The Ultimate Guide to Receivables Tokens: Everything Merchants Need to Succeed with Web3 Global Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

Stop Waiting 90 Days for Your Money

Here's the deal. You ship products. You deliver services. Then you wait. And wait. And wait some more.

30 days. 60 days. Sometimes 90 days before that invoice gets paid.

Meanwhile your suppliers want payment now. Your employees need paychecks today. Your growth plans are stuck in accounts receivable limbo.

Receivables tokens change everything.

What Are Receivables Tokens Anyway?

Think of receivables tokens as digital receipts that actually work for you.

When you issue an invoice, that unpaid invoice becomes a tokenized asset on the blockchain. Instead of waiting months for payment, you sell fractional ownership of that receivable to investors who give you immediate cash.

Your $50,000 invoice? Split it into 50,000 tokens at $1 each. Investors buy those tokens. You get paid today. When your customer pays the invoice in 60 days, the blockchain automatically distributes funds to token holders.

Zero paperwork. Zero credit checks. Zero bank approval needed.

The Larecoin Advantage: 50% Fee Savings

Let's talk numbers.

Traditional payment processors and factoring companies charge 3-5% for similar services. For a merchant doing $1 million annually, that's $30,000 in fees. Every single year.

Larecoin's receivables token system cuts that in half. Same merchant pays roughly $12,000 annually. That's $18,000 back in your pocket.

Payment Method | Annual Fees ($1M Sales) | Settlement Time | Geographic Limits |

Legacy Processors | $20,000-$30,000 | 30-90 days | Bank partnerships required |

Larecoin Receivables | ~$10,000-$12,000 | Hours to same-day | Permissionless globally |

NOWPayments | $15,000-$25,000 | 24-72 hours | Limited regions |

CoinPayments | $18,000-$28,000 | 48-96 hours | Country restrictions |

The math is simple. Lower fees mean higher margins. Higher margins mean faster growth.

CLARITY Act: Why Digital Commodities Win

The CLARITY Act (H.R. 3633) designates cryptocurrencies like Larecoin as digital commodities, not securities.

What does that mean for merchants?

Regulatory clarity. You're not dealing with securities law every time you process a payment. No registration requirements. No complex compliance frameworks designed for Wall Street.

Tax efficiency. Digital commodities receive favorable tax treatment compared to traditional financial instruments. Your receivables tokens benefit from commodity taxation rules.

Global accessibility. Commodities trade freely across borders without triggering securities regulations in every jurisdiction. Your business operates the same way in Tokyo, Toronto, or Toronto.

Larecoin operates within this framework. Clear rules. Predictable outcomes. No regulatory ambiguity.

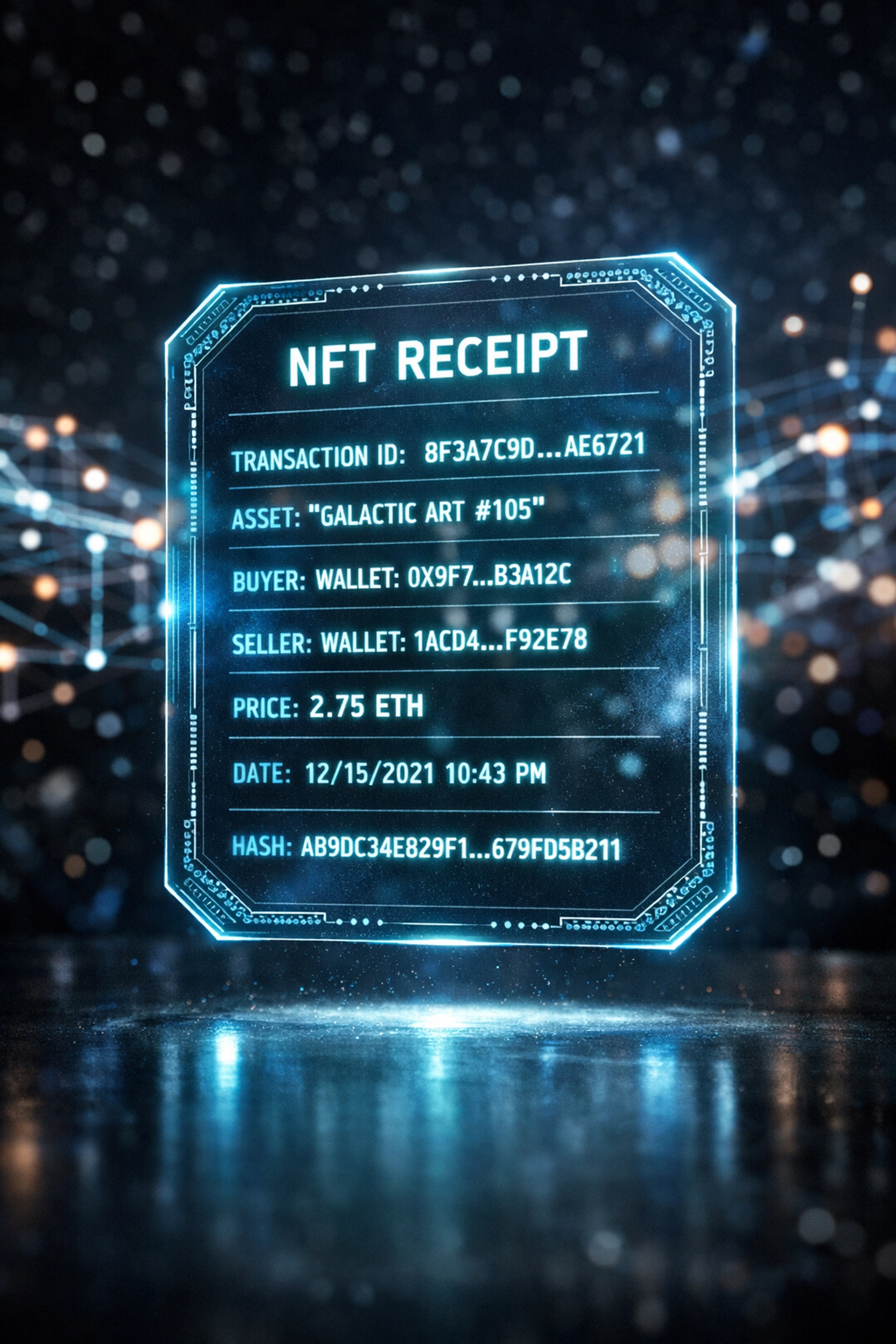

NFT Receipts: Proof That Actually Matters

Every transaction on Larecoin generates an NFT receipt.

Not a collectible. Not digital art. A verifiable proof of transaction that lives on LareBlocks Layer 1 blockchain forever.

Your customer disputes a charge? Pull up the NFT receipt. Timestamp, amount, wallet addresses, smart contract execution: all recorded immutably.

Chargebacks become obsolete. No more "he said, she said" arguments with payment processors. The blockchain proves what happened.

Tax season? Export all NFT receipts instantly. Your accountant gets complete transaction history without digging through emails and PDFs.

LUSD Stablecoin: Volatility Protection Built In

Crypto volatility scares merchants. Understandably.

That's why Larecoin integrates LUSD stablecoin throughout the ecosystem.

Accept payment in volatile crypto. Instantly convert to LUSD. Lock in dollar-equivalent value. No price risk.

When you tokenize receivables, investors can purchase tokens with LUSD. Settlement happens in LUSD. Your working capital stays stable.

Traditional crypto payment processors like NOWPayments and CoinPayments offer conversion services: but they add extra fees and settlement delays. Larecoin builds stablecoin functionality directly into the protocol. Native integration means faster execution and lower costs.

LareBlocks Layer 1: Your Security Fortress

Security matters when you're tokenizing business receivables.

Larecoin operates on LareBlocks, a dedicated Layer 1 blockchain designed specifically for payment infrastructure.

Self-custody control. You hold private keys. Your funds sit in your wallet. No intermediary can freeze accounts or deny transactions.

Smart contract escrow. When customers pay invoices, smart contracts automatically distribute funds to token holders. No manual processing. No delayed settlements. No "processing errors."

SHA-256 cryptographic hashing. Every invoice gets cryptographically hashed before tokenization. Any tampering breaks the hash. Fraud becomes mathematically impossible.

IPFS document storage. Original invoices and supporting documentation get stored on IPFS: decentralized, permanent, tamper-proof. Your business records outlive any single company or server.

Compare this to centralized processors that control your funds, can freeze accounts, and operate on legacy banking rails vulnerable to outages and restrictions.

AI-Powered Metaverse Shopping: The Next Frontier

Here's where it gets wild.

Larecoin integrates AI-powered shopping experiences directly into the metaverse. Merchants set up virtual storefronts. Customers browse using AI assistants. Transactions settle using receivables tokens.

Why does this matter for B2B merchants?

Virtual trade shows. Product demonstrations without shipping physical samples. Instant quote generation based on AI analysis of customer needs.

An automotive parts supplier showcases inventory in metaverse spaces. Buyers from different countries browse simultaneously. AI suggests complementary products. Orders generate receivables tokens instantly.

No legacy processor offers metaverse integration. NOWPayments and CoinPayments focus on traditional e-commerce. Larecoin builds for the next decade of commerce.

Technical Standards That Work

Larecoin's receivables tokens use ERC-3475 as the base standard combined with ERC-3643 for regulatory compliance.

What does that mean in practice?

ERC-3475 supports complex financial instruments like receivables. ERC-3643 enforces compliance rules through code: KYC requirements, jurisdiction restrictions, accredited investor rules: all automated.

You don't need lawyers reviewing every transaction. Smart contracts handle compliance automatically.

The technical architecture includes:

Asset registry encoding invoice data into blockchain

Event logging tracking token lifecycle stages

Automatic settlement executing payments on invoice due dates

Cross-chain bridging enabling transactions across multiple blockchains

Why Larecoin Beats the Competition

NOWPayments and CoinPayments offer crypto payment processing. But they're stuck in the old model: intermediaries controlling funds, delayed settlements, geographic restrictions.

Larecoin is different:

True self-custody. Your keys. Your funds. Period.

Receivables tokenization. Turn unpaid invoices into immediate working capital. Competitors don't offer this.

NFT receipt verification. Immutable proof of every transaction. No chargeback disputes.

Native stablecoin integration. LUSD built into the protocol, not bolted on.

Layer 1 blockchain. Purpose-built for payments, not general-purpose infrastructure.

Metaverse commerce ready. AI-powered shopping experiences competitors can't match.

The choice is clear. Legacy processors keep merchants waiting and paying high fees. Larecoin delivers immediate settlement at half the cost.

Getting Started Is Simple

Setting up Larecoin receivables tokens takes minutes, not months.

Create your Larecoin merchant account

Connect your existing invoicing system via API

Generate receivables tokens from unpaid invoices

Receive immediate capital from token investors

Let smart contracts handle settlement automatically

No credit checks. No loan applications. No bank partnerships required.

Your business operates globally from day one. Same process whether you're in Singapore, São Paulo, or Stockholm.

Check out the detailed merchant guide for step-by-step setup instructions.

The Future of Payment Infrastructure

Receivables tokenization isn't coming someday. It's here now.

Merchants who adopt early gain competitive advantages. Lower costs. Faster capital access. Global reach without gatekeepers.

Traditional payment rails can't compete with blockchain speed and efficiency. Legacy processors can't match 50% fee savings. Centralized platforms can't offer true self-custody.

Larecoin combines proven blockchain technology with merchant-focused features. Receivables tokens. NFT receipts. LUSD stability. LareBlocks security. Metaverse commerce.

Stop waiting 90 days for your money. Start tokenizing receivables today.

Ready to transform your payment infrastructure? Visit Larecoin and join the Web3 payments revolution.

Comments