The Ultimate Guide to Web3 Global Payments: Everything Merchants Need to Know About LUSD, Gas-Only Transfers, and MTL Compliance

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

The Payment Revolution Merchants Can't Ignore

Traditional payment processors are bleeding merchants dry.

3-5% interchange fees per transaction. Currency conversion markups. Chargebacks. Settlement delays. Monthly minimums.

Web3 payments flip the script entirely.

Merchants keep 97-99% of every transaction. Instant settlement. Self-custody. Zero chargebacks. Global reach without FX penalties.

The math isn't complicated. A $100,000 monthly volume costs $3,000-$5,000 in traditional fees. Web3 infrastructure? Under $100.

That's not optimization. That's survival.

Why LUSD Changes Everything for Merchant Settlement

Stablecoin settlement isn't new. But most solutions use USDC or USDT: centralized assets with counterparty risk.

LUSD is different.

Decentralized collateral. LUSD is backed entirely by ETH on Liquity Protocol. No corporate treasury. No bank dependencies. No BlackRock involvement.

Algorithmic stability. The redemption mechanism keeps LUSD pegged without centralized intervention. Price deviations self-correct through arbitrage.

Zero fees on redemption. Convert LUSD to ETH anytime with minimal slippage. No permission required. No compliance delays.

For merchants, this means:

Predictable settlement values

Instant conversion to fiat or crypto

No reliance on Circle or Tether policy changes

Self-custody without volatility risk

Larecoin merchant terminals auto-convert customer crypto payments to LUSD at POS. Customers pay in BTC, ETH, SOL: whatever. Merchants receive stable value instantly.

Traditional processors can't match this. NOWPayments and CoinPayments offer USDC settlement but lack algorithmic stability mechanisms. Triple-A still relies on custodial infrastructure.

LUSD settlement is sovereignty.

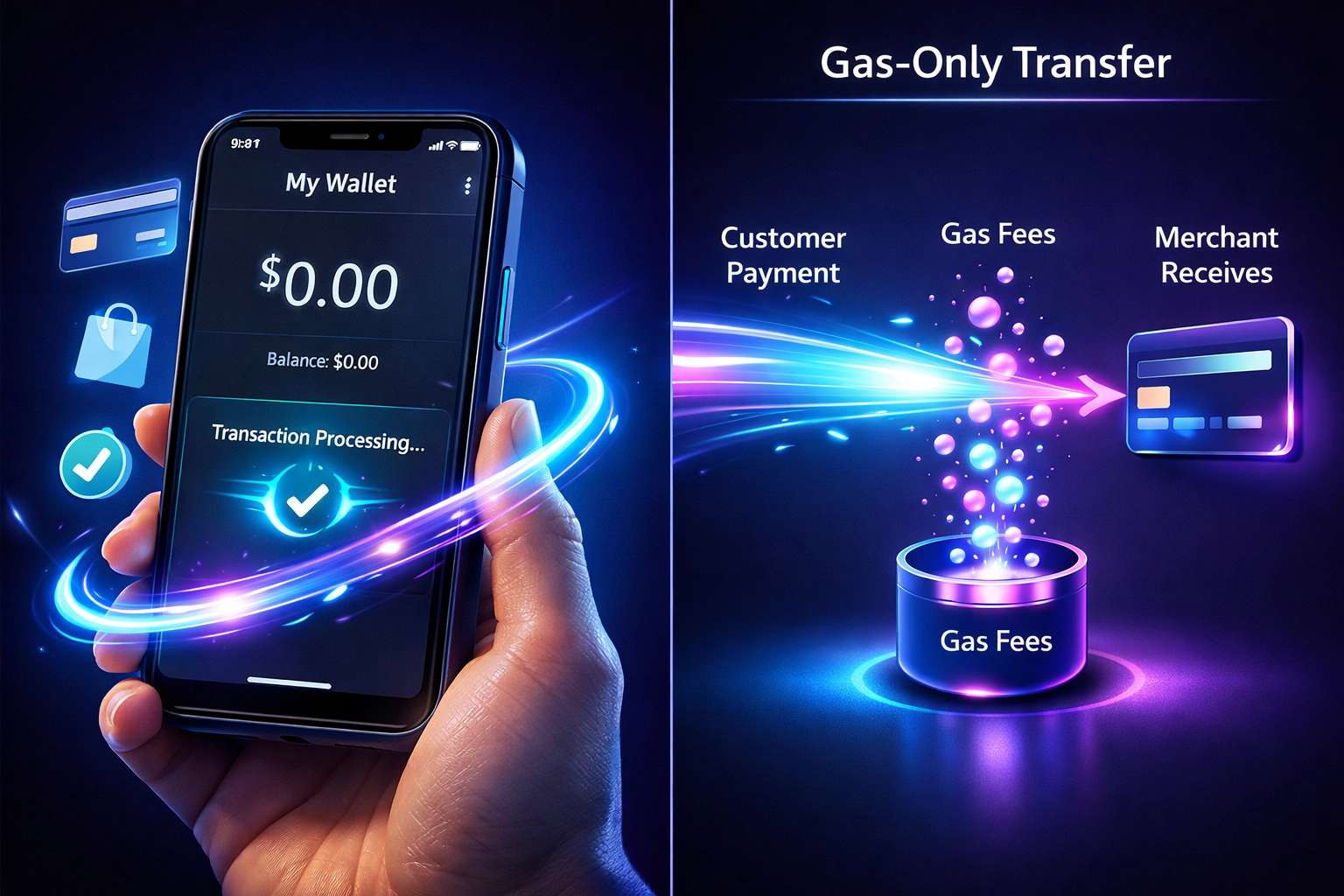

Gas-Only Transfers: The Zero-Balance Payment Innovation

Most crypto payments require merchants to hold base tokens for gas fees. ETH for Ethereum. SOL for Solana. MATIC for Polygon.

Gas-only transfers eliminate this friction entirely.

How it works: The payment transaction includes gas fee coverage within the transfer itself. Merchants receive net payment amount. Gas costs are deducted from customer payment automatically.

Technical implementation: Smart contracts calculate gas requirements pre-transaction. Customer approves total amount (payment + gas). Merchant wallet receives clean settlement without needing native tokens.

This matters for adoption.

Small merchants don't want to manage multiple token balances. They don't want to bridge assets. They don't want to calculate gas budgets.

Gas-only transfers make crypto payments as simple as credit cards. Simpler, actually: no PCI compliance overhead.

Competitors miss this entirely. NOWPayments requires merchants to maintain operational wallets with native tokens. CoinPayments charges withdrawal fees on top of gas. Triple-A uses custodial processing that hides these complexities but removes self-custody benefits.

Larecoin's gas-only model delivers both simplicity and sovereignty.

NFT Receipts: Programmable Proof of Purchase

Every transaction generates an NFT receipt. Permanent. Verifiable. Programmable.

Why this matters:

Accounting reconciliation becomes blockchain-simple

Tax reporting with immutable proof

Customer loyalty programs embedded in receipt metadata

Warranty tracking without centralized databases

Resale verification for secondary markets

Traditional processors issue PDF receipts. Email confirmations. Database entries that companies can alter or lose.

NFT receipts live forever. On-chain. Tamper-proof. Transferable.

Smart merchants are already building loyalty programs around receipt NFTs. Collect 10 purchases, receive 11th free: enforced automatically by smart contract. No punch cards. No fraud. No database management.

The metaverse applications are obvious. Receipt NFTs become access passes. VIP status. Proof of community participation.

CoinPayments doesn't offer NFT receipts. NOWPayments has no programmable receipt infrastructure. Triple-A's custodial model makes this technically impossible.

Larecoin makes every transaction a digital asset.

Master/Sub-Wallet Architecture: Enterprise-Grade Treasury Management

Multi-location merchants need sophisticated wallet management. Not just one address. Dozens. Hundreds.

Master wallet controls overall treasury. Sub-wallets handle individual locations, departments, or franchises.

Benefits:

Centralized accounting with distributed operations

Location-specific sales tracking

Automated fund sweeping to master wallet

Role-based access controls

Multi-signature requirements for large transfers

Restaurant chains use this to manage 50+ locations with one treasury dashboard. Each location receives payments to unique sub-wallets. Finance team sees consolidated reporting in real-time.

Traditional payment processors offer merchant accounts. Not wallets. The distinction is everything.

Merchant accounts are custodial. Banks hold your money. Banks set withdrawal limits. Banks freeze accounts.

Master/sub-wallet architecture is self-custody. You control private keys. You set rules. You access funds instantly.

NOWPayments and CoinPayments offer basic wallet services but lack sophisticated hierarchy tools. Triple-A's custodial model contradicts the entire premise.

Larecoin built treasury management into the protocol layer.

QR-Generated POS: Turn Any Device Into a Payment Terminal

Hardware terminals cost $300-$1,000. Plus monthly fees. Plus software licensing. Plus support contracts.

QR-generated POS costs $0.

How it works:

Merchant opens payment portal on any device

System generates unique QR code for transaction amount

Customer scans with any Web3 wallet

Payment settles instantly to merchant wallet

NFT receipt generated automatically

No specialized hardware. No app downloads. No proprietary technology.

Just QR codes and blockchain infrastructure.

Coffee shops are running entire POS operations from tablets. Food trucks from smartphones. Pop-up retailers from laptops.

The flexibility is unmatched. The cost savings are substantial.

Traditional POS systems lock merchants into expensive ecosystems. Square, Clover, Toast: all charge hardware fees plus transaction percentages plus monthly subscriptions.

Web3 POS eliminates every layer of rent-seeking.

Competitors still push hardware. NOWPayments offers plugins and integrations. CoinPayments has API solutions. Triple-A requires proprietary terminals.

Larecoin gives merchants freedom.

MTL Compliance: The Trust Framework That Actually Matters

Federal MSB registration. State-level Money Transmitter Licenses across all 50 states. FinCEN compliance. AML/KYC protocols.

This isn't marketing copy. It's operational reality.

Why compliance matters:

Legal protection for merchants using the platform

Bank partnership opportunities

Institutional adoption pathways

Regulatory clarity in uncertain environment

Most crypto payment platforms operate in grey zones. Federal registration without state licenses. Selective compliance. "Decentralized" claims that don't hold up legally.

Larecoin maintains full MTL coverage because merchant protection is non-negotiable.

Banks are watching crypto payments closely. They want compliant partners. They need regulatory certainty.

Full MTL compliance opens fiat on/off ramps. Enables traditional business integrations. Protects merchants from regulatory risks.

NOWPayments operates internationally with varying compliance levels. CoinPayments has faced regulatory scrutiny. Triple-A focuses on offshore jurisdictions.

Larecoin chose the harder path: full U.S. regulatory compliance from day one.

The long-term advantage is obvious. When regulation tightens: and it will: compliant platforms win.

Competitor Reality Check: Where Others Fall Short

NOWPayments offers 200+ cryptocurrencies. Impressive selection. But custodial settlement. No self-custody options. No NFT receipts. Basic wallet infrastructure.

CoinPayments has been around since 2013. Established player. But 0.5% platform fees plus withdrawal charges. Centralized custody model. Limited DeFi integration.

Triple-A targets enterprise merchants. Fiat settlement focus. But fully custodial. No self-custody paths. Traditional fee structures around 1%.

None offer:

LUSD algorithmic stablecoin settlement

Gas-only transfer technology

NFT receipt infrastructure

Master/sub-wallet hierarchies

Full U.S. MTL compliance

Metaverse commerce integration

Larecoin isn't iterating on Web2 payment models. It's building Web3-native infrastructure from the ground up.

The Metaverse Commerce Future

VR shopping isn't science fiction. It's happening now.

Larecoin's B2B2C metaverse enables social shopping experiences traditional platforms can't deliver. Virtual storefronts. Immersive product displays. AR try-before-you-buy. NFT authentication.

Merchants create virtual presence. Customers explore socially. Payments settle on-chain. The entire experience lives in Web3.

This isn't a distant vision. It's operational infrastructure merchants can deploy today.

Traditional payment processors aren't building for spatial computing. They're defending legacy rails.

Larecoin is building the payment layer for the next internet.

Making the Switch

The technical advantages are clear. The cost savings are undeniable. The compliance framework is solid.

Merchants staying on traditional rails are paying 50-95% more than necessary. They're missing programmable receipts. They're locked into custodial relationships. They're excluded from the fastest-growing commerce channels.

Web3 payments aren't coming. They're here.

The question isn't whether to adopt. It's whether you're early or late.

Visit Larecoin to set up merchant infrastructure in under 10 minutes.

Zero hardware costs. Self-custody wallets. LUSD settlement. NFT receipts. Full compliance.

The future of payments doesn't require permission.

It just requires action.

Comments