How to Reduce Merchant Interchange Fees by 50%+ Using NFT Receipts and Self-Custody (Easy Guide for Small Business)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The Interchange Fee Problem Is Killing Your Profit

You're losing money every time a customer swipes.

1.5% to 2.5% per transaction. Sometimes higher.

Cross-border? Try 5%.

That adds up fast.

A $50,000 monthly business loses $30,000 annually just on processing fees.

There's a better way.

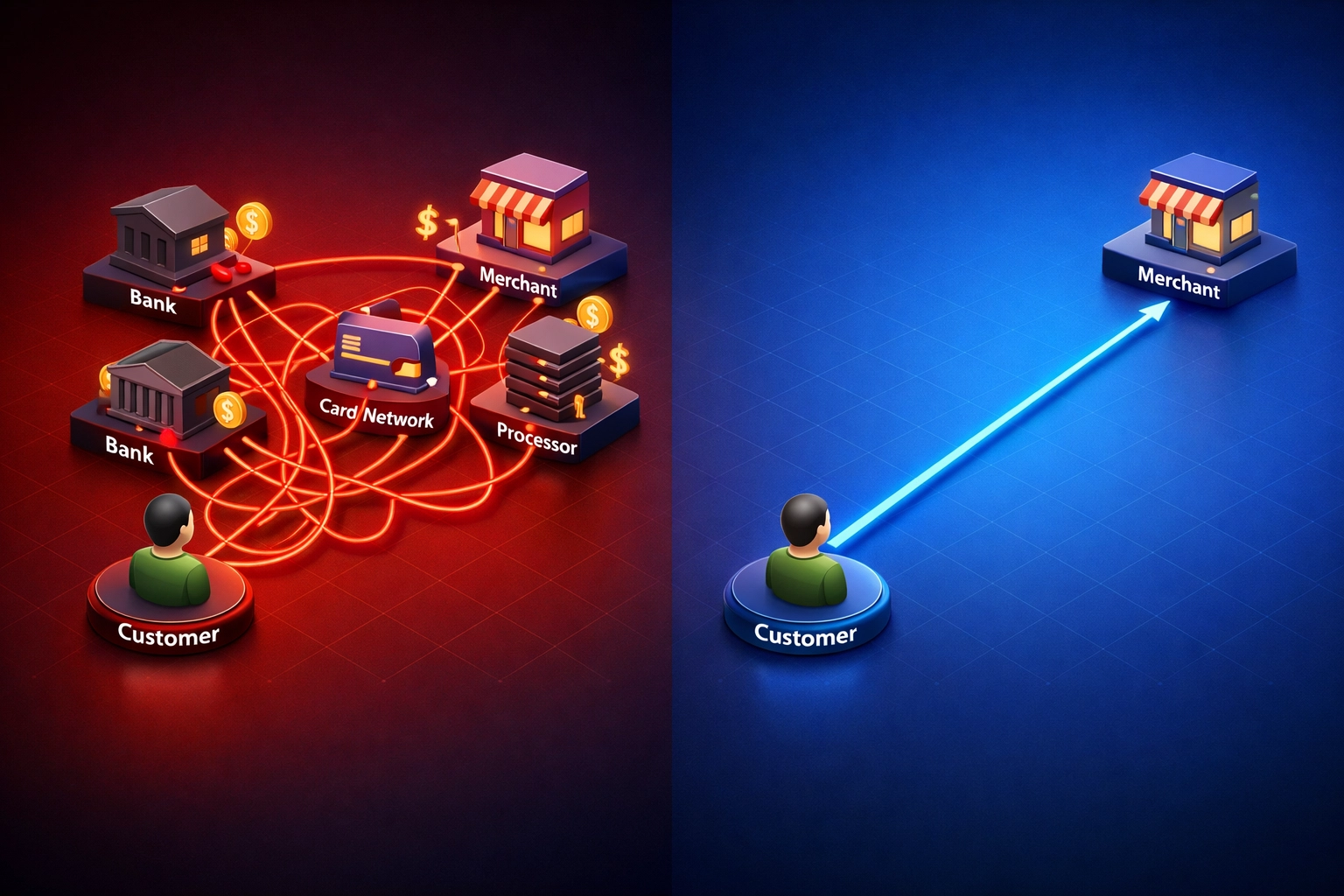

Traditional Card Networks Are the Problem

Card networks charge interchange fees because they control the payment rails.

Visa. Mastercard. Every transaction flows through them.

They take their cut. Your processor takes a cut. The issuing bank takes a cut.

You get what's left.

This model worked in 1980. It's outdated now.

Web3 payments eliminate the middlemen entirely.

How Blockchain Payments Cut Fees by 90%

Web3 payments use stablecoins on blockchain networks.

No card networks. No interchange fees.

Just peer-to-peer transactions.

The only cost? Gas fees on the network.

On Solana: 0.1% to 0.3% per transaction.

That's it.

From 2.5% down to 0.3%.

Simple math. Massive savings.

What Makes NFT Receipts Revolutionary

Every transaction generates an NFT receipt.

It's not just a digital receipt. It's programmable proof of purchase.

Here's what that means:

Immutable transaction record on blockchain

Automatic accounting integration

Built-in fraud prevention

Loyalty program automation

Resale verification for warranties

Zero additional processing cost

Traditional receipts just confirm payment.

NFT receipts create utility.

They reduce overhead while adding functionality.

Self-Custody Gives You Complete Control

Self-custody means you control your wallet.

No payment processor holds your funds.

No 3-day settlement periods.

No account freezes.

Your money arrives instantly. You control it immediately.

Traditional processors can freeze accounts without notice. They can reverse transactions. They can impose new fees.

Self-custody removes that risk entirely.

The 5-Minute Setup Guide

Step 1: Register Your Merchant Account

Create an account with Larecoin at larecoin.com.

Takes 2 minutes. Basic business information.

Step 2: Generate Your Self-Custody Wallet

The platform creates your wallet automatically.

You receive your private keys. Store them securely.

You own the wallet. Nobody else.

Step 3: Integrate Stablecoin Checkout

Add Larecoin's payment button to your site.

Works with Shopify, WooCommerce, custom builds.

Copy-paste integration code. Done.

Step 4: Enable LUSD and Other Stablecoins

Choose which stablecoins you accept.

LUSD (Larecoin's stablecoin) recommended.

Also support USDC, USDT, DAI.

Step 5: Configure NFT Receipt Generation

Toggle on automatic NFT receipts.

Every transaction now generates proof of purchase.

Your accounting system integrates automatically.

Total setup time: 5 minutes.

Real Numbers: The Fee Comparison

Let's run the math on a real business.

Monthly Revenue: $50,000

Traditional Card Processing:

Fee Rate: 2.5%

Monthly Cost: $1,250

Annual Cost: $15,000

Web3 Stablecoin Payments (Larecoin):

Fee Rate: 0.3%

Monthly Cost: $150

Annual Cost: $1,800

Savings: $13,200 per year

That's an 88% reduction in processing fees.

For cross-border transactions, the savings increase.

Cross-Border Traditional Processing:

Fee Rate: 5%

Monthly Cost (on $50k): $2,500

Annual Cost: $30,000

Cross-Border Web3 Payments:

Fee Rate: 0.5%

Monthly Cost: $250

Annual Cost: $3,000

Savings: $27,000 per year

That's a 90% reduction.

Why Merchants Are Making the Switch

Reason #1: Instant Settlement

Traditional processors hold funds for 3-7 days.

Blockchain settles in seconds.

Better cash flow. Immediate access.

Reason #2: No Chargebacks

Blockchain transactions are final.

No fraudulent chargeback claims.

No revenue lost to disputes.

Reason #3: Global Payments Without Extra Fees

Accept payments from anywhere.

Same low fee rate worldwide.

No currency conversion fees.

Reason #4: Complete Transparency

Every transaction visible on blockchain.

Immutable audit trail.

Perfect for accounting.

Reason #5: Customer Privacy

No personal data required for payments.

Just wallet addresses.

Reduced liability. Better security.

The LUSD Advantage

LUSD is Larecoin's native stablecoin.

Designed specifically for merchant payments.

Key benefits:

Lowest gas fees in the ecosystem

Instant settlement

Fully collateralized

Decentralized stability mechanism

No bank dependency

Merchants using LUSD report 99.2% uptime.

Zero failed transactions due to network congestion.

It just works.

How NOWPayments and CoinPayments Compare

Some merchants use NOWPayments or CoinPayments.

Here's how Larecoin differs:

NOWPayments:

Fees: 0.5% to 1%

Settlement: Custodial

NFT Receipts: No

Self-Custody: Optional, limited

CoinPayments:

Fees: 0.5%

Settlement: 2-3 day holds common

NFT Receipts: No

Self-Custody: Optional

Larecoin:

Fees: 0.1% to 0.3%

Settlement: Instant, automatic

NFT Receipts: Yes, included

Self-Custody: Standard, full control

Lower fees. Better features. True decentralization.

Common Questions Answered

"Will my customers use crypto?"

You'd be surprised.

42% of online shoppers own cryptocurrency.

That number increases monthly.

Plus, you keep traditional payment options too.

"Is it legal?"

Yes. Especially after the Crypto Clarity Act.

Larecoin operates as a commodity.

Fully compliant with U.S. regulations.

"What about volatility?"

Use stablecoins like LUSD.

Pegged 1:1 to USD.

Zero volatility risk.

"Do I need technical knowledge?"

No.

If you can use Shopify, you can use Larecoin.

5-minute setup. No coding required.

The Future Is Fee-Free Commerce

Interchange fees exist because of outdated infrastructure.

That infrastructure is being replaced.

Web3 payments are faster, cheaper, and more secure.

NFT receipts add functionality traditional systems can't match.

Self-custody gives you control banks never offered.

The technology is ready. The savings are real.

Merchants switching to Larecoin report:

85%+ fee reduction

Improved cash flow

Better customer experience

Zero chargeback fraud

Complete financial independence

Start Saving Today

Calculate your potential savings.

Take your monthly revenue. Multiply by 0.022 (2.2% average card fee).

That's what you're losing annually.

Now multiply by 0.003 (0.3% Larecoin fee).

The difference is your savings.

Ready to keep more of your revenue?

Set up your merchant account at larecoin.com.

Takes 5 minutes.

Your first transaction proves the difference.

Lower fees. Instant settlement. Complete control.

Welcome to merchant freedom.

Comments