Are You Paying Too Much? 10 Things Every Merchant Should Know About Crypto POS Fees

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 4 hours ago

- 5 min read

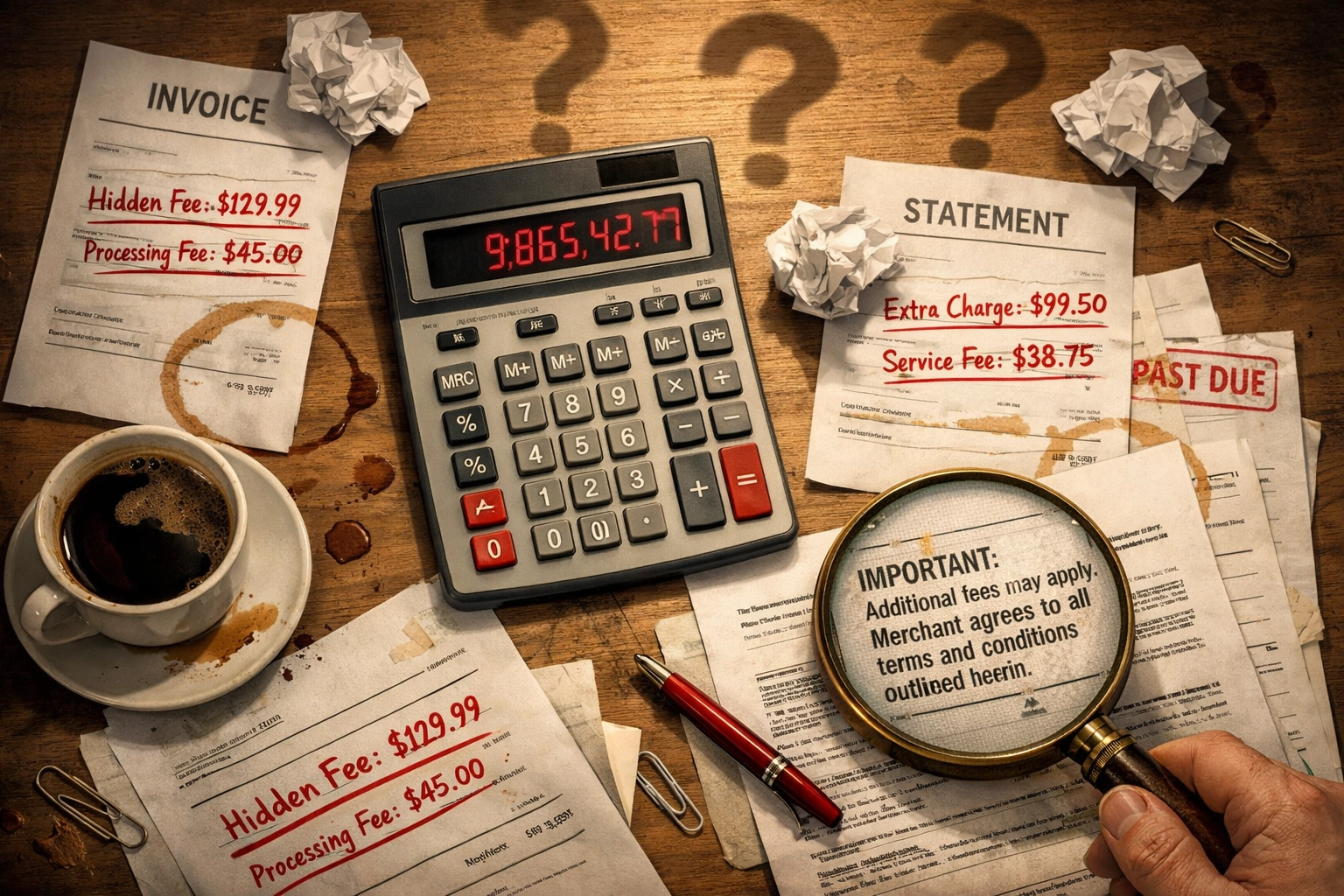

Most merchants are bleeding money on crypto payment fees without even realizing it.

The headline rate looks attractive. 1% here. 0.5% there. But the real cost? Hidden in the fine print, compounding with every transaction, and growing exponentially as your business scales.

Let's break down exactly what you're paying: and how to stop overpaying.

1. Percentage-Based Fees Are Quietly Killing Your Margins

That innocent-looking 1% transaction fee? Do the math.

At $500K annual volume: $5,000 gone. At $5M annual volume: $50,000 vanished.

Traditional processors like NOWPayments and CoinPayments charge 0.5-1% per transaction. Sounds competitive until you scale. The more you succeed, the more you pay.

The alternative: Gas-only models charge a flat network fee regardless of transaction size. $100 transaction? Same fee as $100,000. Your costs stay predictable. Your margins stay protected.

Larecoin operates on a gas-only structure. No percentage cuts. No scaling penalties. Just blockchain network fees: typically pennies per transaction.

2. "Free" Conversion Isn't Free

Most crypto payment processors advertise competitive transaction fees but bury conversion costs in separate line items.

Here's what they don't highlight upfront:

Currency conversion fees: 1-5%

Withdrawal fees: 0.5-1%

Network/blockchain fees: Variable

Fiat settlement premiums: Another 0.5-1%

CoinPayments charges 0.5% transaction fees but adds conversion costs on top. NOWPayments offers similar structures with conversion fees reaching up to 5% depending on the currency pair.

Suddenly that "low" transaction fee doesn't look so attractive.

Self-custody changes everything. When you control your crypto directly, you decide when and how to convert. No mandatory conversions. No automatic deductions. No hidden premiums.

3. Not All Blockchains Cost the Same

Gas fees vary wildly depending on which blockchain processes your transaction.

Ethereum during peak times? $20-50 per transaction. Solana? $0.00025 per transaction. Binance Smart Chain? $0.20 per transaction.

Most payment processors don't let you choose. They select the network based on what's convenient for them: not what's cheapest for you.

Larecoin operates on Solana and supports Binance Smart Chain. Ultra-low gas fees. Lightning-fast settlements. You keep more of every sale.

4. Withdrawal Schedules Lock Up Your Capital

Traditional processors hold your funds on scheduled payment cycles. Weekly. Bi-weekly. Monthly.

That's your capital sitting idle instead of working for your business.

NOWPayments and CoinPayments both use scheduled payouts with minimum withdrawal thresholds. Miss the threshold? Wait another cycle. Need funds faster? Pay express fees.

With self-custody wallets, your funds hit your wallet instantly. No waiting. No minimum thresholds. No express fees. Your money. Your timeline.

5. Fiat Settlement Forces Unnecessary Conversions

Most crypto processors automatically convert every crypto payment to fiat. They market this as a convenience: protection from volatility.

Here's what they're really doing: forcing conversions you might not want, charging conversion fees you didn't anticipate, and eliminating opportunities to hold appreciating assets.

If you believe in crypto long-term, why convert everything immediately? If you need fiat, why not choose which transactions to convert and when?

Larecoin's LUSD stablecoin solves the volatility problem without forced fiat conversions. Accept payments in LUSD. Stable value. No volatility exposure. No mandatory conversions. Convert to fiat only when you choose.

6. You're Paying for Infrastructure You Don't Control

Centralized payment processors charge fees to maintain their infrastructure. Servers. Customer support. Custody solutions. Compliance teams.

You're funding their operational costs with every transaction.

Decentralized systems eliminate the middleman overhead. No central servers to maintain. No custody infrastructure to secure. Lower operational costs translate to lower fees for merchants.

Blockchain networks charge gas fees to validators securing transactions. That's it. No corporate overhead. No shareholder profits. Just network costs.

7. Hidden Platform Fees Compound Over Time

Beyond transaction fees, most processors charge:

Monthly platform fees

Setup fees

Integration fees

Premium feature access

API call limits

Advanced reporting costs

CoinPayments charges for API access beyond basic tiers. NOWPayments has premium features behind paywalls.

These "small" monthly costs compound. $50/month becomes $600/year. $100/month becomes $1,200/year. For smaller merchants, platform fees can exceed transaction fees in total annual cost.

Open-source, decentralized solutions eliminate platform fees entirely. No monthly subscriptions. No premium tiers. No API limits.

8. Chargebacks and Disputes Carry Extra Costs

Credit card chargebacks cost merchants $15-100 per dispute regardless of outcome. Crypto eliminates chargebacks entirely: transactions are final.

But traditional crypto processors still charge dispute resolution fees, account review fees, and risk management premiums that mirror legacy financial systems.

True crypto payments are irreversible. No chargebacks. No dispute fees. No "risk management" premiums. Lower fraud risk means lower costs.

The trade-off? You need strong customer service and clear policies. But you eliminate an entire category of fees and headaches.

9. Volume Discounts Aren't Actually Discounts

Processors advertise enterprise volume discounts. Hit $1M monthly volume, get reduced rates.

Sounds great. Until you realize you've already paid full rates on your way to $1M. And the "discount" still exceeds what you'd pay with gas-only models.

NOWPayments offers volume discounts starting at high transaction volumes. CoinPayments has tiered pricing that rewards scale. But even discounted percentage-based fees grow with your success.

Flat network fees don't require volume negotiations. Your first transaction costs the same as your millionth transaction. No tiers. No negotiation. Just consistent, predictable costs.

10. NFT Receipts Add Value Without Adding Costs

Here's what traditional processors miss entirely: receipts are throwaway data.

NFT receipts transform transactions into assets. Proof of purchase. Loyalty rewards. Access tokens. Digital collectibles. All in one on-chain receipt.

Larecoin's NFT receipt system adds zero transaction costs. Every payment generates an NFT receipt automatically. Merchants can program utility into receipts: discounts on future purchases, exclusive access, rewards points.

No other crypto payment processor offers NFT receipts natively. It's pure added value with no added fees.

Traditional processors charge extra for loyalty program integrations, rewards systems, and customer engagement tools. NFT receipts deliver all that functionality natively on-chain.

The Real Cost of "Cheap" Processing

Add it all up:

Transaction fees: 0.5-1%

Conversion fees: 1-5%

Withdrawal fees: 0.5-1%

Platform fees: $50-200/month

Integration costs: One-time fees

Premium features: Subscription costs

A "0.5% transaction fee" becomes 3-8% total cost when you account for everything.

For a business processing $1M annually:

Headline rate suggests: $5,000 in fees

Actual cost approaches: $30,000-80,000

That's serious money.

Take Control of Your Payment Costs

The crypto payment industry evolved from traditional finance. Same business models. Same fee structures. Just with different technology.

But crypto enables something traditional finance never could: true merchant independence. Self-custody. Gas-only pricing. No middleman taking percentages.

Larecoin built an ecosystem around merchant freedom:

Gas-only transactions – Pay network fees, not percentage cuts

Self-custody wallets – Your crypto, your control

LUSD stablecoin – Avoid volatility without forced conversions

NFT receipts – Add value to every transaction

Multi-chain support – Choose the cheapest network

Compare that to NOWPayments and CoinPayments. Percentage-based fees. Custody solutions. Scheduled payouts. Platform fees.

You know which model serves merchants better.

Next Steps

Calculate your actual payment processing costs. Include everything:

Transaction fees

Conversion fees

Withdrawal fees

Platform subscriptions

Integration costs

Then calculate what you'd pay with gas-only network fees. The difference is money staying in your business instead of funding payment processor profits.

The choice is simple. Keep overpaying: or take control.

Ready to stop bleeding money on payment fees? Join the Larecoin community and discover what merchant independence actually looks like.

Your margins will thank you.

Comments