How to Reduce Merchant Interchange Fees by 50%+ Using Self-Custody Crypto Payments (No Middlemen Required)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

The Hidden Tax Every Merchant Pays

You're losing 2.5% to 3.5% on every credit card transaction.

That's $2,500 to $3,500 per $100,000 in sales.

For what? Processing. Network fees. Interchange. Bank cuts. Payment processor margins.

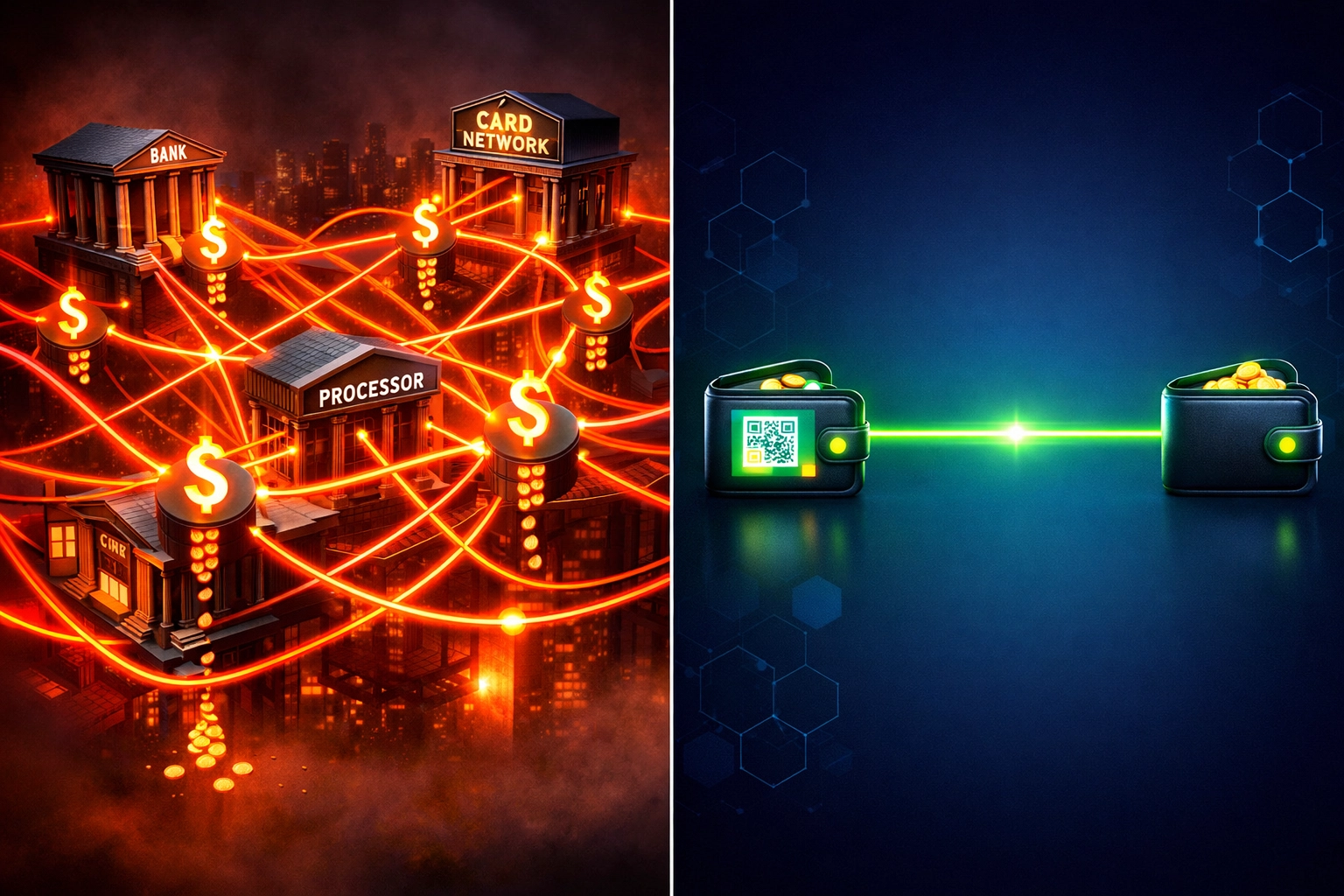

The entire traditional payment stack extracts value at every layer. Card networks take their slice. Banks take theirs. Processors add their percentage.

All before you see a dime.

Self-custody crypto payments eliminate this entire chain.

No Visa. No Mastercard. No payment processor middlemen.

Just customer wallet to your wallet. Direct. Permissionless. Decentralized.

The Real Cost Breakdown

Traditional payment processors charge you percentage-based fees that scale with transaction size.

$1,000 sale = $25 to $35 in fees. $10,000 sale = $250 to $350 in fees.

Over $100,000 in monthly revenue, you're paying $30,000 to $42,000 annually just to accept payments.

Blockchain gas fees work differently.

Fixed cost. Not percentage-based.

$1,000 transaction = $0.001 to $0.10 in gas fees. $10,000 transaction = $0.001 to $0.10 in gas fees.

Same cost. Same speed. Same settlement.

For that same $100,000 monthly revenue, your annual gas fees total approximately $12 to $120.

You're looking at 99%+ savings on payment processing costs.

How Self-Custody Eliminates Middlemen

Traditional payment flow: Customer → Card Network → Acquiring Bank → Payment Processor → Your Bank Account → You (3-5 days later)

Self-custody crypto payment flow: Customer Wallet → Your Wallet (2-10 minutes)

That's it.

No intermediaries extracting fees. No settlement delays. No account freezes. No arbitrary limits.

You control the private keys. You control the funds. You control the entire payment infrastructure.

Larecoin's self-custody approach puts merchants in complete control. Generate your wallet. Share your payment address or QR code. Receive LARE, LUSD, or other supported crypto directly.

Zero middlemen. Zero permission needed.

Why NOWPayments and CoinPayments Still Take Cuts

Most crypto payment processors claim to offer "low fees."

They don't offer self-custody.

NOWPayments charges 0.5% per transaction. Sounds low compared to credit cards. But that's still $500 per $100,000. And you don't control the wallet. They do.

CoinPayments charges 0.5% plus blockchain fees. Similar story. They custody your funds. They can freeze accounts. They decide when you get paid out.

You're still dealing with a middleman. Just a crypto middleman instead of a traditional one.

The fundamental problem remains: Someone else controls your money.

Larecoin's self-custody model eliminates this entirely. You're not a customer of a payment processor. You're a sovereign merchant running your own payment infrastructure.

Your wallet. Your keys. Your funds. Immediately.

No 0.5% cuts. No custody risk. No account freezes. No approval processes.

Just blockchain gas fees: typically $0.01 or less on Solana.

LUSD: Stablecoin Payments Without Volatility Risk

Crypto volatility scares merchants.

Bitcoin swings 10% in a day. You price something at $100, customer pays in BTC, and by the time you check your wallet it's worth $92.

LUSD solves this. Larecoin's stablecoin version maintains 1:1 peg with USD.

Customer pays $100 in LUSD. You receive $100 in LUSD. No volatility. No conversion delays. No surprises.

You get all the benefits of crypto payments: low fees, self-custody, instant settlement, chargeback elimination: without price fluctuation risk.

Accept LUSD for everyday transactions. Hold LARE for ecosystem rewards and appreciation potential. Convert between them instantly within your self-custody wallet.

Merchants finally get crypto payment stability without sacrificing decentralization.

NFT Receipts: The Future of Transaction Records

Every Larecoin payment generates an NFT receipt.

Permanent. Immutable. Verifiable on-chain.

Traditional receipts are paper or email. Easy to lose. Easy to fake. Zero provenance.

NFT receipts live on the blockchain forever. Customers prove purchase history. Merchants verify transactions instantly. Disputes resolve with cryptographic proof.

Want to offer warranties? NFT receipt proves purchase date and authenticity.

Running loyalty programs? Track customer purchase history via their NFT receipt collection.

Dealing with returns? Verify original transaction with on-chain data.

This isn't theoretical. Larecoin's payment infrastructure creates these NFT receipts automatically for every transaction. No extra steps. No additional cost. Just better record-keeping built into every payment.

Setup Takes 20 Minutes, Not Weeks

Traditional merchant account setup:

Application forms

Credit checks

Business verification

Bank account linking

2-6 week approval process

Integration complexity

Monthly minimums

Contract lock-ins

Larecoin self-custody setup:

Create wallet (10 minutes)

Generate payment QR code (2 minutes)

Test transaction (1 minute)

Start accepting payments (immediately)

No applications. No credit checks. No approval processes.

You're operational in under 30 minutes.

Integration options include WordPress plugins, WooCommerce extensions, Shopify apps, or custom API implementations. Service businesses send payment QR codes via email or text. E-commerce stores embed payment widgets directly on checkout pages.

Your merchant dashboard provides everything you need to start accepting crypto payments today.

Additional Benefits Beyond Fee Savings

Chargeback elimination. Blockchain transactions are final once confirmed. No more $125 billion annual chargeback problem. No more $25-100 per incident fees. No more lost merchandise on fraudulent disputes.

Cross-border payments at domestic prices. International credit card transactions cost 6-12% in combined fees. Currency conversion. International processing charges. Exchange rate markups. Blockchain gas fees cost the same whether your customer is local or overseas.

Instant settlement. Credit cards take 3-5 business days to settle. Crypto settles in minutes. Your cash flow improves immediately.

Complete autonomy. Payment processors can freeze your account, impose limits, or terminate service arbitrarily. Self-custody means even if Larecoin disappeared tomorrow, your wallet continues functioning. Your funds remain accessible. Your payment infrastructure stays operational.

Nobody can deplatform you. Nobody can seize your funds. Nobody can tell you which customers you can or cannot serve.

True merchant independence.

Real Savings Calculation

Let's run the numbers for a $50,000 monthly revenue business:

Traditional payment processing:

3% average fee

$1,500 per month

$18,000 per year

NOWPayments/CoinPayments:

0.5% fee

$250 per month

$3,000 per year

Larecoin self-custody:

~$0.01 per transaction (Solana gas)

Assuming 500 transactions/month

$5 per month

$60 per year

Annual savings vs traditional: $17,940

Annual savings vs crypto processors: $2,940

Scale this to $200,000 monthly revenue and you're saving $71,760 annually compared to traditional processors, or $11,760 compared to custodial crypto payment platforms.

That's hiring a full-time employee. Expanding to a new location. Investing in marketing. Growing your business instead of paying transaction fees.

Start Accepting Self-Custody Payments Today

The infrastructure exists right now.

No waiting. No applications. No permission.

Visit Larecoin to set up your self-custody payment wallet in under 30 minutes. Generate your QR code. Share it with customers. Start collecting payments with near-zero fees.

Join the Larecoin Community to connect with other merchants already using self-custody crypto payments. Get technical support. Share integration tips. Learn best practices.

Check out our complete guide to Web3 global payments for deeper technical implementation details.

The merchant payment revolution isn't coming. It's here.

Self-custody. No middlemen. Your funds. Your control.

Stop paying 3% to processors. Start keeping 99.9% of every transaction.

Comments