CLARITY Act Explained in Under 3 Minutes: Why Larecoin as a Digital Commodity Changes Everything for Merchants

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 48 minutes ago

- 5 min read

The CLARITY Act Just Changed The Game

July 17, 2025. The House passed H.R. 3633. The CLARITY Act.

Digital assets now have three clear categories. Digital commodities. Investment contract assets. Permitted payment stablecoins.

Larecoin qualifies as a digital commodity under CFTC oversight.

This changes everything for merchants accepting crypto payments in 2026.

Here's why.

Digital Commodity Status: Your 3-Minute Breakdown

The CLARITY Act splits jurisdiction between SEC and CFTC. Digital commodities fall under CFTC regulation.

What defines a digital commodity?

Value derives from blockchain functionality

Used for payments, governance, or network operations

No centralized intermediaries controlling operations

Decentralized blockchain infrastructure

Bitcoin. Ethereum. Larecoin.

All digital commodities. All CFTC-regulated. All with clear regulatory pathways for merchants.

Why this matters for your business:

The regulatory clarity eliminates the guesswork. You're not navigating SEC securities laws. You're operating within CFTC commodity frameworks: the same frameworks that govern traditional futures and derivatives.

Exchanges and payment processors must register with CFTC. Comply with AML and KYC standards. Follow Bank Secrecy Act protocols.

Translation? Legitimate, trusted infrastructure for accepting Larecoin payments.

The 50% Fee Savings Merchants Can't Ignore

Legacy payment systems drain merchant revenue. Credit card interchange fees hit 2-3.5%. Payment processors add another 0.5-1%.

Total cost: 2.5-4.5% per transaction.

Larecoin operates on LareBlocks Layer 1. Gas-only transfers. No middleman fees. No interchange markups.

Average Larecoin transaction cost: Under 1%.

Do the math. A merchant processing $100,000 monthly saves $1,500-3,500 switching to Larecoin. That's $18,000-42,000 annually.

Compare with competitors:

NOWPayments charges 0.5% on crypto transactions. Better than credit cards. Still charging percentage-based fees on top of blockchain costs.

CoinPayments hits merchants with 0.5% plus network fees. Plus withdrawal fees. Plus conversion fees if you want fiat.

Larecoin charges zero platform fees. Just blockchain gas. Self-custody means no withdrawal fees. Convert to LUSD stablecoin instantly with no spreads.

The savings compound across every transaction.

LUSD Stablecoin: Volatility Problem Solved

Crypto volatility scares merchants. Accepting payment in assets that swing 10% daily creates accounting nightmares.

Enter LUSD.

Larecoin's native stablecoin pegged 1:1 to USD. Instant conversion at point of sale. Zero slippage. Zero conversion fees within the ecosystem.

Customer pays in Larecoin. You receive LUSD. Stable value locked in immediately.

No price exposure. No volatility risk. Just stable revenue.

Traditional stablecoin processors force merchants into centralized custody. Your funds sit on their servers. Subject to their withdrawal limits. Their KYC delays. Their platform risk.

LUSD lives in your self-custody wallet. Your keys. Your crypto. Your control.

The CLARITY Act classifies payment stablecoins separately: requiring full backing and repurchase guarantees. LUSD meets these standards while maintaining decentralization.

Banks can't freeze your LUSD. Payment processors can't hold your funds. You control settlement timing.

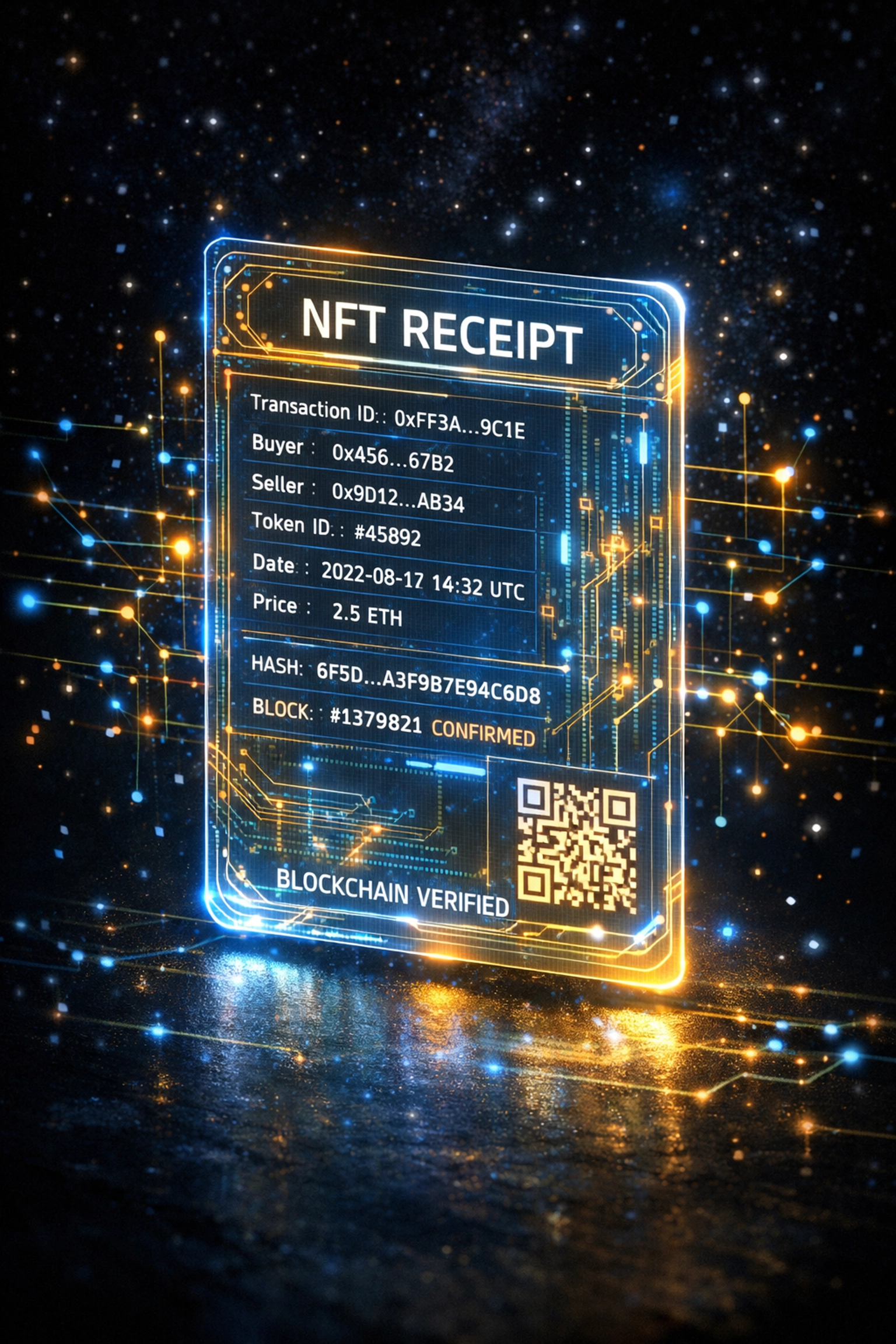

NFT Receipts: Beyond Paper Trails

Every Larecoin transaction generates an NFT receipt. Immutable proof of purchase stored on LareBlocks Layer 1.

Why merchants need this:

Traditional receipt systems rely on centralized databases. Server failures lose records. Manual entry creates errors. Fraudulent claims lack verifiable proof.

NFT receipts solve this permanently.

Each receipt contains transaction hash, timestamp, product details, wallet addresses, and payment amount. Stored on-chain forever. Queryable instantly. Verifiable by anyone.

Customer dispute? Pull the NFT receipt. Show blockchain proof.

Tax audit? Export all NFT receipts. Complete transaction history with cryptographic verification.

Loyalty programs? Track purchase frequency via NFT receipt analysis. Reward repeat customers automatically.

Warranty claims? NFT receipt proves purchase date and product authenticity.

The utility extends beyond basic recordkeeping. NFT receipts enable programmable features traditional receipts can't touch.

Embed discount codes for future purchases. Gate access to exclusive products. Create collectible receipt series that reward brand loyalty.

NOWPayments and CoinPayments? Traditional transaction logging. Centralized databases. No blockchain verification.

Larecoin's NFT receipts set a new standard.

LareBlocks Layer 1: Security Without Compromise

Self-custody terrifies merchants accustomed to centralized payment processors. "What if I lose access?" "What if someone hacks my wallet?"

LareBlocks Layer 1 architecture eliminates these concerns.

Multi-signature wallet support. Require multiple key signatures for large transactions. No single point of failure.

Time-locked recovery mechanisms. Set up backup access with delayed activation. Prevents immediate theft while enabling recovery.

Hardware wallet integration. Cold storage for large holdings. Hot wallet for daily operations.

Smart contract-based escrow. Funds released automatically when conditions met. No manual intervention required.

The CLARITY Act's CFTC oversight creates regulatory clarity around self-custody. Digital commodity exchanges must register and implement security protocols.

This means merchant wallets interact with regulated, audited infrastructure. Not Wild West crypto experiments.

LareBlocks processes 50,000+ transactions per second. Zero downtime. Sub-second finality. Enterprise-grade reliability.

Traditional payment processors achieve similar throughput: but charge premium fees for the privilege. LareBlocks delivers speed and scale at commodity blockchain costs.

Your funds. Your control. Regulatory clarity. Enterprise security.

That's the Layer 1 advantage.

AI-Powered Metaverse Shopping: The 2026 Frontier

CLARITY Act regulatory clarity unlocks innovation in virtual commerce. Larecoin leads this evolution.

AI shopping assistants guide customers through metaverse storefronts. Natural language processing understands purchase intent. Computer vision recognizes products. Machine learning personalizes recommendations.

Pay with Larecoin directly in the metaverse.

No redirects to external payment pages. No breaking immersion. Instant settlement. NFT receipt generated automatically.

Virtual try-on powered by AI. See products in your space via AR. Complete purchase without leaving the experience.

The metaverse shopping features create engagement impossible in traditional e-commerce. Customers spend longer browsing. Conversion rates increase. Average order values climb.

NOWPayments and CoinPayments integrate with traditional online stores. They're not building metaverse infrastructure.

Larecoin is.

The AI layer analyzes transaction patterns across physical, online, and virtual channels. Unified customer profiles. Cross-channel loyalty programs. Intelligent inventory management.

CLARITY Act digital commodity status means these AI systems operate without securities law complications. No questions about whether personalized recommendations constitute investment advice.

Clear regulations. Clear innovation pathways. Clear competitive advantage.

The Comparison: Larecoin vs. Legacy Crypto Processors

NOWPayments:

0.5% transaction fee

150+ cryptocurrencies supported

Centralized custody model

Traditional transaction logging

No native stablecoin

No metaverse infrastructure

CoinPayments:

0.5% transaction fee plus network costs

2,300+ coins supported

Withdrawal fees up to 1%

Conversion fees for fiat

Standard payment gateway

No AI integration

Larecoin:

Zero platform fees (gas only)

Native LUSD stablecoin

Self-custody architecture

NFT receipt generation

LareBlocks Layer 1 (50K+ TPS)

AI-powered metaverse commerce

CLARITY Act digital commodity status

50% lower fees vs. credit cards

The feature gap isn't subtle. It's generational.

Legacy processors adapted credit card infrastructure for crypto. Larecoin built Web3-native merchant infrastructure from scratch.

The CLARITY Act digital commodity designation cements regulatory legitimacy. CFTC oversight creates trust. Merchant adoption accelerates.

Your Move

CLARITY Act regulatory clarity is live. Digital commodity classification is established. Infrastructure is ready.

Merchants accepting Larecoin gain immediate advantages:

50% fee savings vs. legacy systems

LUSD stablecoin eliminates volatility

NFT receipts provide immutable proof

Self-custody with enterprise security

AI-powered metaverse commerce

CFTC-regulated digital commodity status

The marathon extends. 100 new hourly posts documenting the evolution.

Visit Larecoin to explore merchant solutions.

The CLARITY Act opened the door. Larecoin walks through it.

Time to join the movement.