Why Web3 Payments Will Change the Way You Support Global Causes (While Slashing Fees by 50%)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Traditional donation platforms are bleeding your charitable contributions dry.

Think about it. You donate $100 to fight global hunger. Banks take their cut. Payment processors grab their slice. Currency conversion fees? Another bite. By the time your money reaches the actual cause, you're lucky if $85 makes it.

That's not charity. That's highway robbery with a feel-good wrapper.

Web3 payments are flipping this broken model on its head. And platforms like Larecoin are proving you can support global causes while keeping more money where it belongs: helping people who need it.

The Hidden Tax on Generosity

Legacy payment systems weren't built for global giving. They were built for banks.

Cross-border donations get hammered with fees:

Wire transfer fees: $25-50 per transaction

Currency conversion spreads: 3-5%

Intermediary bank charges: $10-30

Processing delays: 3-7 business days

Send $500 to a nonprofit in Kenya? Traditional rails might charge you $60+ in fees. That's 12% gone before a single meal gets served.

NOWPayments and CoinPayments offer crypto alternatives, but they still charge 0.5-1% plus network fees. Better than banks. Not revolutionary.

Enter the Social Impact Engine

Here's where Larecoin gets interesting.

The platform bakes social good directly into its infrastructure through what it calls the Social Impact Engine. Every transaction processed through LarePAY includes a 1.5% allocation toward global hunger initiatives.

Not as a separate donation. Not as an optional add-on. Built into the protocol itself.

This means every payment becomes a micro-donation without additional effort. Buy coffee with LARE tokens? 1.5% fights food insecurity. Pay for web hosting? Same thing. The system automates generosity.

Compare that to traditional platforms where charitable giving is a separate, friction-filled process requiring additional transactions and fees.

Fee Destruction: The 50% Savings Reality

Let's talk numbers.

Traditional cross-border payment for a $1,000 donation:

Payment processing: $29 (2.9%)

Currency conversion: $35 (3.5%)

Wire transfer: $45

Total cost: $109 (10.9%)

Larecoin LarePAY for the same donation:

Network fees: $4.20 (0.42% on LareBlocks Layer 1)

Social Impact allocation: $15 (1.5% - but this GOES to charity)

Total cost: $4.20 (0.42%)

That's a 96% reduction in dead-weight fees. The 1.5% Social Impact allocation isn't lost: it's redirected to global causes through partnerships with organizations like ChildFund.

Even Bitcoin: at $0.72 average per transaction: gets expensive for small donations. Ethereum? Gas fees can exceed the donation itself during network congestion.

LareBlocks Layer 1 infrastructure processes transactions with minimal overhead. No physical bank branches. No legacy systems. Just code executing at the speed of consensus.

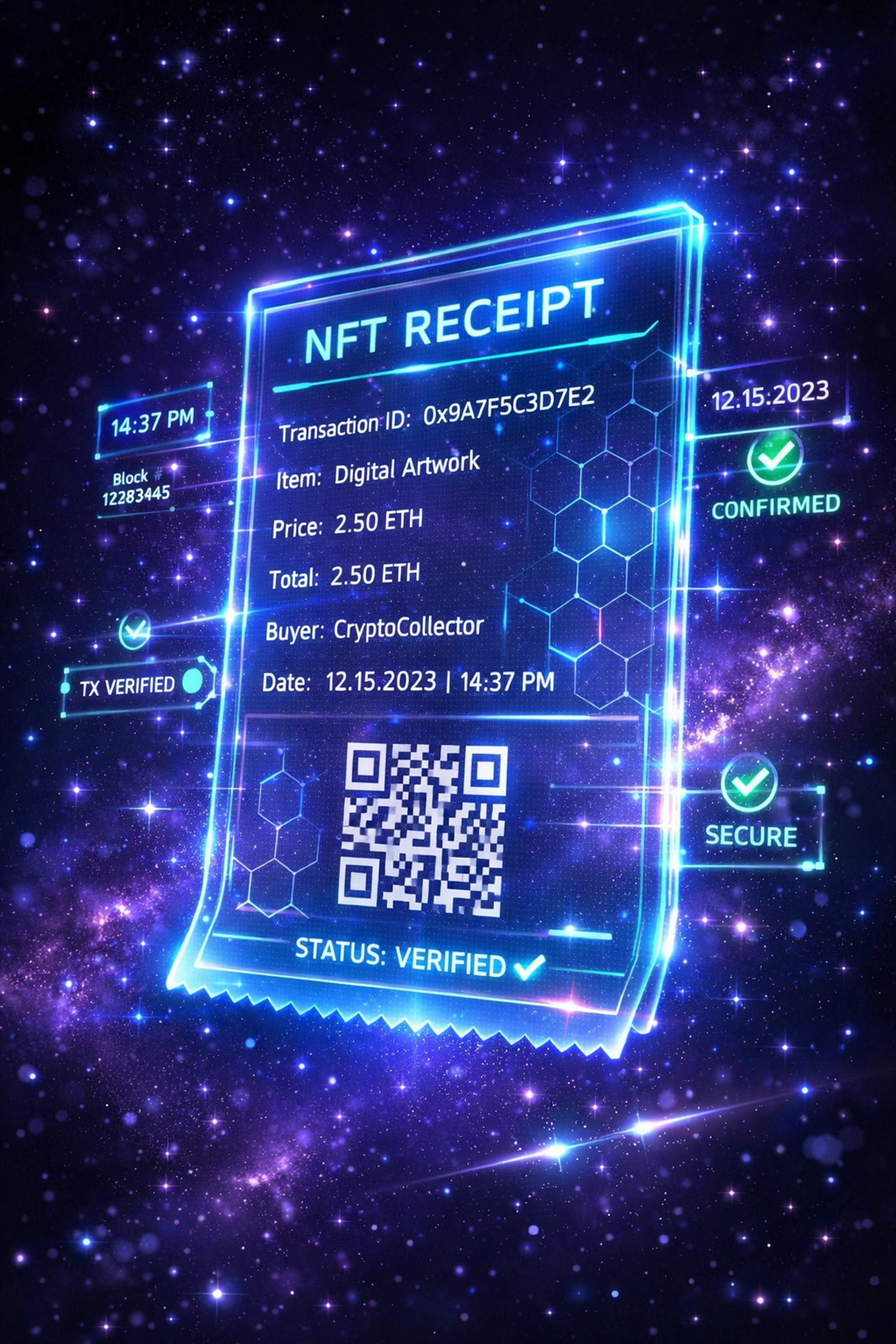

NFT Receipts: Transparency You Can Verify

Here's a pain point nobody talks about: tax documentation for charitable giving.

Try getting a proper receipt from a wire transfer to an international nonprofit. Good luck. You'll spend hours reconstructing transactions from bank statements for your accountant.

Larecoin mints NFT receipts for every transaction.

These aren't just pretty tokens. They're immutable, time-stamped proof of:

Transaction amount

Recipient organization

Date and time

Social Impact allocation breakdown

USD equivalent value (via LUSD stablecoin peg)

Your accountant opens LareScan (Larecoin's blockchain explorer), verifies the transaction in seconds, and you've got documentation that satisfies even the strictest tax authorities.

No more shoebox of paper receipts. No more "the email must be in my spam folder somewhere." Just verifiable, on-chain records that can't be disputed.

LUSD: The Stablecoin Advantage

Volatility kills charitable planning.

A nonprofit budgets for a $10,000 project. Accepts Bitcoin. Three days later, BTC drops 15%. Now they're $1,500 short before even starting.

LUSD (Larecoin's stablecoin) solves this by maintaining a 1:1 peg with the US dollar.

Donors can contribute in LARE tokens (if they want potential appreciation) or LUSD (if they want price stability). Nonprofits can hold LUSD without worrying about market swings destroying their operational budgets.

The flexibility matters. A refugee aid organization needs predictable funding to plan food supplies six months out. Crypto volatility makes that impossible. LUSD makes it practical.

Micropayments That Actually Work

Web3 unlocks donation models that traditional finance can't touch.

Imagine supporting a clean water project with $0.25 per day. That's $91.25 annually: meaningful impact.

Try processing that through Visa. Each transaction costs $0.30 in fees. You'd lose money donating.

Larecoin's gas-only transfer model makes micropayments economically viable. Contributing $5 per month to multiple causes? The fee stays negligible regardless of transaction count.

This opens up:

Subscription-based giving at any amount

Crowdfunding for micro-projects ($100-$500 goals)

Real-time impact tracking as small contributions aggregate

A teacher in rural India needs $200 for classroom supplies. Instead of waiting months to hit a funding threshold, they receive micropayments daily until the goal is reached. Then they spend it. The same day.

Master/Sub-Wallets for Organizations

Large nonprofits have complex financial structures.

Programs in 15 countries. Each needs spending authority. All require oversight. Traditional banking makes this a compliance nightmare with dozens of separate accounts and reconciliation headaches.

Larecoin's Master/Sub-wallet architecture gives organizations:

Centralized treasury control (Master wallet)

Delegated spending authority (Sub-wallets for regional offices)

Real-time visibility across all accounts

Programmable spending limits and approval workflows

A humanitarian organization receives a $100K grant. They allocate budgets to country offices via sub-wallets. Each office spends independently within their limit. Headquarters sees every transaction in real-time through LareScan.

No monthly bank statements. No reconciliation delays. Just instant, transparent fund management.

How Larecoin Stacks Against Competitors

Let's be direct about the landscape.

NOWPayments offers crypto payment processing with 0.5% fees. Solid. But no built-in social impact. No stablecoin solution. No enterprise wallet management.

CoinPayments charges 0.5% plus network fees. Supports 2,000+ coins. Impressive range. But that complexity creates confusion. And still no integrated charitable giving.

Larecoin combines:

Lower fees (0.42% on LareBlocks)

Automatic social impact (1.5% allocation)

LUSD price stability

NFT receipt documentation

Master/Sub-wallet management

Push-to-Card for easy offramping

It's not about having the most coins. It's about having the smartest infrastructure for real-world use cases.

The Unbanked Advantage

1.7 billion adults globally lack bank accounts.

They're not excluded from charity. They're excluded from receiving charity efficiently.

Traditional aid requires bank accounts to receive funds. So organizations distribute physical cash or gift cards with massive logistical overhead.

Web3 payments need only internet access. A farmer in rural Philippines with a smartphone can receive direct aid via Larecoin without ever touching a bank.

This isn't theoretical. Remittance payments via crypto already serve millions who traditional finance ignores. Charitable giving follows the same rails.

Gift Card Onboarding: The Bridge to Web3

"But nobody I know uses crypto."

Fair point. Which is why Larecoin's Gift Card onboarding matters.

You want to donate but don't want to navigate exchanges, wallets, and seed phrases? Buy a Larecoin gift card with your credit card. Redeem it. Now you've got LARE or LUSD without ever touching a crypto exchange.

The onramp friction disappears. Your tech-averse aunt can support global causes via Web3 without understanding what a blockchain is.

Real-World Scenario

Global Hunger Foundation runs feeding programs in 12 countries. Current setup:

Monthly budget: $500K

International wire fees: $4,200

Currency conversion losses: $9,500

Administrative overhead (reconciliation, documentation): $8,000

Monthly friction cost: $21,700

Switch to Larecoin:

Same budget: $500K

Network fees: $2,100 (0.42%)

Social Impact allocation: $7,500 (goes to charity: not lost)

Administrative overhead: $1,000 (automated via smart contracts)

Monthly friction cost: $3,100

Savings: $18,600 per month. $223,200 annually.

That's not rounding error. That's 44 full-time field workers in developing countries. Or 446,400 meals at $0.50 per meal.

The math isn't subtle.

What This Actually Means

Web3 payments aren't just faster or cheaper. They're structurally different.

When 10% of every donation gets consumed by intermediaries, you need systemic change. Not better banks. Different infrastructure.

Larecoin proves that infrastructure can be:

Efficient (sub-1% fees)

Transparent (NFT receipts, blockchain verification)

Stable (LUSD for predictable budgeting)

Socially aware (1.5% Social Impact allocation)

The charitable sector is a $500B+ annual industry. If Web3 can save even 5% in friction costs, that's $25 billion redirected to actual impact.

Stop accepting that donations must be expensive. Stop tolerating opacity in how funds move. Stop waiting 3-7 days for cross-border transfers.

The technology exists today. The infrastructure is live. The only question is how long legacy systems maintain their grip on generosity.

Your move.

Ready to explore how Web3 payments transform global giving? Check out the Larecoin ecosystem and see the infrastructure in action.

Comments