CLARITY Act Meets Crypto Payments: How Larecoin's Digital Commodity Status Saves Merchants 50%+ in Fees

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The CLARITY Act just changed the game.

H.R. 3633 passed the House with a 294-134 vote. Digital commodities now have clear federal oversight under the CFTC. No more regulatory purgatory. No more SEC securities headaches.

Larecoin operates as a digital commodity. That means merchants accepting LARE payments save 50-96% on transaction fees compared to legacy processors.

Here's how the math works in your favor.

Digital Commodity Status: Your New Competitive Edge

The CLARITY Act splits digital assets into three categories:

Digital commodities

Investment contract assets

Permitted payment stablecoins

Larecoin qualifies as a digital commodity because its value ties directly to LareBlocks Layer 1 functionality. It powers transactions. It fuels network operations. It doesn't exist for capital raising or speculative securities offerings.

CFTC oversight means unified federal rules. No state-by-state compliance nightmares. No broker-dealer licensing requirements. No accredited investor restrictions.

Traditional payment processors drown in fragmented regulations. You pay for their compliance costs through higher fees.

Larecoin's digital commodity status eliminates those burdens. The savings go straight to your bottom line.

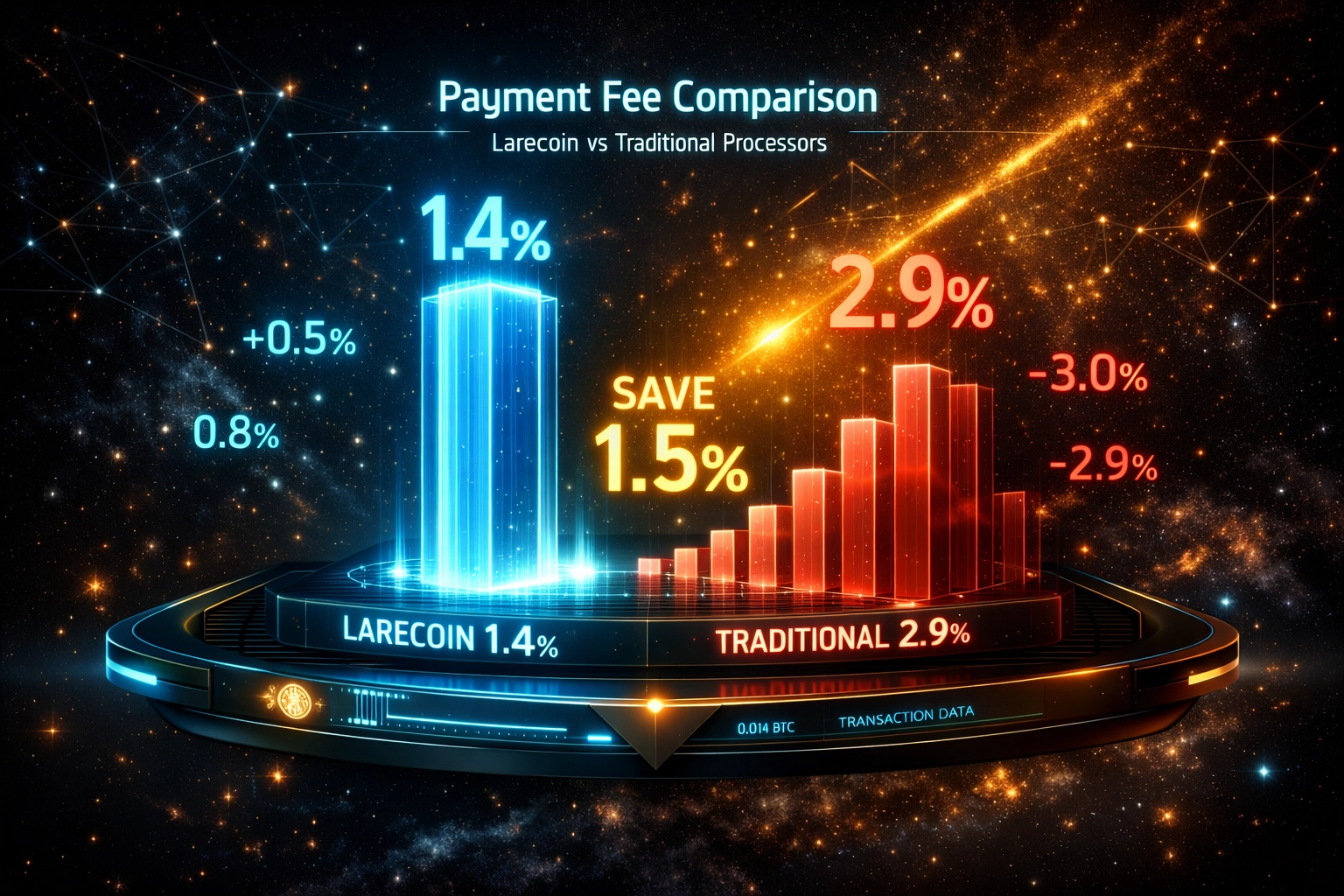

Fee Breakdown: The 50% Savings Reality

Standard payment processors charge 2.9% + $0.30 per transaction.

Larecoin averages 1.4% transaction costs.

On a $1,000 sale:

Traditional processor: $29.30 in fees

Larecoin: $14.00 in fees

Your savings: $15.30 per transaction

Scale that across monthly revenue. A business processing $100,000/month saves $18,360 annually.

That's capital you can reinvest. Inventory. Marketing. Team expansion. Product development.

The fee advantage compounds when you factor in chargebacks. Crypto payments are irreversible. Zero chargeback fraud. No disputed transaction fees eating your margins.

NOWPayments & CoinPayments: The Comparison

NOWPayments charges 0.5% for crypto transactions. Sounds competitive until you examine the fine print.

Limited blockchain support. Custodial wallet requirements. Third-party conversion fees for fiat settlements. Delayed payouts during network congestion.

CoinPayments offers broader token support but operates on older infrastructure. Gas fees during peak periods can exceed 3%. Their API documentation lacks modern developer tools.

Larecoin combines low fees with modern architecture:

LareBlocks Layer 1 native processing

Self-custody wallet integration

Real-time settlement without intermediaries

LUSD stablecoin for price stability

NFT receipt generation for every transaction

You're not just saving on fees. You're accessing next-generation payment infrastructure.

NFT Receipts: Immutable Transaction Records

Every Larecoin payment generates an NFT receipt on LareBlocks Layer 1.

Why this matters:

Permanent transaction verification

Zero dispute resolution costs

Automated compliance documentation

Customer purchase history stored on-chain

Resale tracking for digital goods

Traditional receipt systems rely on centralized databases. They fail. They get hacked. They create liability.

NFT receipts exist permanently on the blockchain. No server costs. No data breach vulnerabilities. No lost records.

For merchants selling digital products or services, NFT receipts enable secondary markets. Customers can trade or transfer their proof of purchase. You can program royalties into smart contracts.

That's passive revenue from resale activity. Traditional payments can't offer that.

LUSD Stablecoin: Price Stability Without Volatility

Crypto volatility scares merchants. You don't want to accept payment worth $100 that's worth $85 tomorrow.

LUSD solves this. Larecoin's native stablecoin maintains 1:1 parity with the US dollar.

Accept payments in LARE. Automatically convert to LUSD. Lock in your sale value immediately.

The conversion happens on-chain without third-party fees. No custodial risk. No external stablecoin dependencies like USDC or USDT.

You maintain complete control over your funds while eliminating price risk.

For businesses with thin margins, this changes everything. Accept crypto payments without gambling on market movements.

LareBlocks Layer 1: Self-Custody Security

Most crypto payment processors hold your funds in custodial wallets. You're trusting them to safeguard your revenue.

Larecoin operates on LareBlocks Layer 1 with self-custody wallet integration. You control your private keys. Your funds never touch a centralized exchange or payment processor wallet.

This eliminates:

Platform insolvency risk

Frozen account scenarios

KYC delays on withdrawals

Third-party access to your capital

Self-custody also means instant access. No waiting periods for settlements. No withdrawal limits. Your money moves when you decide.

For fund managers and institutional merchants, this satisfies compliance requirements around asset control and fiduciary responsibility.

AI-Powered Metaverse Shopping Integration

Larecoin payments extend beyond traditional e-commerce. The platform integrates with AI-powered metaverse environments.

Customers shop in immersive 3D spaces. AI assistants guide purchase decisions. Payment processing happens seamlessly through Web3 wallets.

You can set up virtual storefronts. Host product launches in metaverse venues. Accept payments from customers globally without geographic restrictions.

Traditional payment processors don't support metaverse commerce. They're built for web2 infrastructure.

Larecoin's architecture anticipates the spatial internet. Merchants adopting now gain first-mover advantages as metaverse shopping scales.

Learn more about metaverse features that future-proof your business.

The Regulatory Arbitrage Advantage

CLARITY Act compliance under CFTC jurisdiction creates regulatory arbitrage opportunities.

While competitors navigate SEC uncertainty, Larecoin operates with federal clarity. This means:

Faster feature deployment

Lower compliance overhead

Predictable legal framework

Easier institutional adoption

Securities regulations slow innovation. Commodities regulations enable it.

Your business benefits from Larecoin's ability to iterate quickly without securities law constraints.

Implementation: Simpler Than You Think

Integrating Larecoin payments takes minutes, not weeks.

The API documentation covers major e-commerce platforms. WordPress, Shopify, WooCommerce, Magento. Custom implementations supported for enterprise merchants.

No coding expertise required for standard integrations. Install the plugin. Connect your self-custody wallet. Start accepting payments.

For businesses with development teams, the API offers extensive customization. Webhooks for automated inventory management. Smart contract triggers for loyalty programs. On-chain analytics for customer behavior.

Support includes technical documentation and direct developer assistance. You're not navigating integration alone.

The 2026 Crypto Payment Landscape

CLARITY Act passage marks a turning point for crypto commerce.

Regulatory clarity attracts institutional capital. More merchants adopt crypto payments. Customer demand for Web3 transactions grows.

Early adopters capture market share while legacy processors scramble to adapt.

The fee savings alone justify switching. The additional benefits: NFT receipts, metaverse integration, self-custody security: create competitive moats.

Traditional processors can't replicate Larecoin's architecture. They're locked into centralized infrastructure and securities compliance costs.

You can wait for competitors to catch up. Or you can capture the advantage now.

Your Next Move

Calculate your current payment processing fees. Compare against Larecoin's 1.4% average. Multiply the difference by your annual transaction volume.

That's money you're leaving on the table.

Digital commodity status under the CLARITY Act isn't a marketing gimmick. It's a structural regulatory advantage with measurable financial impact.

Merchants processing $500K annually save $91,800 in fees by switching to Larecoin. That's not a projection. That's arithmetic.

The infrastructure is live. The regulatory framework is established. The fee savings are real.

Get started at Larecoin.com and lock in your merchant advantage before your competitors do.

The CLARITY Act opened the door. Larecoin walked through it. Now it's your turn.

Comments