Looking for a CoinPayments Alternative? Here Are 10 Things You Should Know About Self-Custody Merchant Accounts

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 3 min read

CoinPayments has been around for years. But custodial models? They're showing their age.

If you're exploring alternatives, self-custody isn't just a buzzword: it's the smartest move for merchants who value control, privacy, and lower fees. Here's what you need to know before making the switch.

1. Self-Custody Means You Actually Own Your Funds

With CoinPayments, your crypto sits in their wallets. You're essentially renting access to your own money.

Self-custody flips this. Payments land directly in your wallet. No intermediaries. No waiting for withdrawals. No "account frozen" emails at 3 AM.

Larecoin takes this further: merchant accounts run on decentralized infrastructure. You hold the keys. Period.

2. Custodial Platforms Charge Hidden Withdrawal Fees

CoinPayments lists their transaction fees upfront. But withdrawal fees? That's where they get you.

Every time you move funds off their platform, you're paying again. Bitcoin withdrawals, Ethereum withdrawals, altcoin withdrawals: each costs extra.

Self-custody merchant accounts eliminate this entirely. Once funds hit your wallet, moving them costs only network gas fees. No platform cut.

3. KYC Requirements Are Optional with True Self-Custody

CoinPayments requires identity verification for most features. NOWPayments markets "no KYC": but they're still custodial.

Real self-custody solutions don't need your passport. Why would they? They're not holding your funds.

Larecoin's merchant portal operates without mandatory KYC for basic functionality. You're not a customer: you're a sovereign participant in the network.

4. You Can Cut Processing Fees by 50%+ Immediately

CoinPayments charges 0.5% per transaction. Seems reasonable until you realize that's on top of network fees.

Self-custody platforms running on Layer 1 infrastructure like Larecoin's Lareblocks cut this dramatically. How Lareblocks Layer 1 cuts merchant fees by 50% breaks down the math.

Average savings? 50-80% compared to custodial processors.

For a merchant processing $100K monthly, that's $6,000+ saved annually. Real money.

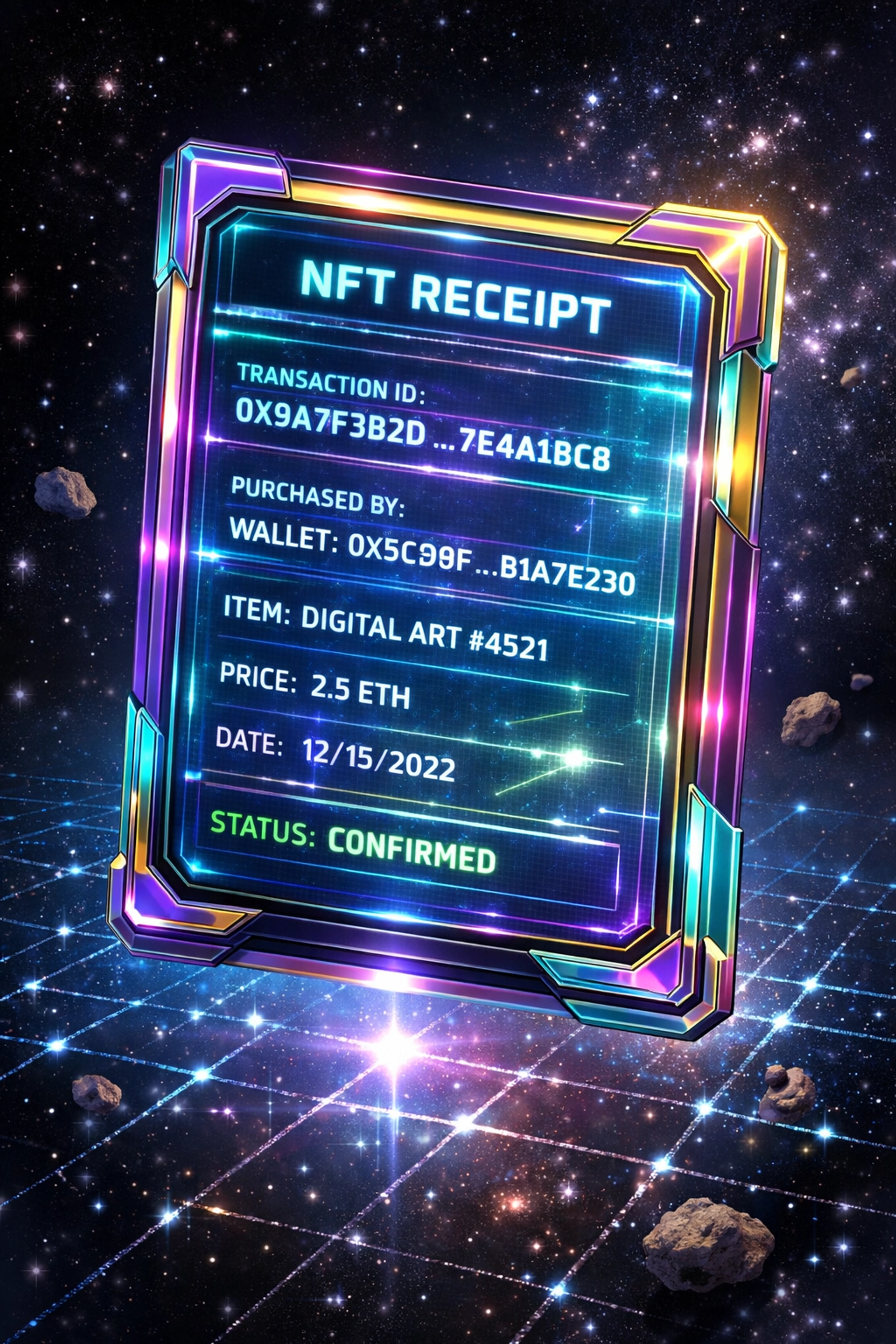

5. NFT Receipts Replace Traditional Transaction Records

Paper receipts are dead. Digital PDFs are boring.

NFT receipts are revolutionary. Every payment generates a unique, verifiable, tradeable receipt stored on-chain.

Larecoin issues NFT receipts automatically for merchant transactions. Customers can collect them. Display them. Even resell them if they become valuable.

This isn't just innovation: it's proof of purchase that can't be faked.

6. LUSD Stablecoin Integration Solves Volatility Concerns

"Crypto is too volatile for everyday business."

Heard it a thousand times. It's why stablecoins exist.

CoinPayments supports stablecoins, but conversion happens on their terms, with their fees. Self-custody lets you choose when and how to convert.

Larecoin's LUSD stablecoin is pegged 1:1 with USD. Accept it directly. Zero volatility risk. Full self-custody benefits.

Merchants get stability without sacrificing control.

7. Custodial Platforms Can Freeze Your Account Anytime

Read the fine print. CoinPayments: like all custodial services: reserves the right to suspend accounts.

Regulatory pressure? Frozen. "Suspicious activity"? Frozen. Algorithmic flag? Frozen.

Your business grinds to a halt while you submit appeals and documentation.

Self-custody eliminates this risk completely. No one can freeze what they don't control.

8. Direct Wallet Payments Mean Faster Settlement

CoinPayments batches payments. You wait for their settlement schedule.

Self-custody is instant. Transaction confirms on-chain? Funds are yours. No batch processing. No settlement delays.

For cash flow-sensitive businesses, this is massive. Pay suppliers same-day. Reinvest profits immediately. Operate at crypto speed, not banking speed.

9. You Avoid Counterparty Risk Entirely

Custodial platforms are targets. Hacks happen. Insolvency happens. Regulatory seizures happen.

Remember when exchanges collapsed and merchants lost everything? That's counterparty risk.

Self-custody means zero counterparty risk. The only vulnerabilities are your own security practices: which you control.

Larecoin's architecture ensures no central point of failure. Your funds. Your responsibility. Your peace of mind.

10. Integration Is Easier Than You Think

"Self-custody sounds complicated."

It's not. Modern solutions make setup simple.

Larecoin's merchant portal handles the technical heavy lifting. Generate payment addresses. Track transactions. Issue NFT receipts. All from one dashboard.

No server management like BTCPay. No complex Lightning infrastructure. Just straightforward Web3 payments designed for real merchants.

Implementation takes hours, not weeks.

Why Larecoin Outperforms CoinPayments and NOWPayments

Let's compare directly:

CoinPayments: Custodial. Withdrawal fees. KYC required. 0.5% + network fees.

NOWPayments: Custodial. No KYC marketing (but still holding your funds). 0.4-0.5% fees.

Larecoin: Self-custody. No withdrawal fees (you already own the funds). Optional KYC. ~50% lower effective fees. NFT receipts. LUSD stability. Layer 1 infrastructure.

The choice is clear.

Real Merchant Freedom Starts Here

Traditional processors: whether fiat or crypto: operate on the same principle: control your money, charge you for access.

Self-custody breaks this model.

You're not a customer anymore. You're an independent operator running your business on open infrastructure.

That's the future of commerce. Decentralized. Permissionless. Unstoppable.

Explore more about self-custody and merchant independence or dive into how Larecoin's 1.5% tax supports global charities while you operate.

Ready to take control? Visit Larecoin.com and set up your self-custody merchant account today.

No middlemen. No hidden fees. No compromises.

Just pure merchant freedom.

Comments