NFT Receipts for Accounting: 7 Mistakes Merchants Make (and How Larecoin Fixes Them)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Crypto payments are great for your business. Until tax season hits.

Suddenly you're drowning in transaction records. Your accountant is charging triple. The IRS wants documentation you never captured. And traditional payment processors like NOWPayments and CoinPayments? They took your money but left you with accounting nightmares.

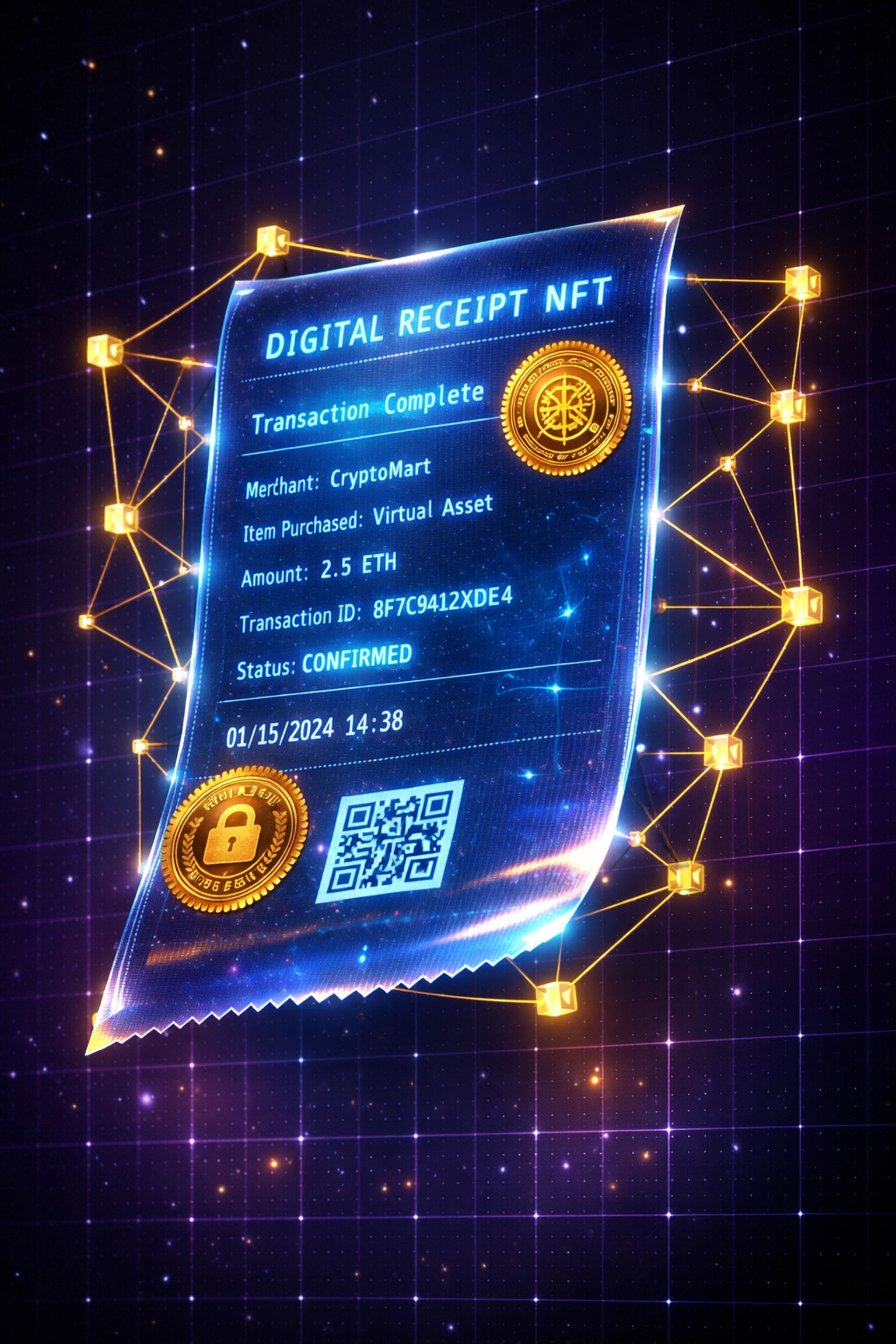

NFT receipts change everything.

Larecoin built a system that captures every detail automatically. On-chain. Permanent. IRS-ready. Let's break down the seven biggest accounting mistakes merchants make, and how our NFT receipt system fixes them.

Mistake #1: Not Tracking Every Single Transaction

Every crypto transaction is taxable. Period.

Doesn't matter if it's $5 or $5,000. The IRS's automated matching system flags everything. They compare your filings against exchange reports on Form 1099-DA.

The problem: Merchants skip small trades. Forget gas fees. Miss cross-wallet transfers.

How Larecoin fixes it: Our NFT receipt system captures EVERY transaction automatically. Gas fees? Recorded. Wallet transfers? Logged. Small payments? All there. Each transaction mints an immutable receipt the moment it happens. No manual entry. No forgotten records.

NOWPayments and CoinPayments process your payment and move on. Larecoin creates permanent documentation.

Mistake #2: Losing Cost Basis Documentation

Your accountant needs three critical pieces of data:

Purchase price

Holding period

Applicable tax rate

Traditional processors don't capture this. You're left reconstructing history from scattered emails and exchange exports.

The problem: Hours of manual reconstruction. Estimated figures. Audit triggers everywhere.

How Larecoin fixes it: NFT receipts capture cost basis at transaction time. Purchase price in USD and crypto. Exact timestamp for holding period calculation. Automatic tax treatment classification. Everything your CPA needs, stored on-chain, accessible forever.

When tax season arrives, export a CSV. Hand it to your accountant. Done.

Mistake #3: Manual Reconciliation Errors

Payment processors charge 0.5-1% per transaction. You receive net payments. Your accounting software shows gross revenue.

The math doesn't match.

The problem: You spend 6-8 hours monthly reconciling fees. Matching payment processor statements to bank deposits. Accounting for the gap between what you earned and what you received.

How Larecoin fixes it: Larecoin charges ZERO processing fees on LUSD stablecoin payments. Just network gas fees, pennies, not percentages. Your revenue = your deposit. No reconciliation needed. NFT receipts show the exact amount sent and received. The numbers match perfectly.

CoinPayments takes their cut and sends you the rest. Larecoin gives you everything and documents it transparently.

Mistake #4: Missing Fair Market Value Timestamps

The IRS requires contemporaneous documentation. That means capturing the USD value at the exact transaction second.

Crypto fluctuates 5% daily. Sometimes 5% hourly.

The problem: Email confirmations arrive late. Traditional receipts don't capture real-time FMV. You're estimating values weeks later during bookkeeping.

How Larecoin fixes it: NFT receipts timestamp FMV automatically. The moment a payment completes, the receipt records the USD equivalent. Not an estimate. Not end-of-day pricing. The exact fair market value at transaction time.

Auditors love this. You'll love it more when you're not scrambling for documentation three years later.

Mistake #5: Inadequate Audit Trail Documentation

Payment gateways confirm payment. Great.

But what about the supporting documentation? Invoice number? Item description? Customer details? Payment terms?

The problem: When auditors request proof of income, you're digging through email archives. Matching payments to invoices manually. Hoping you saved everything.

How Larecoin fixes it: NFT receipts create comprehensive audit trails. Each receipt stores:

Complete item descriptions

Invoice numbers

Payment terms

Customer wallet identifiers

Full transaction metadata

All on-chain. Retrievable instantly. Even years later. No scattered files. No lost emails. Just query the blockchain and pull your documentation.

Mistake #6: Misclassifying NFT Assets

NFTs lack specific guidance under U.S. GAAP. Are they inventory? Intangible assets? Collectibles subject to 28% capital gains rates?

The problem: The difference between ordinary income and capital gains treatment is 15-20% in tax liability. Most merchants guess. Some pay CPAs $300/hour to figure it out.

How Larecoin fixes it: Our system tags each NFT receipt by transaction type automatically:

Business income

Payment receipts

Service exchanges

Asset transfers

Classification happens at transaction time. No guessing. No expensive consultations. The receipt knows what it is and documents it permanently.

NOWPayments processes your NFT payment but doesn't classify it. You're on your own for tax treatment.

Mistake #7: Failing to Integrate with Accounting Software

Traditional processors require middleware. Plugins. Custom development. API integrations that break during updates.

The problem: Integration costs thousands. Manual data entry creates errors. Your payment processor and accounting software live in separate universes.

How Larecoin fixes it: Blockchain-based receipts function as self-documenting data structures. Export to CSV, JSON, or query directly via blockchain explorers. Your accounting software reads them natively. Zero middleware. Zero custom development. Zero integration headaches.

QuickBooks? Works. Xero? Works. FreshBooks? Works. Any accounting platform that imports structured data? Works perfectly.

The Real Cost of Broken Accounting

Merchants switching to NFT receipt systems report:

4-6 hours monthly saved on reconciliation

$600-900 recovered in bookkeeper time

90% reduction in common audit triggers

Zero processing fees on LUSD payments

CoinPayments charges you 0.5% plus processing fees. Gives you basic transaction confirmations. Leaves you with accounting chaos.

Larecoin charges gas-only fees. Gives you comprehensive NFT receipts. Hands you IRS-ready documentation automatically.

Self-Custody Meets Accounting Compliance

Traditional payment processors control your funds. They process. They settle. They charge fees. They decide when you get paid.

Larecoin operates differently.

Self-custody means you control your crypto. Payments arrive directly to your wallet. No intermediary holds your funds. No settlement delays. No processor deciding if your transaction is "suspicious."

But self-custody usually creates accounting complexity. Not with NFT receipts.

Each payment to your self-custody wallet automatically generates a compliant receipt. You get financial independence AND accounting simplicity. No trade-offs.

LUSD: Stablecoin Accounting Without Volatility

Accepting Bitcoin or Ethereum creates additional tax complications. Every payment triggers a taxable event. Every price fluctuation needs documentation.

LUSD stablecoin payments simplify everything. Pegged 1:1 with USD. Minimal volatility. Simpler tax treatment. All the benefits of crypto payments without the accounting complexity of volatile assets.

NFT receipts document LUSD payments with the same thoroughness as any crypto transaction. But the stable value means cleaner books and easier reconciliation.

Why Merchants Choose Decentralized Payments

Freedom. Independence. Control.

Centralized processors like NOWPayments and CoinPayments operate gatekeepers. They approve your account. Monitor your transactions. Flag activity they don't like. Freeze your funds if something seems off.

Decentralized crypto payments eliminate the middleman. Customer to merchant. Direct. Peer-to-peer. Exactly how crypto was designed to work.

Larecoin's NFT receipt system brings enterprise-grade accounting to decentralized payments. You get merchant freedom without sacrificing compliance.

The Bottom Line

Crypto accounting doesn't have to be painful.

Traditional processors charge fees and provide minimal documentation. NFT receipts capture everything automatically. On-chain. Permanent. Compliant.

Larecoin built this system because merchants deserve better. Better fees. Better documentation. Better control over their money.

Stop making these seven mistakes. Start using NFT receipts that actually solve your accounting problems.

Ready to fix your crypto accounting? Check out Larecoin and see how NFT receipts transform your bookkeeping from nightmare to seamless.

Comments