7 Reasons Your Crypto Payment Provider Is Costing You Too Much (And How Self-Custody Changes Everything)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Your crypto payment gateway is bleeding your business dry.

Not with a single massive fee. With death by a thousand cuts.

The industry standard? Somewhere between 0.5% and 2% per transaction. Sounds reasonable until you dig deeper and realize that's just the entry ticket. NOWPayments advertises 0.5% for most transactions. CoinPayments charges around 0.5% but with additional withdrawal fees up to 1%. Decent rates on paper.

But here's what they're not telling you.

Reason #1: The Hidden Fee Stack That Nobody Talks About

Transaction fees are just the beginning.

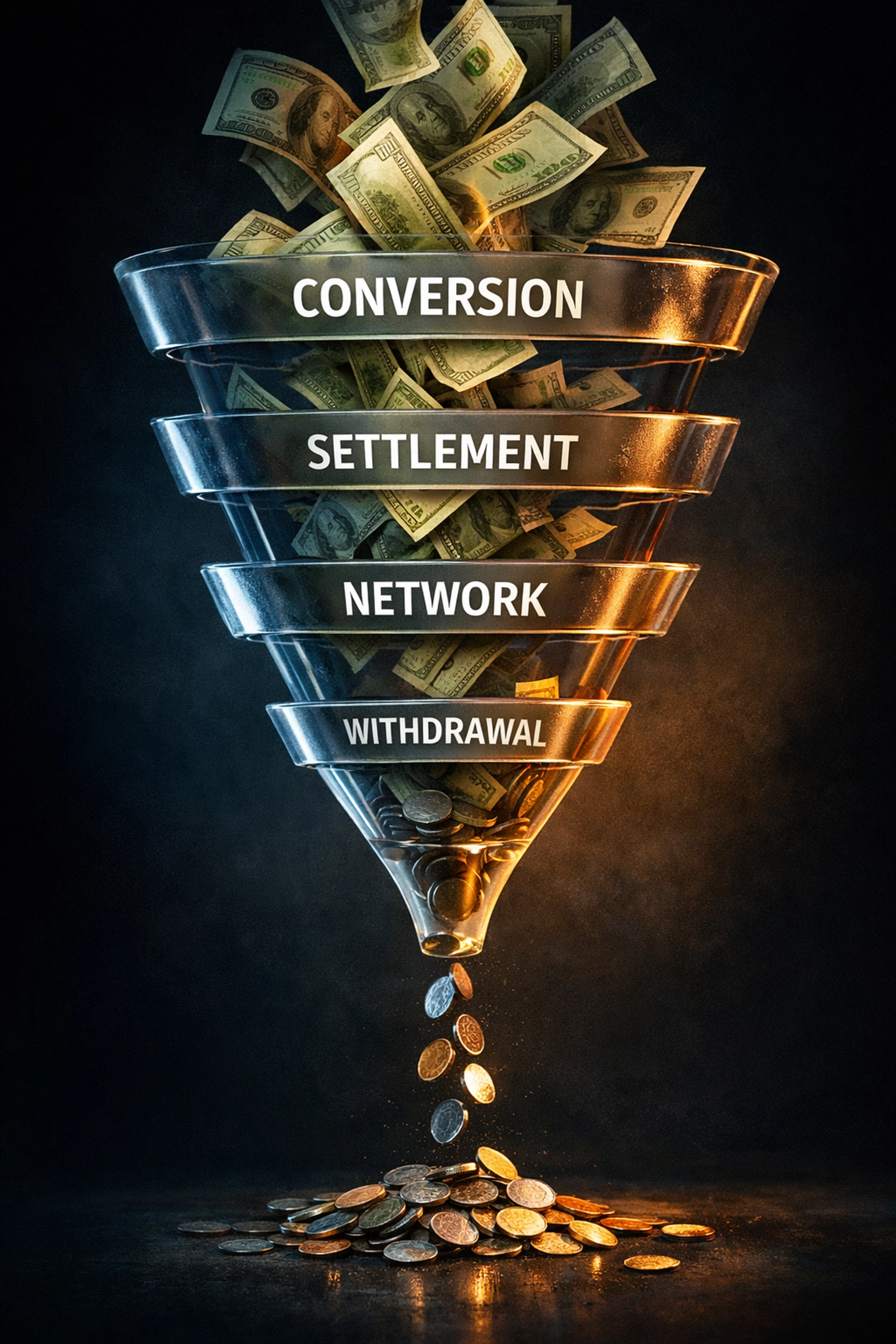

Currency conversion fees hit you for another 3-5%. Fiat settlement spreads eat 1-2% more. Network gas fees compound on top of everything. Withdrawal fees when you actually want to use your money.

A "$1,000 payment" at 0.5% becomes:

Base fee: $5

Conversion fee: $30-50

Settlement spread: $10-20

Network fees: $5-15

Withdrawal fee: $10

You're looking at $60-100 in actual costs. That's a 6-10% effective rate.

Most providers bury these details deep in their pricing documentation. They advertise the low transaction fee. They stay quiet about everything else.

Reason #2: Volume Discrimination Against Growing Businesses

The tier trap is real.

Providers like Binance, Kraken, and most payment gateways use volume-based pricing. Great rates for enterprises pushing $1M+ monthly. Brutal rates for businesses building toward that threshold.

CoinPayments offers volume discounts: but only after you've already processed massive amounts. Small and medium businesses pay premium rates while building their customer base.

You're subsidizing enterprise clients.

This backward incentive structure penalizes exactly the businesses that need cost efficiency most. Startups and growing merchants get squeezed while established players enjoy preferential treatment.

Reason #3: Custodial Control Means They Own Your Money

Self-custody isn't just a buzzword.

Traditional payment processors hold your funds. They control when you can access them. They decide withdrawal limits. They can freeze accounts based on their internal policies.

NOWPayments and CoinPayments both function as custodial intermediaries. Your crypto sits in their wallets until withdrawal. That's counterparty risk you didn't sign up for.

The crypto revolution promised financial sovereignty. Custodial payment processors deliver the same old banking model with blockchain lipstick.

Reason #4: Fiat On-Ramps Destroy Your Margins

Converting crypto to fiat isn't free. It's expensive.

Most traditional processors charge 1-3% for fiat settlement on top of their base transaction fees. Exchange rate spreads add another layer of cost. You're paying multiple entities to touch your money.

The payment processor takes their cut. The exchange takes their cut. The banking partner takes their cut.

By the time funds hit your bank account, you've lost a significant chunk to intermediaries who added minimal value. Larecoin flips this model entirely with LUSD: our stablecoin that maintains value without constant conversion bleed.

Reason #5: Zero Innovation Beyond Basic Processing

Generic payment gateways process transactions. That's it.

No NFT receipts. No loyalty integration. No metaverse compatibility. No Web3-native features that differentiate your business or add customer value.

You're paying for 2018 technology in a 2026 market.

CoinPayments offers basic invoicing. NOWPayments handles standard transaction processing. Neither delivers the cutting-edge features that Web3-savvy customers expect.

Larecoin builds NFT receipts directly into every transaction. Verifiable proof of purchase. Collectible transaction history. Real utility that enhances customer experience without additional cost.

Reason #6: Compliance Uncertainty Creates Business Risk

Regulatory clarity matters. Most crypto payment processors operate in gray zones.

Are they properly registered as Money Service Businesses? Do they hold state-level Money Transmitter Licenses? Can they legally operate in all 50 states?

Vague answers create risk for your business.

Larecoin maintains rigorous US compliance through our MSB registration and comprehensive state MTL strategy. We're not dodging regulations: we're embracing them. That's the difference between a legitimate financial infrastructure partner and a provider that might disappear when regulators tighten enforcement.

Operating with a compliant partner protects your business from regulatory blowback. It ensures continuity. It signals legitimacy to customers and partners.

Reason #7: Gas Fees Aren't Actually the Problem

Everyone complains about Ethereum gas fees. They're missing the point.

The real cost isn't the network fee: it's the processing markup on top of it. Custodial providers charge you for gas, then add their own fees, then add conversion spreads, then add withdrawal costs.

Larecoin operates on Solana. Near-zero gas fees. But more importantly, our self-custody model eliminates intermediary markups entirely. You pay only actual network costs: nothing more.

When gas fees are $0.0002 instead of $15, and there's no processing markup, the math changes dramatically.

How Self-Custody Changes Everything

Self-custody isn't just about control. It's about cost structure.

When you eliminate custodial intermediaries, you eliminate their fees. No conversion spreads. No withdrawal charges. No tiered pricing discrimination. Just direct peer-to-peer transactions with transparent, minimal costs.

The Larecoin model:

Gas-only transfers: Pay network fees, nothing more

LUSD stablecoin: Eliminate conversion cost bleed

NFT receipts: Value-added features at no extra cost

Push-to-card services: Direct settlement without intermediary markup

Full transparency: See exactly what you're paying and why

Traditional processors charge 0.5-2% plus hidden fees. Larecoin charges gas fees: typically under 0.1%: with zero hidden costs.

On $100,000 in monthly transactions:

NOWPayments: ~$500-2,000+ in fees

CoinPayments: ~$500-1,500+ in fees

Larecoin: ~$100 in actual network costs

The difference compounds monthly. Annually. It's not marginal: it's transformational.

The Real Value of Receivable Tokens

LARE operates as a receivable token within the ecosystem. That means instant liquidity without waiting periods. No settlement delays. No frozen funds during "processing."

Compare to traditional models where payments sit in limbo for 24-72 hours while processors verify, clear, and settle. You can't use funds you can't access.

Larecoin tokens move instantly. Use them immediately for payroll, inventory, reinvestment: whatever your business needs. Time value of money isn't theoretical when you're running tight cash flow.

Building on Real Innovation

The Solana foundation isn't arbitrary. It's strategic.

Solana processes 65,000 transactions per second. Ethereum processes about 15. When your payment infrastructure scales without congestion-driven fee spikes, you can actually build a sustainable business model.

Traditional payment processors can't offer this because they're not building on scalable infrastructure. They're patching legacy systems with blockchain integrations.

Larecoin is blockchain-native from the ground up. Every feature, every tool, every service designed specifically for Web3 commerce from day one.

Why This Matters Now

2026 isn't the future anymore. It's now.

Customers expect Web3 payments. They expect metaverse integration. They expect NFT receipts and decentralized commerce options.

Generic payment processors are scrambling to add these features as afterthoughts. Larecoin built them as core functionality years ago.

The businesses winning in this space aren't the ones paying premium rates for outdated infrastructure. They're the ones leveraging purpose-built Web3 payment ecosystems that reduce costs while expanding capabilities.

The Choice Is Simple

Keep paying intermediary markups for custodial control and limited features.

Or switch to self-custody infrastructure that reduces costs by 80-90% while adding Web3-native capabilities your competitors can't match.

The math isn't complicated. The strategic advantage is clear.

Larecoin isn't just cheaper. It's better. Purpose-built for crypto payments with compliance infrastructure that protects your business and customer experience features that differentiate your brand.

Check out how merchants are reducing interchange fees with Web3 payment solutions.

Your current payment processor is charging you for limitations. Time to trade up.

Comments