LareBlocks Explained in Under 3 Minutes: The Layer 1 Blockchain Built for Real-World Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

What Is LareBlocks?

LareBlocks is Larecoin's proprietary Layer 1 blockchain.

Built from scratch. Designed for one thing: real-world payments at scale.

No borrowed architecture. No piggyback protocols. Just pure, purpose-built infrastructure for merchants who need fast, cheap, and reliable crypto transactions.

Think of it as the engine under the hood. Larecoin is what users interact with. LareBlocks is what makes it all possible.

Why Layer 1 Matters for Payments

Most crypto payment systems run on borrowed chains. Ethereum. Solana. Binance Smart Chain.

They're fast. But they're not payment-optimized.

Layer 1 control means:

Custom consensus mechanisms for transaction finality

No external network congestion

Predictable gas fees (spoiler: they're dirt cheap)

Zero reliance on third-party validators

LareBlocks processes payments in under 2 seconds. Not "pending." Not "confirming." Done.

!

The Speed Advantage

Traditional payment rails are slow.

Visa processes transactions instantly at the point of sale. But settlement? That's 2-3 business days for the merchant.

Credit card chargebacks? Up to 120 days of uncertainty.

LareBlocks settles in real-time. Merchants get funds immediately. No batch processing. No waiting. No chargeback risk from the blockchain side.

Speed breakdown:

Transaction broadcast: 0.5 seconds

Block confirmation: 1.5 seconds

Final settlement: 2 seconds total

That's faster than a card swipe. And it's irreversible once confirmed.

Fee Structure That Makes Sense

Here's where LareBlocks destroys traditional payments.

Visa and Mastercard charge 2.5%–3.5% per transaction. Sometimes more for international or premium cards.

LareBlocks? 0.1%–0.5% depending on volume.

A $1,000 sale costs a merchant:

Traditional card: $25–$35 in fees

LareBlocks: $1–$5

That's less than 50% of typical payment processing costs. For high-volume merchants, that difference adds up to thousands per month.

And unlike card networks, there are no hidden fees. No monthly minimums. No PCI compliance costs.

!

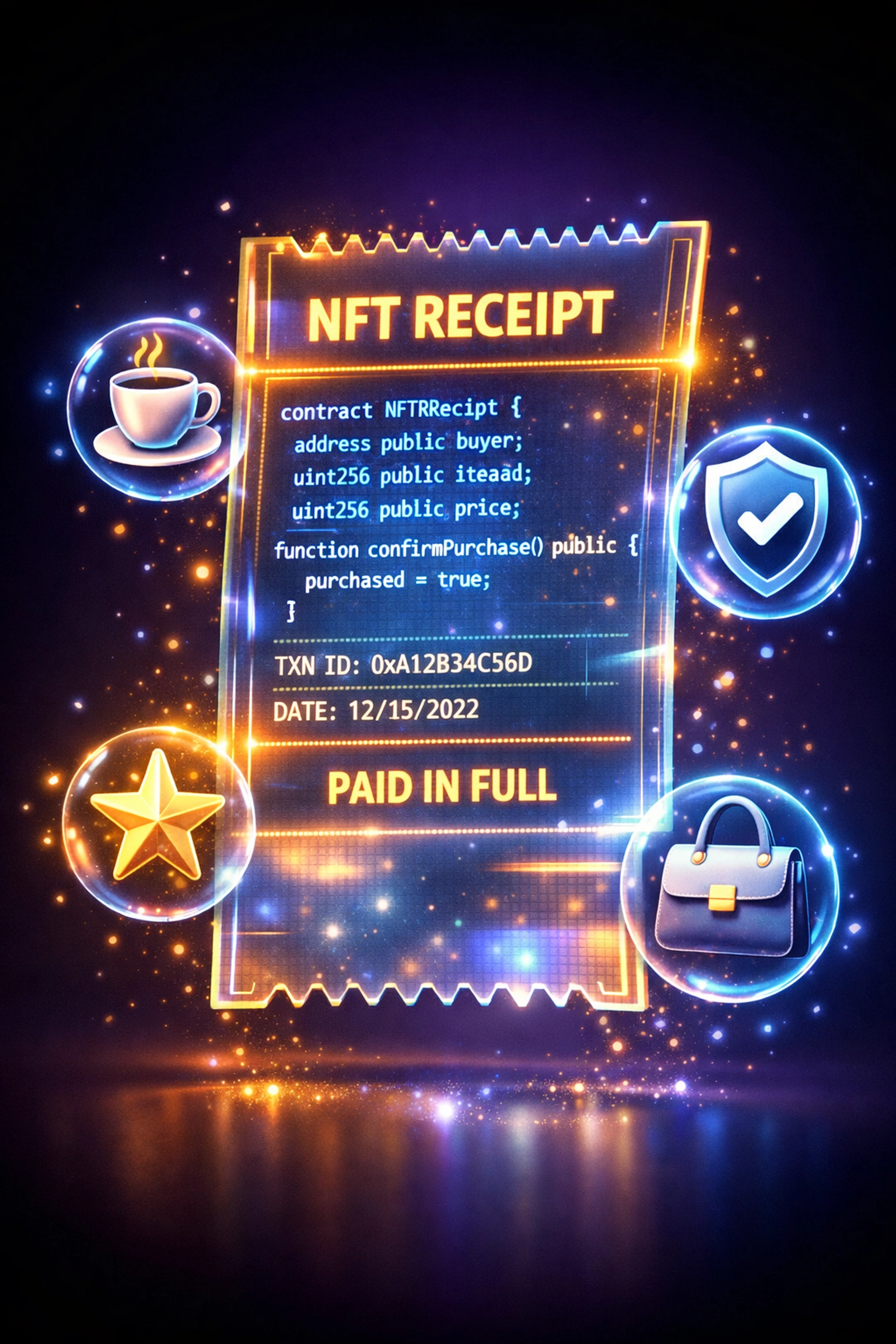

NFT Receipts: Programmable Transaction History

Every transaction on LareBlocks can be minted as an NFT receipt.

Why does that matter?

Because receipts become programmable assets.

Use cases:

Proof of purchase for warranties

Loyalty points embedded in the transaction

Resale verification for secondary markets

Tax documentation that can't be lost

A coffee shop can issue an NFT receipt. That receipt unlocks a free drink after 10 purchases. The smart contract tracks it. The customer never needs a punch card.

A luxury retailer can tie an NFT receipt to authenticity. The product comes with provable purchase history. Forever.

This isn't theory. It's live on LareBlocks today.

LUSD: The Stablecoin Built for Commerce

LareBlocks supports LUSD, Larecoin's native stablecoin.

Pegged 1:1 to the US dollar. Backed by real reserves. Audited monthly.

For merchants who don't want crypto volatility, LUSD is the answer. Accept payments. Hold value. No conversion friction.

LUSD features:

Instant settlement in stable value

No off-ramp fees to convert back to fiat

Direct push-to-card for instant withdrawals

Cross-chain compatibility for broader reach

It's stablecoin infrastructure that actually works for retail.

!

Decentralization Without Sacrifice

LareBlocks runs on a delegated proof-of-stake (DPoS) consensus model.

Translation? Fast, secure, and decentralized.

Unlike proof-of-work systems (Bitcoin, older Ethereum), there's no energy waste. Validators are selected based on stake and reputation.

Unlike fully centralized payment processors, no single entity controls the network. Larecoin operates validator nodes. So do community members. So do enterprise partners.

The result:

Censorship resistance for merchants in restrictive regions

Uptime reliability with distributed nodes globally

Transparent auditing via LareScan block explorer

Every transaction is publicly verifiable. But user privacy is preserved through cryptographic addressing.

LareScan: Real-Time Transparency

LareScan is the block explorer for LareBlocks.

Think of it like Google for the blockchain.

Search any transaction. View wallet balances. Track token transfers. Monitor network health.

Merchants can share transaction links with customers. Instant proof of payment. No third-party receipt required.

Developers can build on top of LareScan data. Analytics. Dashboards. Custom reporting tools.

Total transparency. Zero opacity.

Enterprise-Grade Tools Baked In

LareBlocks isn't just for small merchants.

Enterprise features include:

Master/sub-wallet architecture for multi-location businesses

API access for custom integrations

Batch processing for high-volume days

White-label solutions for payment processors

A restaurant chain can manage 50 locations from one master wallet. Each location gets a sub-wallet. The corporate office sees everything in real-time.

A payment processor can build their own branded solution on top of LareBlocks. Same speed. Same fees. Their brand.

Real-World Use Cases Already Live

LareBlocks isn't vaporware.

Merchants are using it today.

Coffee shops in Miami. E-commerce stores in Singapore. Freelancers in Nigeria.

Volume is growing. Transaction count doubled in Q4 2025. On track to hit 1 million daily transactions by mid-2026.

Why the growth? Because it works.

No downtime. No failed transactions. No surprise fees.

!

The Technical Edge

Under the hood, LareBlocks uses:

BFT consensus for Byzantine fault tolerance

Sharding for horizontal scalability

State channels for microtransactions

Cross-chain bridges for interoperability

That's a lot of jargon. Here's what it means:

The network can handle massive transaction volume. Millions per day without slowing down.

If one validator goes offline, the network keeps running. No single point of failure.

Micropayments (like $0.10 tips) don't clog the network. They process off-chain and settle in batches.

Need to bridge assets from Ethereum or Solana? LareBlocks supports it natively.

Why This Matters for Merchants

You don't need to understand the tech.

You need to understand the benefit.

LareBlocks means:

Lower fees than credit cards

Faster settlement than banks

Global reach without currency conversion

No chargebacks or fraud risk

24/7 uptime with no maintenance windows

It's payment infrastructure built for the next decade. Not retrofitted from the last one.

Get Started with LareBlocks Today

Ready to see it in action?

Set up a merchant account at larecoin.com.

Integration takes under 10 minutes. No coding required for basic setups. API docs available for custom builds.

Or explore the network yourself on LareScan. Watch transactions happen in real-time. See the speed for yourself.

LareBlocks isn't the future. It's already here.

And it's processing payments right now.

Comments