Struggling With High Payment Processing Costs? 7 LUSD Stablecoin Benefits That Give You Merchant Freedom

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

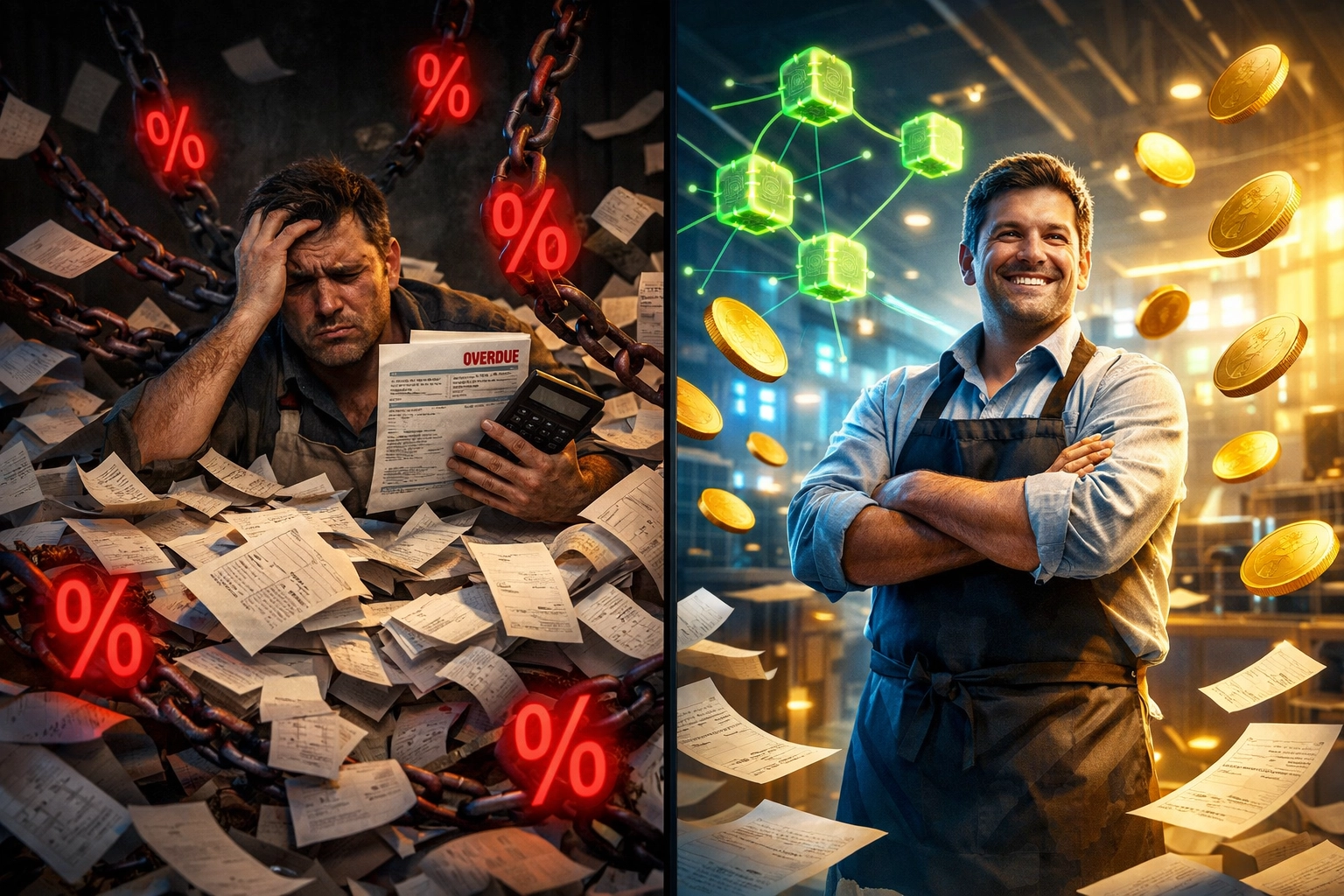

You're getting crushed by payment processing fees.

2.9% plus $0.30 per transaction. High-risk merchants? Try 5-8%. That's thousands bleeding from your business every month.

Traditional payment processors have you locked in. Chargebacks. Account freezes. Multi-day settlement holds. Zero control over your own money.

There's a better way.

LUSD stablecoin flips the entire payment processing model. Replace percentage-based fees with flat network costs. Gain full custody of your funds. Settle transactions in minutes instead of days.

Let's break down the seven LUSD stablecoin benefits that give you true merchant freedom.

1. Slash Your Processing Costs By 95%+

Traditional processors charge you based on transaction volume. The more you sell, the more they take.

LUSD operates differently.

Network gas fees range from $0.50 to $15 per transaction. Fixed costs regardless of transaction size. Send $100 or $100,000 – same fee.

The math is brutal for traditional processors:

Processing $100,000 monthly with traditional rates? You're paying $2,900 to $8,000 in fees.

With LUSD? Roughly $500 in gas fees for 1,000 transactions.

Annual savings: $29,820 to $90,000.

That's working capital back in your business. Not lining payment processor pockets.

2. Algorithmic Stability Without Corporate Control

Most stablecoins rely on bank backing or corporate promises. USDC, USDT – centralized entities control the reserves.

LUSD is different.

Smart contracts maintain the $1 peg automatically. No bank accounts. No corporate oversight. No risk of frozen reserves.

The stability mechanism runs 24/7/365 through decentralized protocols. Predictable pricing without volatility or third-party interference.

You get stability without surrendering control to centralized gatekeepers.

3. Self-Custody Merchant Accounts = Zero Middlemen

Traditional merchant accounts give you access. Not ownership.

Your payment processor holds your funds. They decide when you can withdraw. They set the limits. They can freeze everything with zero notice.

Self-custody merchant accounts flip this completely.

You hold private keys. You control funds directly. No intermediary approval required.

Benefits stack fast:

Instant 24/7/365 access to your money

No withdrawal limits

No account freezes

No third-party approval chains

Complete financial sovereignty

Your business. Your funds. Your control.

4. Instant Settlement vs 3-7 Day Holds

Cash flow kills more businesses than bad products.

Traditional processors hold your funds for 3-7 days. Rolling reserves. Risk mitigation policies. Bureaucratic nonsense keeping YOUR money hostage.

LUSD transactions settle in under 10 minutes.

Customer pays. Funds arrive. Transaction complete.

No waiting periods. No settlement schedules. No cash flow gaps.

You can reinvest revenue immediately. Pay suppliers faster. Take advantage of time-sensitive opportunities.

Instant settlement transforms how you operate.

5. NFT Receipts For Automated Accounting

Manual bookkeeping is expensive and error-prone.

Every LUSD transaction generates an immutable NFT receipt. Timestamped. On-chain. Permanent record.

This creates automatic audit trails:

Transparent transaction history

Automatic reconciliation

Tax-ready documentation

No manual data entry

Instant financial reporting

Your accountant will thank you. Your auditor will love you. Tax season becomes painless.

NFT receipts for accounting aren't a gimmick. They're a productivity revolution.

6. Global Payment Parity Across All Countries

Traditional international payments are a nightmare.

Currency conversion fees. Correspondent bank delays. Different processing rates by region. Multi-day settlement for cross-border transactions.

LUSD eliminates geographic payment friction.

Transaction from Tokyo costs the same as Texas. Settles in minutes regardless of location. Zero currency conversion fees. No correspondent banks.

True Web3 global payments mean:

Single payment infrastructure worldwide

Consistent costs everywhere

No geographic restrictions

Instant cross-border settlement

Global customer base accessible instantly

Expand internationally without payment processing headaches.

7. Bank Independence = True Business Freedom

Banks can deplatform you overnight.

Wrong industry. Regulatory concerns. Algorithm flags. Compliance issues. Suddenly your merchant account vanishes.

LUSD operations require zero bank involvement.

You need:

Crypto wallet

Internet connection

That's it

No bank account requirements. No merchant application approvals. No account termination risk.

Complete bank-free business operations become reality.

How LUSD Compares To Traditional Crypto Payment Processors

NOWPayments, CoinPayments, and Triple-A still operate like traditional processors. They reduce fees slightly but maintain centralized control.

NOWPayments charges 0.5% to 1% per transaction. Better than traditional rates. Still percentage-based. Still gives up custody during processing.

CoinPayments runs similar models. Fees range from 0.5% to 1%. Multi-currency support adds complexity. You're still trusting a third party.

Triple-A targets enterprise merchants. Lower fees for volume. Still centralized infrastructure. Still custody handoff during transactions.

Larecoin with LUSD stablecoin operates fundamentally differently.

Gas-only costs. Self-custody throughout. No percentage fees ever. NFT receipt automation. Complete merchant sovereignty.

It's not a "NOWPayments alternative" or "CoinPayments alternative." It's a different paradigm entirely.

The Receivables Token Advantage

LUSD integrates seamlessly with Larecoin's receivable token system.

Convert incoming LUSD payments into yield-generating receivables tokens. Monetize your accounts receivable immediately. Transform payment processing into working capital generation.

Traditional processors take your money and pay you later.

Larecoin lets you leverage receivables instantly.

Building Your Crypto POS System For Small Business

Implementation is straightforward.

Point-of-sale integration takes minutes. Web3 global payments infrastructure connects through simple APIs. No complex technical requirements.

You can operate:

Online checkout systems

Physical store terminals

Mobile payment solutions

Metaverse storefronts

One payment infrastructure. Multiple channels. Complete flexibility.

Take Control Of Your Payment Processing

High merchant interchange fees aren't inevitable.

Self-custody merchant accounts aren't radical. NFT receipts for accounting aren't experimental.

They're available now through Larecoin's LUSD stablecoin system.

Reduce fees by 95%+. Settle instantly. Control your funds completely. Automate accounting. Operate globally. Eliminate bank dependency. Gain true merchant freedom.

The question isn't whether Web3 payments work.

The question is how much longer you'll pay legacy processors thousands monthly for worse service.

Ready to cut your payment processing costs permanently?

Visit Larecoin and explore how LUSD stablecoin benefits transform merchant operations. Join the Larecoin Community to connect with merchants already operating with financial sovereignty.

Your money. Your control. Your future.

Start today.

Comments