Why Everyone Is Talking About Crypto with a Conscience: Larecoin's 1.5% Social Impact Tax Explained

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The Crypto Industry Has a Reputation Problem

Everyone knows crypto has an image issue. Speculation. Volatility. Quick profits.

Not exactly the stuff that builds trust with mainstream merchants and everyday shoppers.

Larecoin flips that script entirely. Built into every single transaction is a 1.5% social impact tax that automatically funds verified charities. No opt-in required. No extra steps. Just payments that matter.

And the numbers? They're making traditional payment processors sweat.

Breaking Down the 1.5% Social Impact Tax

Here's exactly where your money goes when you transact with Larecoin:

0.8% → Pre-Verified 501(c)(3) Charities

Hunger relief programs

Education initiatives

Healthcare access

Disaster response teams

0.7% → Infrastructure & Ecosystem Development

LareBlocks Layer 1 maintenance

LareScan explorer improvements

NFT receipt generation

Blockchain transparency tools

The math is simple. 87% of the social tax flows directly into charitable work. The rest? It funds the infrastructure that makes the whole system run without intermediaries.

Smart contracts handle every allocation automatically. Zero human intervention. Zero overhead bloat.

The Real Cost Comparison That Changes Everything

Traditional payment processors charge 2.9% plus per-transaction fees. Sometimes higher for international payments.

Larecoin's total fee structure: 2.0%

0.5% base processing

1.5% social impact tax

Already better. But here's where it gets interesting.

That 0.8% charitable portion? Fully tax-deductible for merchants. Claim it as a charitable contribution. Reduce your effective cost by approximately 30% through tax optimization.

Suddenly you're paying less than traditional processors and funding global impact initiatives. That's not marketing spin. That's basic math.

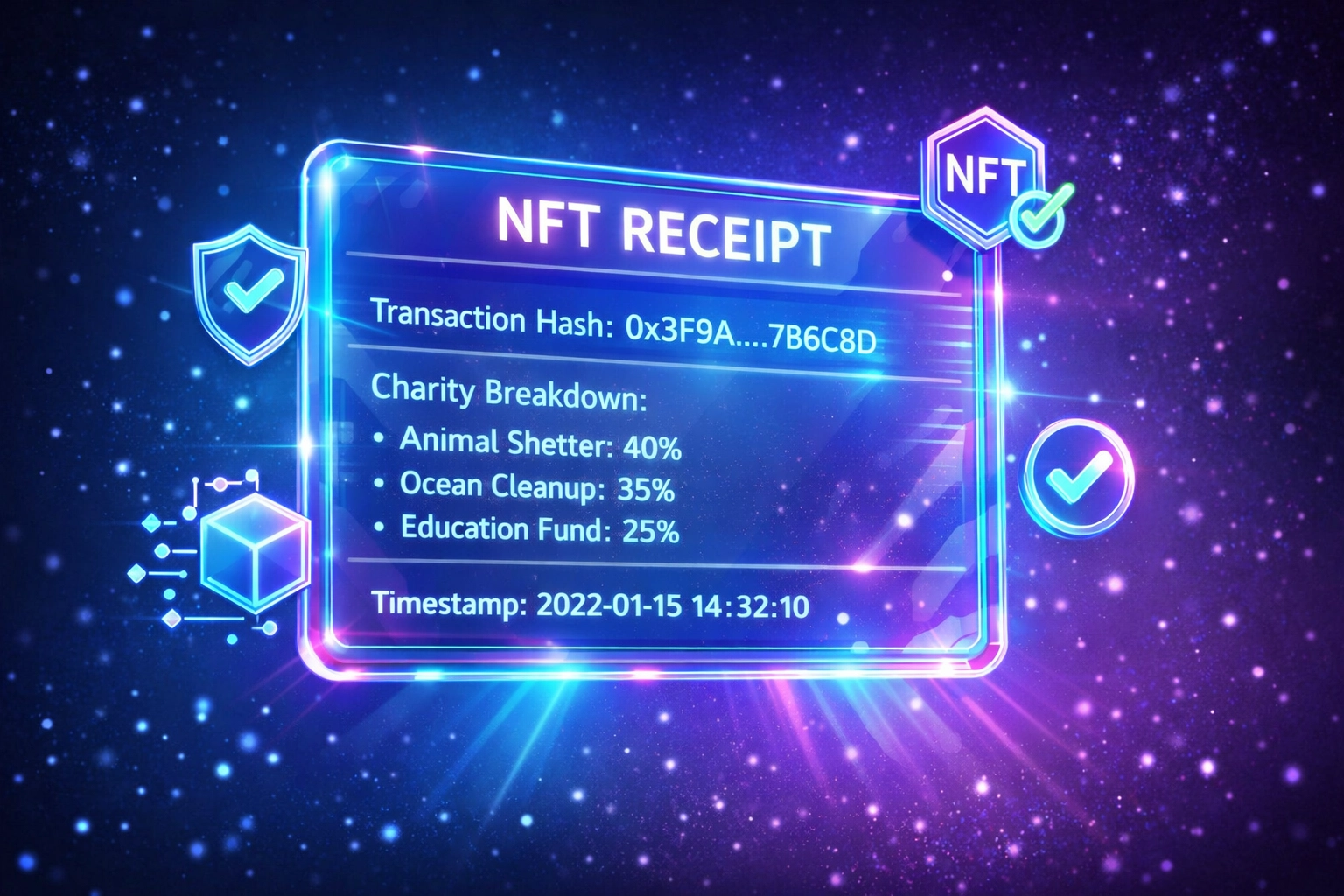

NFT Receipts: Your Tax Documentation Solved

Every Larecoin transaction generates an NFT receipt containing:

Complete transaction details

Charity allocation breakdown

Tax documentation ready for IRS Form 8283

Blockchain verification hash

Timestamp and wallet addresses

No scrambling at tax time. No manual record-keeping. Your accountant will actually thank you.

The NFT receipt system provides IRS-compatible documentation without additional accounting overhead. It's built directly into the transaction layer.

For merchants processing hundreds or thousands of transactions monthly, this alone saves hours of administrative headache.

Why This Model Works in 2026

The CLARITY Act (H.R. 3633) established digital commodity frameworks that give Larecoin regulatory clarity.

As of February 2026, crypto payment processors operating under these guidelines have defined legal standing. Merchants can confidently claim charitable deductions. Tax authorities recognize blockchain-verified documentation.

This isn't some gray-area experiment. It's payments infrastructure built on clear regulatory foundations.

The timing matters. Five years ago, this model would have faced constant regulatory uncertainty. Today? It's protected under federal digital commodity law.

The Competitive Edge: Web3 vs. Traditional Processors

Let's compare Larecoin against the major players:

NOWPayments:

0.5% base fee

No charitable component

Basic receipt system

Limited tax advantages

CoinPayments:

0.5% base fee

No social impact

Standard transaction records

Traditional merchant tools

Larecoin:

2.0% total fee (0.5% + 1.5% social tax)

Automatic charity allocations

NFT receipt documentation

Tax-deductible charitable portion

Effective cost reduction through write-offs

The others beat us on raw transaction cost. But they lose on total cost of ownership once you factor in tax benefits and compliance documentation.

Plus, there's something bigger at play here. Consumer sentiment is shifting. People want to support businesses that give back. The social impact tax becomes a marketing differentiator, not just a cost center.

Real-World Applications for Enterprise Merchants

Master and Sub-Wallet Management

Enterprise merchants can deploy sophisticated wallet structures:

Central treasury wallet

Department-specific sub-wallets

Location-based allocations

Automated reconciliation across all channels

Each sub-wallet maintains independent transaction records while rolling up to master reporting. The charity allocations flow automatically regardless of which wallet processes the payment.

Cross-Border Without the Headache

International payments through traditional processors can hit 4-5% in fees and currency conversion costs.

Larecoin transactions? Same 2.0% whether you're paying a supplier in Tokyo or a vendor in Toronto. The blockchain doesn't care about borders.

Currency conversion happens at market rates through decentralized exchanges. No markup. No hidden fees. Just transparent, verifiable pricing.

The LareBlocks Layer 1 Advantage

All of this runs on LareBlocks, Larecoin's custom Layer 1 infrastructure.

Why does that matter for the social impact tax?

Speed. The network processes transactions in under 3 seconds. Charity allocations happen in real-time, not batch settlements at end-of-day.

Transparency. Every allocation is verifiable on LareScan, the native blockchain explorer. Merchants can prove exactly how much they've contributed to each charity. Donors can track funds all the way to final distribution.

Cost. Layer 1 infrastructure means lower gas fees compared to Layer 2 solutions piggybacking on congested networks. Those savings flow back to merchants and charities.

Onboarding Without the Crypto Learning Curve

"But my customers don't have crypto wallets."

Not a problem.

Larecoin offers multiple onboarding paths:

Gift cards sold at retail locations

ACH transfers from traditional bank accounts

Push-to-card services for instant fiat conversion

Direct purchase through integrated exchanges

Your customers can pay with crypto without even realizing they're using blockchain technology. The social impact tax still applies. The charity allocations still happen. The tax benefits still accrue to you as the merchant.

That's the power of thoughtful infrastructure design. Remove friction. Maintain benefits.

The Charity Verification Process

"How do I know the charities are legitimate?"

Fair question. Here's the process:

Every charity receiving funds through the social impact tax must:

Provide valid 501(c)(3) status documentation

Submit to quarterly financial audits

Maintain public transparency reports

Meet minimum operational efficiency standards (administrative costs below 15%)

The verification happens before they enter the allocation pool. Merchants and customers don't have to research charity ratings. That work is done upfront.

And it's all documented on-chain. Check LareScan. Verify the wallet addresses. Trace the funds yourself.

What This Means for Your Business

If you're a merchant considering crypto payments in 2026, the calculation is straightforward:

Traditional Processor:

2.9% + $0.30 per transaction

No tax advantages

No marketing differentiation

Manual tax documentation

Larecoin:

2.0% total (including social impact)

30% effective cost reduction via tax write-offs

Positive brand association

Automatic tax documentation via NFT receipts

Verified charity support

The net cost favors Larecoin. The compliance burden is lower. The customer perception is better.

That's before you factor in cross-border efficiency, enterprise wallet management, and ecosystem features like the B2B2C metaverse and AI-powered shopping tools.

Join the Movement

The conversation around "crypto with a conscience" isn't slowing down. It's accelerating.

Merchants processing their first Larecoin transaction realize they're not just accepting payment. They're joining an ecosystem that defaults to positive impact.

That's why everyone's talking about it. That's why the model works.

Ready to see how the 1.5% social impact tax applies to your business? Explore the Larecoin ecosystem and connect with our merchant support team.

Your next payment can fund more than just your bottom line.

Comments