The Small Business Owner's Guide to Crypto POS Systems at 50% Lower Fees

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Running a small business is tough. Margins are razor-thin. Every percentage point matters.

Credit card processors take 2.5% to 3.5% per transaction. That's money straight out of your pocket. Month after month. Year after year.

What if you could slash those fees in half?

Crypto POS systems make it possible. And Larecoin's ecosystem takes it even further.

This guide breaks down everything you need to know about accepting crypto payments, reducing fees, and keeping full control of your funds.

Why Traditional Payment Processing Is Bleeding Your Business Dry

Let's talk numbers.

Average credit card processing fee: 2.9% + $0.30 per transaction

Monthly sales of $50,000? That's roughly $1,750 going to payment processors. Every single month.

Annually? Over $21,000 vanishes into fees.

Now imagine keeping half of that.

Crypto POS systems typically charge between 0.5% and 1%. Some ecosystems: like Larecoin: push those savings even further with direct merchant-to-customer transactions.

No middlemen. No excessive cuts. Just simple, borderless payments.

How Crypto POS Systems Actually Work

Forget complicated setups. Modern crypto payment systems are surprisingly straightforward.

Here's the flow:

Customer selects crypto at checkout

POS generates a QR code or payment link

Customer scans with their wallet

Transaction confirms on the blockchain

Funds hit your wallet: instantly

No waiting 3-5 business days. No chargebacks. No disputes from fraudulent claims.

Setup time? Less than an hour for most systems. No external bank gateway required.

Small businesses everywhere are already doing this. Coffee shops accepting Bitcoin. Boutique stores taking stablecoins. Food trucks running mobile crypto payments.

The barrier to entry has never been lower.

Larecoin vs. NOWPayments vs. CoinPayments: The Real Comparison

Not all crypto payment processors are created equal. Let's break down the major players.

NOWPayments

Fees: 0.5% per transaction

Supports 200+ cryptocurrencies

Auto-conversion to fiat available

Custodial model: they hold your funds

CoinPayments

Fees: 0.5% to 1% depending on the coin

Supports 2,000+ cryptocurrencies

Multi-coin wallet included

Custodial: funds pass through their system

Larecoin Ecosystem

Fees: Drastically reduced through direct transactions

LUSD stablecoin eliminates volatility

Self-custody: you control your keys

NFT receipts for every transaction

No intermediary holding your funds

See the difference?

With NOWPayments and CoinPayments, your money passes through their custody. You're trusting a third party with your revenue.

Larecoin flips the script. Self-custody means your funds go directly to your wallet. Period.

That's merchant freedom in its purest form.

The LUSD Advantage: Stability Without Sacrifice

Volatility scares merchants away from crypto. Understandable.

You accept $100 in Bitcoin today. Tomorrow it's worth $85. That's a problem.

LUSD solves this.

Larecoin's stablecoin maintains a consistent value, giving you the benefits of crypto payments without the price swings.

Accept payments in LUSD. Hold in LUSD. Convert when you want: on your terms.

Your revenue stays predictable. Your accounting stays simple. Your stress levels stay manageable.

Stablecoins are the bridge between traditional finance and decentralized payments. LUSD is built specifically for merchants who want that stability.

NFT Receipts: More Than Just a Gimmick

Every Larecoin transaction can generate an NFT receipt.

Why does this matter?

Proof of purchase that can't be faked. Traditional receipts get lost, damaged, or fabricated. NFT receipts live on the blockchain forever.

Customer loyalty integration. Link receipts to rewards programs. Track purchase history. Build genuine relationships with repeat buyers.

Dispute resolution simplified. Clear, immutable proof of every transaction. No he-said-she-said scenarios.

Brand differentiation. Your customers get something unique. Something they can actually own. That's memorable.

NFT receipts aren't just tech for tech's sake. They're practical tools that solve real merchant problems.

Self-Custody: Your Money, Your Control

Here's where Larecoin fundamentally differs from competitors.

Custodial solutions (like NOWPayments and CoinPayments) mean:

A third party holds your funds

You request withdrawals

They can freeze accounts

You depend on their uptime and security

Self-custody with Larecoin means:

Funds go directly to your wallet

Instant access: no withdrawal requests

No account freezes possible

Your security, your responsibility

For small business owners who've dealt with payment processor holds, frozen funds, or unexpected account terminations: self-custody is liberation.

Your revenue belongs to you. Not some corporate intermediary.

Getting Started: The Practical Steps

Ready to cut your payment processing fees in half? Here's your roadmap.

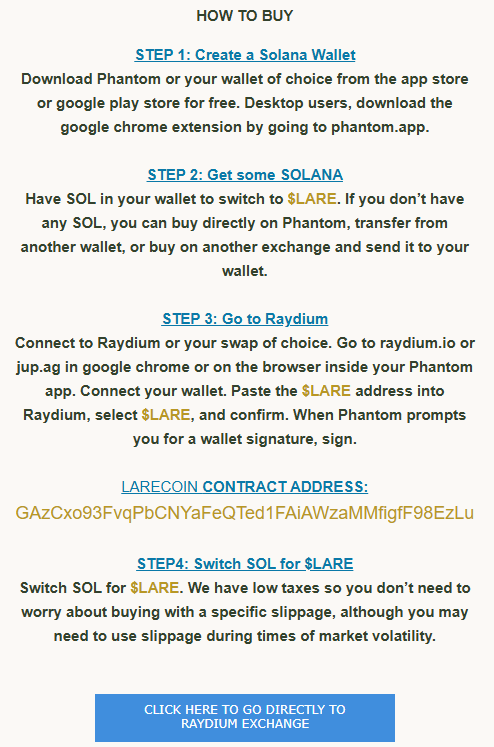

Step 1: Set Up Your Wallet

You need a non-custodial wallet that supports the Larecoin ecosystem. Solana-compatible wallets work perfectly.

Step 2: Acquire LUSD or LARE

Head to Larecoin's crypto page to get started with the ecosystem. Swap SOL for LARE through Raydium or acquire LUSD for stable transactions.

Step 3: Configure Your POS

Integrate Larecoin payments into your existing checkout flow. QR code generation takes seconds. Your customers scan and pay.

Step 4: Start Accepting Payments

Display "Crypto Accepted Here" signage. Train your staff on the simple process. Watch the fees drop.

Step 5: Track and Optimize

Monitor your transactions. Compare your processing costs month-over-month. See the difference in your bottom line.

Real-World Use Cases

Coffee Shop in Austin

Accepts Bitcoin and LUSD via mobile POS. Reduced payment processing costs by 52% in the first quarter. Attracts crypto-native customers who specifically seek out crypto-friendly businesses.

Online Boutique

Integrated Larecoin checkout alongside traditional payment options. NFT receipts became a marketing tool: customers share their unique receipts on social media.

Food Truck Operator

Mobile setup. No external bank gateway. Accepts payments even at festivals with spotty cell coverage (offline transaction signing).

These aren't hypotheticals. This is happening now.

The Bottom Line on Fees

Let's circle back to the math.

Provider | Typical Fee | Custody Model | Stablecoin Option |

Credit Cards | 2.9% + $0.30 | N/A | N/A |

NOWPayments | 0.5% | Custodial | Yes (third-party) |

CoinPayments | 0.5-1% | Custodial | Yes (third-party) |

Larecoin | Minimal/Gas | Self-Custody | LUSD (native) |

The savings are clear. The control is unmatched.

Your Move

Small business owners have been at the mercy of payment processors for decades. High fees. Held funds. Chargebacks.

Crypto POS systems offer an alternative. Larecoin's ecosystem offers something more: true merchant independence.

Lower fees. Self-custody. NFT receipts. Stablecoin stability.

The tools exist. The infrastructure is ready. The question is whether you're ready to take control.

Explore the Larecoin ecosystem today. Join the community of merchants building a different kind of payment future.

Your margins will thank you.

Comments