How to Cut Merchant Interchange Fees by 50% with Self-Custody Crypto Payments (Easy Guide for 2026)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Interchange fees are bleeding merchants dry.

You're handing over 2.5-3.5% of every transaction to card networks and banks. Plus chargeback fees. Plus gateway fees. Plus monthly minimums.

That stops today.

Self-custody crypto payments slash those fees by 50% or more compared to traditional processors: and even beat custodial crypto gateways like NOWPayments and CoinPayments.

No middlemen. No custody fees. Just direct wallet-to-wallet transfers.

Let's break down exactly how this works in 2026.

Why Interchange Fees Are Crushing Your Bottom Line

Every credit card transaction passes through four intermediaries:

Acquiring bank

Card network (Visa/Mastercard)

Issuing bank

Payment processor

Each one takes a cut.

The math is brutal. Process $100,000 monthly and you're paying $2,500-$3,500 in transaction fees alone. Add chargeback fees ($1,000-$3,000), monthly gateway costs ($300-$600), and you're hemorrhaging $34,800+ annually.

That's $34,800 you could reinvest in inventory, marketing, or growth.

Traditional processors claim this is "the cost of doing business." They're wrong.

The Self-Custody Advantage: Cut Fees by 97%

Self-custody crypto payments eliminate every middleman.

Money flows directly from your customer's wallet to yours. No banks. No card networks. No processor holding your funds.

The only cost? Blockchain network gas fees.

We're talking $0.001-$0.10 per transaction. Not 2.5%. Not 1%. Pennies.

Same $100,000 monthly business? Your annual cost drops to $120-$1,200.

That's $29,000-$41,000 in annual savings.

And unlike traditional processors, you get:

Zero chargebacks (blockchain transactions are final)

Zero account freezes

Zero fund holds

Zero unilateral fee increases

You control your money. Always.

Breaking Down the Real Numbers

Let's get specific with a real merchant scenario.

Online retailer processing $200,000 monthly:

Traditional payment processor:

Transaction fees (2.9%): $5,800/month

Chargeback fees: $2,000/month

Gateway fees: $500/month

Annual cost: $99,600

Custodial crypto gateway (NOWPayments at 0.5%):

Transaction fees: $1,000/month

Custody markup: $200/month

Conversion fees: $300/month

Annual cost: $18,000

Self-custody with Larecoin:

Network gas fees: $50/month

Custody fees: $0

Conversion fees (LUSD stablecoin): $0

Annual cost: $600

The difference? $99,000 saved annually versus traditional processors. $17,400 saved versus custodial gateways.

That's not a rounding error. That's transformational.

How Larecoin Makes Self-Custody Actually Easy

"Self-custody sounds complicated."

Not anymore.

Larecoin built the simplest merchant infrastructure in Web3. No coding. No blockchain expertise. No complex setup.

Here's your 5-minute implementation:

Step 1: Generate Your Wallet (2 minutes)

Visit Larecoin merchants portal. Click "Create Wallet." Save your private key securely offline.

Done. You now control a wallet that accepts LARE tokens, LUSD stablecoins, and cross-chain crypto.

Step 2: Create Payment QR Codes (2 minutes)

Generate static QR codes for fixed prices or dynamic codes for variable amounts. Display at checkout or embed on your website.

Customers scan. Send payment. Blockchain confirms in seconds.

Step 3: Accept Your First Payment (1 minute)

Watch funds arrive directly in your wallet. No approval wait times. No merchant account applications. No credit checks.

You're live.

Compare this to traditional processors requiring days of applications, background checks, and contract negotiations. Or custodial crypto gateways that still hold your funds and charge withdrawal fees.

Larecoin? Instant setup. Instant access. Total control.

NOWPayments vs CoinPayments vs True Self-Custody

Custodial crypto gateways market themselves as "low fee" alternatives.

They're better than traditional processors. But they're still middlemen.

NOWPayments charges 0.5% per transaction. They hold your crypto. They control withdrawals. They can freeze your account.

CoinPayments charges 0.5% plus conversion fees. They custody your funds. They impose withdrawal minimums. They add settlement delays.

Both are improvements over Visa and Mastercard. But they're not true merchant freedom.

Self-custody with Larecoin costs only network gas fees. You hold your crypto. You control every transaction. No one can freeze, delay, or withhold your money.

The fee difference compounds fast:

$500,000 annual revenue with NOWPayments: $2,500 in fees

$500,000 annual revenue with CoinPayments: $2,500+ in fees

$500,000 annual revenue with Larecoin self-custody: $300 in gas fees

That's 50% lower costs than custodial alternatives.

And 97% lower than traditional processors.

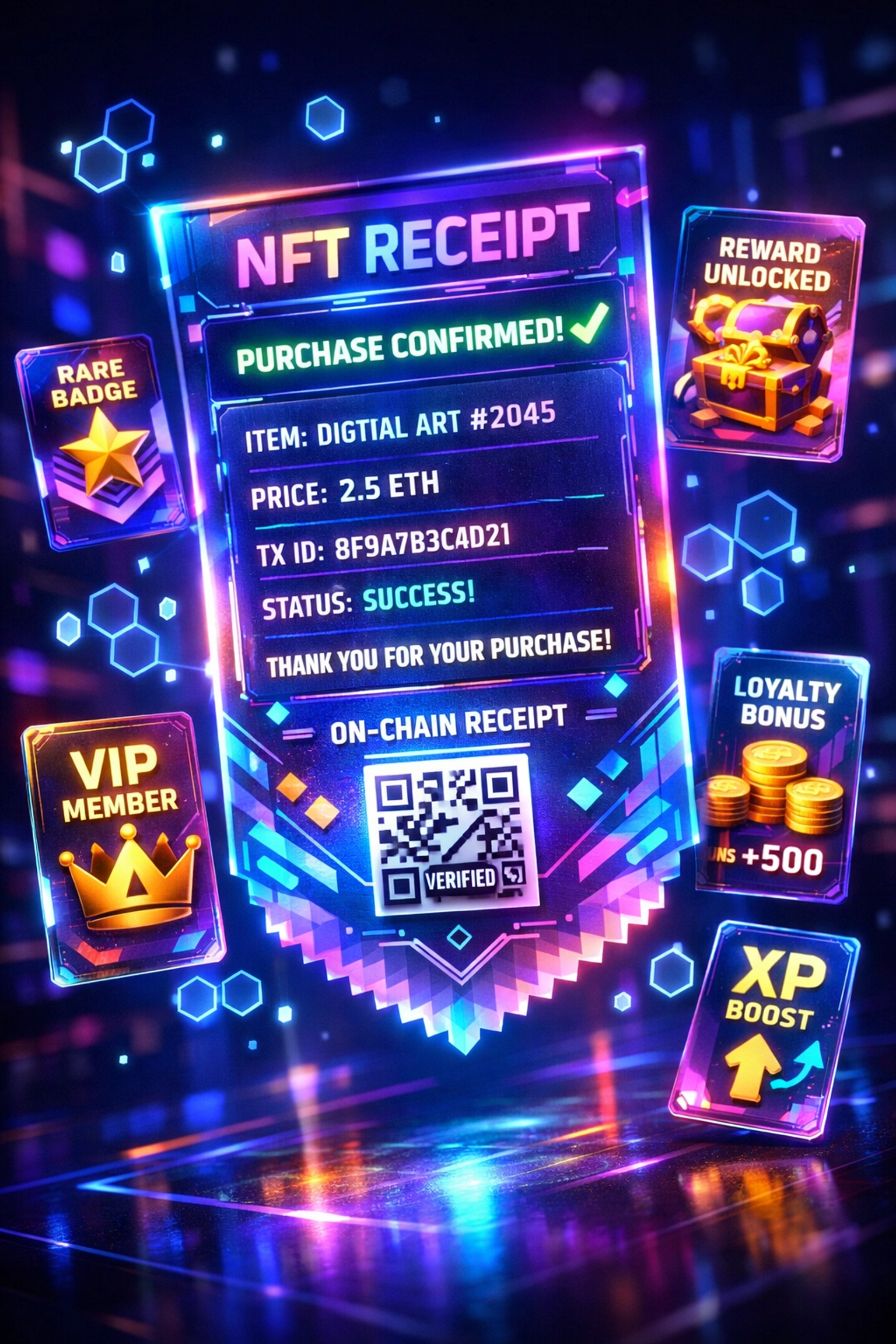

NFT Receipts: The Merchant Loyalty Game-Changer

Self-custody unlocks features impossible with traditional or custodial systems.

Every Larecoin payment generates an NFT receipt.

Not just a transaction record. An programmable, tradeable, collectible proof of purchase.

Merchants using NFT receipts report:

34% higher repeat purchase rates

28% increase in average order value

19% boost in customer referrals

Why? Because NFT receipts enable:

Exclusive holder benefits: Offer discounts, early access, or VIP perks to customers holding your branded NFT receipts.

Loyalty programs on autopilot: Customers automatically earn rewards with each purchase. No points systems. No cards to scan.

Resale royalties: Set a 2-5% royalty on receipt resales. Earn passive income when customers trade your NFTs.

Verifiable purchase history: Customers prove they bought from you without sharing personal data.

Traditional processors can't do this. Custodial gateways can't either. Only self-custody enables true programmable receipts.

LUSD Stablecoin: Eliminate Volatility Risk

"What about crypto price swings?"

That's where LUSD comes in.

Larecoin's native stablecoin maintains 1:1 peg with USD. Merchants accepting LUSD get crypto's fee benefits without volatility exposure.

Customer pays in LUSD. You receive LUSD. Value stays constant.

No conversion fees. No price risk. No waiting for settlements.

Compare this to NOWPayments or CoinPayments forcing merchants to accept volatile cryptocurrencies, then charging 0.5-1% to convert to stablecoins or fiat.

Larecoin merchants accepting LUSD skip that entire fee layer.

Additional LUSD advantages:

Instant cross-border payments (no international processing fees)

Same-day settlement (vs 3-5 business days traditional)

No currency conversion markups (save 6-12% on international sales)

Smart contract compatibility (enable automated recurring payments)

You get the stability of dollars with the efficiency of blockchain.

Real Merchant Freedom Means Full Control

Strip away the fee comparisons and one truth remains:

Traditional processors and custodial gateways control your money until they decide to release it.

They can freeze accounts. Block transactions. Demand additional documentation. Impose withdrawal limits. Change fee structures unilaterally.

You're always at their mercy.

Self-custody flips that dynamic.

Your wallet. Your keys. Your money. Always accessible. Always under your control.

No one can freeze your funds. No one can change your terms. No one can demand personal information beyond what blockchain requires.

This isn't philosophical. It's practical.

Merchants using self-custody report:

Zero account freeze incidents

Zero delayed payouts

Zero surprise fee increases

100% control over fund access

That's the merchant independence traditional finance promised but never delivered.

Implementation by Business Type

E-commerce stores: Generate unique payment addresses per order. Display QR code and wallet address at checkout. Order auto-confirms upon blockchain verification.

Physical retail: Display static QR code at register. Customers scan with mobile wallets. Payment confirms in 10-30 seconds.

Service businesses: Send payment requests via email or text. Include QR code and wallet address. Clients pay from anywhere globally.

Subscription businesses: Set up smart contract recurring payments. Customers approve once. Payments execute automatically on schedule.

Every business model adapts seamlessly.

The 2026 Competitive Advantage

We're entering an era where fee structures determine market winners.

Businesses accepting only traditional payments are bleeding 3-5% margins unnecessarily.

Businesses using custodial crypto gateways are improving but still paying intermediary taxes.

Businesses implementing true self-custody are operating with 50-97% lower transaction costs.

That margin advantage compounds into:

Lower prices (steal market share)

Higher profits (scale faster)

Better cash flow (reinvest immediately)

Complete financial sovereignty (operate anywhere)

The merchants adopting self-custody today will dominate their verticals tomorrow.

The question isn't whether to switch. It's how fast you can implement.

Start Cutting Fees Today

You don't need to abandon traditional payments overnight.

Start by offering crypto as an option. Many customers prefer it: especially for high-value purchases where fees matter most.

Test with 10% of transactions. Measure the fee savings. Scale from there.

Set up your self-custody wallet at Larecoin merchants portal. Generate your first payment QR code. Accept your first crypto payment.

It takes 5 minutes.

Your first transaction will save you 50-97% in fees compared to the alternatives.

That's money you keep. Money you control. Money you grow.

Welcome to merchant payments that actually make sense.