The Merchant's Guide to Financial Sovereignty: How Receivables Tokens Beat Traditional Payment Processors

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 4 min read

You're losing $28,000+ annually to payment processors.

That's the reality for merchants processing $1 million in revenue through traditional systems. Interchange fees. Settlement delays. Chargeback fraud. Hidden costs everywhere.

Receivables tokens change everything.

The Financial Sovereignty Problem

Traditional payment processors control your money.

They hold your funds for 30-90 days. They charge 2-3.5% per transaction. They freeze accounts without warning. They impose arbitrary compliance requirements.

You built your business. You served your customers. But you're waiting months to access your own capital.

This isn't sovereignty. This is dependency.

How Receivables Tokens Work

The process is dead simple:

Step 1: Issue invoice to customer Step 2: Invoice becomes blockchain token Step 3: Investors purchase token at discount Step 4: You receive immediate capital Step 5: Customer pays, token holders get return

No banks. No credit checks. No personal guarantees.

Your $100,000 in receivables becomes liquid capital within 24 hours. The blockchain handles settlement. Smart contracts enforce payment terms. You control everything from your wallet.

Traditional factoring charges 3-5% fees. Receivables tokens cost approximately 1.5%.

Same-day settlement versus 90-day waiting periods.

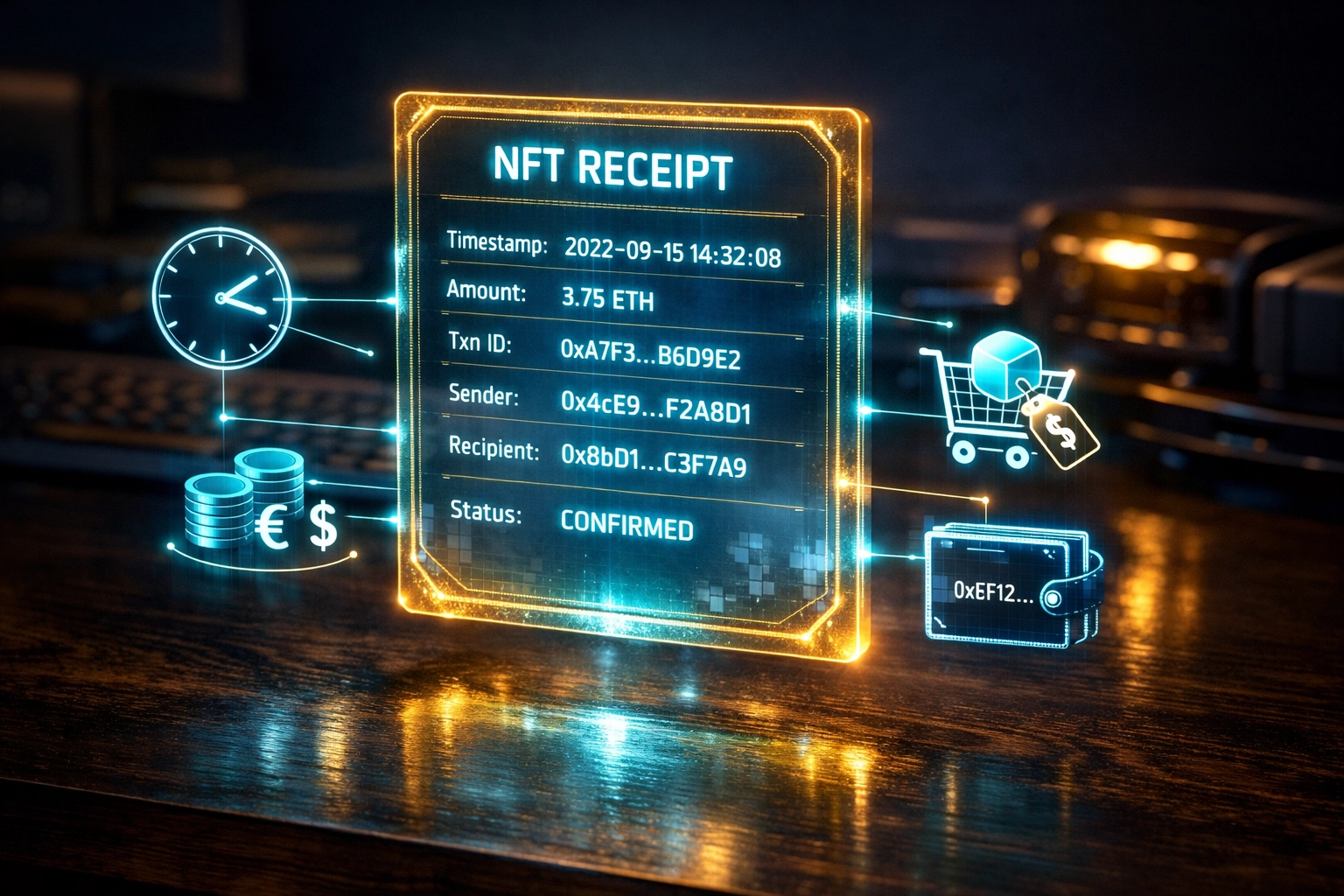

The NFT Receipt Revolution

Every transaction generates an NFT receipt.

This isn't a gimmick. This is infrastructure.

Each NFT contains complete transaction metadata:

Timestamp (immutable)

Transaction amount (verified)

Items purchased (detailed)

Wallet addresses (cryptographically linked)

Payment terms (smart contract enforced)

Your accountant exports directly from blockchain. No reconciliation across multiple processors. No manual entry. No errors.

Tax season becomes automatic. IRS compliance is built-in. Audit trails are cryptographically verified.

Plus: You own these receipts. Forever. No third party controls your transaction history.

LUSD Stablecoin Advantages

Price volatility kills merchant adoption.

LUSD solves this without centralized control.

Traditional stablecoins like USDC or USDT require trusted issuers. They can freeze funds. They comply with government mandates. They're not sovereign.

LUSD is algorithmically maintained. Decentralized collateral backing. No company controls issuance. No freeze function exists.

For merchants, this means:

Predictable pricing - $100 invoice stays $100

No depegging risk - Algorithm maintains value

True self-custody - Nobody can freeze your stablecoin

Global acceptance - Same value everywhere

When you accept LUSD through Larecoin, you get stablecoin benefits with sovereign money principles.

No waiting for Coinbase to "approve" your withdrawal. No PayPal freezing your balance. No bank questioning your business model.

Self-Custody: The Non-Negotiable Requirement

Web3 payments without self-custody isn't Web3.

It's just traditional banking with blockchain theater.

Larecoin gives you the private keys. Your wallet. Your control. Your funds settle to addresses you own: not company-controlled custodial wallets.

Compare this to alternatives:

NOWPayments: Custodial wallet required. They hold your crypto. Settlement to their addresses first. Then they transfer to you (maybe). Average withdrawal time: 24-48 hours. Hidden custody risks.

CoinPayments: Mixed custody model. Some self-custody options. But premium features require custodial accounts. Withdrawal limits exist. Verification delays common.

Larecoin: Pure self-custody from first transaction. Funds hit your wallet immediately. No withdrawal process. No custody risk. No intermediary control.

This matters when:

Exchange gets hacked (you're not affected)

Processor freezes accounts (can't happen to you)

Regulatory changes restrict withdrawals (you already have funds)

Company faces bankruptcy (your money isn't in their pool)

Self-custody is financial sovereignty. Everything else is permission-based finance.

The Real Cost Comparison

Let's run actual numbers.

$1 Million Annual Revenue Merchant:

Traditional Processors:

Transaction fees: $25,000-$35,000

Chargeback losses: $15,000

Factoring costs: $0 (no access to receivables financing)

Total Cost: $40,000+

Larecoin Receivables Tokens:

Gas fees: $3,000-$5,000

Receivables discount: $7,000-$10,000

Chargeback protection: Smart contract verification

Total Cost: $12,000

Annual Savings: $28,000+

$2 Million Annual Revenue Merchant:

Traditional: $80,000+ in fees Larecoin: $27,000 in total costs Annual Savings: $53,000+

The savings scale with volume. The bigger you grow, the more you save.

And you get immediate capital access. No waiting 30-90 days for settlement.

Why Larecoin Beats Competitors

NOWPayments and CoinPayments offer crypto payment processing.

Larecoin offers financial sovereignty infrastructure.

NOWPayments limitations:

Custodial wallets (they control funds)

No receivables tokenization

Standard 0.5% fee (doesn't include gas)

Limited stablecoin options

No NFT receipt system

CoinPayments limitations:

Custodial for premium features

No receivables financing

0.5% fee plus network costs

Complicated withdrawal process

Generic transaction records

Larecoin advantages:

Pure self-custody architecture

Receivables token financing built-in

Gas-only transfer option (50%+ fee reduction)

LUSD decentralized stablecoin integration

NFT receipts with complete metadata

Same-day settlement

Global operation without restrictions

You're not choosing between payment processors.

You're choosing between dependency and sovereignty.

Implementation Reality Check

Merchants complete transition in two weeks.

The learning curve is minimal. The setup is straightforward. The results are immediate.

Physical retail? Contactless POS terminals handle blockchain payments. E-commerce? Plugin integrations work with existing platforms. Service business? Invoice tokenization happens automatically. Subscription model? Smart contracts handle recurring payments.

85-95% of merchants report dramatic cost reductions within first month.

Cash flow improves immediately through instant settlement.

Accounting becomes simpler through blockchain exports.

And you maintain traditional payment options for mainstream customers who aren't crypto-native yet. Receivables tokens handle the financing side. Stablecoins handle crypto-native transactions. Traditional processors handle legacy customer preferences.

This isn't either/or. This is optimal stack architecture.

The Sovereignty Decision

Traditional payment processors built their models on merchant dependency.

Long settlement times create working capital gaps. High fees extract maximum revenue. Account freezes maintain control. The system works for them: not for you.

Receivables tokens flip the model.

You tokenize future payments. You access capital immediately. You control settlement. You own transaction records. You maintain sovereignty.

The technology exists today. The savings are proven. The implementation is straightforward.

Question is: How much longer will you pay $28,000+ annually for the privilege of waiting 90 days to access your own money?

Financial sovereignty isn't coming.

It's here.

Ready to cut payment processing costs by 50%+?Explore Larecoin's receivables token infrastructure and join merchants taking control of their financial future.

Comments