How to Reduce Merchant Interchange Fees by 50%+ Using Web3 Global Payments (5-Minute Setup)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant fees are bleeding your business dry.

Every swipe. Every transaction. Every sale.

2-4% for domestic transactions. 4-6% for international payments.

That's not a business expense. That's highway robbery.

The Hidden Tax on Your Revenue

Traditional payment processors stack fees like a casino stacks the deck against you.

The breakdown:

Interchange fees: 1.5-3.5%

Network assessment: 0.13-0.15%

Acquiring bank fees: 0.1-0.5%

Processor markup: 0.2-0.5%

Foreign exchange spread: 1-3% (cross-border)

Add it up. You're handing over 3-7% of every transaction to middlemen who add zero value to your business.

Processing $500,000 annually? You're paying $18,000+ in fees.

That's a salary. Equipment. Marketing budget. Gone.

How Web3 Payments Cut Fees by 75%

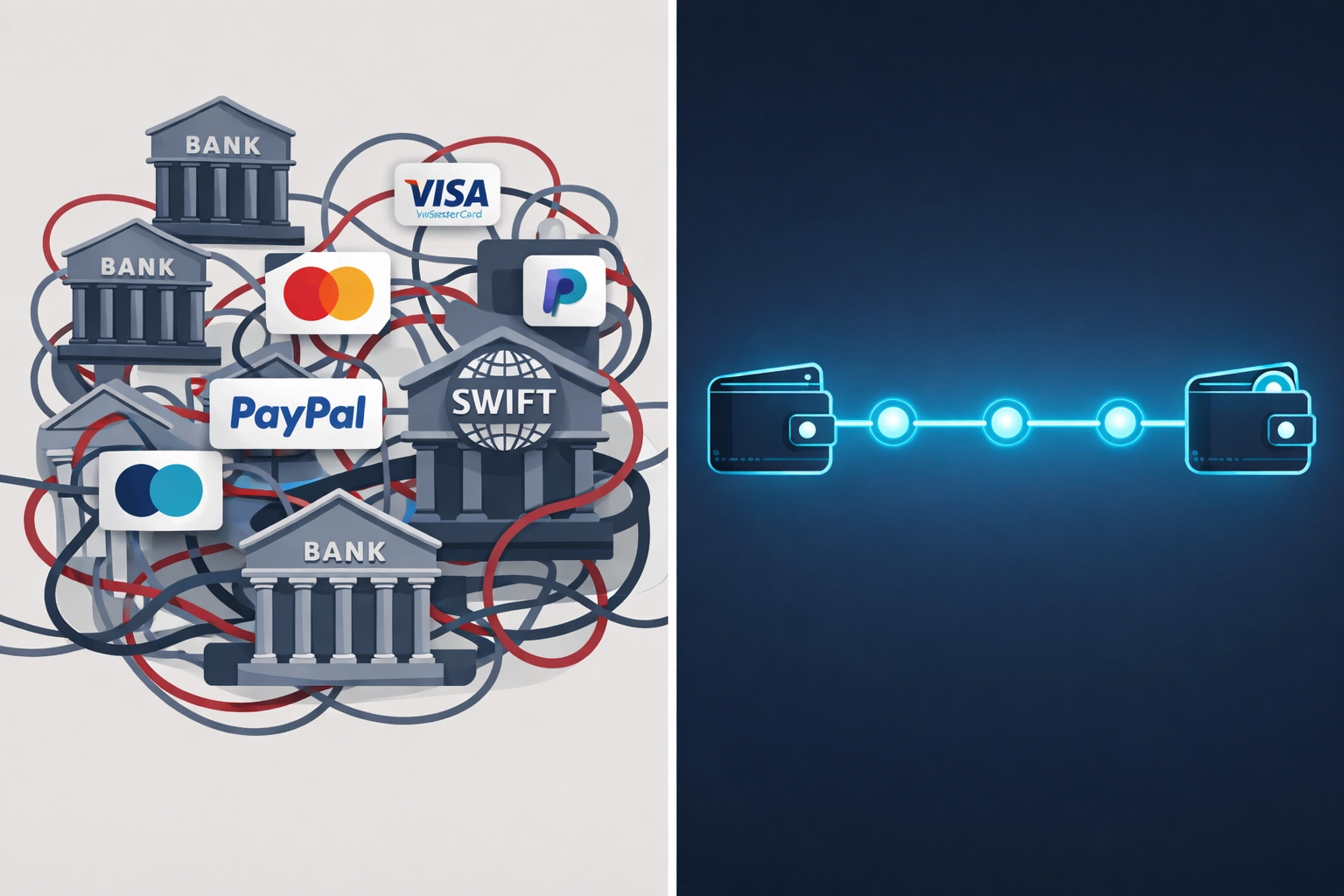

Web3 global payments eliminate the entire fee stack.

No banks. No payment processors. No correspondent banking networks.

Direct peer-to-peer settlement from customer wallet to merchant wallet.

The blockchain handles everything. You pay minimal gas fees instead of percentage-based cuts.

Traditional payment flow: Customer → Card Network → Acquiring Bank → Payment Processor → Multiple Intermediaries → Your Account (minus 3-7%)

Web3 payment flow: Customer Wallet → Blockchain → Your Wallet (minus 0.5-1%)

Every intermediary removed is money back in your pocket.

The 5-Minute Setup (No Exaggeration)

Step 1: Create Your Self-Custody Merchant Account

Head to Larecoin's merchant portal.

No credit checks. No bank applications. No waiting weeks for approval.

Set up your wallet. Control your private keys. Own your funds immediately.

Traditional merchant accounts require:

Business bank account

Credit history review

Processing history verification

2-4 week approval timeline

Self-custody merchant accounts require:

Email address

3 minutes

Step 2: Configure Payment Acceptance

Choose your stablecoins. LUSD offers algorithmic stability without centralized control.

No reliance on traditional banking reserves. No regulatory freeze risk.

Enable multiple payment options:

LUSD (decentralized stability)

USDC (widely adopted)

Native crypto (BTC, ETH, SOL)

Your customers pay their way. You receive immediate settlement.

Step 3: Activate NFT Receipts

Every transaction generates a blockchain-verified receipt as an NFT.

Immutable. Timestamped. Auditable.

Your accountant will thank you. The IRS accepts blockchain records.

Traditional receipts get lost. NFT receipts live forever on-chain.

Real Numbers That Matter

Let's talk actual savings.

Monthly Volume | Traditional Fees (3.5%) | Web3 Fees (0.9%) | Monthly Savings | Annual Savings |

$50,000 | $1,750 | $450 | $1,300 | $15,600 |

$200,000 | $7,000 | $1,800 | $5,200 | $62,400 |

$500,000 | $17,500 | $4,500 | $13,000 | $156,000 |

Small business processing $50K monthly saves $15,600 annually.

Mid-size operation at $200K monthly? $62,400 back in your business.

Scale merchants handling $500K+ monthly save over $156,000 per year.

That's not margin improvement. That's transformative.

Why Competitors Fall Short

NOWPayments:

0.5% fee sounds good

Still requires KYC verification

Limited stablecoin options

No NFT receipt functionality

No receivables tokenization

CoinPayments:

0.5% base fee

Additional withdrawal fees

Complex integration process

No self-custody option

Custodial wallet requirement

Triple-A:

Enterprise-focused pricing

High minimums for small business

Limited blockchain support

Traditional business model with Web3 paint

Larecoin delivers:

True self-custody

NFT receipts for accounting

LUSD stablecoin integration

Receivables token for cash flow management

Zero withdrawal fees to your wallet

Crypto POS system for physical locations

Technical Advantages Traditional Processors Can't Match

NFT Receipts for Accounting

Every transaction mints a receipt NFT.

Metadata includes:

Transaction amount

Timestamp

Customer wallet (pseudonymous)

Product/service details

Tax jurisdiction

Your bookkeeper imports directly from blockchain. No manual data entry. No lost receipts. No reconciliation headaches.

LUSD Stablecoin Benefits

Algorithmic stability without centralized reserves.

Traditional stablecoins (USDC, USDT) require:

Banking relationships

Regulatory compliance

Trust in issuer reserves

LUSD requires:

Ethereum collateral

Smart contract logic

Zero trust assumptions

Decentralized. Censorship-resistant. Truly stable.

Self-Custody Merchant Accounts

You control private keys. You own your funds.

No account freezes. No payment holds. No "risk assessment" delays.

Traditional merchant accounts freeze funds for:

Unusual activity patterns

High-risk industry classifications

Chargebacks

Compliance reviews

Self-custody accounts freeze funds for:

Nothing. You control everything.

Receivables Token

Convert invoices into tradeable tokens.

Need cash before payment clears? Sell your receivables token at a discount.

Instant liquidity without factoring companies taking 20% cuts.

Traditional factoring:

15-30% discount on invoice value

Lengthy approval process

Recourse if customer doesn't pay

Receivables tokens:

Market-determined discount (typically 2-5%)

Instant settlement

Blockchain-verified authenticity

Bank-Free Business Operations

Web3 payments eliminate banking dependency entirely.

No business bank account required. No ACH delays. No wire transfer fees.

Receive payments globally without correspondent banking networks charging 3-5% on international transfers.

Your customer in Japan pays the same fee as your customer in Jersey City.

Currency conversion happens on-chain at spot rates. No 3% FX markup. No "spread" hidden in exchange rates.

Setting Up Your Crypto POS System

Physical retail needs point-of-sale solutions.

Larecoin offers contactless POS terminals that accept:

Crypto payments

Stablecoin transactions

Traditional card payments (if you still want them)

One device. Multiple payment rails. Maximum flexibility.

Your customer decides payment method. You receive optimal settlement.

QR code generation for instant checkout. No hardware required for online merchants.

The Competitive Edge

Merchants using Web3 payments gain advantages beyond fee reduction.

Global customer access: Serve customers in 200+ countries without payment processor restrictions.

Instant settlement: Funds arrive in your wallet within minutes. No 2-3 day ACH hold.

Chargeback elimination: Blockchain transactions are final. No fraudulent chargeback losses.

Privacy preservation: Your revenue numbers stay private. No data sharing with payment networks.

Regulatory flexibility: Operate in jurisdictions traditional processors avoid.

Getting Started Today

Visit Larecoin's merchant portal to set up your account.

Five minutes from now you can accept your first Web3 payment.

Five minutes from now you stop hemorrhaging 3%+ on every transaction.

The technology exists. The savings are real. The setup takes less time than reading this article.

Traditional payment processing is a relic of the pre-blockchain era.

Web3 global payments are here. Merchants who adopt early capture competitive advantage.

Those who wait pay 50%+ more in fees while their competition operates leaner.

Your choice is simple: keep paying the payment processor tax or switch to Web3 and keep your money.

The 5-minute setup isn't marketing hype. It's reality in 2026.

Comments