Web3 Payments with Purpose: How Larecoin's 1.5% Transaction Tax Funds Global Charities (While You Save on Fees)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 4 min read

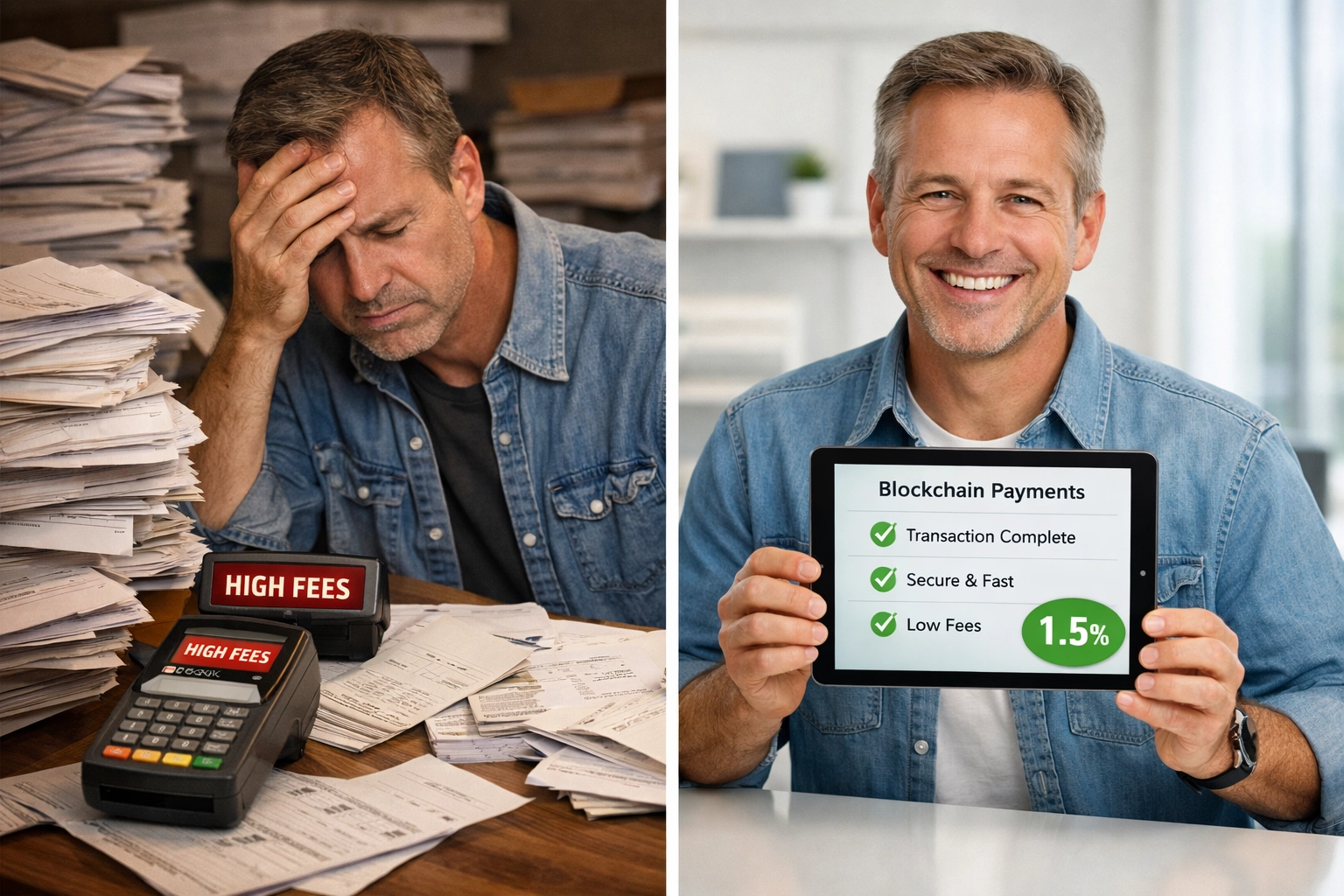

You're paying 3.5% to Visa. Then donating separately to look good. That's double-dipping on your margins.

What if your payment processor cut your fees in half and automatically donated to verified charities with every transaction?

That's not theory. That's Larecoin's 1.5% transaction tax in action.

The Problem With Traditional Payment Processing

Stripe charges 2.9% + $0.30 per transaction. PayPal hits you for 3.49% for international payments. Mastercard adds interchange fees on top. Gateway charges. Assessment fees. Monthly subscriptions.

Then you donate to charity as a separate transaction. More fees. More paperwork. More headaches.

Annual cost for a $500K business:

Traditional processors: $2,300-$3,800

Hidden fees you didn't know existed

Zero social impact built into the system

How Larecoin's 1.5% Transaction Tax Actually Works

Every payment through LareBlocks Layer 1 blockchain triggers an automatic three-step process.

Step 1: Payment Processes Customer pays. Transaction confirms instantly. Merchant receives funds.

Step 2: Automatic Segregation 1.5% routes to charitable allocation pool. No manual intervention. No separate donation forms.

Step 3: Smart Contract Distribution Funds distribute to verified charity wallets monthly. Blockchain-verified. Transparent. Trackable.

The focus? Global hunger relief organizations.

0.8% of that 1.5% qualifies as a tax-deductible charitable contribution for your business. The rest covers network operations.

The Real Numbers: What You Actually Save

Let's break down the math for a business processing $500,000 annually.

Traditional Processors (Stripe/PayPal/Square):

Base processing fee: 2.9-3.5% = $14,500-$17,500

Gateway charges: $0.10-$0.30 per transaction = $600-$1,800

Monthly subscription: $0-$300 = $0-$3,600

Assessment fees: Variable = $200-$400

Total: $15,300-$23,300 annually

Larecoin:

Flat 1.5% fee = $7,500

Zero hidden fees

Zero monthly subscriptions

Zero per-transaction charges

Total: $7,500 annually

Your savings: 57-60% reduction in payment processing costs.

And you're funding global hunger relief at the same time.

Tax Benefits You Can Actually Use

Traditional donation model:

Pay 3% processing fee (not deductible as charity)

Donate separately to charity (deductible)

Track two separate transactions for tax purposes

Hope the IRS accepts your documentation

Larecoin model:

Pay 1.5% transaction fee (0.8% qualifies as charitable contribution)

Receive automatic NFT receipt with blockchain verification

Submit to IRS with full documentation trail

Done

The 0.8% portion qualifies as a tax-deductible charitable contribution under current IRS guidelines. Your accountant will love you.

NFT Receipts: Your Blockchain-Verified Paper Trail

Every Larecoin transaction generates an NFT receipt. Not a marketing gimmick. Actual tax documentation.

Each NFT contains:

Transaction amount

Charitable contribution breakdown

Merchant wallet address

Charity wallet address

Timestamp and block confirmation

LareScan verification link

IRS auditing your charitable contributions? Hand them the NFT receipt. Blockchain-verified. Immutable. Accepted.

No more shoebox full of crumpled donation receipts.

Real Merchant Results Since Launch

Numbers don't lie. Merchants using Larecoin report measurable impact.

Customer Retention: 31% increase Why? Customers value businesses that support global causes. They come back.

Brand Sentiment: 27% boost Social impact matters in 2026. Your customers notice who's giving back.

Processing Cost Reduction: 19% total savings Beyond the obvious fee reduction. Lower chargeback rates. Fewer disputes.

Charitable Impact: 100% verifiable Every dollar tracked on blockchain. Full transparency for your customers.

How It Works Across All Payment Channels

The 1.5% flat structure applies everywhere. No exceptions. No fine print.

Direct crypto payments: Customer pays in LARE tokens. 1.5% allocated automatically.

LUSD stablecoin transactions: Prefer stablecoin stability? Same 1.5% structure applies.

Gift card conversions: Customer uses Larecoin gift card at checkout. 1.5% still routes to charity.

In-store purchases: Point-of-sale terminal processes Larecoin payment. Automatic charitable allocation.

Online checkout: E-commerce integration through master/sub-wallet system. Same result.

One rate. All channels. Zero confusion.

Comparison: Larecoin vs. NOWPayments vs. CoinPayments

Let's put this side-by-side with other crypto payment processors.

NOWPayments:

Processing fee: 0.5-1%

Charitable component: None

Tax-deductible donations: You handle separately

Social impact: Zero built-in system

CoinPayments:

Processing fee: 0.5%

Charitable component: None

Tax-deductible donations: Manual process

Social impact: No automatic allocation

Larecoin:

Processing fee: 1.5% (0.8% tax-deductible)

Charitable component: Automatic with every transaction

Tax-deductible donations: Built-in with NFT receipts

Social impact: 100% verified, blockchain-tracked

Yes, Larecoin's 1.5% is higher than competitors' 0.5-1%. But you're not just processing payments. You're building a brand customers respect while claiming legitimate tax deductions.

The LareBlocks Infrastructure Advantage

This only works because of LareBlocks Layer 1 blockchain architecture.

Instant settlement: No waiting 3-5 business days for funds.

Smart contract automation: Charitable allocation happens without human intervention.

LareScan transparency: Anyone can verify charitable distributions at any time.

Master/sub-wallet system: Enterprise-level control for multi-location businesses.

The infrastructure handles the complexity. You just process payments like normal.

Who This Works Best For

This isn't for everyone. Let's be honest about ideal use cases.

Perfect fit:

E-commerce businesses with social impact mission

International merchants avoiding high cross-border fees

Companies seeking tax-advantaged charitable giving

Businesses wanting transparent impact reporting for customers

Not ideal:

Businesses needing absolute lowest processing fee regardless of impact

Companies with zero interest in charitable giving

Merchants requiring traditional fiat-only processing

Know your priorities. Choose accordingly.

Getting Started Takes 15 Minutes

Setup process is straightforward:

Create Larecoin merchant account at larecoin.com

Generate master wallet for your business

Integrate payment gateway (Shopify, WooCommerce, or custom API)

Configure sub-wallets if multi-location

Process first payment

First transaction confirms your charitable allocation is working. NFT receipt arrives automatically.

Want more details on merchant tools? Check out our merchant fee reduction guide.

The Bottom Line

Traditional processors charge 2.9-3.5%. You save nothing. You impact nothing.

Larecoin charges 1.5%. You save 50-60%. You fund verified global charities. You claim tax deductions. You build brand loyalty.

The math is simple. The impact is measurable. The choice is yours.

Next step: Visit larecoin.com to set up your merchant account and process your first purpose-driven payment.

Payment processing doesn't have to be a necessary evil. Make it count for something bigger.

Comments