Are Merchant Interchange Fees Killing Your Margins? Here's How Self-Custody Crypto POS Systems Fix It

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Your Payment Processor Is Bleeding You Dry

Every swipe costs money. Every tap costs more.

Merchants lose $2-$3 on every $100 transaction. That's not negotiable. That's just the price of doing business with legacy payment networks.

Until now.

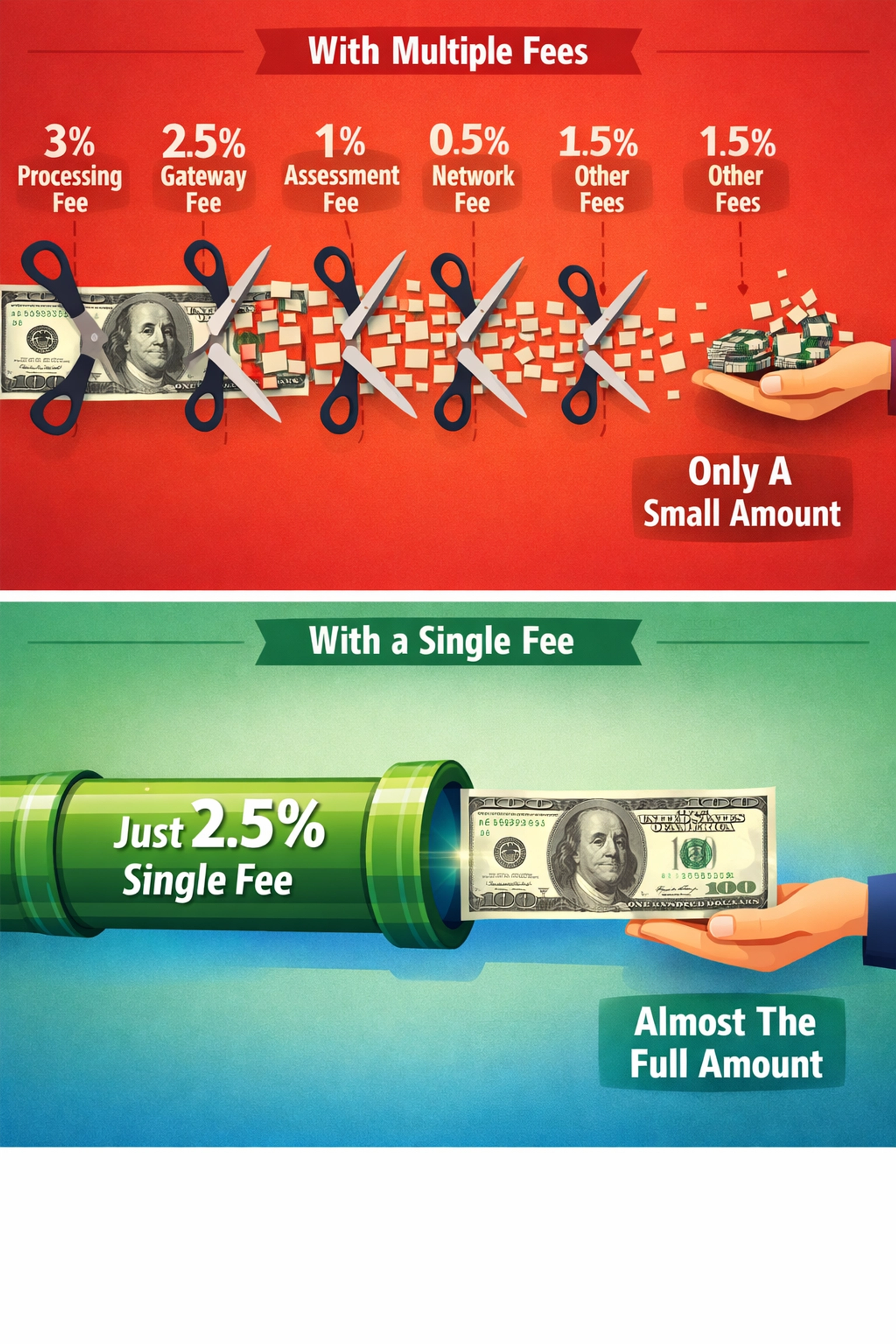

Traditional card processors charge 1.81% on average across all transaction types. Premium rewards cards? 2.4-2.8% plus flat fees. Corporate cards push 2.7-3.2%. Digital wallets clock in at 2.14% + $0.10.

These fees represent 60-80% of your total payment acceptance costs. You can't negotiate them. Visa and Mastercard set the rates. Banks enforce them. You pay them.

Or you switch to crypto.

The Hidden Tax on Your Revenue

Let's run real numbers.

Annual revenue: $1 million. Average transaction processing: 2.5%. Annual fee burden: $25,000.

Scale that to $5 million? You're hemorrhaging $125,000 annually.

Most merchants accept this as inevitable. Card networks built a monopoly. They set the terms. The entire traditional payment infrastructure operates on their rails.

But Web3 changed the game.

Cryptocurrency POS systems with self-custody architecture slash these fees by 50% or more. Some transactions cost pennies regardless of ticket size.

The catch? You need to understand what you're buying.

Not all crypto payment processors are created equal.

Self-Custody: The Only Model That Makes Sense

Here's the dirty secret about most crypto payment gateways.

NOWPayments? They custody your crypto. CoinPayments? Same story.

You accept Bitcoin. They hold your Bitcoin. You request withdrawal. They process it (for a fee). You wait. You hope their security holds.

That's not financial sovereignty. That's just a different middleman.

Self-custody means you control your private keys. Your funds hit your wallet directly. No intermediary. No waiting period. No withdrawal limits.

Larecoin POS systems operate on pure self-custody architecture. Every payment flows directly to wallets you control. We never touch your funds. We can't freeze your account. We don't know your balance.

This isn't just philosophy. It's practical risk management.

Exchange hacks happen monthly. Custodial services fail. Regulations change overnight. Self-custody removes these attack vectors entirely.

Fee Structure Reality Check

Traditional payment processing:

Base interchange: 1.81%

Network assessment: 0.13%

Processor markup: 0.30-0.50%

Gateway fees: $0.10-$0.30 per transaction

Monthly fees: $10-$50

PCI compliance: $50-$200/year

Chargeback fees: $15-$25 each

Total effective rate: 2.5-3.5% plus fixed costs.

Larecoin crypto POS:

Network fees: Variable (typically $0.01-$0.50)

No percentage-based fees on transaction value

No monthly minimums

No gateway fees

No PCI compliance costs

Chargebacks impossible (blockchain finality)

Total effective rate: <0.5% for most transactions.

The savings compound. High-ticket merchants see the biggest impact. A $10,000 sale costs $250-$350 in traditional fees. The same transaction on Larecoin? Under $1 in network costs.

LUSD Stablecoin: The Volatility Solution

"Crypto is too volatile."

Fair criticism. Bitcoin swings 5% daily. Ethereum follows.

That's why we built on LUSD.

LUSD is an over-collateralized, decentralized stablecoin pegged to USD. No central authority. No freeze functions. No algorithmic instability.

Key advantages:

Collateralized at 110%+ with ETH

Decentralized protocol (Liquity)

No governance token manipulation

Redemption always available at $1

Censorship-resistant

Unlike USDC (Circle can freeze) or USDT (centralized reserves), LUSD maintains Web3 principles while solving volatility.

Merchants price in dollars. Accept LUSD. Convert when needed. Zero volatility exposure.

The stablecoin integrates seamlessly with Larecoin POS systems. Customers pay with any supported crypto. Backend converts to LUSD automatically. You receive stable value immediately.

NFT Receipts: Utility Beyond Transactions

Every transaction generates an NFT receipt.

Sounds gimmicky. It's not.

Traditional receipts are worthless paper or lost emails. NFT receipts live on-chain permanently. They carry programmable utility:

Warranty Tracking: Products linked to purchase NFTs verify ownership and warranty status automatically.

Loyalty Programs: Receipt NFTs accumulate points, unlock tiers, trigger rewards without separate loyalty platforms.

Resale Verification: Luxury goods authenticated through original purchase NFTs. No more counterfeit concerns.

Tax Documentation: Immutable purchase history for accounting and audits. No lost receipts. Ever.

Customer Relationships: Direct communication channel to verified purchasers. No email lists. No privacy violations.

This transforms receipts from throwaway artifacts into persistent value containers.

Customers own their transaction history. Merchants gain verified customer relationships. Everyone wins.

Larecoin vs The Custodial Competition

NOWPayments processes crypto payments. They charge 0.5-1% fees. They custody your funds. They require KYC. They can freeze accounts.

CoinPayments operates similarly. Fees range 0.5-1%. Custodial model. Central authority. Terms of service restrictions.

Both improved on traditional payments. Neither embraced true Web3 principles.

Larecoin's differentiation:

True Self-Custody: Your keys. Your coins. Always.

NFT Receipt Integration: Built-in, not bolted-on.

LUSD Stablecoin Native: Volatility solved at protocol level.

Gas Optimization: Transactions batched and optimized for minimal fees.

No Percentage Fees: We don't take cuts of your revenue.

Metaverse Ready: POS systems work in virtual environments.

The competitive advantage isn't marginal. It's architectural.

Custodial services serve merchants who want "crypto lite." Self-custody systems serve merchants who understand Web3's full potential.

Implementation: Simpler Than You Think

Fear of complexity kills crypto adoption.

Setting up Larecoin POS takes under 30 minutes:

Generate wallet (we provide step-by-step guidance)

Install POS app or integrate API

Configure accepted tokens

Test transaction

Go live

No complex KYC process. No banking relationships. No multi-week onboarding.

Support options include:

API documentation for developers

No-code POS app for retail

WooCommerce/Shopify plugins

Point-of-sale hardware integration

Technical knowledge optional. Basic crypto literacy required.

The Margin Math Changes Everything

Let's revisit those numbers with crypto POS:

$1 million annual revenue:

Traditional fees: $25,000

Crypto POS fees: ~$3,000

Annual savings: $22,000

$5 million annual revenue:

Traditional fees: $125,000

Crypto POS fees: ~$15,000

Annual savings: $110,000

These aren't hypotheticals. Merchants report 50-70% reduction in payment processing costs.

The savings drop straight to bottom line. No operational changes. No reduced service quality. Just eliminated middleman costs.

Financial Sovereignty Isn't Optional Anymore

Traditional payment networks own merchants. They set fees. They enforce compliance. They control access.

That worked when no alternatives existed.

Web3 provides the alternative.

Self-custody crypto POS systems return control to merchants. Your revenue. Your wallets. Your terms.

Interchange fees aren't killing margins by accident. They're designed to extract maximum value from every transaction.

You can accept that. Or you can build different.

Larecoin chose different. Self-custody architecture. LUSD stability. NFT utility. Sub-0.5% effective fees.

The infrastructure exists today. Implementation takes minutes. Savings begin immediately.

Traditional payment processors won't lower fees voluntarily. Competition won't force meaningful change. The system works exactly as designed.

For them.

Time to build systems designed for you.

Ready to slash processing fees by 50%+?

Explore Larecoin's self-custody POS solutions at larecoin.com or dive deeper into Web3 payment advantages in our comprehensive merchant guide.

Your margins thank you.

Comments