Larecoin Vs NOWPayments Vs CoinPayments: Which Crypto Payment Solution Saves You the Most on Fees?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The Hidden Costs Nobody Tells You About

Crypto payment processors love advertising low fees.

0.5% here. 1% there. Sounds cheap, right?

Wrong.

Network fees, withdrawal penalties, conversion spreads, and custodial risks can double: sometimes triple: your actual costs. The advertised rate is just the beginning.

Time to break down what you're really paying with NOWPayments, CoinPayments, and Larecoin.

NOWPayments: The Fee Breakdown

NOWPayments positions itself as transparent. Here's what they actually charge:

Base Fees:

0.5% for single-currency payments

1% total for multi-currency (0.5% service + 0.5% exchange)

1.5–2.3% for fiat withdrawals depending on method and region

The Fine Print: Network fees charged separately. Every blockchain transaction costs extra. Ethereum? Expensive. Bitcoin? Slow and costly. These aren't included in their advertised rates.

Want your money in your bank account? Add another 1.5–2.3% on top.

The math gets ugly fast.

$10,000 in monthly sales. Multi-currency setup. Fiat withdrawal. You're looking at $100 (processing) + $50 (exchange) + up to $230 (withdrawal) = $380 in fees. That's 3.8% effective rate.

Not quite the 0.5% they advertise.

CoinPayments: The Veteran with Aging Infrastructure

CoinPayments has been around since 2013. They support 2,000+ cryptocurrencies. Sounds impressive until you realize most merchants only need 5–10 coins.

Their Fee Structure: Approximately 0.5% for standard transactions. But details get murky.

Network fees? Charged separately.

Withdrawal fees? Varies by coin.

Currency conversion? Another spread hidden in the exchange rate.

The platform feels dated. The UX is clunky. Support tickets pile up during high-volume periods.

And here's the kicker: custodial model. Your funds sit in their wallets. You trust them. They control your money until you withdraw: for a fee.

Enter Larecoin: The Web3 Payment Disruptor

Larecoin isn't just another crypto payment processor.

It's a complete Web3 payments ecosystem built on Solana. Lightning-fast transactions. Near-zero network fees. Full self-custody.

The Larecoin Advantage:

1. Actual Fee Savings

Solana network fees average $0.00025 per transaction. Not 0.00025%. Literal fractions of a penny.

Process $10,000 in sales? Your network costs are under $1. Compare that to Ethereum's $5–50 per transaction.

No hidden exchange fees. No withdrawal penalties. No custodial middleman taking cuts.

The LARE token processes payments at gas-only rates. That means you pay network fees. Period.

2. LUSD Stablecoin Benefits

Larecoin offers LUSD: the ecosystem's stablecoin version. Accept payments in crypto. Receive stable value immediately.

No volatility risk. No conversion spreads. No waiting for settlements.

Merchants need predictability. LUSD delivers it without third-party stablecoin risks or banking intermediaries.

3. NFT Receipts as Proof-of-Transaction

Every Larecoin payment generates an NFT receipt. Immutable proof-of-transaction stored on-chain forever.

Why does this matter?

Accounting: Instant, verifiable records Compliance: Transparent audit trails Customer protection: Undeniable proof of purchase Loyalty programs: Transform receipts into collectibles

Traditional processors give you a database entry. Larecoin gives you blockchain-verified ownership.

4. Self-Custody from Day One

NOWPayments holds your funds. CoinPayments controls your wallet. Both act as custodians.

Larecoin? Your keys. Your crypto. Always.

Payments flow directly into your non-custodial wallet. No waiting. No withdrawal fees. No asking permission to access your own money.

This is what Web3 was built for.

The Compliance Edge: Built for US Markets

Crypto regulation is tightening. The US market demands compliance.

Larecoin isn't playing games.

MSB Registration: Money Services Business compliance at federal level State MTL Strategy: Pursuing Money Transmitter Licenses across key states Proactive Approach: Building regulatory relationships before requirements hit

Most crypto payment processors operate in gray areas. Hope regulators don't notice. Cross fingers during compliance updates.

Larecoin chose the hard path. The legitimate path.

For merchants, this means:

Reduced regulatory risk

Banking relationship stability

Long-term partnership viability

Clear legal standing

You can't build a sustainable business on shaky regulatory foundations. Larecoin gets it.

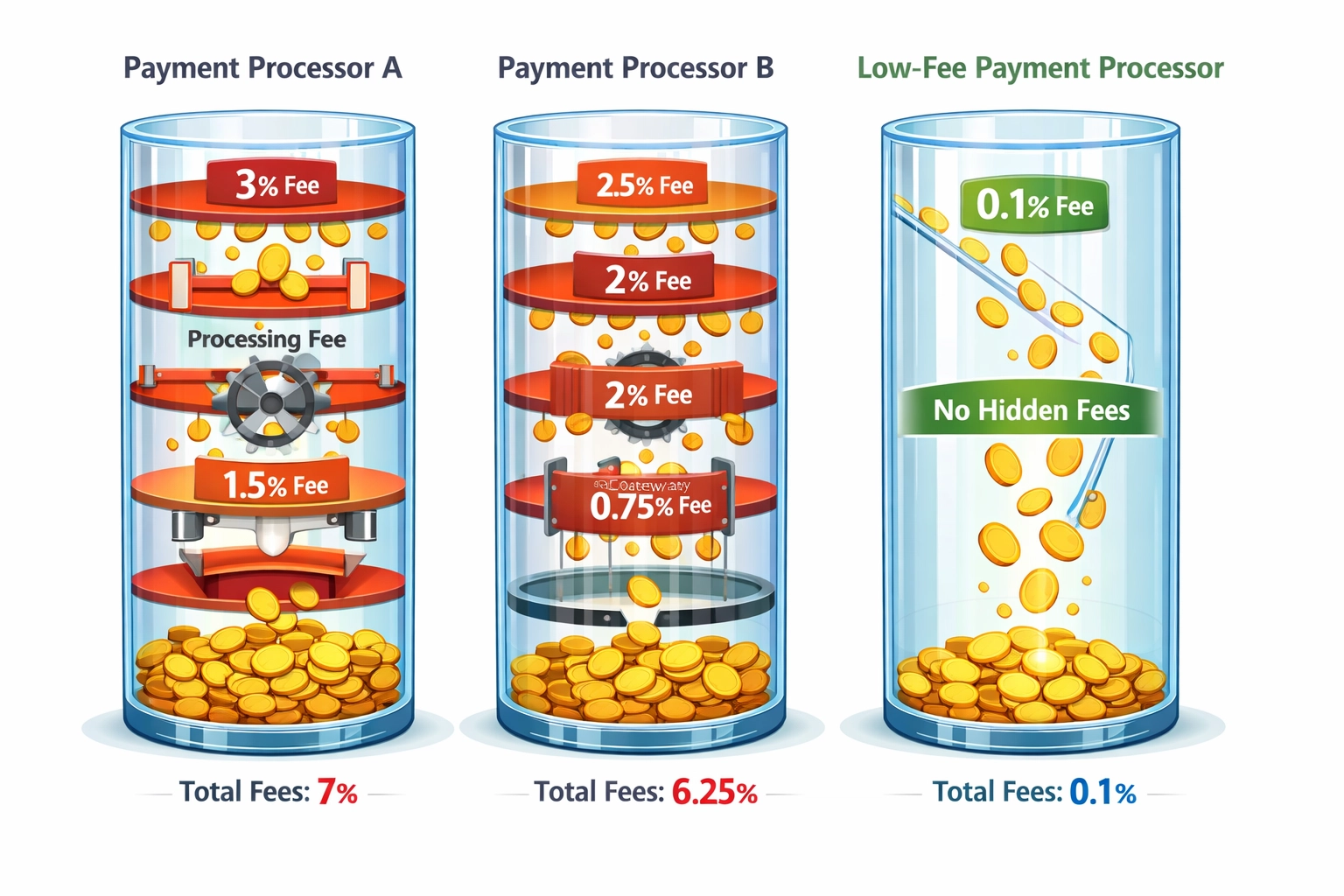

Real-World Cost Comparison

Let's run the numbers on $50,000 monthly transaction volume:

NOWPayments:

Processing: $250 (0.5%)

Multi-currency exchange: $250 (0.5%)

Fiat withdrawal: $750–1,150 (1.5–2.3%)

Network fees: $200+ (varies)

Total: $1,450–1,850 (2.9–3.7%)

CoinPayments:

Processing: $250 (0.5%)

Network fees: $150–300 (blockchain dependent)

Withdrawal fees: $100–400 (coin dependent)

Hidden conversion spreads: $100–250

Total: $600–1,200 (1.2–2.4%)

Larecoin:

Processing: $0 (gas-only model)

Network fees: <$10 (Solana)

Withdrawal: $0 (self-custody, no withdrawals needed)

Conversion to LUSD: Minimal spreads

Total: <$50 (0.1%)

The savings are undeniable.

Beyond Fees: The Innovation Factor

Fee comparison matters. But Larecoin offers advantages competitors can't match:

Push-to-Card Functionality: Crypto payments. Card deposits. Instant liquidity without exchanges.

Metaverse Integration: Ready for virtual commerce. Built for the future of retail.

Receivable Token Model: Convert invoices into tradeable assets. Unlock working capital instantly.

Community Ecosystem: Join active discussions at Larecoin Community. Real users. Real feedback. Real development.

Merchant Products: Show your Web3 commitment with Larecoin branded merchandise. Build brand affinity while supporting the ecosystem.

This isn't just payment processing. It's infrastructure for Web3 commerce.

The Bottom Line

NOWPayments and CoinPayments serve a purpose. They helped bridge crypto and traditional payments.

But they're built on Web2 thinking. Custodial models. Hidden fees. Complex withdrawals.

Larecoin represents the next evolution:

True self-custody

Transparent, minimal fees

Blockchain-native features

Regulatory compliance

Future-ready infrastructure

The question isn't whether to accept crypto payments.

The question is whether you'll choose outdated infrastructure or cutting-edge Web3 technology.

Smart merchants choose Larecoin.

Want to explore more about how Larecoin fits into the future of commerce? Check out our insights on metaverse shopping features.

Ready to make the switch? Visit larecoin.com and join the payment revolution.

Your bottom line will thank you.

Comments