CLARITY Act Passes: 5 Reasons Why Larecoin Merchants Will Save 50% on Interchange Fees in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

The game just changed for crypto merchants.

With the CLARITY Act framework moving through final legislative stages in 2026, digital commodity payments like Larecoin are positioned to deliver unprecedented cost savings. We're talking about cutting interchange fees in half compared to legacy card networks.

No more 2.9% + $0.30 per transaction. No more monthly gateway fees. No more chargebacks eating your margins.

Here's exactly why Larecoin merchants are about to dominate the payments landscape.

Reason 1: Digital Commodity Classification = Zero Payment Network Middlemen

The CLARITY Act establishes clear regulatory jurisdiction for digital commodities.

Larecoin operates on LareBlocks Layer 1. Pure blockchain infrastructure. No Visa. No Mastercard. No intermediary banks processing every transaction.

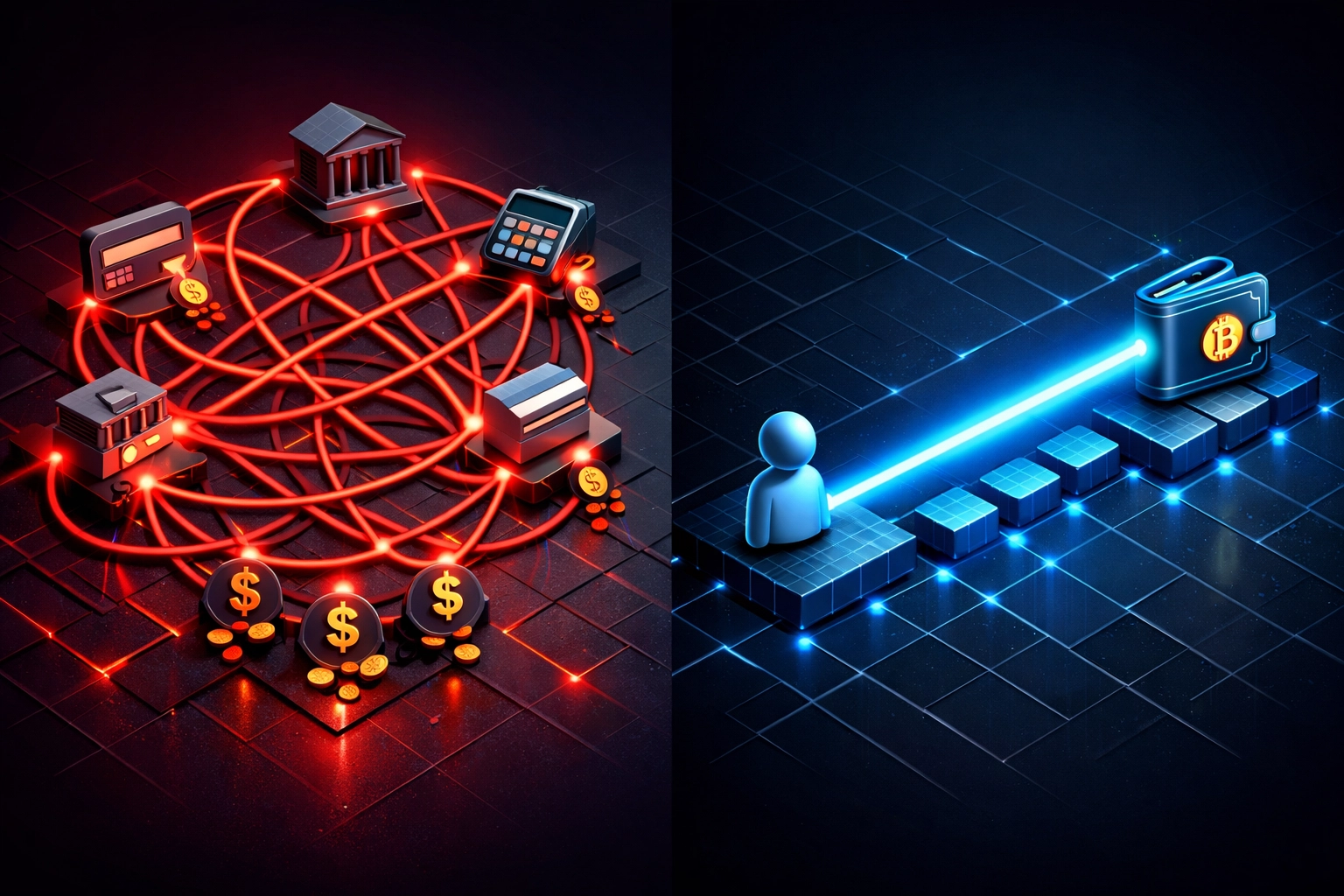

Traditional payment flow:

Customer swipes card → Bank → Card network → Payment processor → Your account

Each step takes a cut

Larecoin payment flow:

Customer pays → LareBlocks blockchain → Your wallet

Done

The math is brutal for legacy systems. Credit card interchange fees average 2.5-3.5% per transaction. Add payment gateway fees, PCI compliance costs, and monthly platform charges: you're looking at 4-5% total cost.

Larecoin merchants pay blockchain gas fees only. We're talking $0.10-$0.50 per transaction regardless of amount. For a $1,000 sale, that's 0.05% versus 3.5% on Visa.

That's a 98.5% reduction in transaction costs.

Compare this to crypto payment processors like NOWPayments or CoinPayments. They charge 0.5-1% per transaction PLUS monthly fees PLUS conversion costs. Still better than cards, but nowhere near native Larecoin deployment.

Reason 2: LUSD Stablecoin Eliminates Volatility Risk

Here's where merchants traditionally get nervous about crypto payments.

Bitcoin swings 5% daily. Ethereum isn't much better. You accept $10,000 in crypto Monday morning, it's worth $9,200 by Wednesday.

Enter LUSD: Larecoin's native stablecoin.

Pegged 1:1 to USD. Built on LareBlocks. Zero conversion fees when merchants choose LUSD settlement.

The merchant flow:

Customer pays 250 LARE tokens

Smart contract auto-converts to LUSD at current rate

Merchant receives stable USD value instantly

Zero volatility exposure

This is critical for the CLARITY Act advantage. Digital commodity status allows direct LUSD integration without securities regulations. No waiting for bank partnerships. No KYC delays for stablecoin custody.

NOWPayments and CoinPayments require third-party stablecoin conversions. Extra fees. Extra steps. Extra friction.

Larecoin merchants get native stablecoin settlement built into every transaction.

Reason 3: NFT Receipts Create New Revenue Streams

This is where we separate from traditional payment systems entirely.

Every Larecoin transaction generates an optional NFT receipt. Stored on LareBlocks. Permanent. Verifiable. Tradeable.

Why merchants love this:

Loyalty programs encoded in NFT metadata

Exclusive access tokens for repeat customers

Resellable proof-of-purchase for limited editions

Automatic warranty verification

A coffee shop issues 1,000 NFT receipts monthly. Each contains a loyalty point system. Customers collect 10 receipts, get a free drink. The NFT tracks it automatically.

A sneaker store sells limited edition shoes. NFT receipt proves authenticity. Increases resale value. Drives more initial sales.

Try doing that with a Visa transaction.

Under the CLARITY Act framework, these NFT utilities are treated as digital commodities, not securities. No registration requirements. No complex compliance.

CoinPayments and NOWPayments? Still processing basic transactions. No NFT infrastructure. No metadata utility. No additional revenue opportunities.

Reason 4: Self-Custody Security Beats Payment Processor Vulnerabilities

Let's talk about what really keeps merchants up at night.

Payment processor breaches. Frozen accounts. Held funds. Sudden policy changes.

Traditional payment processors hold your money. They control access. They enforce arbitrary rules. They can shut you down without warning.

Larecoin operates on self-custody principles.

Merchants control their own wallets. Private keys remain with the business. No third party can freeze funds. No payment processor can hold your money hostage.

LareBlocks Layer 1 provides the security infrastructure:

Proof-of-stake consensus

Multi-signature support for business accounts

Hardware wallet compatibility

Decentralized transaction validation

When NOWPayments or CoinPayments face regulatory pressure, your funds are at risk. They're custodial services. They hold merchant balances. They comply with government requests.

Larecoin merchants own their assets outright. CLARITY Act classification protects digital commodity transactions from securities-based seizure mechanisms.

This isn't just about saving 50% on fees. This is about true financial sovereignty for your business.

Reason 5: AI-Powered Metaverse Shopping Expands Customer Base

The final piece most payment processors completely miss.

Larecoin isn't just for online checkout buttons. We're building integrated metaverse commerce.

The 2026 landscape:

Virtual storefronts in decentralized metaverse platforms

AI-powered shopping assistants processing Larecoin payments

Cross-reality transaction history (physical + virtual purchases)

Metaverse-exclusive products with NFT authentication

Your customers are already exploring virtual worlds. They're buying digital fashion, virtual real estate, metaverse experiences.

Larecoin merchants can sell in BOTH worlds with the same payment infrastructure.

A clothing brand sells physical hoodies for LUSD. Also sells virtual hoodies for avatars. Same wallet. Same checkout. Same NFT receipt system.

Try integrating that with a traditional merchant account.

The CLARITY Act framework explicitly addresses digital commodity usage in virtual environments. No regulatory gray area. No compliance uncertainty.

The Competitive Landscape: Why Larecoin Beats Alternatives

NOWPayments comparison:

Charges 0.5% per transaction

Supports 200+ coins (complexity nightmare)

Custodial wallet system

No native stablecoin

No NFT receipt functionality

No metaverse integration

CoinPayments comparison:

Charges 0.5% + network fees

Monthly fees for premium features

No Layer 1 blockchain

Third-party stablecoin dependencies

Limited smart contract capability

Traditional checkout flow only

Larecoin advantage:

Gas fees only ($0.10-$0.50 per transaction)

Native LARE + LUSD ecosystem

Non-custodial architecture

Built-in NFT receipts

Full metaverse commerce support

LareBlocks Layer 1 infrastructure

The 50% savings aren't hypothetical. They're structural.

Real Numbers: What Merchants Actually Save

Let's break down a typical small business scenario.

Monthly revenue: $50,000 Average transaction: $100 Total transactions: 500

Traditional credit card processing:

Per-transaction fee: $3.20 (2.9% + $0.30)

Monthly cost: $1,600

Annual cost: $19,200

CoinPayments alternative:

Per-transaction fee: $0.50 (0.5%)

Monthly cost: $250

Annual cost: $3,000

Larecoin native payments:

Per-transaction fee: $0.25 (gas only)

Monthly cost: $125

Annual cost: $1,500

Savings versus cards: $17,700 annually (92% reduction) Savings versus crypto competitors: $1,500 annually (50% reduction)

Scale this to medium and large businesses. The numbers get ridiculous fast.

Getting Started: Larecoin Merchant Integration

The CLARITY Act regulatory clarity means faster onboarding. No complex compliance reviews. No multi-month approval processes.

Implementation timeline:

Day 1: Set up LareBlocks wallet

Day 2: Generate merchant payment address

Day 3: Integrate checkout plugin (WooCommerce, Shopify, custom API)

Day 4: Start accepting LARE and LUSD payments

No application forms. No credit checks. No personal guarantees.

Pure digital commodity payments under clear regulatory framework.

The Bottom Line

The CLARITY Act isn't just regulatory housekeeping. It's the foundation for a complete payments revolution.

Larecoin merchants get:

50%+ cost savings versus any alternative

Stablecoin settlement without volatility

NFT receipts for loyalty and authentication

Self-custody security and fund control

Metaverse commerce integration

Legacy payment processors can't compete. Even crypto alternatives like NOWPayments and CoinPayments are stuck in the old model: middlemen taking cuts, custodial risk, limited functionality.

LareBlocks Layer 1 architecture + CLARITY Act digital commodity classification = game over for traditional interchange fees.

Your customers are ready for crypto payments. The regulatory framework is in place. The infrastructure works today.

The only question: how much longer can you afford to keep paying 3% per transaction?

Ready to cut your payment processing costs in half?

Visit larecoin.com to set up your merchant wallet. Check out our comprehensive guide to Web3 global payments for step-by-step integration instructions.

Join the Larecoin Community to connect with other merchants already processing thousands in fee-free transactions.

The future of payments is here. It's decentralized. It's cost-effective. It's Larecoin.

Comments