NOWPayments vs CoinPayments vs Larecoin: Which Crypto POS System Slashes Your Merchant Fees by 50%+?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

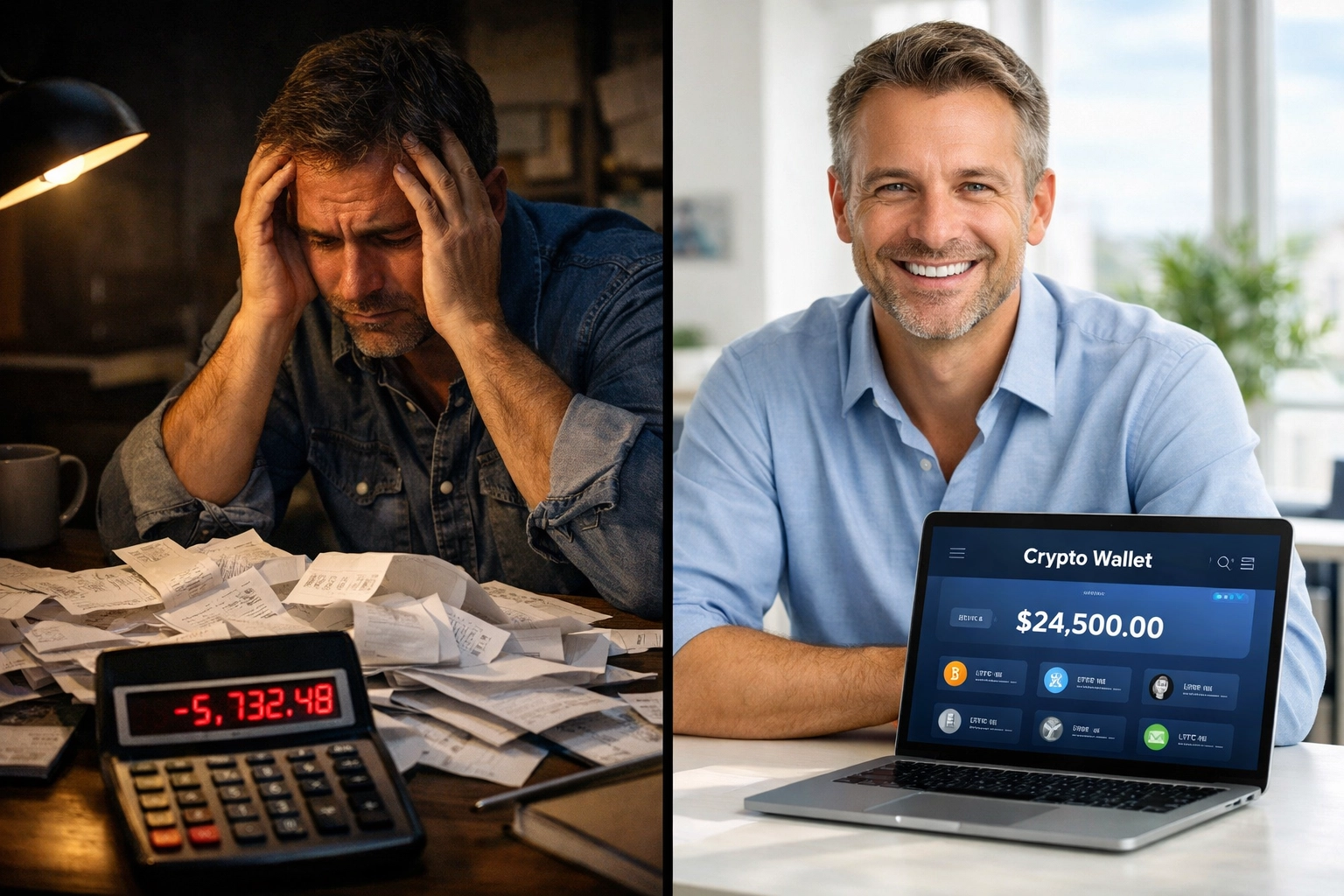

Merchant Fees Are Killing Your Margins

Every transaction costs you money. NOWPayments charges you. CoinPayments charges you. Traditional payment processors absolutely destroy you.

What if there was a better way?

Welcome to the crypto POS system showdown. We're putting NOWPayments, CoinPayments, and Larecoin head-to-head to find out which platform actually saves you money.

Spoiler: One of them slashes fees by 50-80%.

The Quick Breakdown

NOWPayments: 0.5-1% per transaction + network fees + withdrawal fees + conversion charges.

CoinPayments: 0.5-1% per transaction + blockchain fees + withdrawal penalties + conversion costs.

Larecoin: 0% platform fees. Just Solana gas costs (pennies per transaction).

That's the difference between paying thousands in fees versus almost nothing.

Let's break down the numbers.

Fee Structure Reality Check

Traditional crypto payment processors operate like mini-banks. They take a cut of every transaction. Then charge you again for withdrawals. Then hit you with conversion fees. Then add network costs on top.

Death by a thousand cuts.

NOWPayments Fee Model:

0.5% for single-currency transactions

1% for multi-currency payments

Network fees (varies by blockchain)

Withdrawal fees (2-5% depending on crypto)

Currency conversion charges

Settlement delays

CoinPayments Fee Model:

0.5% base transaction fee

Additional blockchain fees

Withdrawal penalties

Conversion costs between cryptos

Settlement fees

Higher rates for instant settlements

Larecoin Fee Model:

0% platform fees

Solana gas costs only ($0.00025 average)

No withdrawal fees

No conversion penalties

Instant settlement

Self-custody = your money stays yours

The math is brutal for traditional platforms.

Real-World Cost Examples That'll Make You Switch

Let's talk real numbers. Not theoretical savings: actual dollar amounts leaving your business.

$500,000 Annual Processing Volume:

NOWPayments/CoinPayments cost: $2,500-$5,000 in platform fees alone. Add network fees, withdrawal costs, conversion charges? You're looking at $3,000-$6,500 total.

Larecoin cost: Under $2,000 total. Just gas fees.

Savings: $1,500-$4,500 annually (50-60% reduction).

$1 Million Annual Processing Volume:

NOWPayments/CoinPayments cost: $5,000-$10,000 in platform fees. Total with all extras? $7,000-$12,000.

Larecoin cost: Under $2,000 total.

Savings: $5,000-$10,000 annually (67-83% reduction).

$5 Million Annual Processing Volume:

NOWPayments/CoinPayments cost: ~$25,000 in platform fees. Total costs easily hit $30,000-$35,000.

Larecoin cost: ~$5,000 total.

Savings: $25,000-$30,000 annually (80%+ reduction).

Scale matters. The more you process, the more you save with Larecoin.

Beyond Fees: Technical Advantages That Actually Matter

Merchant fees are just the beginning. Larecoin brings Web3 innovation that competitors can't match.

NFT Receipts for Accounting

Every transaction generates an NFT receipt. Immutable proof of payment. Perfect for accounting, audits, and compliance.

NOWPayments? Standard digital receipts that can be modified.

CoinPayments? Basic transaction records.

Larecoin? Blockchain-verified NFT receipts that make your accountant happy and auditors ecstatic.

LUSD Stablecoin Benefits

Volatility kills crypto payments. Bitcoin drops 10% during checkout? Your customer just overpaid or underpaid.

Larecoin integrates LUSD: a decentralized stablecoin pegged to USD. No volatility. No surprises. No chargebacks from price fluctuations.

NOWPayments and CoinPayments offer stablecoin support, but they're not built around stability-first transactions.

Self-Custody Merchant Accounts

Here's the big one: Self-custody.

NOWPayments and CoinPayments hold your funds. They control your money until withdrawal. They can freeze accounts. They have terms of service that give them power over your business.

Larecoin? Non-custodial from day one. Payments go directly to YOUR wallet. No intermediary. No seizures. No "account under review" nightmares.

True financial sovereignty.

Receivables Token Innovation

Larecoin's receivables token system lets you tokenize incoming payments. Create liquidity from accounts receivable. Trade them. Use them as collateral.

Try doing that with NOWPayments or CoinPayments.

The Global Reach Advantage

Operating internationally? Payment processors love charging you extra for cross-border transactions.

NOWPayments: Supports 150+ cryptocurrencies but charges conversion fees between them. International settlements take 1-3 days.

CoinPayments: Similar multi-currency support with similar conversion penalties. Settlement delays still exist.

Larecoin: Built on Solana for instant global transactions. No borders. No conversion fees between supported tokens. Settlement in seconds, not days.

Your customer in Tokyo pays the same gas fee as your customer in Toronto. True Web3 global payments.

The Small Business Reality

Small businesses get crushed by merchant fees. Every percentage point matters when margins are tight.

Traditional card processors charge 2-3%. Crypto processors like NOWPayments and CoinPayments charge 0.5-1% plus extras. Still significant for small operations.

Larecoin's gas-only model means a $100 transaction costs you $0.00025 in fees.

That's it. No percentage cuts. No withdrawal penalties. No minimum volume requirements.

A crypto POS system for small business that actually makes financial sense.

Why Merchants Are Making the Switch

The migration is happening. Merchants are leaving traditional crypto payment processors for Larecoin.

Why?

Lower costs. 50-80% fee reduction.

Better tech. NFT receipts, self-custody, receivables tokens.

True ownership. Your funds, your wallet, your control.

No bank dependence. Bank-free business operations are finally viable.

Faster settlements. Seconds instead of days.

Global by default. No international transaction fees.

The value proposition is clear. Traditional crypto processors evolved from legacy payment systems: they still operate like banks.

Larecoin was built Web3-native from the ground up. No legacy baggage. No custodial overhead. No percentage-based fee structures designed to maximize platform revenue.

The Competitive Landscape Shift

NOWPayments and CoinPayments dominated early crypto payments because they were first. They built solid platforms with multi-currency support and merchant tools.

But they're stuck with outdated fee models. Custodial architectures. Traditional business structures that require percentage-based revenue.

Larecoin represents the next generation. Decentralized infrastructure means lower costs. Self-custody means true ownership. Solana blockchain means speed and scale.

The question isn't whether to accept crypto payments. The question is which platform keeps more money in your pocket.

Making the Decision

Compare your current costs. Calculate what you're paying in merchant fees annually.

If you're processing $500K+, you're probably leaving $5K-$10K on the table every year with traditional crypto processors.

If you're processing $1M+, that's $10K-$20K in unnecessary fees.

If you're processing $5M+, you're looking at $30K+ wasted annually.

Reduce merchant interchange fees with a platform designed for maximum efficiency.

The Bottom Line

NOWPayments works. CoinPayments works. Both are established players with proven track records.

But both charge percentage-based fees that scale with your success. The more you earn, the more they take.

Larecoin flips that model. Fixed, minimal costs regardless of volume. The more you process, the better your effective rate becomes.

Add NFT receipts for bulletproof accounting. Self-custody for financial sovereignty. LUSD integration for stability. Receivables tokens for liquidity.

The choice is clear.

Visit Larecoin and calculate your savings. Run the numbers on your actual transaction volume.

Then decide if you want to keep funding your payment processor's margins or keep that money in your business.

Web3 global payments aren't the future. They're available right now. The only question is when you'll make the switch.

Comments