How to Choose the Best Crypto POS System for Small Business (Compared)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 1 hour ago

- 4 min read

Small business owners are waking up. Crypto payments aren't optional anymore. They're essential.

But here's the problem. Not all crypto POS systems are created equal. Some drain your profits with fees. Others lock up your funds. Many force you to trust centralized custodians with your hard-earned revenue.

Time to break it down. Let's compare the best crypto POS systems for small business and find out which one actually serves you.

What to Look for in a Crypto POS System

Before diving into comparisons, nail down your priorities. These factors matter most.

Fee Structure. Every percentage point counts. Some processors charge 1%. Others hit you with 2-3% plus hidden conversion fees. That adds up fast.

Self-Custody Options. Who holds your crypto? Centralized platforms mean counterparty risk. Your funds. Your keys. Period.

Settlement Speed. How fast do you access your money? Same-day? Next week? Cash flow is king for small businesses.

Cryptocurrency Support. Bitcoin only? Or full multi-chain support? Flexibility attracts more customers.

Integration Ease. No one wants to hire a developer for basic setup. Simple wins.

Unique Features. NFT receipts, stablecoins, rewards programs, these differentiate forward-thinking solutions.

The Big Three: NOWPayments vs CoinPayments vs Larecoin

Let's get specific. Here's how the major crypto POS contenders stack up.

NOWPayments

Overview: Popular choice for e-commerce integration. Supports 150+ cryptocurrencies. Offers plugins for major platforms.

Fees: 0.5% to 1% per transaction. Competitive on paper.

Settlement: Instant to your wallet or auto-conversion to fiat through partners.

The Catch: Custodial by default. Your payments route through their system first. Auto-conversion adds hidden exchange fees. Limited control over your funds.

Best For: Merchants who prioritize currency variety over true ownership.

CoinPayments

Overview: One of the oldest crypto payment processors. Supports 2,000+ coins. Multi-asset vault included.

Fees: 0.5% standard fee. Additional fees for conversions and withdrawals.

Settlement: Funds sit in CoinPayments wallet until you withdraw. Extra steps.

The Catch: Centralized custody. You're trusting a third party with your revenue. Withdrawal fees nibble at profits. Interface feels dated.

Best For: Merchants wanting maximum altcoin support who don't mind custodial trade-offs.

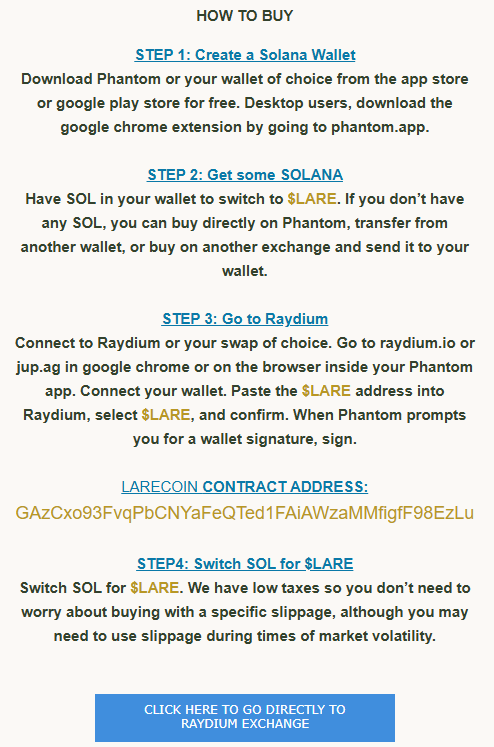

Larecoin

Overview: Web3-native payment ecosystem built for merchant independence. Self-custody first. LUSD stablecoin integration. NFT receipt technology.

Fees: Industry-low transaction fees. No hidden conversion surprises. Gas-only transfers keep costs minimal.

Settlement: Direct to your wallet. Instant. No middleman holding your funds.

The Differentiator: True self-custody. You receive payments directly. No custodial risk. Plus NFT receipts for every transaction, immutable proof of purchase on-chain.

Best For: Merchants who want freedom, lower fees, and innovative Web3 features.

Why Self-Custody Changes Everything

Here's the truth most payment processors don't want you to hear.

When they hold your crypto, they control your business. Exchange collapses? Your funds gone. Account frozen for "review"? Revenue stuck in limbo.

Self-custody flips the script.

With Larecoin's approach, payments hit your wallet directly. Not a corporate vault. Not a centralized exchange. Your wallet.

This matters more than ever in 2026. Regulatory uncertainty. Exchange failures. Counterparty risk is real.

Smart merchants protect themselves. Self-custody isn't paranoia. It's good business.

The NFT Receipt Revolution

Paper receipts? Dead. Email confirmations? Easily lost or disputed.

NFT receipts solve problems you didn't know you had.

Immutable Proof. Every transaction minted on-chain. Can't be altered. Can't be faked.

Dispute Resolution. Customer claims they never received goods? Check the blockchain. Timestamped. Verified.

Customer Loyalty. NFT receipts can double as collectibles or unlock future discounts. Engagement built into every purchase.

Tax Documentation. Clean, verifiable transaction records for accounting. Your CPA will thank you.

Larecoin pioneered NFT receipts in the merchant payment space. It's not a gimmick. It's the future of commerce documentation.

LUSD: Stability Without Sacrificing Crypto Benefits

Volatility scares merchants. Understandably.

Accept $500 in Bitcoin. Wake up to $450. That's not sustainable.

Traditional solution? Auto-convert to fiat instantly. But that means fees. And you lose crypto upside.

LUSD offers a third path.

Larecoin's stablecoin maintains dollar parity while keeping you in the crypto ecosystem. No volatility shock. No forced fiat conversion.

Benefits for Merchants:

Price stability for inventory planning

Stay in crypto for future appreciation opportunities

Lower conversion fees than fiat off-ramps

Seamless integration with Larecoin POS

Accept payment. Hold in LUSD. Convert when you decide. On your terms.

Fee Comparison: The Numbers Don't Lie

Let's do the math on a $10,000 monthly transaction volume.

Processor | Base Fee | Estimated Monthly Cost | Hidden Fees |

NOWPayments | 0.5-1% | $50-100 | Exchange conversion |

CoinPayments | 0.5% | $50 | Withdrawal fees |

Larecoin | Minimal gas | ~$10-20 | None |

Over a year, that's hundreds: potentially thousands: saved with Larecoin.

Small margins make or break small businesses. Fee savings compound. That money belongs in your pocket.

Integration: Get Started in Minutes

Complex setup kills adoption. We get it.

Larecoin's ecosystem prioritizes simplicity:

Set up your merchant wallet

Connect to your existing POS or e-commerce platform

Start accepting crypto payments

Receive funds directly: no middleman

No lengthy verification processes. No corporate gatekeepers deciding if your business qualifies.

Merchant freedom means frictionless onboarding.

The Decentralization Difference

Centralized processors answer to shareholders. Regulators. Banks.

You're an afterthought.

Decentralized payment rails answer to the protocol. To math. To immutable code.

Larecoin's architecture means:

No account freezes without due process

No arbitrary policy changes killing your revenue stream

No corporate intermediary taking a cut of every sale

True peer-to-peer commerce

This isn't ideology. It's practical business protection.

Making the Switch: What to Consider

Already using a crypto payment processor? Switching isn't complicated.

Evaluate your current costs. Calculate total fees including hidden charges.

Assess custody risk. How much revenue sits in third-party wallets?

Test the alternative. Run parallel systems during transition.

Train your team. New tools require brief onboarding.

Most merchants complete migration within a week. The savings start immediately.

The Bottom Line

Choosing a crypto POS system isn't just about accepting Bitcoin.

It's about protecting your business. Maximizing margins. Embracing innovation.

NOWPayments and CoinPayments serve their purpose. They introduced merchants to crypto payments.

But the game has evolved.

Self-custody. NFT receipts. LUSD stability. Minimal fees. True merchant independence.

Larecoin delivers what small businesses actually need in 2026 and beyond.

Ready to take control of your crypto payments?

Explore the Larecoin ecosystem and discover what merchant freedom really means. Check out our blog for more guides on navigating Web3 commerce.

Your business. Your crypto. Your rules.

Comments