How the CLARITY Act Turns Your Crypto POS System Into a Tax-Saving Machine (NFT Receipts Explained)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Regulatory Clarity Just Changed the Game for Crypto Merchants

The CLARITY Act (H.R. 3633) isn't another boring regulatory framework.

It's the first piece of legislation that actually tells you which digital assets the SEC oversees and which ones fall under the CFTC's jurisdiction. No more guessing games. No more compliance nightmares.

For merchants running crypto POS systems, this clarity means you finally know the rules of the road. And when you combine that regulatory certainty with Larecoin's NFT receipt technology, you unlock serious tax advantages that were always there: you just couldn't access them before.

The De Minimis Exemption: Your Secret Weapon

Here's what most crypto merchants don't know.

The IRS has a de minimis exemption for cryptocurrency transactions under $200. That means if your customer buys a $150 pair of sneakers with crypto, they don't have to report capital gains on that transaction.

Zero paperwork for your customers. Zero capital gains headaches. Maximum convenience.

But there's a catch: proving that a transaction qualifies requires meticulous record-keeping. That's where most traditional crypto payment processors fail merchants. They give you basic transaction logs, but nothing designed specifically for tax compliance.

Larecoin's NFT receipt system flips this completely.

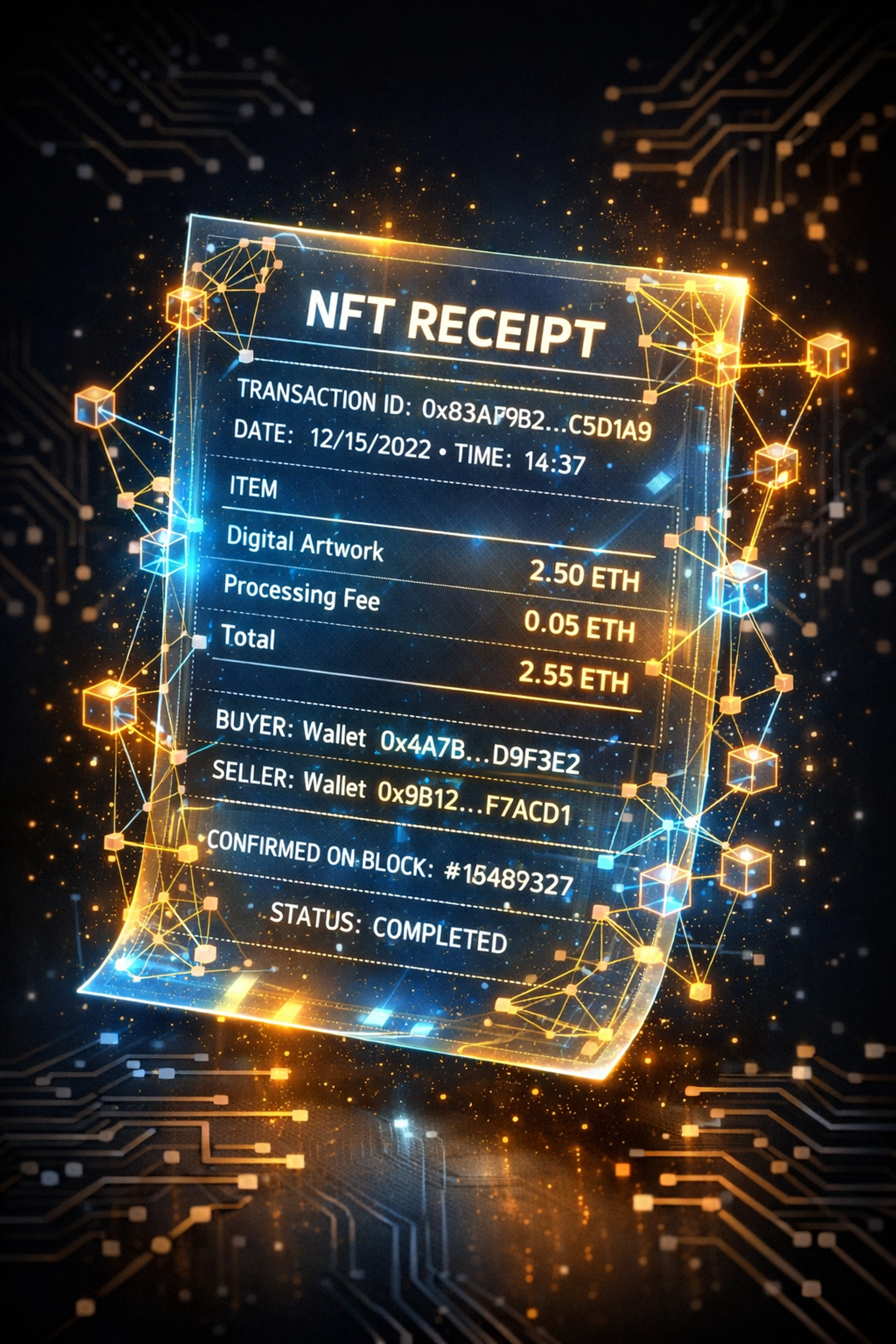

NFT Receipts: Permanent, Immutable, Tax-Ready Documentation

Every transaction processed through Larecoin's POS generates an NFT receipt on the LareBlocks Layer 1 blockchain.

Not a PDF. Not a database entry. A permanent, tamper-proof digital asset that contains:

Transaction amount in both crypto and fiat

Timestamp verified by blockchain consensus

Merchant and customer wallet addresses

Item-level purchase details

Real-time exchange rates at moment of sale

This NFT lives forever on LareScan, Larecoin's blockchain explorer. Your customers can access it anytime. Your accountant can verify it instantly. The IRS can't dispute it.

Traditional payment processors give you receipts that disappear in email folders or get lost in accounting software migrations. NFT receipts are blockchain-native. They survive system failures, company bankruptcies, and data center fires.

How the CLARITY Act Amplifies This Advantage

Before the CLARITY Act, merchants faced regulatory ambiguity.

Is LARE a security or a commodity? Which agency regulates our stablecoin transactions? What disclosure requirements apply to our customer receipts?

The CLARITY Act answers these questions by establishing clear classification criteria. Decentralized tokens like LARE fall under CFTC oversight. Centralized tokens face SEC scrutiny.

This clarity means Larecoin can optimize its entire infrastructure: including NFT receipts: for the specific regulatory framework that applies. No over-compliance. No under-compliance. Just the right amount of documentation for the right regulatory body.

When your POS system generates compliant records from day one, tax season transforms from nightmare to non-event.

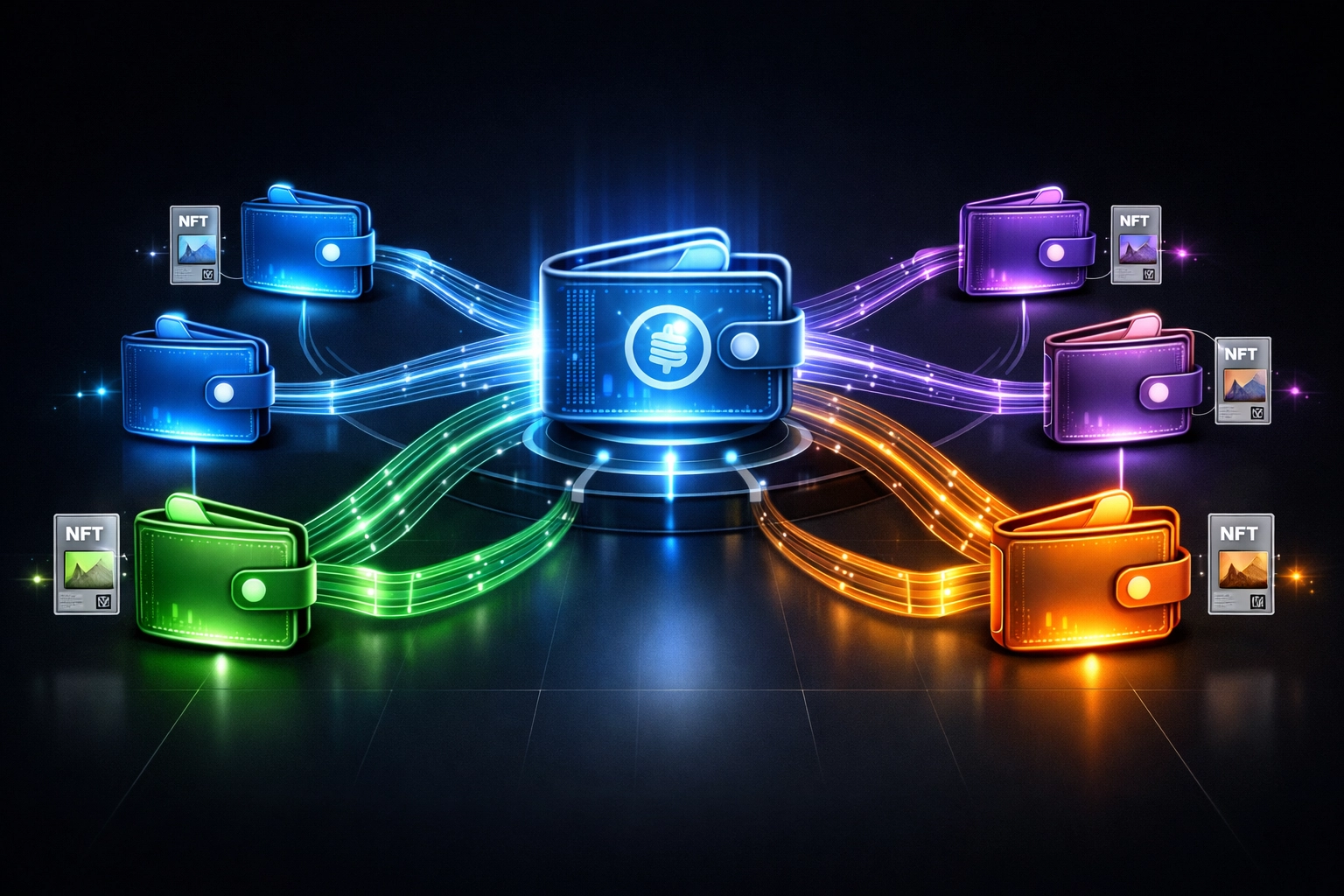

Master/Sub-Wallet Architecture: Tax Segregation Built In

Larecoin's Master/Sub-wallet system takes this further.

Merchants get a Master wallet for business operations and unlimited Sub-wallets for different purposes:

One Sub-wallet for taxable sales

Another for tax-exempt transactions

Another for international customers

Another for wholesale B2B payments

Each Sub-wallet generates separate NFT receipts on the blockchain. Your accountant can pull reports by wallet address instead of sorting through mixed transaction logs.

Compare this to NOWPayments or CoinPayments. They dump everything into one payment stream. You sort it out manually. Good luck during an audit.

Larecoin's architecture assumes you'll get audited and designs compliance into the protocol layer.

The 50% Fee Advantage Compounds Over Time

Larecoin charges 50% lower fees than NOWPayments, CoinPayments, and Triple-A.

That's not marketing fluff. That's actual savings you can calculate.

A $100,000/month merchant saves approximately $6,000 annually in processing fees compared to competitors. Over five years? $30,000+ back in your business instead of payment processor pockets.

But here's the hidden multiplier effect:

Lower fees + NFT receipt automation + Master/Sub-wallet segregation = dramatically reduced accounting costs.

Your bookkeeper spends less time reconciling transactions. Your CPA spends less time preparing tax documents. You spend less time stressing about compliance.

The total cost of ownership for crypto payment acceptance drops by 60-70% compared to traditional processors.

LUSD Stablecoin: Eliminate Volatility Without Sacrificing Crypto Benefits

Merchants love crypto speed and borderless payments. Merchants hate crypto price swings.

Larecoin's LUSD stablecoin solves this tension perfectly.

Customers pay with LARE, Bitcoin, Ethereum, or 50+ other tokens. Larecoin's AI-powered routing converts it instantly to LUSD at point of sale. You receive stable value in your wallet. The customer paid with their preferred crypto.

Every LUSD transaction still generates an NFT receipt. You still get the tax documentation benefits. You still qualify for de minimis exemptions on qualifying purchases.

But you eliminate the volatility risk that makes traditional crypto merchant adoption scary.

Push-to-Card: Turn Crypto Sales Into Spendable Fiat Instantly

Here's where Larecoin's ecosystem really shines.

You accept crypto payments. NFT receipts generate automatically. Funds settle in LUSD. Then what?

Push-to-Card services let you transfer LUSD to any debit card in seconds. No waiting for bank ACH transfers. No dealing with crypto off-ramps. Just instant liquidity.

This closes the loop completely:

Customer pays with crypto (potentially tax-exempt under de minimis)

NFT receipt documents the transaction (IRS-ready proof)

LUSD eliminates volatility (stable business accounting)

Push-to-Card converts to spendable fiat (immediate cash flow)

The entire cycle happens in under 60 seconds. Try doing that with traditional crypto processors that take 3-5 business days to settle funds.

B2B2C Metaverse Integration: Future-Proof Your Compliance Stack

Larecoin isn't just building for today's retail transactions.

The platform's AI-powered shopping and B2B2C metaverse experiences mean your NFT receipt system works identically whether customers shop:

In your physical store

On your website

In a metaverse storefront

Through AI-assisted shopping agents

One compliance system. One receipt format. One blockchain record.

As commerce moves into virtual spaces, your tax documentation doesn't break. Your NFT receipts follow your sales across every channel automatically.

Traditional payment processors will need to rebuild their entire infrastructure for metaverse commerce. Larecoin already operates there natively.

Social Impact: 1.5% Tax to Charity Adds Deduction Benefits

Every transaction on Larecoin allocates 1.5% to charity automatically.

This isn't just feel-good marketing. It's a built-in tax deduction multiplier.

Your business accepts crypto payments. Larecoin routes 1.5% to registered charitable organizations. You receive documentation of the donation. Your accountant claims the charitable contribution deduction.

The NFT receipt system tracks both your business income AND your charitable contributions in one immutable record. No separate donation receipts to manage. No forgetting to claim deductions you've already made.

The social impact is real: Larecoin has funded thousands of charitable causes. But the tax efficiency is equally real for merchants who structure their operations correctly.

LareBlocks Layer 1: Why Infrastructure Matters for Tax Compliance

Other crypto payment processors operate on third-party blockchains.

Larecoin built its own Layer 1.

Why does this matter for merchants?

Complete control over transaction finality, receipt generation timing, and compliance features. When regulatory requirements change, Larecoin updates the protocol. You don't wait for Ethereum governance or Bitcoin improvement proposals.

LareBlocks processes transactions with gas-only fees, meaning lower operational costs get passed directly to merchants. And because NFT receipts mint on the same chain as payments settle, there's zero delay between transaction completion and documentation availability.

Your accountant gets real-time access to compliant records the moment sales occur. Not hours later. Not days later. Instantly.

Getting Started: Zero Complexity, Maximum Compliance

Setting up Larecoin's tax-optimized POS takes minutes:

Create your Master wallet at larecoin.com

Configure Sub-wallets for different transaction types

Enable NFT receipt generation (default on)

Integrate your existing POS or use Larecoin's contactless terminal

Start accepting 50+ cryptocurrencies with automatic LUSD conversion

Your first NFT receipt generates automatically with your first sale.

No blockchain expertise required. No crypto accounting degree needed. Just straightforward merchant tools designed by people who understand both crypto infrastructure and real-world business tax requirements.

The CLARITY Act created the regulatory framework. Larecoin built the merchant infrastructure. Your job is just to start accepting the future of payments.

Comments