Web3 Global Payments Vs Traditional Processors: The Proven Framework for Merchant Freedom

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Merchants are bleeding cash. Every transaction chips away at already-thin margins.

Traditional payment processors pocket 2.5-3.5% per swipe. Plus flat fees. Plus hidden interchange rates. Plus monthly minimums.

The math is brutal. Process $500,000 monthly? You're handing over $14,500 to Visa, Mastercard, and their friends.

Web3 flips the script. Sub-1% costs. No intermediaries. No chargebacks. No bullshit.

This is the proven framework for merchant freedom.

The Real Cost of Traditional Processing

Let's break down what traditional processors actually cost.

Small merchant example: Coffee shop processing $50,000 monthly pays roughly $1,450 in fees. That's $17,400 annually. For what? Moving digital numbers from A to B.

Mid-sized merchant example: Online retailer doing $500,000 monthly loses $14,500 per month. That's $174,000 yearly. Gone. Poof.

Operating on 10-15% margins? Those fees just ate half your profit.

Traditional processors hide costs everywhere:

Interchange rates

Gateway charges

Monthly minimums

Cross-border markups

Currency conversion fees

Chargeback penalties

You never see the full picture until it's too late.

Web3 Payment Infrastructure: The Cost Revolution

Larecoin operates at gas-only costs. That coffee shop? $50-100 monthly. The online retailer? Approximately $100.

That's a 99.3% cost reduction.

Not theoretical. Not "someday." Right now.

Our LUSD stablecoin eliminates volatility risk. Merchants receive payments in stable value. No conversion slippage. No exchange rate gambling.

Gas-only transfers mean you pay for network usage. Nothing else. No middleman margins. No profit stacking.

The savings compound fast. Over time. Across thousands of transactions.

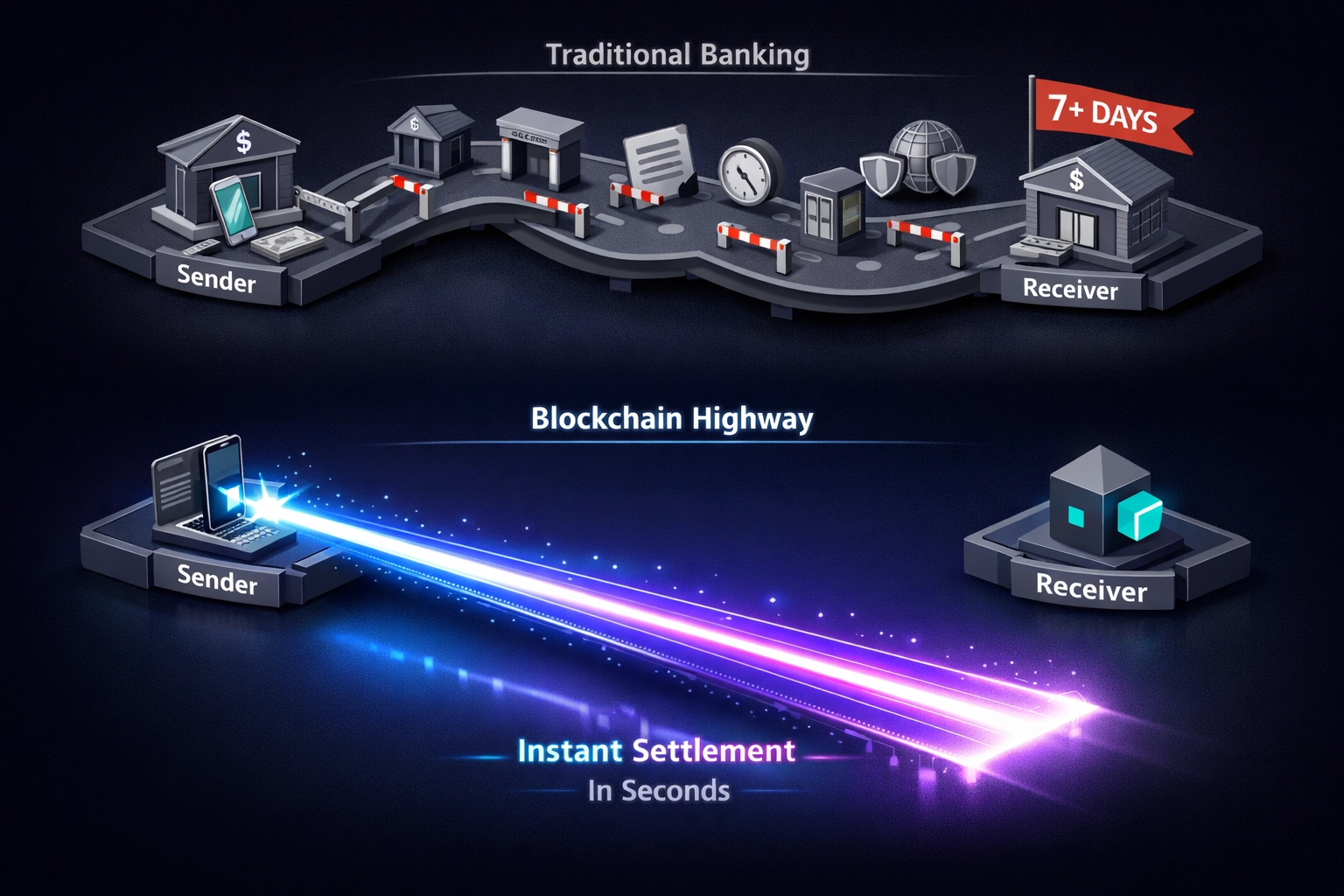

Settlement Speed Matters More Than You Think

Traditional processors take 2-7 days for settlements. Cross-border? Add another week.

Web3 payments settle in minutes.

This isn't just about speed. It's about cash flow. Working capital. Business survival.

That 7-day wait? Your money is frozen. You can't reinvest it. Can't pay suppliers. Can't capitalize on opportunities.

Meanwhile, the processor earns interest on YOUR money.

Larecoin provides immediate finality. Transactions clear in minutes. Funds hit your wallet. You control them instantly.

No holds. No freezes. No "pending review."

Self-Custody: The Non-Negotiable Advantage

Traditional payment accounts aren't yours. Banks control them. Processors control them. Governments control them.

One flag? Your account freezes. Your business stops. No warning. No appeal.

Self-custody changes everything.

You hold the keys. You control the funds. Always.

Smart contracts replace middlemen. Code executes automatically. No human gatekeepers. No arbitrary decisions.

This matters for:

High-risk industries (cannabis, crypto, gaming)

Emerging market merchants

Cross-border businesses

Anyone who values sovereignty

Banks classify entire sectors as "high-risk." They refuse service. Web3 doesn't discriminate.

Larecoin operates independently of traditional banking rails. Your business model doesn't matter. Your location doesn't matter. Your customer base doesn't matter.

Access is universal.

NFT Receipts: More Than Digital Paper

This is where Larecoin pulls ahead.

Every transaction generates an NFT receipt. Sounds gimmicky? Think again.

Tax benefits: Immutable proof of all transactions. No lost receipts. No reconstructing records. Perfect audit trails.

Accounting automation: NFT metadata contains full transaction details. Product info. Customer data. Timestamps. Everything your accounting software needs.

Customer loyalty programs: Turn receipts into collectibles. Reward repeat customers. Create gamified experiences.

Resale value: Limited edition NFT receipts for exclusive products. Secondary market potential. Brand building.

Traditional receipts? Paper trash or email clutter. NFT receipts? Living blockchain assets.

The utility scales with volume. Process 10,000 transactions monthly? That's 10,000 NFT receipts building your on-chain business history.

Competitors like NOWPayments and CoinPayments? They process payments. That's it. No NFT infrastructure. No advanced merchant tools.

LUSD Stablecoin: Stability Without Compromise

Crypto volatility scares merchants. Rightfully so.

Accept Bitcoin at $50K. Price crashes to $40K. You just lost 20% instantly.

LUSD stablecoin solves this. Pegged to USD. Maintains stable value. No volatility risk.

But here's the key difference: LUSD is decentralized. No central issuer. No freeze mechanisms. No blacklist functions.

Compare to USDC or USDT. Circle and Tether can freeze your coins. Comply with government orders. Block addresses.

LUSD? Immutable. Censorship-resistant. True peer-to-peer.

Larecoin integrates LUSD natively. Accept stable payments. Hold stable value. Transfer with blockchain speed.

The best of both worlds. Crypto infrastructure. Fiat stability.

Larecoin Vs The Competition

Let's compare directly.

NOWPayments:

Basic cryptocurrency acceptance

Limited stablecoin support

No self-custody infrastructure

No NFT receipt system

Traditional fee structure (0.5-1%)

Custodial by default

CoinPayments:

Multi-currency support

Higher fees (0.5% + network costs)

Custodial wallet system

No advanced merchant features

No receivable token infrastructure

Limited DeFi integration

Larecoin:

Gas-only cost structure

Full self-custody control

NFT receipt generation

LUSD stablecoin integration

Receivable token liquidity

Complete DeFi ecosystem access

Push-to-card functionality

No third-party dependencies

The gap is massive. Competitors process payments. We built an entire merchant freedom framework.

The Framework: Five Pillars

Here's how it works.

Pillar 1: Cost Elimination Replace percentage-based fees with gas-only costs. Save 90%+ immediately.

Pillar 2: Self-Custody Control Hold your keys. Control your funds. No intermediary risk.

Pillar 3: Settlement Speed Receive payments in minutes. Improve cash flow. Eliminate working capital constraints.

Pillar 4: NFT Infrastructure Generate receipt NFTs automatically. Build on-chain business history. Enable advanced accounting.

Pillar 5: Stable Value Accept LUSD payments. Eliminate volatility risk. Maintain purchasing power.

Each pillar reinforces the others. Together, they create merchant sovereignty.

Traditional processors? They fight this framework. Their business model requires your dependence.

Real Numbers, Real Savings

Monthly processing volume: $500,000

Traditional processor costs:

Base fees: $14,500

Chargeback fees: $500-2,000

Monthly minimums: $25-50

Cross-border markups: $1,000-3,000

Total: $16,000-19,500

Larecoin costs:

Gas fees: $100

No chargebacks: $0

No monthly minimums: $0

No conversion markups: $0

Total: $100

Annual savings: $190,000-234,000

That's real money. Capital you reinvest. Margins you protect. Growth you fund.

Scale matters. Process $1M monthly? Double the savings. Process $10M? 10x the impact.

The Migration Path

Switching sounds complicated. It's not.

Week 1: Set up Larecoin merchant portal. Generate wallet. Configure payment preferences.

Week 2: Test transactions. Verify NFT receipt generation. Confirm settlement speeds.

Week 3: Run parallel processing. Traditional and Web3 simultaneously. Compare results.

Week 4: Full migration. Cut traditional processor. Keep 90%+ of your revenue.

We handle technical complexity. You handle your business.

Support team available 24/7. Documentation comprehensive. Community active at larecoin.com.

Why Now?

Monthly stablecoin payment flows exceeded $10 billion in early 2026. Business transactions represent 63% of volume.

The market moved. Smart merchants followed.

Traditional processors are scrambling. Stripe bought Bridge for $1.1 billion. Visa and Mastercard launched crypto products.

They see the writing on the wall.

You have a choice. Stay dependent. Or claim independence.

The framework is proven. The technology is live. The savings are real.

Merchant freedom isn't coming. It's here.

Take Control

Traditional processors built empires on your fees. Time to stop paying tribute.

Larecoin provides the infrastructure. Self-custody. Stable value. NFT receipts. Gas-only costs.

Everything you need. Nothing you don't.

Visit larecoin.com to start your migration. Read the documentation. Join the community. Ask questions.

The 10-year marathon continues. We're building the future of merchant payments.

You coming?

Comments