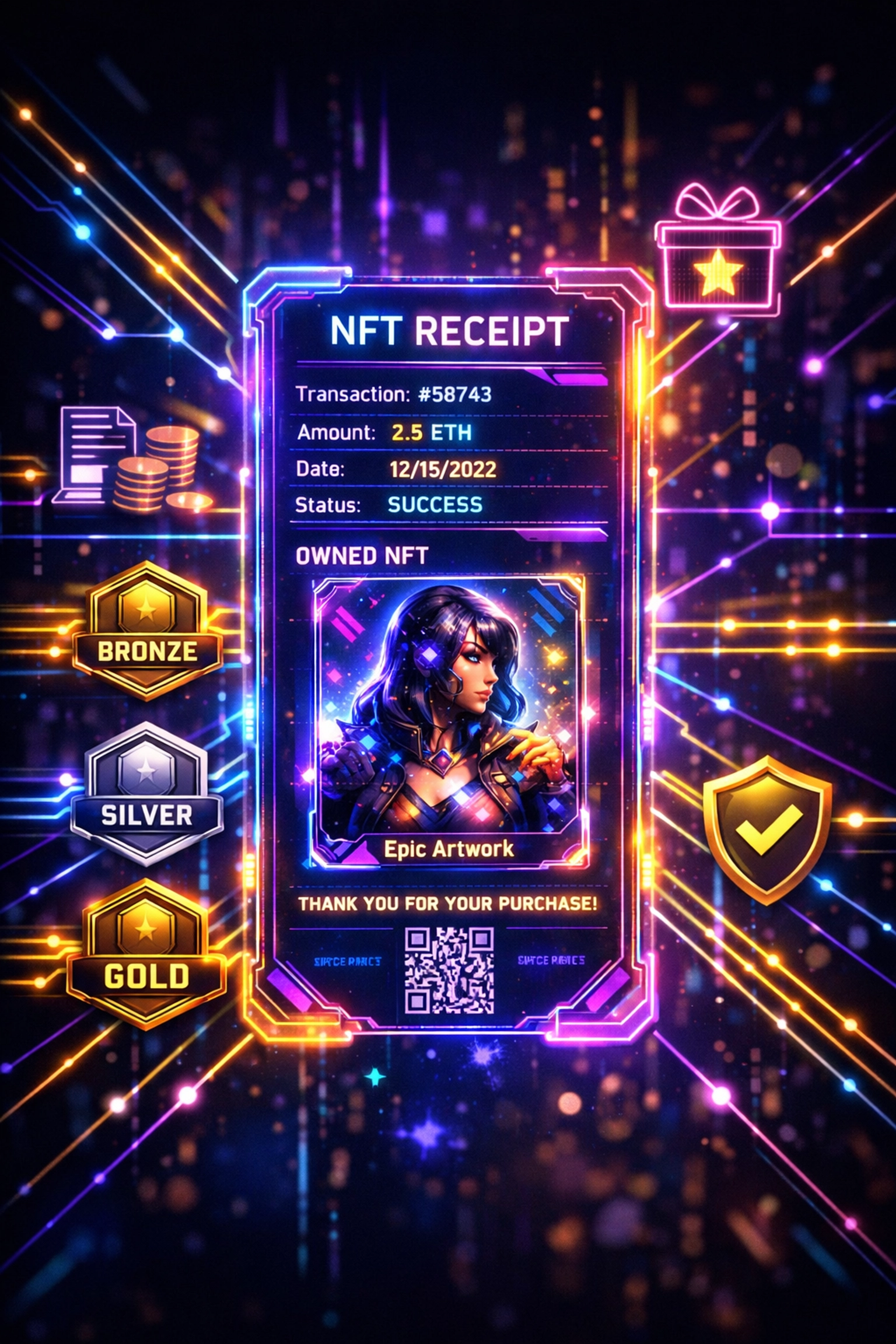

Hack #4: Deploy NFT Receipt Technology

Every payment generates an NFT receipt on Larecoin.

This isn't gimmicky. It's revolutionary.

Benefits:

Immutable proof of payment

Automatic accounting reconciliation

Customer loyalty program infrastructure

Verifiable transaction history

Chargeback defense documentation

Traditional receipts are PDFs in email. Easily forged. Frequently lost. Zero programmability.

NFT receipts are cryptographically signed, timestamped blockchain records. They double as:

Digital collectibles for brand engagement

Tiered rewards triggers (spend $500 → silver tier NFT)

Resale marketplace opportunities

Community membership tokens

One Larecoin merchant turned NFT receipts into a secondary revenue stream. Customers trade limited-edition receipts from exclusive product drops. The merchant earns 2.5% royalty on every secondary sale.

Neither NOWPayments nor CoinPayments offer native NFT receipt infrastructure. You'd need separate smart contracts, wallet integrations, and custom development.

Larecoin includes it standard.

Hack #5: Enable Multi-Chain Payment Rails

Don't limit yourself to one blockchain.

Larecoin operates across Solana, Ethereum, and expanding networks. Customers pay with whatever crypto they hold: you receive LUSD stablecoin automatically.

The conversion happens invisibly:

Customer pays 0.5 ETH

Larecoin protocol converts to LUSD at market rate

You receive $1,247 LUSD in your wallet

Customer sees seamless checkout

This eliminates the "which token?" problem that plagued early crypto payments.

CoinPayments supports 2,000+ cryptocurrencies but charges 0.5% conversion fees on top of base rates. NOWPayments offers 200+ tokens with similar conversion markups.

Larecoin's multi-chain infrastructure is fee-optimized. You pay network gas only: no protocol conversion tax.

Hack #6: Eliminate Chargeback Risk Completely

Chargebacks cost merchants 0.5-1% of annual revenue.

Fraudulent disputes. Friendly fraud. Representment fees. Operational overhead managing disputes.

Blockchain transactions are final.

No reversals. No chargebacks. No dispute process.

Once payment hits your wallet, it's yours. The customer can't call their card issuer and claw back funds 90 days later.

This fundamentally changes unit economics for high-chargeback industries:

Digital goods (0% chargeback vs. 3-5% card average)

Travel bookings (0% vs. 2-4%)

Subscription services (0% vs. 1-2%)

For a merchant processing $1 million annually with 1.5% chargeback rate, that's $15,000 in pure savings.

Traditional payment rails can't offer this. Card networks legally require chargeback rights. It's baked into Visa/Mastercard operating regulations.

Web3 payments don't operate under those rules.

Hack #7: Target Cross-Border Operations First

Domestic interchange fees are regulated and relatively fixed.

Cross-border fees are the Wild West.

International payment stack costs:

Interchange: 2.5-3.5%

Currency conversion: 2-4% FX spread

Cross-border assessment: 0.4-1%

Correspondent banking: $25-45 flat fee

Settlement delays: 5-10 business days

Total effective cost: 5-8% plus opportunity cost.

Web3 global payments:

Network fee: 0.2-0.8%

No FX spread (stablecoin denominated)

No correspondent banks

Settlement: 5 minutes

If 30% of your revenue comes from international customers, prioritize Web3 rails there first. The ROI is immediate and measurable.

Larecoin's MSB registration and state MTL compliance strategy means you can accept global payments without regulatory uncertainty. NOWPayments operates offshore with unclear US licensing. CoinPayments has limited state coverage.

Regulatory clarity = sustainable business operations.

The Compliance Advantage Nobody Talks About

Here's what separates Larecoin from every competitor.

US regulatory compliance is not optional.

It's the difference between building a real business and praying regulators don't notice you.

Larecoin maintains:

Money Services Business (MSB) federal registration

State Money Transmitter License (MTL) expansion strategy

AML/KYC protocols meeting FinCEN standards

Transaction monitoring and reporting infrastructure

This matters when you're processing millions in merchant volume.

NOWPayments routes through foreign entities. CoinPayments has faced regulatory scrutiny. Neither prioritizes US compliance the way Larecoin does.

You're not just choosing cheaper fees. You're choosing a partner that won't disappear when regulators start asking questions.

Real Merchant Results

Mid-size e-commerce merchant. $2 million annual processing volume.

Before Larecoin (traditional cards):

Total fees: $60,000 annually

Settlement time: 3 days average

Chargeback losses: $18,000

Total cost: $78,000

After Larecoin (70% Web3, 30% traditional mix):

Web3 fees: $12,000

Traditional fees: $6,000

Settlement: instant

Chargeback losses: $0 (Web3 portion)

Total cost: $18,000

Annual savings: $60,000.

That's not theoretical. That's actual P&L impact.

Implementation Timeline

Week 1: Add Larecoin checkout widget to your site Week 2: Monitor Web3 adoption rate (typically 5-15% initially) Week 3: Promote LUSD payments with 2% discount incentive Week 4: Expand to all international customers

Start small. Scale based on data.

You don't need to flip 100% of volume overnight. Even 20% Web3 adoption generates 5-figure annual savings for mid-size merchants.

The Bottom Line

Interchange fees are a 1970s business model running on 1950s infrastructure.

Web3 global payments are here. They work. They save money.

Larecoin combines:

Sub-1% total payment costs

LUSD stablecoin stability

NFT receipt innovation

Self-custody control

Multi-chain flexibility

US regulatory compliance

NOWPayments and CoinPayments offer pieces of this puzzle. Nobody offers the complete integrated solution.

Stop wasting money on interchange fees.

Start accepting payments that cost 50-86% less.

Your margin will thank you.

Ready to slash payment costs?Set up your Larecoin merchant account and start saving this week.

Comments