How to Reduce Merchant Interchange Fees By 50%+ With Self-Custody Accounts (Easy Guide for Small Business)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Running a small business means watching every dollar. And if you're accepting cards, you're bleeding 2-4% on every single transaction.

That's $34,800 annually on $100K monthly revenue. Gone. To payment processors, banks, and card networks.

Self-custody crypto accounts flip this entire model. You keep 96-97% of what traditional processors take. Gas fees? $0.001-$0.10 per transaction. That's $120-$1,200 annually instead of tens of thousands.

This isn't theory. It's happening right now with Web3 payment solutions like Larecoin.

The Hidden Tax Killing Small Businesses

Every swipe costs you.

Traditional payment processing chains:

Acquiring bank takes a cut

Card network takes a cut

Issuing bank takes a cut

Payment processor takes a cut

You wait 1-3 days for your money

The math is brutal:

Monthly Revenue | Annual Processor Fees | Your Actual Loss |

$50,000 | $17,400 | A new employee's salary |

$100,000 | $34,800 | Your marketing budget |

$500,000 | $174,000 | An entire expansion plan |

And that's just fees. Add chargebacks, holds, account freezes, and random policy changes you can't control.

Traditional processors own your cash flow. Self-custody gives it back.

How Self-Custody Merchant Accounts Work

No middlemen. No percentages. Just blockchain.

The Web3 payment model:

Customer sends crypto to your wallet

Transaction confirms on-chain

Funds hit your account instantly

You pay only gas fees (pennies)

With platforms like Larecoin, you're not asking permission. No credit checks. No application reviews. No waiting weeks for approval.

Generate a wallet. Start accepting payments. Keep everything.

Real savings breakdown:

If you process $100K monthly with traditional methods, you're paying $2,900/month in fees. Switch to self-custody crypto? You're paying $10-$100 monthly in gas fees.

That's $33,600-$34,680 back in your pocket annually.

5-Minute Setup Guide

Forget complex integrations. This takes less time than your coffee break.

Step 1: Create Your Self-Custody Wallet (3 minutes)

Download a non-custodial wallet. You get private keys. You control everything.

For daily operations, use hot wallets. For holding larger amounts, hardware wallets.

Never share your seed phrase. Write it down offline. Store it securely.

Step 2: Connect to Larecoin (2 minutes)

Link your wallet to Larecoin's merchant dashboard. Configure your settlement preferences.

Choose LUSD stablecoin for price stability. Set up payment notifications. Define refund policies.

Done. You're ready to accept payments globally.

Step 3: Generate Payment QR Codes (1 minute)

Static codes for fixed prices. Dynamic codes for variable amounts.

Print them. Display them at checkout. Embed them on your website.

Step 4: Accept Your First Payment (30 seconds)

Customer scans code. Sends crypto. Funds arrive instantly.

No approval pending. No settlement delay. No percentage taken.

Step 5: Scale As You Grow

Create sub-wallets for different locations. Track each revenue stream separately. Maintain master wallet oversight.

Beyond Fee Reduction: The Full Advantage Stack

Self-custody merchant accounts aren't just cheaper. They're better in every dimension.

Instant Settlement

Traditional processors hold your money for days. Self-custody? Instant. Your funds. Your wallet. Right now.

Need to pay suppliers? Transfer immediately. Want to reinvest profits? Do it today, not next week.

Zero Chargebacks

Crypto transactions are final. No friendly fraud. No reversed payments three months later.

You delivered the product? You keep the money. Simple.

Global Payments Without Global Fees

International transaction on Visa? 3.5% plus currency conversion fees.

International crypto payment? Same $0.01 gas fee as domestic.

Sell to customers in 195 countries. Pay the same tiny fee for every transaction.

Complete Financial Sovereignty

No account freezes. No sudden fee increases. No policy changes that wreck your margins.

Your wallet. Your keys. Your business. Nobody can touch it.

NFT Receipts for Accounting

Larecoin generates NFT receipts automatically. Every transaction is verifiable, permanent, and organized on-chain.

Tax season becomes easier. Accounting becomes cleaner. Compliance becomes provable.

Larecoin vs The Competition

Self-custody isn't new. But most platforms still act like traditional processors.

NOWPayments Alternative:

NOWPayments charges 0.5% fees. Still taking a percentage. Still acting as intermediary.

Larecoin? Gas fees only. No percentages. True self-custody with your own wallet.

CoinPayments Alternative:

CoinPayments holds your funds. You're asking for withdrawals. Waiting for approvals.

Larecoin puts funds directly in your self-custody wallet. Instant access. Full control.

Triple-A Alternative:

Triple-A focuses on custody services. They hold your crypto. You trust them.

Larecoin eliminates trust. Non-custodial from transaction to settlement. You hold everything.

The Larecoin Difference:

LUSD stablecoin integration for price stability

NFT receipt generation for accounting

Gas-only transfer costs (no percentage fees)

Receivables token system for advanced treasury management

Push-to-card functionality for easy conversion

Full Web3 global payments infrastructure

Not just cheaper. Fundamentally different architecture.

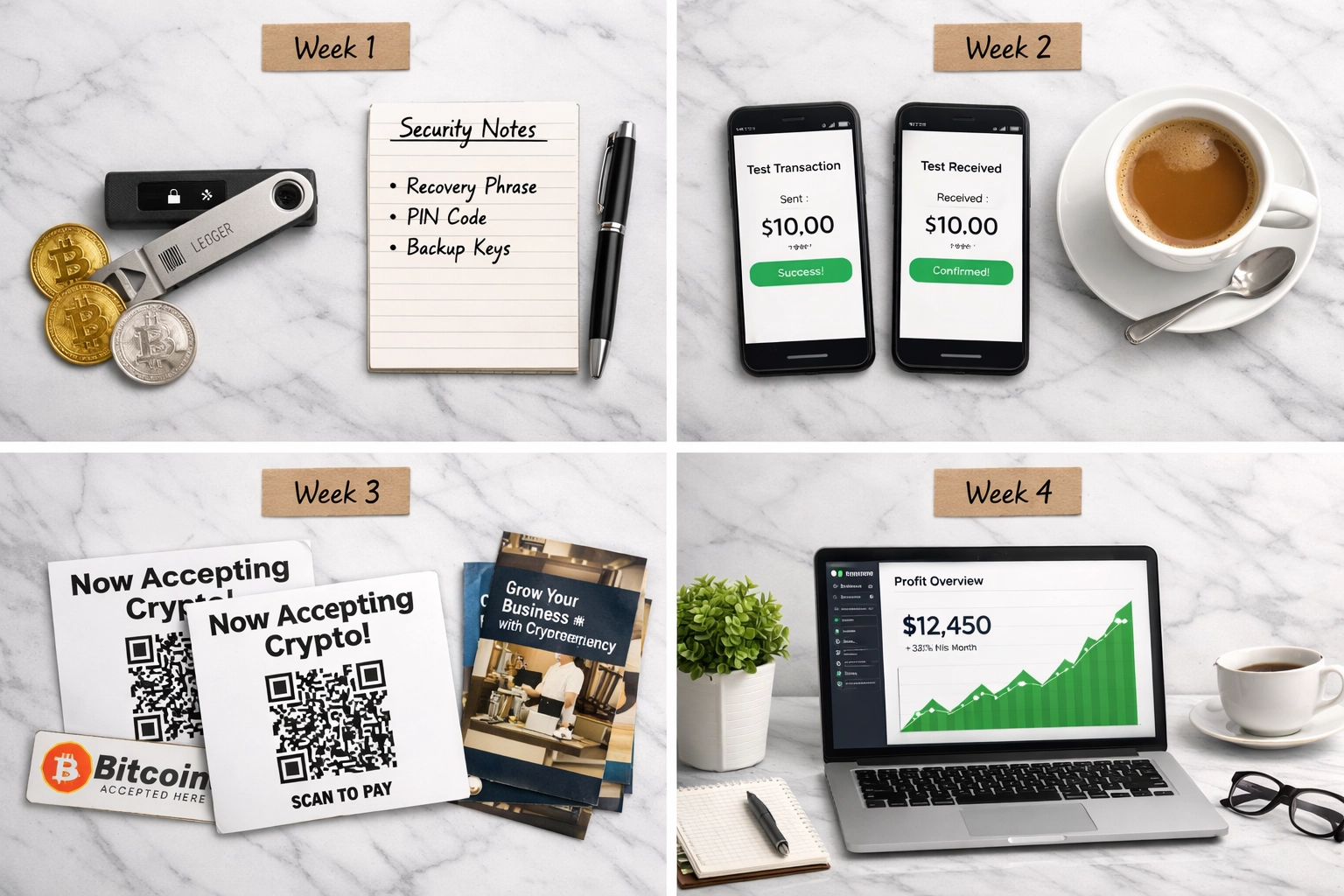

Real Implementation Timeline

Don't overthink this. Most merchants go live in four weeks.

Week 1: Setup & Security

Generate self-custody wallet

Secure private keys offline

Connect to Larecoin merchant dashboard

Configure payment settings

Week 2: Testing Phase

Process small test transactions

Train staff on QR code payments

Verify settlement flows

Document procedures

Week 3: Deployment

Add payment QR codes to checkout

Embed payment links on website

Print promotional materials

Notify existing customers

Week 4: Optimization

Run parallel with traditional processors

Compare actual fee savings

Adjust pricing for crypto discounts

Scale up transaction volume

Most businesses keep traditional payment methods initially. Once you see the fee difference in your dashboard, you'll push crypto harder.

Critical Considerations

This isn't magic. It's better technology with real tradeoffs.

Customer Adoption:

Not everyone holds crypto yet. You're early. That's the point.

Offer 5% discounts for crypto payments. Your 2.9% savings becomes a shared win. Customers save money. You save more.

Security Responsibility:

Lose your seed phrase? Lose your funds. No customer service to call.

Hardware wallets for large holdings. Encrypted backups. Multiple secure locations.

Self-custody means self-responsibility. Worth it for the control and savings.

Network Conditions:

Blockchain transactions depend on network congestion. During high traffic, confirmations might take minutes instead of seconds.

Still faster than 1-3 day ACH transfers. And LUSD on efficient chains stays consistently fast.

Getting Started Today

Stop paying thousands monthly to processors who add zero value.

Self-custody merchant accounts through Larecoin give you:

96-97% fee reduction vs traditional processors

Instant settlement instead of multi-day holds

Global payment acceptance with zero added costs

Complete financial sovereignty over your revenue

NFT receipts for cleaner accounting

No chargebacks or fraud reversal headaches

Traditional payment processing made sense when blockchain didn't exist.

Now it just looks expensive.

Set up your self-custody merchant account. Process your first crypto payment. Watch the fees disappear.

Your business. Your wallet. Your money.

Visit Larecoin to connect your first self-custody merchant wallet in under five minutes.

The question isn't whether to switch. It's how much money you're willing to keep giving away while you wait.

Comments