CLARITY Act Explained in Under 3 Minutes: Why Crypto Merchants Are Winning in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The CLARITY Act hit Congress like a thunderbolt in 2025.

Passed the House with bipartisan support. Set up clear rules between SEC and CFTC. Created compliance pathways for exchanges and merchants.

Then it stalled in the Senate.

But here's the thing: crypto merchants are winning anyway.

What Is the CLARITY Act? (60-Second Version)

H.R. 3633 divides digital asset regulation between two agencies:

SEC gets jurisdiction over: Digital assets functioning as securities CFTC gets jurisdiction over: Commodities on decentralized networks

The goal? End regulatory confusion. Provide safe harbors for DeFi developers. Create clear pathways for tokens that evolve over time.

Smart legislation. Practical framework. Long overdue.

Why Merchants Don't Need to Wait for Washington

Traditional finance always moves slow.

Banks lobby against crypto rewards. State regulators contest asset definitions. Committee markups get delayed indefinitely.

Meanwhile, forward-thinking merchants build infrastructure that works right now.

The CLARITY Act framework: whether passed or not: proves one thing: mainstream acceptance is here. Regulatory clarity is coming. Smart merchants prepare today, not tomorrow.

The Larecoin Advantage: Built for Regulatory Reality

Larecoin launched with compliance in mind.

Layer 1 blockchain architecture? Check. Full transaction transparency via LareScan? Check. Merchant tools that scale with regulation? Absolutely.

Here's what separates winners from waiting:

1. Master/Sub-Wallet Infrastructure

Traditional payment processors force merchants into single-account structures.

Larecoin's Master/Sub-Wallet system lets businesses segregate funds instantly. Track revenue streams. Manage multiple locations. Maintain compliance across jurisdictions.

One dashboard. Full control. Zero headaches.

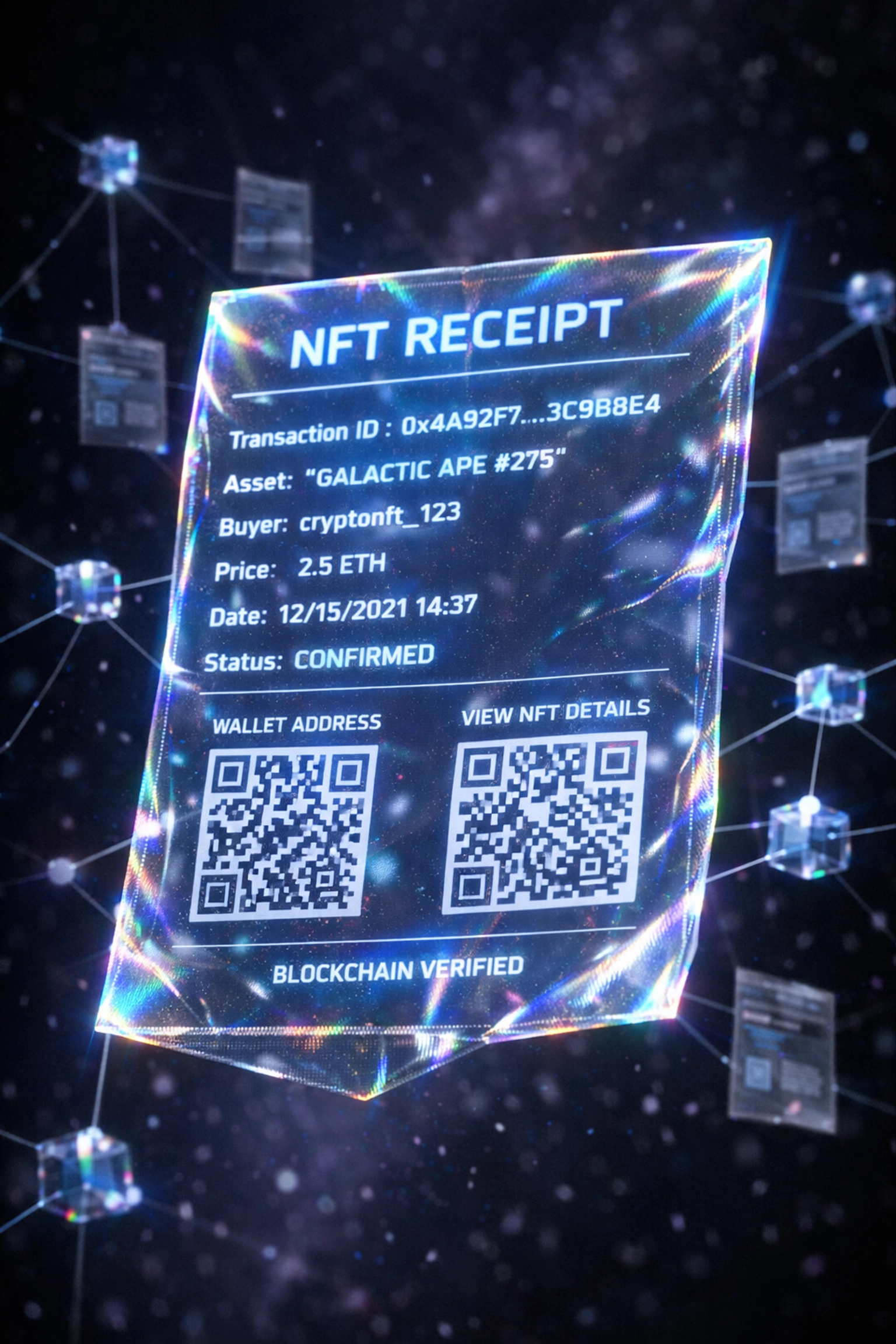

2. NFT Receipts = Permanent Records

Regulation demands documentation.

Every Larecoin transaction generates an NFT receipt. Immutable proof of purchase. Complete audit trail. Tax reporting made simple.

Your accountant will love you.

3. LUSD Stablecoin Stability

Price volatility kills merchant adoption.

LUSD stablecoin eliminates crypto risk. Accept payments in LARE. Convert instantly to LUSD. Hold value without market swings.

The CLARITY Act distinguishes between speculative assets and functional payment tools. LUSD sits firmly in the second category.

50% Lower Fees vs. NOWPayments and CoinPayments

Regulation or not, margins matter.

Traditional crypto payment processors charge 2-3% per transaction. Add currency conversion, withdrawal fees, and compliance costs? You're looking at 4-5% easy.

Larecoin charges half that.

Why? LareBlocks Layer 1 infrastructure eliminates middlemen. No Ethereum gas wars. No network congestion. Just fast, cheap, transparent transactions.

Run the numbers:

$100,000 monthly revenue

NOWPayments fee: $4,000

Larecoin fee: $2,000

Annual savings: $24,000

That's real money. Real competitive advantage.

Fee Comparison Table

Provider | Transaction Fee | Withdrawal Fee | Monthly Cost (on $100K) |

NOWPayments | 0.5-2% | Variable | $2,000-$4,000 |

CoinPayments | 0.5% | High | $2,500-$3,500 |

Triple-A | 1% | Medium | $2,000-$3,000 |

Larecoin | 0.5% | Low | $1,000-$2,000 |

Push-to-Card: Instant Fiat Conversion

Here's where Larecoin destroys the competition.

Accept crypto. Convert to fiat. Push directly to your business debit card.

No waiting periods. No complicated exchanges. No regulatory limbo.

The CLARITY Act framework envisions seamless crypto-to-fiat rails. Larecoin built them first.

Merchants need liquidity today, not three business days from now. Push-to-Card solves that.

Social Impact: The 1.5% That Changes Everything

Regulation loves accountability.

Every Larecoin transaction includes a 1.5% automatic donation to verified charities. Not optional. Not hidden. Transparent and trackable via LareScan.

Why does this matter for merchants?

Brand differentiation. Customers choose businesses that give back. Tax advantages. Documented charitable contributions. Regulatory goodwill. Demonstrable social responsibility.

When regulators evaluate crypto payment systems, community benefit weighs heavy. Larecoin merchants win that conversation automatically.

AI-Powered Shopping: The B2B2C Metaverse Play

The CLARITY Act addresses digital assets and securities.

It doesn't address the next generation of commerce.

Larecoin's AI-powered shopping platform integrates metaverse experiences with real-world transactions. B2B2C architecture connects manufacturers, merchants, and consumers directly.

Virtual storefronts with physical inventory

AI-driven product recommendations

Seamless checkout across digital and physical spaces

NFT-based loyalty programs

Traditional payment processors can't touch this. They're stuck in Web2.

Layer 1 Infrastructure: Why It Matters

Most crypto payment solutions run on Ethereum or other established chains.

That means:

Network congestion during peak times

Unpredictable gas fees

Dependency on third-party infrastructure

Regulatory exposure to base-layer decisions

LareBlocks Layer 1 eliminates every single issue.

Full control. Predictable costs. Purpose-built for payments. When regulators come knocking, Larecoin merchants point to a clean, transparent, purpose-built blockchain.

LareScan provides complete transaction visibility. Every payment. Every fee. Every conversion. All on-chain and auditable.

Compliance teams dream about this stuff.

The Reality Check: Why 2026 Favors Early Adopters

The CLARITY Act stalled in January 2026.

Traditional banks lobbied hard against crypto rewards. State regulators contested asset definitions. Markup sessions got delayed indefinitely.

But merchant adoption didn't stop.

Smart businesses recognized the trend: crypto payments are inevitable. Regulatory framework is coming. Infrastructure exists today.

Early adopters win. Late movers scramble.

Where's your business on that spectrum?

Action Steps for Merchants Right Now

Stop waiting for perfect regulatory clarity.

Start building payment infrastructure that scales with regulation.

Here's your 3-step plan:

Set up a Larecoin merchant account – larecoin.com

Integrate Master/Sub-Wallets for compliance – Segregate funds from day one

Enable Push-to-Card for instant liquidity – Never wait for settlements again

The merchants winning in 2026 made these moves in 2025.

The merchants dominating in 2027 are making them right now.

Bottom Line

The CLARITY Act represents mainstream recognition of crypto's legitimacy.

Whether it passes this year or next doesn't change merchant reality: customers want crypto payment options. Businesses need lower fees. Regulation demands transparency.

Larecoin delivers all three.

50% lower fees than NOWPayments and CoinPayments. Full regulatory compliance via LareBlocks infrastructure. Instant fiat conversion through Push-to-Card services.

Plus automatic social impact, AI-powered shopping experiences, and purpose-built metaverse integration.

Traditional payment processors offer none of this.

The question isn't whether crypto payments will dominate commerce. They already do.

The question is: which merchants saw it coming?

Ready to join them?Explore merchant solutions and start saving money today.

Comments