NOWPayments vs CoinPayments vs Larecoin: Which Self-Custody Solution Actually Cuts Your Interchange Fees in Half?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 1 hour ago

- 3 min read

Your interchange fees are bleeding you dry.

Traditional payment processors eat 2-3% of every transaction. That's $30,000 gone on a million-dollar revenue year. Crypto payment gateways promise relief. But do they deliver?

Let's cut through the marketing noise.

The Self-Custody Reality Nobody Talks About

Here's the problem: Most "crypto payment solutions" aren't actually self-custody.

NOWPayments and CoinPayments both operate on custodial models. Translation? They hold your funds. You're trusting a third party with your money. Again.

That's Web2 wearing a Web3 mask.

Larecoin flips this completely. True self-custody means you control your private keys. Your funds stay in your wallet. Always.

No intermediary. No counterparty risk. Just pure financial sovereignty.

Fee Structures: Where the Real Savings Live

Let's talk numbers.

NOWPayments charges:

0.5% for single-currency transactions

1% for multi-currency swaps

No payout fees (but you're still paying that percentage)

CoinPayments runs similar:

0.5-1% depending on cryptocurrency

Variable processing speeds

Network fees on top of their cut

Larecoin operates differently:

Gas-only fee model

Zero percentage-based charges

You pay network fees. That's it.

Here's what that means in real dollars:

Annual Volume | Traditional Processor | NOWPayments/CoinPayments | Larecoin |

$500,000 | ~$15,000 | ~$5,000 | Under $2,000 |

$1,000,000 | ~$30,000 | ~$10,000 | Under $4,000 |

$5,000,000 | ~$150,000 | ~$50,000 | Under $20,000 |

That's not a 50% reduction. That's 60-80% savings at scale.

Why Self-Custody Changes Everything for Merchants

Custodial solutions create bottlenecks.

Want to withdraw funds? Wait for processing. Need liquidity? Request access to your own money. Platform decides to freeze accounts? You're stuck.

Self-custody eliminates these failure points.

With Larecoin:

Instant access to your funds 24/7

No withdrawal limits or approval processes

Complete control over your treasury

Zero platform risk

This isn't just about fees. It's about operational freedom.

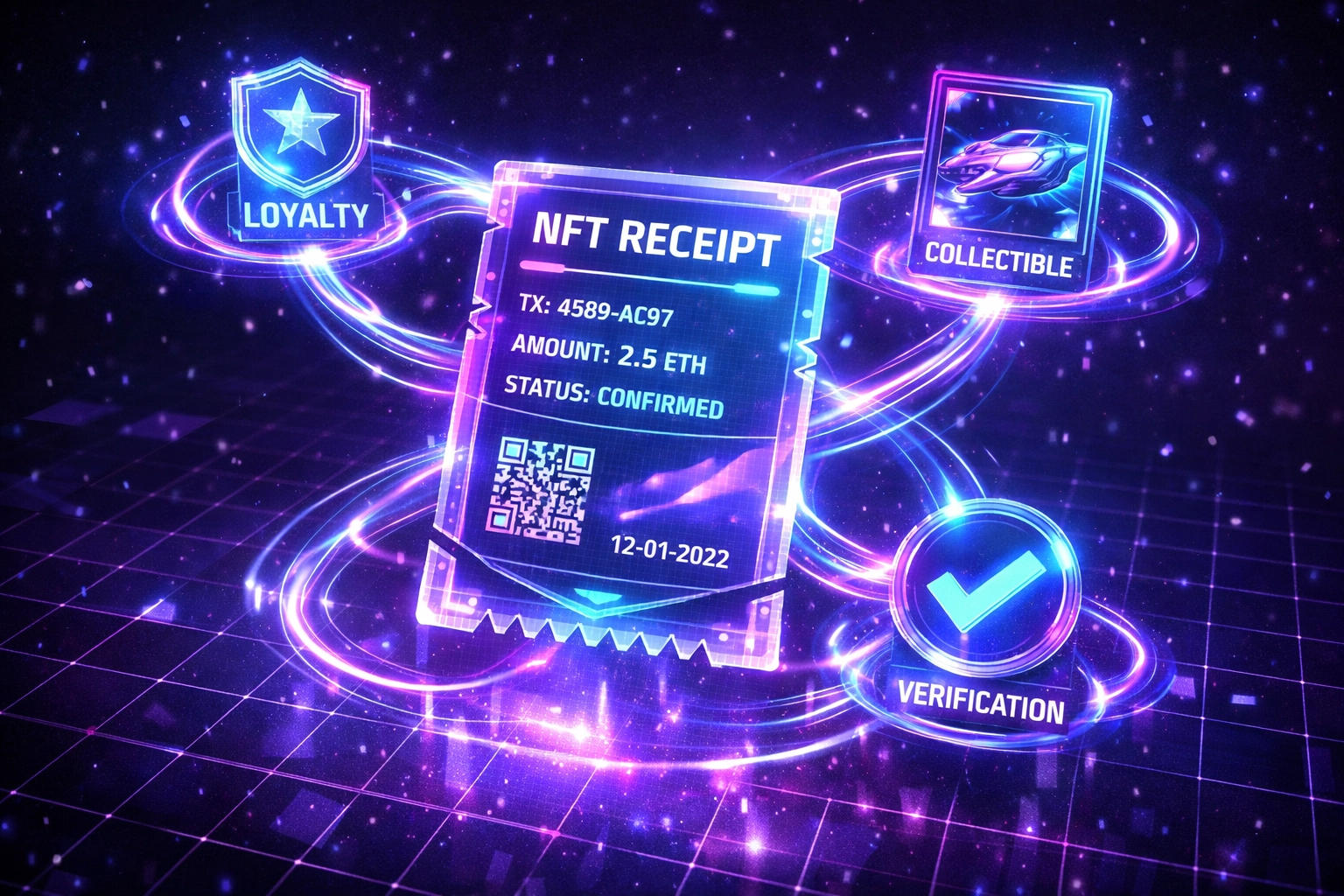

The NFT Receipt Advantage Most Platforms Miss

Here's where it gets interesting.

Traditional receipts? Paper trash or inbox clutter. Digital receipts from other platforms? Basic transaction logs.

Larecoin issues NFT receipts.

Each transaction creates a unique, verifiable token. Why does this matter?

For merchants:

Immutable proof of sale

Automated accounting integration

Customer loyalty program integration

Dispute resolution made simple

For customers:

Verifiable proof of purchase

Resale value for limited edition purchases

Collectible transaction history

Web3-native experience

Think about it. Every transaction becomes a programmable asset. Build loyalty programs around receipt NFTs. Create exclusive offers for customers holding specific transaction tokens. The possibilities stack.

LUSD: The Stablecoin You Actually Want to Hold

Not all stablecoins are created equal.

USDT has regulatory questions. USDC can freeze funds. Most stablecoins are custodial nightmares wrapped in blockchain tech.

LUSD (Liquity USD) is different:

Fully decentralized

Over-collateralized with ETH

No central authority

Algorithmically maintained peg

Larecoin integrates LUSD natively. This means:

Stable pricing without centralization risk

No freeze functions or blacklisting

Predictable accounting for merchants

True DeFi integration

When you accept payments in LUSD through Larecoin, you're holding a genuinely decentralized asset. Not someone's IOU.

Breaking Down Real Merchant Scenarios

Scenario 1: Small E-commerce Store

Revenue: $500,000 annually

Traditional processor cost: $15,000

NOWPayments cost: $5,000

Larecoin cost: Under $2,000

Savings: $13,000 annually

That's hiring a part-time employee. Or reinvesting in inventory. Or pure profit.

Scenario 2: Growing SaaS Business

Revenue: $2,000,000 annually

Traditional processor cost: $60,000

CoinPayments cost: $20,000

Larecoin cost: Under $8,000

Savings: $52,000 annually

That's a marketing budget. A developer salary. Serious growth capital.

Scenario 3: Enterprise Merchant

Revenue: $10,000,000 annually

Traditional processor cost: $300,000

Crypto gateway cost: $100,000

Larecoin cost: Under $40,000

Savings: $260,000 annually

That's game-changing money.

The Migration Math

Switching payment processors feels risky. Let's make it simple.

What you're leaving behind:

Percentage-based fee bleeding

Custodial control loss

Platform dependency

Centralization risk

What you're gaining:

Gas-only fee model

Complete fund control

True financial sovereignty

Web3-native infrastructure

Integration time? Most merchants go live in under 48 hours.

Why Competitors Can't Match This Model

NOWPayments and CoinPayments built their businesses on the traditional payment processor model. Take a percentage. Custody funds. Operate as middlemen.

That model worked in Web2. It doesn't belong in Web3.

Larecoin started with a different question: What if merchants actually owned their payment infrastructure?

The answer required:

Self-custody architecture from day one

Gas-only fee structures

NFT receipt innovation

True decentralized stablecoin integration

You can't retrofit these features onto custodial platforms. The foundation is different.

Making the Switch

Here's your decision framework:

Stick with custodial solutions if:

You prefer someone else managing your funds

Percentage fees don't bother you

Centralization risk feels acceptable

You're okay with withdrawal limitations

Switch to Larecoin if:

You want actual self-custody

Cutting fees by 60-80% matters

Financial sovereignty is non-negotiable

You're building for Web3's future

The math speaks clearly. The architecture speaks clearly.

Your interchange fees can actually get cut in half: and then some.

Time to stop paying gatekeepers for permission to access your own money. Visit Larecoin and see the difference self-custody makes.

The future of merchant payments isn't custodial. It's sovereign.

Comments