Larecoin Blog Marathon (Extension): The Ultimate Guide to Reducing Crypto Payment Fees and Boosting Business Growth in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The Fee Problem Is Killing Your Margins

U.S. merchants paid $172 billion in processing fees in 2025.

That's not a typo. Over $172 billion drained from business margins to credit card networks, payment processors, and intermediaries.

Your business is paying 1.5–3% on every transaction. International payments? Even worse.

Crypto payments slash those fees by up to 90%.

Traditional Payment Processing: Death by a Thousand Cuts

Every swipe, tap, or online checkout bleeds money.

Card networks take their cut. Payment processors take theirs. Banks want their piece. Currency conversion adds another layer.

The breakdown:

Interchange fees: 1.5–2.5%

Processing fees: 0.3–0.5%

Gateway fees: $0.10–$0.30 per transaction

International conversion: 2–4% extra

Chargeback fees: $15–$100 per incident

Small margins disappear fast.

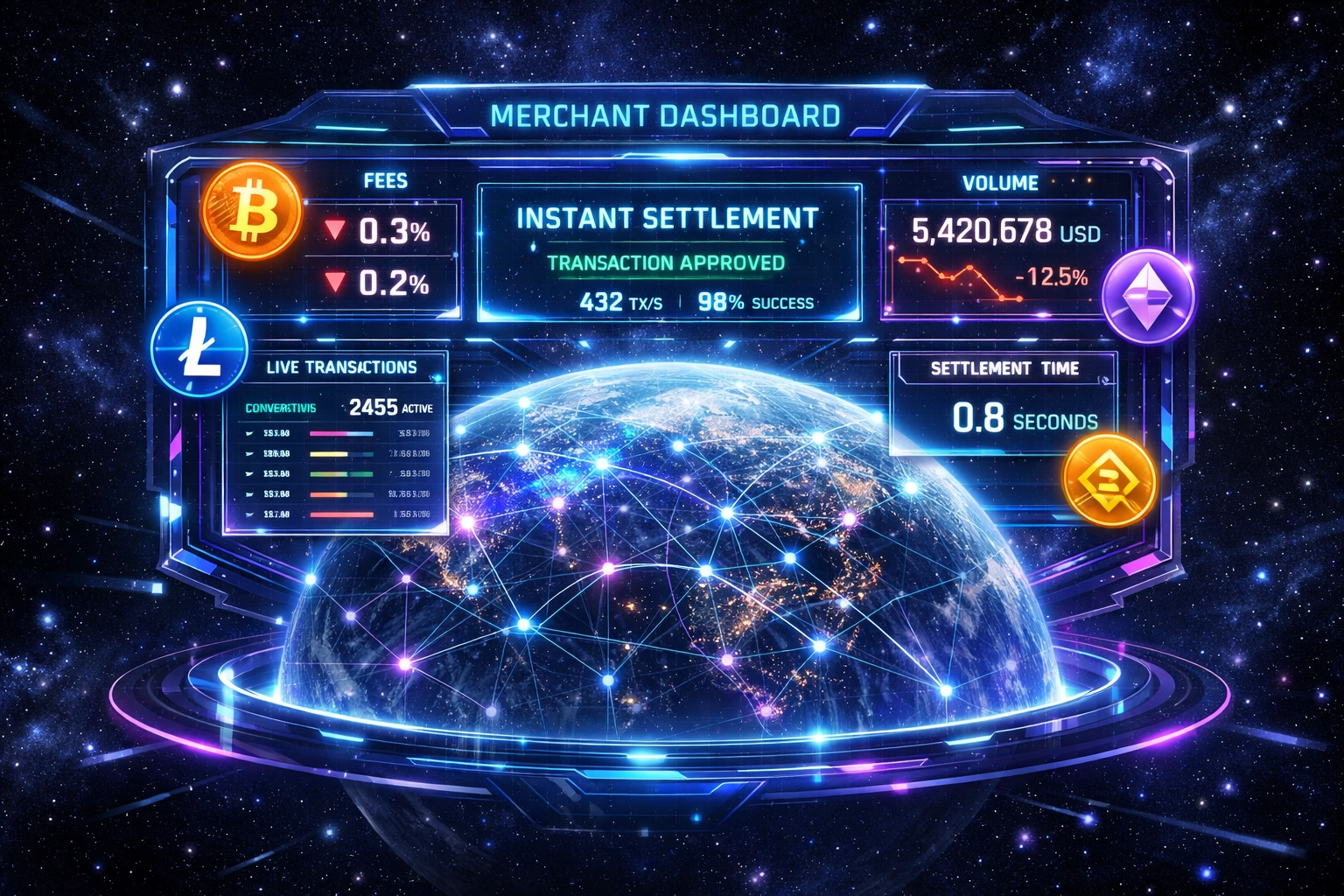

Crypto Payment Gateways: The Real Numbers

Most crypto processors charge 0.5–1% base commission.

That's it.

No intermediaries. No currency conversion nightmares. No chargeback fraud.

Merchants report savings exceeding 90% on international payments.

The math is simple. Traditional payment on a $10,000 international order costs $300–$500. Same transaction via crypto? $50–$100.

That difference compounds across thousands of transactions.

Practical Strategies to Cut Crypto Transaction Fees Even Further

Crypto payments are already cheap. But you can optimize further.

Network timing matters. Send transactions during low-activity periods. Fewer transactions competing for block space means lower fees.

Consolidate inputs. Merge smaller wallet balances before sending large transactions. Reduces transaction size and fees.

Use lower-priority settings. Non-urgent payments don't need instant confirmation. Choose slower speeds for reduced costs.

Leverage automatic fee optimization. Modern wallets suggest efficient fee rates based on real-time network conditions.

These strategies stack. Every percentage point saved flows directly to your bottom line.

Larecoin's Fee Advantage: Beyond the Basics

Standard crypto gateways save money. Larecoin takes it further.

LUSD integration means stablecoin settlements without volatility exposure. Get crypto's benefits without price risk.

NFT receipts provide permanent, immutable transaction records. No more receipt storage nightmares or audit headaches.

Self-custody options give you full control. Your funds. Your wallet. No third-party risk.

Gas-only transfers eliminate unnecessary overhead. Pay only for network costs.

The Larecoin ecosystem prioritizes merchant freedom. You choose how to settle. You control your funds. You own your transaction data.

How Larecoin Compares to Alternatives

Let's talk competitors.

NOWPayments offers 70+ cryptocurrencies and 0.5% fees. Decent option. But limited stablecoin focus and no native NFT receipt system.

CoinPayments supports 2,000+ coins with 0.5% processing fees. Impressive selection. But overwhelming complexity and higher withdrawal fees reduce actual savings.

Larecoin's edge:

LUSD stablecoin built specifically for merchant settlements

NFT receipts as standard feature, not add-on

Self-custody by default, not afterthought

Streamlined coin selection focused on actually useful payment tokens

Lower total cost when factoring withdrawal and conversion fees

We're not trying to support every obscure token. We're building the smartest payment infrastructure for merchants who want simplicity, savings, and sovereignty.

Settlement Flexibility: Your Money, Your Way

Choose your settlement preference:

Auto-convert to fiat for zero crypto exposure. Traditional banking comfort with crypto fee savings.

Settle in LUSD to access benefits without volatility. Stablecoins bridge both worlds.

Hold Larecoin or Bitcoin if bullish on crypto. Participate in potential appreciation.

Split settlements across multiple options. Diversify based on your risk tolerance.

Lock rates during transactions. Guarantee prices for customers. Receive deposits directly to bank accounts while custody is managed securely.

Beyond Fee Savings: The Growth Multipliers

Lower fees are just the start.

Instant settlements mean international payments complete in minutes, not days. Better cash flow. Faster business cycles.

Global access removes currency restrictions. Accept payments from any country without banking red tape.

Fraud protection via blockchain irreversibility. Chargebacks become impossible. No more fraudulent disputes.

New customer segments emerge. Crypto-knowledgeable consumers prefer merchants who accept digital payments. Access technologically advanced and developing markets simultaneously.

Transparent compliance strengthens audit readiness. Every transaction timestamped, traceable, and final once confirmed.

These advantages compound over time.

Implementation: Simpler Than You Think

Adding crypto payments doesn't require technical expertise.

No-code plugins enable quick setup for e-commerce platforms. Install, configure, launch.

API integration provides custom experiences for developers. Full control over user flows.

Testing environments let you experiment risk-free before going live.

Most businesses go live within days, not months.

The technical barrier has disappeared. The competitive advantage remains.

Security Without Compromise

Reliable payment infrastructure includes:

Data encryption protecting customer information

Two-factor authentication securing access

PCI DSS and AML compliance meeting regulatory standards

Anti-fraud tools detecting suspicious patterns

Regular security audits maintaining protection

Choose between custodial models (simplified management) or non-custodial options (full fund control).

Larecoin defaults to self-custody. Your security. Your responsibility. Your control.

Evaluating Total Cost Structure

Base commission isn't the full story.

Calculate total service cost:

Base processing fee (0.5–1%)

Fiat conversion fees (if applicable)

Withdrawal charges to bank accounts

Hidden compliance or reversal fees

Compare apples to apples. Some providers advertise low base fees but charge significantly more on backend operations.

Larecoin's transparent pricing eliminates surprises. What you see is what you pay.

The 2026 Outlook: Stablecoins and Beyond

Cryptocurrency adoption accelerates daily.

Stablecoins are positioned to dominate cross-border payments. They cut currency conversion costs, eliminate intermediary fees, reduce settlement delays, and enable faster transfers.

LUSD sits at this intersection. Purpose-built for merchant settlements. Stable value. Low fees. Fast finality.

Regulatory clarity improves. Technology matures. User adoption grows.

Businesses adopting crypto payments now gain first-mover advantage. Those waiting pay premium fees while competitors operate more efficiently.

Your Next Move

The payment processing landscape has changed.

Traditional fees are no longer inevitable. Crypto alternatives deliver genuine savings, faster settlements, global reach, and operational advantages.

Larecoin provides infrastructure for merchant independence. Lower costs. Greater control. Permanent records. Flexible settlements.

Join the smartest merchants already reducing fees and boosting growth.

Explore the Larecoin ecosystem and discover how much you're currently overpaying.

The marathon continues. Every post delivers real value for merchants embracing Web3 payments.

Comments