NOWPayments vs CoinPayments vs Larecoin: Which Crypto POS System Actually Cuts Your Fees in Half?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

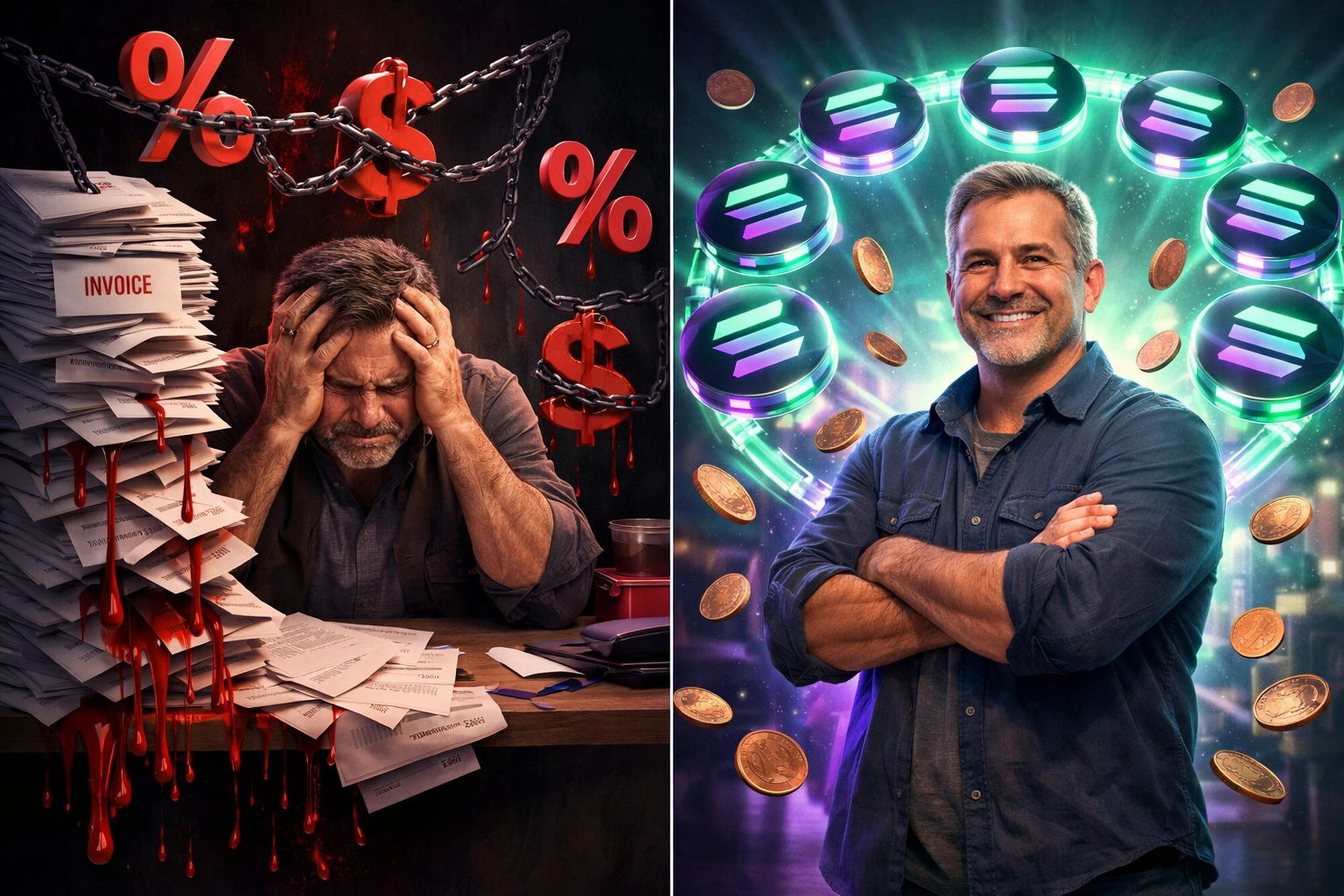

You're Bleeding Money on Payment Fees

Every time a customer swipes, taps, or clicks: you lose.

Traditional payment processors? 2.9% + $0.30 per transaction.

Crypto processors like NOWPayments and CoinPayments? Better, but still eating into your margins with platform fees, withdrawal charges, and conversion costs.

The average merchant processing $500K annually hands over $2,500–$5,000 to their crypto payment processor. That's before calculating withdrawal fees and network costs.

There's a better way.

Let's compare three crypto POS systems and find out which one actually delivers on the promise of slashing your fees in half: or more.

The Traditional Crypto Payment Fee Trap

Both NOWPayments and CoinPayments charge percentage-based fees that compound as your business grows.

The Standard Fee Structure:

0.5–1% platform fee per transaction

Network fees on every payment

Withdrawal fees when you move funds

Currency conversion charges when switching between assets

Here's what kills merchants: these fees scale with your success.

Process $100K? Pay $750–$1,000. Hit $1.2M? That's $6,000–$12,000 gone. Reach $5M? You're giving up $25,000+ annually.

The more you earn, the more they take.

This is the interchange fee model repackaged for crypto. Same trap. Different wrapper.

How Larecoin Breaks the Fee Model

Larecoin runs on Solana.

No platform fees. No withdrawal penalties. No conversion charges stacking up.

Just gas fees: and on Solana, those are pennies per transaction.

The Zero-Fee Structure:

Platform fee: $0

Withdrawal fee: $0

Conversion fee: $0

Gas cost: ~$0.001–$0.01 per transaction

Whether you process $10K or $10M, the cost per transaction stays flat. Your payment processor doesn't get richer as you grow.

This is what a crypto POS system for small business should look like.

Real-World Savings: The Numbers Don't Lie

Let's calculate what you'd actually save switching to Larecoin.

Annual Volume: $100,000

NOWPayments/CoinPayments: $750–$1,000

Larecoin: $300–$400

Your savings: 50%+

Annual Volume: $500,000

NOWPayments/CoinPayments: $2,500–$5,000

Larecoin: Under $2,000

Your savings: 60%+

Annual Volume: $1.2 Million

NOWPayments/CoinPayments: $6,000–$12,000

Larecoin: ~$2,000

Your savings: 67–83%

Annual Volume: $5 Million

NOWPayments/CoinPayments: $25,000+

Larecoin: ~$5,000

Your savings: 80%+

The gap widens as you scale. That's $20,000+ staying in your business instead of vanishing into platform fees.

The Self-Custody Advantage

Here's what NOWPayments and CoinPayments don't advertise: they control your funds.

Custodial wallets mean:

They hold your crypto

They decide when you withdraw

They can freeze your account

You're trusting a third party with your revenue

Larecoin uses self-custody merchant accounts.

You control your private keys. Your funds live in your wallet. Nobody can freeze, seize, or restrict your money.

This is financial sovereignty. Not just lower fees.

When you combine self-custody with zero platform fees, you're running a bank-free business operation that's actually yours.

NFT Receipts: The Accounting Game-Changer

Every Larecoin transaction generates an NFT receipt.

Immutable. Timestamped. Blockchain-verified.

Why This Matters for Merchants:

Instant transaction proof

Automated accounting reconciliation

Dispute resolution with cryptographic evidence

Tax-ready documentation

Traditional crypto processors send you CSV files. Maybe. If you remember to download them.

NFT receipts for accounting means your books update automatically. No manual entry. No missing records. No headaches during tax season.

This is Web3-native infrastructure that actually solves real problems.

LUSD Stablecoin: Volatility Protection Without Conversion Fees

Accept Bitcoin today at $85K. Wake up tomorrow, it's $78K.

That's the crypto merchant nightmare.

Most processors charge conversion fees to move from volatile crypto to stablecoins. CoinPayments and NOWPayments both take a cut when you want stability.

Larecoin offers LUSD stablecoin benefits:

Pegged to USD with algorithmic stability

Accept volatile crypto, automatically convert to LUSD

Zero conversion fees within the Larecoin ecosystem

Maintain purchasing power without platform charges

You get crypto's speed and global reach without the volatility risk or the conversion fee penalty.

The Receivables Token Revolution

Here's where Larecoin pulls ahead technically.

The receivables token system lets you:

Tokenize outstanding invoices

Trade receivables on secondary markets

Improve cash flow without loans

Create liquidity from future payments

No competitor offers this.

You're not just accepting crypto payments: you're accessing Web3 financial tools that transform how you manage working capital.

Traditional factoring companies charge 1–5% to advance on receivables. Larecoin's token system operates on smart contracts with minimal fees.

Cash flow problems solved. No banks required.

Feature Comparison: Beyond Just Fees

NOWPayments:

✓ Multi-currency support

✓ API integration

✗ Self-custody

✗ NFT receipts

✗ Receivables tokens

Fee model: Percentage-based

CoinPayments:

✓ Established platform

✓ Shopping cart plugins

✗ Self-custody

✗ NFT receipts

✗ Modern Web3 features

Fee model: Percentage-based + withdrawal fees

Larecoin:

✓ Self-custody wallets

✓ NFT receipt system

✓ LUSD stability without conversion fees

✓ Receivables token liquidity

✓ DAO governance

✓ Cross-chain bridging

Fee model: Gas-only (pennies per transaction)

The technical gap is massive.

Larecoin isn't just cheaper: it's architecturally superior for merchants who want Web3 global payments without compromising on features.

Who Should Use Each Platform?

Use NOWPayments or CoinPayments if:

You process under $50K annually (fees matter less at low volume)

You want maximum cryptocurrency variety

You prefer custodial convenience over control

You're okay with percentage-based fees

Use Larecoin if:

You process $100K+ annually (savings compound fast)

You want to reduce merchant interchange fees by 50–80%

You value self-custody and financial sovereignty

You need NFT receipts for accounting automation

You want access to receivables token liquidity

You're building for Web3-native customers

For most growing merchants, the math is simple: Larecoin saves more money while offering more control.

The Bottom Line on Cutting Fees in Half

Here's what actually matters:

NOWPayments and CoinPayments charge percentage-based fees that grow with your revenue. You're locked into custodial wallets. You pay withdrawal fees. Conversion costs add up.

Larecoin eliminates platform fees entirely. Self-custody puts you in control. NFT receipts automate accounting. LUSD provides stability without conversion charges. Receivables tokens create new liquidity options.

At $500K annual volume, you save $3,000–$4,000 per year. At $1.2M, that's $8,000–$10,000 staying in your business. At $5M, you're keeping $20,000+ that would otherwise vanish.

The savings are real. The technology is superior. The control is yours.

Check out the full Larecoin merchant portal to calculate your specific savings and see how a NOWPayments alternative or CoinPayments alternative could transform your payment operations.

Web3 global payments aren't coming. They're here.

The only question: how much longer will you keep overpaying?

Comments