NOWPayments vs CoinPayments vs Larecoin: Which Self-Custody Crypto POS Saves You the Most on Fees?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant payment processors are eating your profits. Time to fight back.

You're running a tight ship. Every basis point matters. Every transaction fee compounds into thousands: sometimes hundreds of thousands: lost annually.

Here's the brutal truth: NOWPayments and CoinPayments are charging 0.5% to 1% per transaction. Plus network fees. Plus withdrawal penalties. Plus conversion markups.

Larecoin? Gas only.

Let's break down the numbers so you can see exactly where your money's going.

The Fee Structure Breakdown: Where Your Money Actually Goes

NOWPayments charges:

0.5% for same-currency transactions

1% when customers pay in different crypto than you settle

Network fees on top

Withdrawal charges when you move funds out

Conversion spreads buried in the fine print

CoinPayments takes:

0.5% to 1% per transaction depending on volume

Separate network fees

Custodial wallet fees

Withdrawal penalties that stack up fast

Larecoin's model:

Zero platform fees

Zero percentage cuts

Only blockchain gas (pennies on Solana)

Self-custody from transaction one

The difference isn't subtle. It's transformative.

Real Cost Scenarios: Run Your Numbers

Let's model three business profiles and see where the savings actually land.

$500K Annual Volume Business:

NOWPayments/CoinPayments: $2,500 to $5,000 in fees

Larecoin: Under $2,000 (gas only)

Your savings: 50-60% annually

$1M Annual Volume Business:

NOWPayments/CoinPayments: $5,000 to $10,000 in fees

Larecoin: $2,000 to $4,000 (gas only)

Your savings: 47-83% annually

$5M Annual Volume Business:

NOWPayments/CoinPayments: $25,000 to $37,500 in fees

Larecoin: $5,000 to $6,000 (gas only)

Your savings: 50-84% annually

That's not marketing fluff. That's real capital staying in your business instead of bleeding to payment processors.

The Self-Custody Advantage: Your Keys, Your Coins, Your Control

NOWPayments and CoinPayments operate custodial systems. They hold your funds. They control withdrawal timing. They set the fees.

You're trusting a third party with your revenue stream.

Larecoin flips that model completely.

Self-custody from day one means:

Instant access to your funds

No withdrawal delays or approval gates

No counterparty risk exposure

Complete operational autonomy

Zero percentage-based extraction

Your wallet. Your private keys. Your business sovereignty.

The Solana blockchain handles settlement. You handle everything else. No middleman skimming percentages indefinitely.

NFT Receipts: The Web3 Feature Competitors Don't Offer

Here's where Larecoin separates from the pack entirely.

Every transaction generates an NFT receipt. Permanent. Immutable. Verifiable on-chain forever.

Why this matters:

Accounting becomes bulletproof

Tax documentation is automated

Chargebacks become impossible to fake

Customers get collectible proof of purchase

Loyalty programs can integrate seamlessly

NOWPayments? Standard transaction logs. CoinPayments? Basic receipt emails. Larecoin? Blockchain-native proof that doubles as a marketing asset.

Customers love collecting these. Early adopters are already trading rare receipts from limited product drops.

Your payment infrastructure just became a community engagement tool.

LUSD: The Stablecoin That Stabilizes Your Treasury

Crypto volatility kills merchant adoption. You can't price inventory when your settlement currency swings 5% daily.

Larecoin's LUSD stablecoin integration solves this instantly.

LUSD benefits for merchants:

Pegged to USD with algorithmic stability

Decentralized backing (no USDC or USDT centralization risk)

Instant settlement without volatility exposure

Compatible with Larecoin's gas-only fee model

Accepted across the entire ecosystem

Accept Bitcoin. Accept Ethereum. Accept Larecoin. Settle everything to LUSD.

Your accounting team stays sane. Your treasury stays stable. Your margins stay predictable.

NOWPayments and CoinPayments offer conversion services: for a fee. Larecoin offers native stablecoin settlement with zero markup.

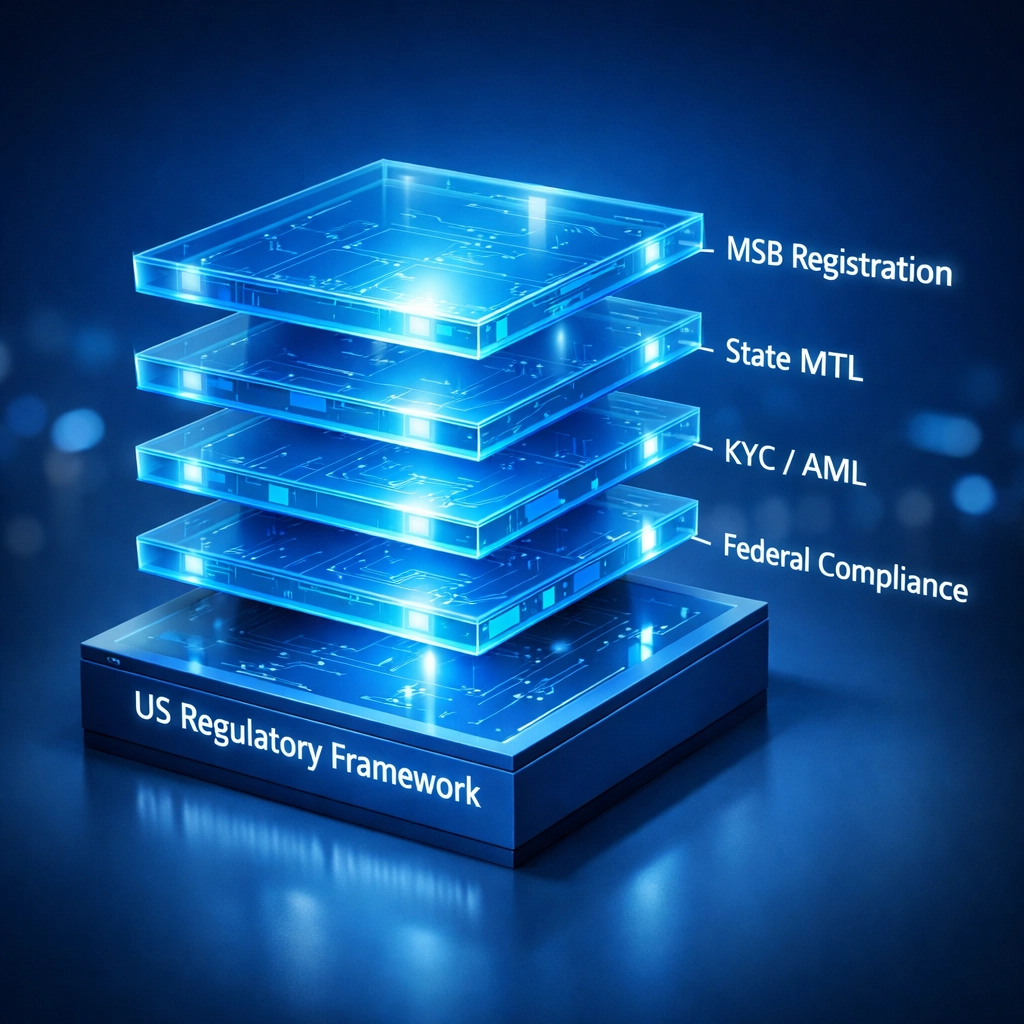

US Compliance Done Right: MSB Registration + State MTL Strategy

Here's the regulatory elephant in the room: most crypto payment processors operate in legal gray zones.

Larecoin doesn't play that game.

Our compliance infrastructure:

Registered Money Services Business (MSB) with FinCEN

Active state-by-state Money Transmitter License (MTL) strategy

KYC/AML protocols that satisfy federal requirements

Transparent regulatory roadmap updated quarterly

Why this matters for you:

Lower audit risk exposure

Cleaner books for institutional investors

Partnership readiness with regulated entities

Future-proof against enforcement actions

NOWPayments and CoinPayments? Check their disclosures carefully. Compliance posture varies significantly by jurisdiction.

Larecoin built US regulatory compliance into the foundation. Not bolted on later. Not ignored entirely.

The Hidden Costs Nobody Talks About

Percentage-based fees compound in ways merchants don't always see immediately.

Cost scenarios over 5 years at $2M annual volume:

NOWPayments/CoinPayments model:

Year 1: $10,000 to $20,000 in fees

Year 2: $10,000 to $20,000 in fees

Year 3: $10,000 to $20,000 in fees

Year 4: $10,000 to $20,000 in fees

Year 5: $10,000 to $20,000 in fees

Total: $50,000 to $100,000

Larecoin model:

Year 1: $4,000 in gas

Year 2: $4,000 in gas

Year 3: $4,000 in gas

Year 4: $4,000 in gas

Year 5: $4,000 in gas

Total: $20,000

The difference? $30,000 to $80,000 in retained capital.

That's hiring another developer. Opening a second location. Funding your next product launch.

Percentage fees steal your growth capital silently.

Making the Switch: Migration Path From Legacy Processors

Worried about switching costs? Larecoin's onboarding kills friction.

Migration timeline:

Set up your self-custody wallet (15 minutes)

Integrate payment API or use hosted checkout (1-2 hours)

Configure LUSD settlement preferences (10 minutes)

Go live accepting payments (immediate)

No multi-week compliance reviews. No deposit holds. No graduated fee tiers you have to negotiate.

Gas-only pricing is the same whether you're processing $1,000 or $10,000,000 annually.

Your first transaction costs the same as your millionth.

The Bottom Line: Do the Math for Your Business

Pull your payment processing statements from the last 12 months.

Calculate total fees paid to NOWPayments, CoinPayments, or whoever's currently extracting percentages.

Now calculate Larecoin's gas-only model on Solana (estimate $0.00025 per transaction).

The difference is your annual savings.

For most merchants processing $500K+, that's $2,500 to $35,000 staying in your treasury instead of disappearing to processors.

Why self-custody + gas-only fees win:

No percentage extraction ever

True Web3 payment sovereignty

NFT receipts for next-gen loyalty

LUSD stability without conversion fees

US regulatory compliance built-in

NOWPayments and CoinPayments serve a purpose for businesses wanting custodial simplicity.

But if you're ready for true crypto payment efficiency: where fees don't scale with success: Larecoin's the move.

Your Next Step

Run the numbers for your business. Model the savings.

The gas-only payment future is here. Your competitors are already switching.

Time to stop paying percentage fees forever.

Comments