How to Reduce Merchant Interchange Fees by 50%+ Using Web3 Global Payments (Without Giving Up Control)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Merchant interchange fees are killing your margins.

2.5% to 3.5% for domestic cards. 4% to 6% for international transactions. Add network fees, acquiring bank cuts, and FX spreads. Suddenly 8% of your revenue vanishes before you see a dime.

Traditional payment processors claim they're "competitive." They're not. They're just expensive middlemen stacking fees.

Web3 global payments slash these costs by 50%+ while giving you complete control. No banks. No intermediaries. No permission needed.

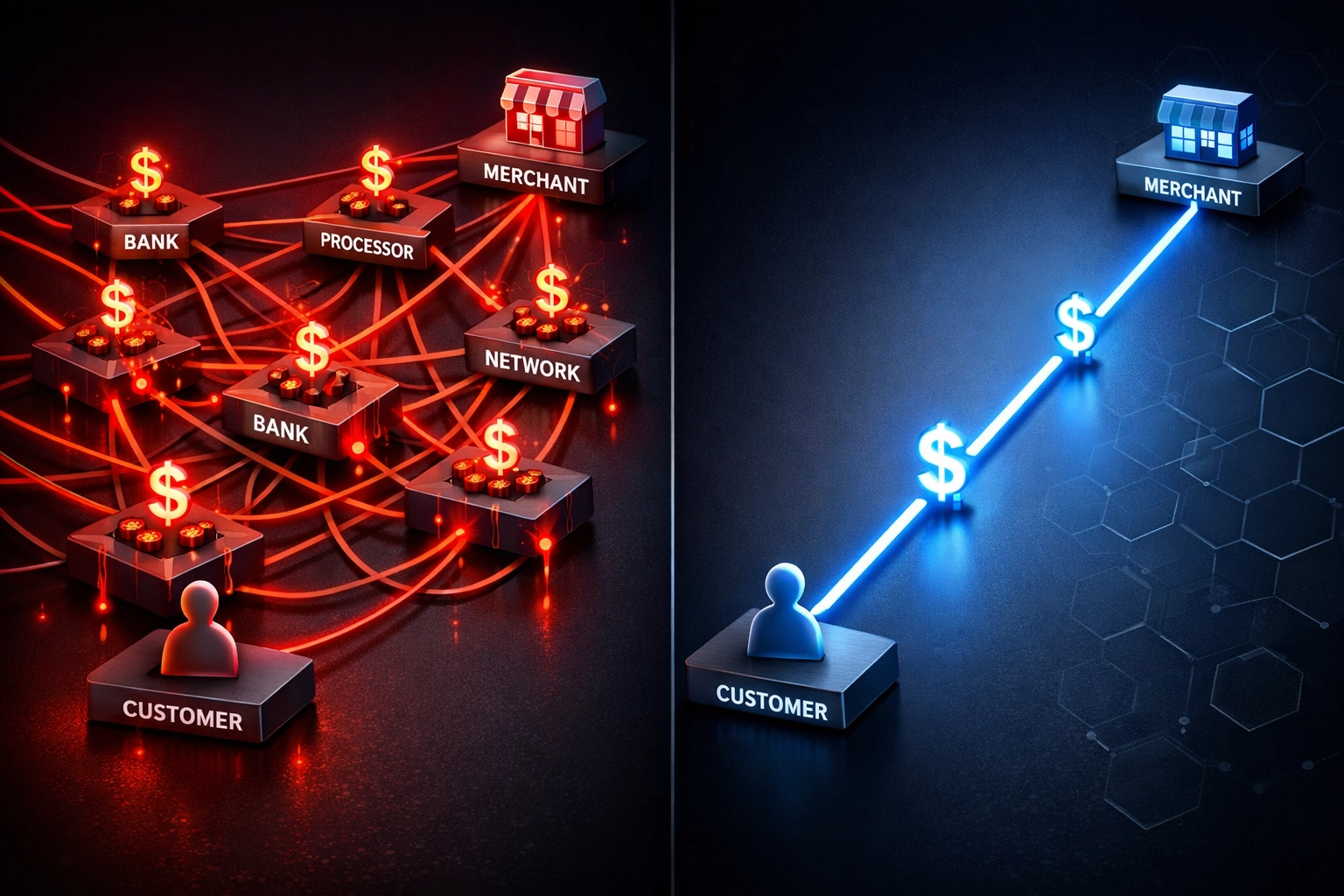

The Hidden Cost of Traditional Payment Processing

Every credit card swipe triggers a cascade of fees.

Issuing bank takes 1.5-2.5%. Card network grabs 0.1-0.2%. Acquiring bank adds another 0.5-1%. Payment gateway tacks on their cut. Foreign transactions multiply everything.

A $100 international sale costs you $6-8 in fees.

That's $60,000-80,000 per million in revenue. Gone.

Small businesses get hit hardest. E-commerce stores operating on 20-30% margins watch profits evaporate. Cross-border merchants pay double penalties: interchange fees AND currency conversion spreads.

The system is designed to extract maximum value from merchants. You have zero negotiating power.

Why NOWPayments and CoinPayments Still Leave Money on the Table

Legacy crypto payment processors promised disruption. They delivered incremental improvement.

NOWPayments charges 0.5% per transaction. Better than Visa. Still not revolutionary. You're paying for custodial services you don't need. They hold your funds. They control settlement timing. You're renting access to your own money.

CoinPayments offers 0.5% fees with optional self-custody. Progress. But their infrastructure relies on outdated payment rails. No native stablecoin support. No automated accounting integration. No receivables tokenization.

Triple-A targets enterprise merchants with "competitive" rates. Translation: hidden fees buried in conversion spreads. You pay more than advertised. Always.

These platforms reduce fees. They don't eliminate the fundamental problem: centralized control and unnecessary intermediaries.

How Larecoin Achieves 50%+ Fee Reduction

Larecoin eliminates every unnecessary layer.

Direct blockchain settlement. No intermediaries. No custody fees. No conversion spreads on stablecoin transactions.

The Math:

Traditional card processing: 2.5-6%

NOWPayments/CoinPayments: 0.5%

Larecoin: Network gas fees only (0.01-0.1%)

That's 50-90% savings depending on your current processor.

A merchant processing $1 million annually saves $25,000-58,000 switching to Larecoin. Every year. Forever.

But cost savings are just the beginning.

LUSD Stablecoin: Your Shield Against Volatility

Accepting crypto without price risk sounds impossible. It's not.

LUSD is an overcollateralized, decentralized stablecoin. Pegged to $1 USD. No central authority. No custody risk. No blacklist capabilities.

Accept payments in LUSD. Settle instantly. Zero conversion fees. No volatility exposure between sale and settlement.

Unlike USDC or USDT: centralized stablecoins that can freeze your funds: LUSD operates entirely on-chain. Code, not corporations, controls the protocol.

Your money. Your custody. Your rules.

Self-Custody Merchant Accounts: Take Back Control

Traditional processors hold your funds for 2-7 days. "Risk mitigation," they claim. Reality: they profit from float while you wait.

Larecoin self-custody means payments hit your wallet instantly. No holding periods. No suspicious account freezes. No sudden "compliance reviews" that lock your capital.

Your private keys. Your funds. Always.

Set up takes five minutes:

Create a Web3 wallet

Connect to Larecoin merchant portal

Start accepting payments

No business verification that takes weeks. No underwriting that rejects "risky" industries. No arbitrary account closures.

Banks and payment processors can't deplatform what they don't control.

NFT Receipts: Automated Accounting That Saves Hours

Every transaction generates an NFT receipt. Immutable proof of payment stored on-chain.

No manual reconciliation. No chasing paper receipts. No accounting errors.

Each NFT contains:

Transaction amount

Timestamp

Merchant details

Customer wallet address

Tax jurisdiction data

Your accounting software ingests these automatically. QuickBooks integration coming Q2 2026. Xero support launching Q3.

Tax season transforms from nightmare to button-click. Export transaction history with cryptographic verification. Auditors love blockchain receipts: they're tamper-proof.

Receivables Tokens: Turn Future Revenue Into Immediate Capital

Traditional invoice financing costs 2-5% monthly. Factors advance 70-90% of invoice value. You wait 30-90 days for full payment.

Larecoin receivables tokens flip the model.

Issue a token representing future payment. Sell it on secondary markets for immediate liquidity. Buyers bid on your receivables. Market determines the discount rate.

No credit checks. No loan applications. No predatory interest rates.

A $10,000 invoice due in 30 days sells for $9,700-9,900 today. That's 1-3% cost versus traditional 2-5% monthly factoring fees.

Game-changing for cash flow management.

Crypto POS System Built for Small Business

Brick-and-mortar merchants need point-of-sale systems that actually work.

Larecoin's contactless POS accepts:

QR code payments

NFC wallet taps

Lightning Network transactions

Push-to-card settlements

Customer scans or taps. Payment confirms in 3-15 seconds. Receipt generates automatically as NFT.

Hardware costs $150-300. No monthly terminals fees. No percentage-based processing charges. Just gas fees.

Coffee shop processing 500 transactions monthly saves $350-750 compared to Square or Clover. Small margins compound fast in retail.

Global Payments Without Bank Intermediaries

Cross-border payments are broken. SWIFT transfers take 3-5 days. Wire fees run $25-50. Currency spreads steal another 2-4%.

Larecoin settles internationally in minutes. Same fee whether customer is local or across the globe.

Accept payments from 180+ countries. No foreign transaction fees. No currency conversion markups. No correspondent banking delays.

A dropshipping store sourcing from Asia and selling to Europe saves thousands monthly eliminating SWIFT fees and FX spreads.

True global commerce. Zero borders. Minimal friction.

Financial Sovereignty: Build a Bank-Free Business

Operating without traditional banking sounds radical. It's increasingly necessary.

Banks close accounts for "prohibited industries." Payment processors terminate merchants arbitrarily. Regulations tighten constantly.

Larecoin enables complete financial independence:

Treasury management on-chain

Payroll through crypto payments

Supplier payments via stablecoin

Zero bank account requirements

Controversial businesses: CBD, supplements, adult content, firearms: can't get reliable payment processing. Banks reject them. Processors charge 5-10% premium rates.

Larecoin doesn't discriminate. Code processes payments. Algorithms don't judge.

Legal commerce deserves reliable infrastructure. Web3 delivers it.

Implementation: From Setup to First Payment in One Afternoon

Getting started takes less time than opening a business bank account.

Step 1: Create merchant account at larecoin.com. Email and password. Done.

Step 2: Connect your Web3 wallet. MetaMask, Trust Wallet, Ledger: all supported.

Step 3: Generate payment buttons or integrate API. Copy-paste for websites. SDK for custom builds.

Step 4: Start accepting payments. Share wallet address or QR code.

First transaction settles before your coffee gets cold.

Compare to traditional merchant account setup: 5-10 business days. Background checks. Business verification. Credit review. Maybe approval. Maybe rejection.

Web3 moves at internet speed. Banks move at bureaucracy speed.

The Competitive Advantage of Lower Costs

50%+ fee reduction isn't just savings. It's strategic advantage.

Lower costs mean you can:

Undercut competitor pricing

Offer better customer discounts

Invest more in marketing

Expand product lines faster

Weather economic downturns

Margins matter. Small percentage improvements compound over time.

A business saving $50,000 annually on payment fees can hire another team member. Launch new products. Open additional locations.

Competitors paying 3% watch you dominate paying 0.1%. Math wins. Always.

Why Web3 Payments Are Inevitable

Traditional finance is extractive by design. Each intermediary takes their cut. System optimizes for banks, not merchants.

Web3 infrastructure optimizes for participants. Lower costs benefit everyone. Open protocols prevent monopolistic control.

The transition is happening now. Early adopters gain multi-year advantages. Laggards pay premium prices until forced to adapt.

Reducing merchant interchange fees 50%+ isn't future speculation. It's current reality. Thousands of merchants already made the switch.

Join the Larecoin ecosystem and keep more of what you earn. Your business deserves payment infrastructure that works for you, not against you.

Control your money. Cut your fees. Build without permission.

That's Web3 global payments. That's Larecoin.

Comments