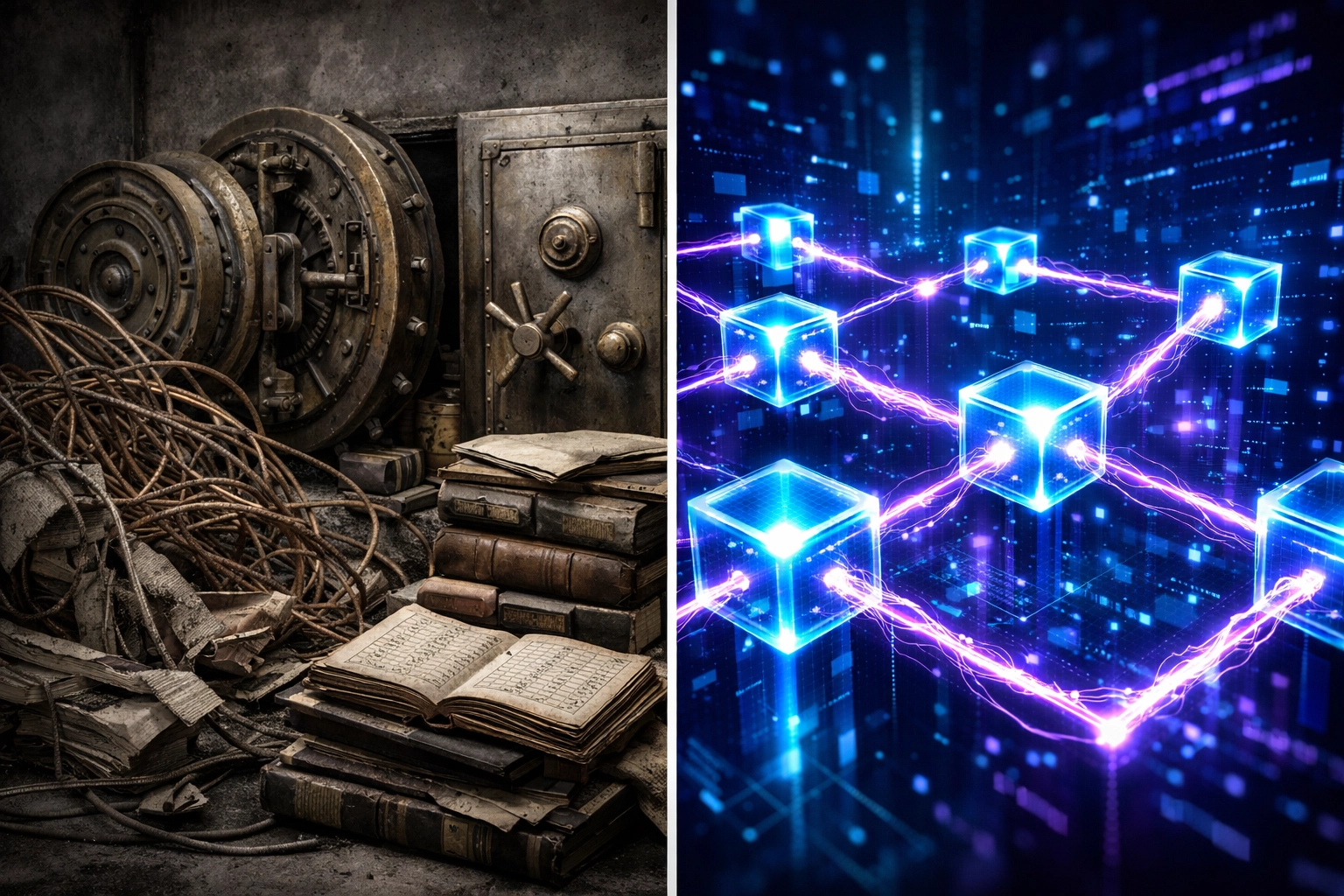

LareBlocks vs Traditional Payment Rails: Which Is Better For Your Enterprise?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 3 min read

Your enterprise processes $1 million in payments monthly.

You're bleeding $41,000 in fees. Every. Single. Month.

Welcome to traditional payment rails. Visa. Mastercard. The legacy infrastructure draining your cash flow while you wait 2-5 business days for settlements.

There's a better way.

The Hidden Tax of Legacy Payment Systems

Traditional payment processors aren't transparent about the full cost.

Here's the breakdown for $1 million in monthly transaction volume:

Transaction fees: $29,000 (3.5-4% average)

Chargeback fees: $10,000

Gateway fees: $2,000

Total monthly cost: $41,000

That's $492,000 annually. Half a million dollars extracted from your business for the privilege of accepting payments.

A single $1,000 transaction costs you $25-$35 in fees alone.

The payment networks call this "industry standard." We call it highway robbery.

Enter LareBlocks: Web3 Payment Infrastructure

LareBlocks processes that same $1 million volume for $20-500 monthly.

Total fees: 1.2-1.5%. That includes everything:

Network transaction fees

Settlement costs

Fraud protection

NFT receipt generation

Master/sub-wallet infrastructure

A $1,000 transaction? Under $1.50.

The math is brutal for traditional rails. Annual savings: $312,000 to $491,000.

This is part of our 10-year marathon. 100 hourly posts documenting how Web3 payments solve real enterprise problems.

No hype. Just infrastructure.

Settlement Speed = Working Capital Freedom

Traditional rails operate on batch processing. Legacy banking infrastructure from the 1970s.

Settlement timeline: 2-5 business days.

Your money sits frozen. Inaccessible. While payment networks collect interest on the float.

LareBlocks settles in under 30 seconds. Sub-second finality on every transaction.

Real-world impact: A business processing $500,000 monthly immediately frees up $50,000+ in working capital. No more waiting. No more cash flow constraints.

Money hits your wallet. Instantly usable. Deploy it for inventory, payroll, expansion: whatever drives growth.

That's not innovation. That's basic efficiency the legacy system refuses to deliver.

Master/Sub-Wallet Architecture for Multi-Location Enterprises

Running multiple locations? Traditional rails force you into separate merchant accounts for each.

Different account numbers. Different reconciliation processes. Different reporting dashboards. Complete operational nightmare.

LareBlocks offers unlimited sub-wallets under one master wallet.

One enterprise account. Unlimited locations. Each gets its own sub-wallet with independent transaction tracking and settlement controls.

Corporate treasury maintains master wallet oversight. Individual store managers access their sub-wallet only. Complete separation of duties without administrative chaos.

No more paying for multiple merchant accounts. No more reconciling across disparate systems. One unified infrastructure.

NFT Receipts: Chargeback Protection Built-In

Chargebacks cost traditional merchants an average of $400 monthly. Fraudulent disputes. "Item not received" claims. Card-not-present fraud.

The customer disputes. The merchant loses. Even when you're in the right.

LareBlocks generates NFT receipts for every transaction.

Immutable. Verifiable. On-chain.

Each NFT contains:

Transaction timestamp

Exact amount

Wallet addresses

Product/service details

Cryptographic proof of purchase

Dispute a LareBlocks transaction? The blockchain doesn't lie. The NFT receipt provides irrefutable evidence.

No more "he said, she said." No more automatic merchant liability. Cryptographic truth eliminates friendly fraud.

Chargebacks? They basically vanish.

The Infrastructure Advantage

Traditional payment rails require multiple intermediaries:

Card networks (Visa/Mastercard)

Payment processors

Settlement banks

Acquiring banks

Gateway providers

Each extracts fees. Each adds delays. Each creates failure points.

LareBlocks operates as a dedicated Layer 1 blockchain.

Direct wallet-to-wallet transfers. No intermediaries. No rent-seeking middlemen.

Technical specifications:

4,500+ transactions per second

Sub-second finality

Decentralized validator network

LUSD stablecoin for price stability

Enterprises processing high volume need infrastructure that scales. LareBlocks handles peak transaction loads without degradation.

Black Friday? No problem. Flash sales? Bring it on. The blockchain doesn't throttle.

Real Enterprise Case Study

E-commerce business. $2 million annual volume. 8,000 monthly transactions.

Traditional rail costs:

Transaction fees: $70,000

Chargebacks: $4,800

Gateway fees: $1,400

Annual total: $76,200

LareBlocks costs:

Transaction fees: $28,000

Chargebacks: $0 (NFT receipts)

Gateway fees: $560

Annual total: $28,560

Savings: $47,640 annually.

That's not accounting for improved cash flow from instant settlements. Or the operational efficiency from master/sub-wallet architecture.

Real money. Real savings. Real competitive advantage.

Decentralization Means No Single Point of Failure

Visa goes down? Your business stops accepting payments.

Mastercard experiences an outage? Same problem.

Payment processor has technical issues? You're offline.

Decentralized infrastructure doesn't have single points of failure.

LareBlocks runs on distributed validator nodes globally. Network redundancy is built into the architecture.

One node goes offline? The other 499 keep processing transactions. Zero downtime. Zero revenue loss.

For enterprises operating 24/7, that reliability is non-negotiable.

The Bottom Line for Your Enterprise

Traditional payment rails charge 3.5-4% plus fees.

LareBlocks charges 1.2-1.5% total.

Traditional rails settle in 2-5 days.

LareBlocks settles in 30 seconds.

Traditional rails expose you to chargebacks.

LareBlocks provides NFT receipt protection.

Traditional rails require multiple merchant accounts.

LareBlocks offers master/sub-wallet architecture.

The choice isn't complicated.

Lower costs. Faster settlement. Better protection. Superior infrastructure.

This is what Web3 payment rails deliver. This is why enterprises are migrating.

Want the full breakdown? Check our comprehensive guide on reducing merchant interchange fees.

The 10-year marathon continues. Enterprise payment infrastructure is changing. LareBlocks is leading.

Traditional rails had their moment.

That moment is over.

Comments