What Is a Receivables Token? The Simple Trick to Cut Payment Fees by 50% Your Bank Won't Tell You

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Your bank is bleeding you dry.

Every payment. Every invoice. Every transaction.

Traditional payment processors take 3-5% of your revenue. That's not a service: it's a tax.

But there's a solution your financial institution desperately hopes you never discover.

Receivables tokens.

What Exactly Is a Receivables Token?

Simple.

A receivables token is a digital asset on the blockchain representing an unpaid invoice.

Think of it as your invoice turned into crypto.

Instead of waiting 30-90 days for payment, you tokenize that invoice. Sell it to investors. Get cash within hours.

The magic happens through smart contracts. No middlemen. No bank approvals. No hidden fees eating your margins.

Here's the breakdown:

You issue an invoice to a customer ($10,000 example)

Convert that invoice into blockchain tokens

Investors purchase tokens at a small discount

You receive immediate working capital

When customer pays, smart contracts distribute funds automatically

The blockchain handles everything. Transparent. Immutable. Instant.

Traditional factoring companies charge 3-5% for this service. Sometimes more.

Receivables tokenization? A fraction of that cost.

The Real Cost of Traditional Payment Processing

Let's talk numbers.

Traditional factoring: 3-5% per invoice.

Your bank's merchant services: 2.9% + $0.30 per transaction.

Credit card processors: 2.5-3.5% depending on volume.

On a $100,000 monthly revenue, that's $3,000-$5,000 vanishing into processing fees.

Annually? $36,000-$60,000 gone.

For small and medium merchants, that's devastating. Those fees could be payroll. New inventory. Marketing budget. Growth capital.

But here's what they won't tell you.

Those fees aren't necessary.

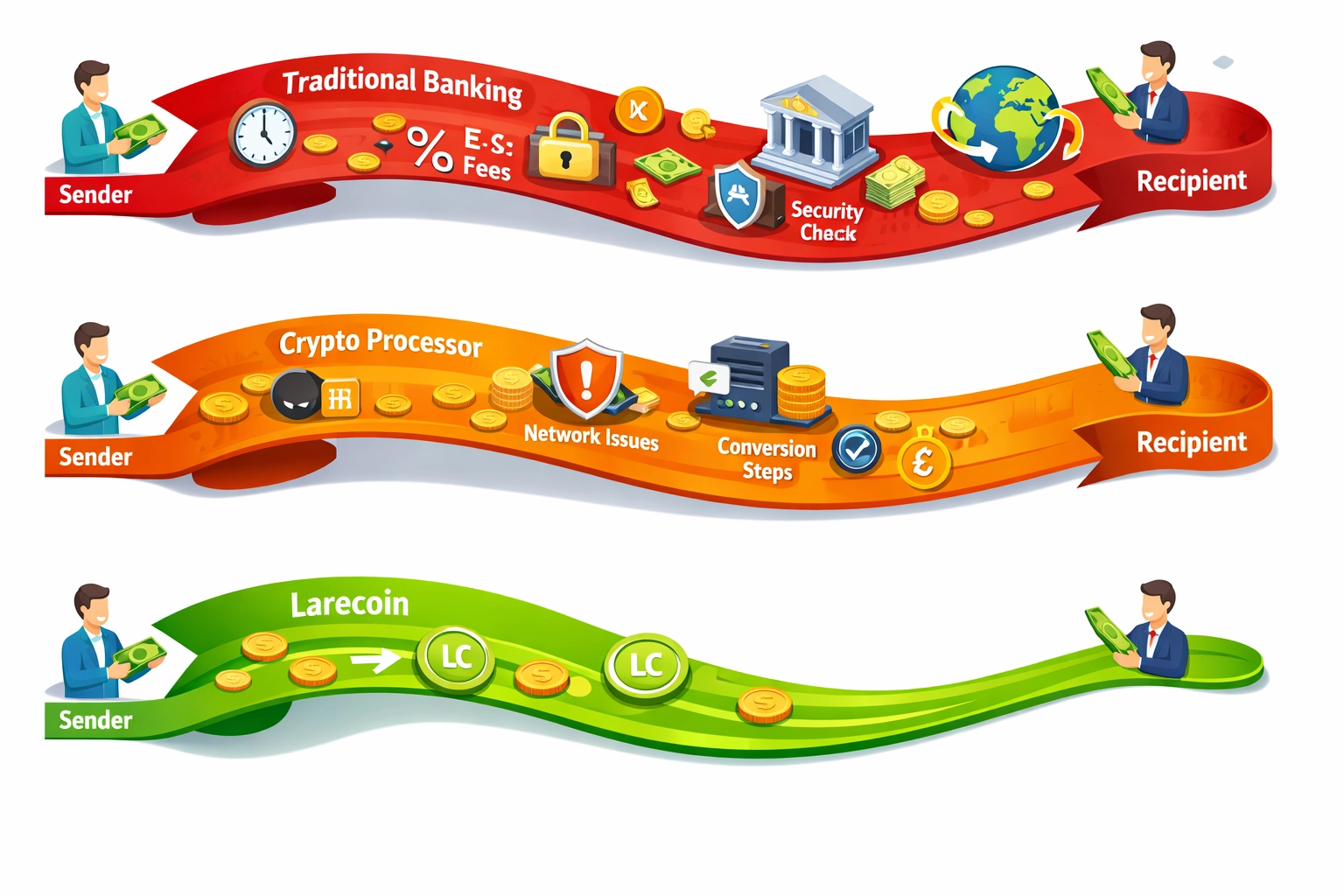

How Crypto Payment Processors Compare (Spoiler: Still Too High)

Traditional crypto payment platforms improved the game. Slightly.

NOWPayments charges 0.5% for custody solutions. Better than banks, sure. But you're still paying hundreds or thousands monthly. Plus you surrender custody of your crypto.

CoinPayments? Similar structure. Fees ranging from 0.5% to higher depending on your setup. Again: custody issues. Your crypto, their control.

Both platforms lock you into their ecosystems. Withdrawal limits. Verification delays. Third-party dependence.

You escaped traditional banking just to enter crypto banking.

That's not freedom. That's a different cage.

Enter Receivables Tokens + Self-Custody

Larecoin flips the script entirely.

Instead of paying 0.5% to a processor, you pay only blockchain gas fees. That's it.

Real example:

$10,000 invoice payment through NOWPayments: $50 fee

Same payment through Larecoin receivables token: $0.50 gas fee

That's a 99% reduction.

But the benefits go deeper than fee savings.

You maintain full custody. Your wallet. Your keys. Your crypto.

No intermediary holding your funds. No withdrawal limits. No verification queues.

When a customer pays, the receivables token settles directly to your wallet. Instant. Transparent. Decentralized.

The NFT receipt provides permanent proof of transaction. Immutable record on-chain. Perfect for accounting, audits, and dispute resolution.

Why LUSD Changes Everything for Merchants

Volatility kills merchant adoption.

You can't run a business when payment values fluctuate 10% daily.

Enter LUSD: Larecoin's stablecoin solution.

Receivables tokens can be denominated in LUSD. Pegged to USD. No price volatility.

Your $10,000 invoice? Stays $10,000.

Customer pays in crypto. You receive LUSD equivalent. Convert to fiat instantly or hold in stable value.

Best of both worlds:

Blockchain speed and transparency

Fiat stability and predictability

Zero intermediary fees

Complete self-custody

Traditional stablecoin transfers through competitors still charge processing fees. LUSD on Larecoin? Just gas.

The NFT Receipt Revolution

Every receivables token transaction generates an NFT receipt.

Why does this matter?

Permanent proof. Can't be altered. Can't be disputed. Can't be "lost in the system."

Traditional payment processors give you PDF receipts. Email confirmations. Dashboard screenshots.

All editable. All deletable. All vulnerable.

NFT receipts live on-chain forever. Cryptographically verified. Timestamped. Immutable.

For merchants dealing with chargebacks, disputes, or audit requirements: this is game-changing.

Your receivables token becomes your proof of invoice. Your NFT receipt becomes proof of payment. Both on blockchain. Both permanent.

No more "I never received the invoice" disputes.

No more "payment didn't process" claims.

Everything's on-chain. Transparent. Verifiable by anyone.

Breaking Down Real Savings

Let's compare three scenarios for a merchant processing $50,000 monthly:

Traditional Bank Merchant Services:

Processing fee: 2.9% + $0.30 per transaction

Average transaction: $500

Monthly transactions: 100

Monthly fees: $1,450 + $30 = $1,480

Annual cost: $17,760

NOWPayments (Crypto Processor):

Processing fee: 0.5%

Monthly fees: $250

Annual cost: $3,000

Larecoin Receivables Tokens + LUSD:

Processing fee: Gas only (average $0.50 per transaction)

Monthly fees: $50

Annual cost: $600

You save $17,160 annually compared to traditional banking.

You save $2,400 annually compared to crypto competitors.

That's not incremental improvement. That's a complete business model disruption.

Merchant Freedom and Independence

Here's what receivables tokens really represent:

Financial sovereignty.

No processor deciding which industries they'll serve. No sudden account freezes. No unexplained holds.

Your business. Your payments. Your control.

Traditional processors ban entire verticals. High-risk industries get blacklisted. Controversial products? Good luck finding payment processing.

Crypto processors like NOWPayments and CoinPayments improved this. But they still enforce terms of service. Still maintain blacklists. Still act as gatekeepers.

Larecoin's receivables token system runs on public blockchain. Permissionless. Censorship-resistant.

If you can create a wallet, you can accept payments. No approval needed. No applications. No waiting.

That's true merchant independence.

How to Implement Receivables Tokens Today

Getting started takes minutes.

Set up a Web3 wallet supporting Larecoin

Generate receivables tokens for your outstanding invoices

Share payment addresses with customers

Receive payments directly to your self-custody wallet

Collect NFT receipts automatically on-chain

No complicated integration. No developer required. No monthly minimums.

Compare this to traditional payment processor onboarding:

Application forms

Business verification

Bank account linking

Waiting periods

Setup fees

Monthly minimums

Contract lock-ins

Larecoin eliminates all that friction.

You're operational immediately.

The Competitive Moat

Why can't NOWPayments or CoinPayments offer this?

Their business models depend on processing fees.

They're intermediaries. They profit by standing between you and your customers.

Larecoin built different architecture. Our model isn't fee extraction: it's ecosystem growth.

We benefit when merchants succeed. When transaction volume increases. When adoption spreads.

Not from taking cuts of your revenue.

This fundamental difference drives everything:

Self-custody instead of custodial wallets

Gas fees instead of percentage-based processing

NFT receipts instead of centralized databases

LUSD stability without conversion fees

The entire system prioritizes merchant success over platform profit.

Real-World Use Cases

E-commerce merchants using receivables tokens see instant settlement. No more waiting on payment processor transfers. Funds hit your wallet immediately.

B2B companies tokenize net-30 or net-60 invoices. Convert to immediate liquidity. Keep cash flow healthy without factoring fees.

Service providers issue receivables tokens as payment requests. Clients pay via crypto. You receive LUSD stable value. NFT receipt confirms delivery.

Freelancers and contractors eliminate international wire fees. Cross-border payments settle in minutes, not days. Gas fees instead of $40 SWIFT transfers.

Every vertical benefits from the same core advantages:

Lower fees. Faster settlement. Full custody. Permanent records.

The Banking Secret They'll Never Share

Traditional financial institutions know this technology exists.

They know blockchain can eliminate their fee structures.

They know smart contracts make intermediaries obsolete.

But they'll never tell you.

Why would they? Their entire profit model depends on information asymmetry.

Keep merchants ignorant. Keep fees high. Keep control centralized.

Receivables tokens expose that model as unnecessary.

The technology exists today. The infrastructure is live. The savings are real.

Your bank won't educate you about alternatives. They profit from your lack of knowledge.

So spread the word.

Taking Control of Your Payment Infrastructure

The shift to decentralized payments isn't coming.

It's here.

Receivables tokens prove that blockchain isn't just hype. It solves real merchant problems. Dramatically reduces costs. Increases financial independence.

Every month you delay adoption costs you thousands in unnecessary fees.

Traditional processors won't lower their rates. Crypto intermediaries won't eliminate their cuts.

The only way to escape predatory fee structures is to exit the system entirely.

Self-custody. Direct settlements. Blockchain transparency.

That's the Larecoin approach.

Learn more about reducing merchant fees and join the payment revolution that puts merchants first.

Your business deserves better than 3% fees and intermediary control.

Receivables tokens deliver exactly that.

Comments