Why the CLARITY Act Will Change the Way Merchants Accept Crypto Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 4 min read

Regulatory Clarity Just Arrived

The CLARITY Act (H.R. 3633) just rewrote the rules for crypto payments.

For the first time, merchants have a clear regulatory framework. No more gray zones. No more guessing which agency regulates what.

Digital commodities? CFTC jurisdiction. Securities? SEC territory.

This separation changes everything for payment processors like Larecoin.

Why Commodity Classification Matters for Merchants

Larecoin qualifies as a digital commodity under the CLARITY Act framework.

That means:

Clear regulatory oversight from CFTC

Reduced enforcement risk compared to undefined tokens

Standardized compliance requirements across platforms

Lower operational costs passed directly to merchants

Traditional payment processors operate under complex banking regulations. Credit cards involve multiple intermediaries: issuing banks, acquiring banks, card networks, payment gateways.

Each layer adds fees. Each layer adds compliance costs.

Digital commodity classification cuts through this mess. Direct peer-to-peer settlement. Minimal intermediaries. Transparent fee structures.

The 50% Fee Advantage

Legacy payment systems charge merchants 2.5% to 3.5% per transaction.

Larecoin? Under 1%.

That's not a typo. Merchants save approximately 50% on processing fees.

The math is simple:

$100,000 monthly revenue through traditional processors:

Processing fees: $2,500–$3,500

Annual cost: $30,000–$42,000

Same revenue through Larecoin:

Processing fees: $800–$1,000

Annual cost: $9,600–$12,000

Savings: $20,400–$30,000 per year

The CLARITY Act makes this sustainable. Regulatory clarity reduces compliance overhead. Lower overhead equals lower merchant fees.

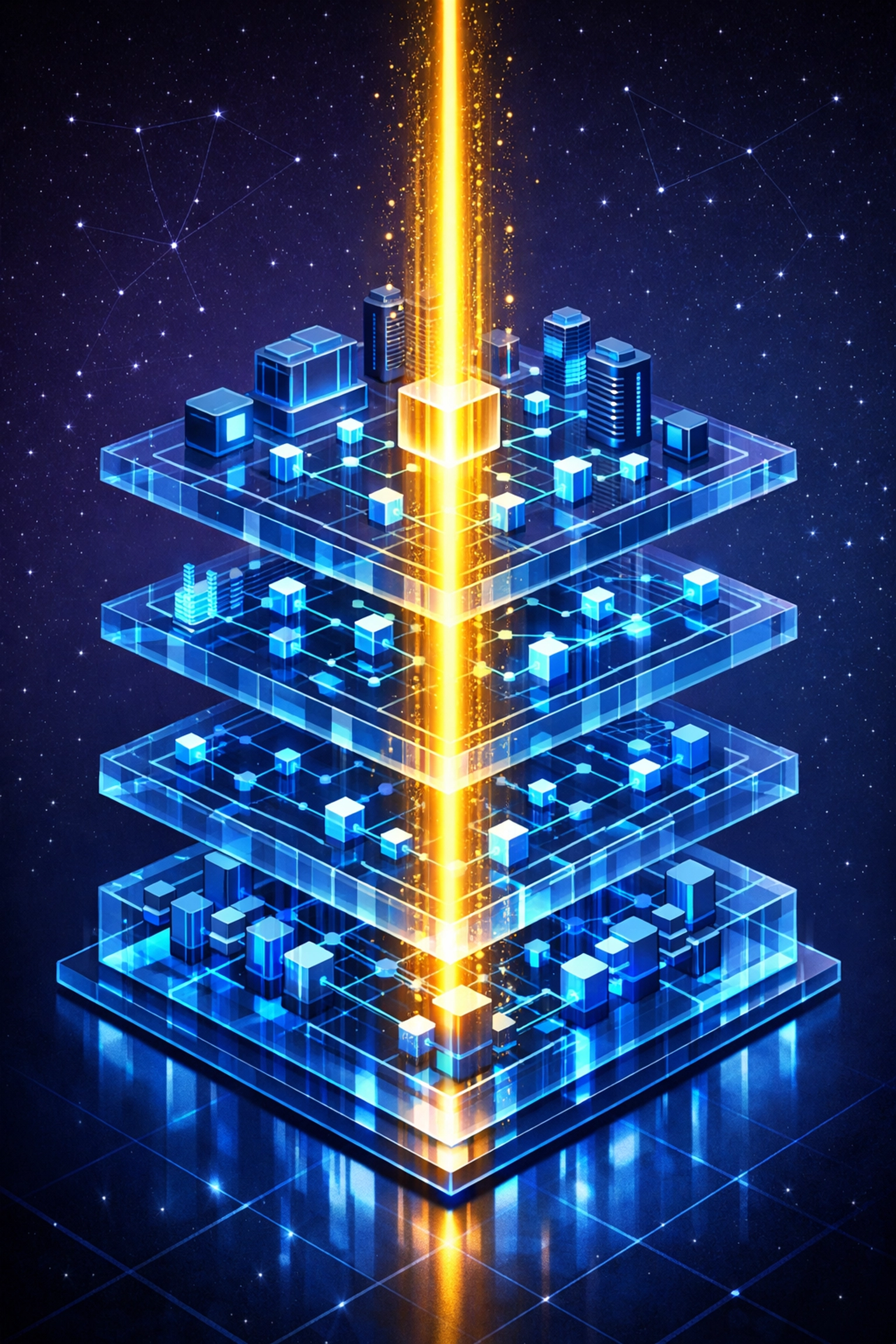

LareBlocks Layer 1: Infrastructure That Scales

The CLARITY Act's Digital Commodity Exchange (DCEX) registration framework demands robust infrastructure.

Larecoin built for this moment.

LareBlocks Layer 1 delivers:

Sub-second transaction finality

Self-custody security architecture

Gas-only transfer protocols

Cross-chain bridging capabilities

Traditional payment gateways like NOWPayments rely on multiple blockchain networks. Each network has different settlement times. Different security models. Different fee structures.

This creates friction.

LareBlocks eliminates friction. One unified Layer 1. Consistent performance. Predictable costs.

LUSD Stablecoin: Regulatory Compliance Built-In

The CLARITY Act includes specific provisions for stablecoins.

Larecoin's LUSD stablecoin was designed with these requirements in mind.

Key features:

1:1 USD peg maintained through transparent reserves

Compliant with emerging stablecoin regulations

No prohibited reward structures (per CLARITY Act restrictions)

Instant merchant settlement without volatility risk

Compare this to competitors:

NOWPayments: Relies on third-party stablecoins with varying compliance standards. No proprietary stable asset. Merchants exposed to multiple regulatory frameworks.

CoinPayments: Similar model. Accepts 2,000+ cryptocurrencies but lacks native stablecoin infrastructure. Conversion risks passed to merchants.

Larecoin's advantage: Native LUSD integration. Regulatory compliance baked into the protocol. Merchants get stability without complexity.

NFT Receipts: The Future of Transaction Records

The CLARITY Act's commodity classification opens new possibilities for transaction documentation.

Larecoin pioneered NFT receipt technology.

Every transaction generates a unique, immutable NFT receipt stored on LareBlocks.

Benefits for merchants:

Permanent, tamper-proof transaction records

Instant verification without intermediaries

Reduced chargeback fraud (blockchain-verified proof of purchase)

Enhanced customer loyalty programs through collectible receipts

Traditional payment processors generate PDF receipts. These can be altered, lost, or disputed.

NFT receipts exist permanently on-chain. Customers can verify authenticity instantly. Merchants eliminate documentation disputes.

This wasn't technically possible under previous regulatory ambiguity. The CLARITY Act's commodity framework legitimizes innovative use cases like NFT-based transaction records.

Self-Custody Changes Merchant Security

CLARITY Act compliance requires transparent custody solutions.

Larecoin supports full self-custody for merchant wallets.

What this means:

Merchants control their private keys

No third-party custody risk

Instant access to funds 24/7/365

No withdrawal limits or delays

Compare this to centralized alternatives:

NOWPayments and CoinPayments both use custodial wallet models. Merchants must trust the platform to hold funds. Withdrawal processing takes 24-48 hours minimum. Third-party risk exposure.

Under CLARITY Act compliance standards, self-custody becomes a competitive advantage. Merchants want control. Larecoin delivers.

AI-Powered Metaverse Shopping Integration

The CLARITY Act establishes digital commodities as legitimate payment rails.

This enables next-generation commerce experiences.

Larecoin's AI-powered metaverse shopping platform connects physical retail with virtual worlds.

How it works:

Customer shops in metaverse environment

AI assistant processes payment via LUSD

NFT receipt minted automatically

Physical goods ship to real-world address

This wasn't mainstream before regulatory clarity. Merchants hesitated to adopt crypto payments without clear legal framework.

CLARITY Act removes hesitation. Merchants now have confidence to experiment with Web3 commerce models.

Competitive Analysis: Why Larecoin Wins

Let's compare directly.

NOWPayments:

Supports 150+ cryptocurrencies

Custodial wallet model only

No proprietary Layer 1

Third-party stablecoin reliance

Average fees: 0.5% (plus network fees)

Settlement: 24-48 hours

CoinPayments:

Supports 2,000+ cryptocurrencies

Custodial wallets required

No native blockchain infrastructure

No proprietary stablecoin

Fees: 0.5% plus withdrawal fees

Settlement: Variable by network

Larecoin:

Focused digital commodity ecosystem

Self-custody options available

Native LareBlocks Layer 1

LUSD stablecoin integrated

Fees: Under 1% all-in

Settlement: Sub-second finality

The difference is infrastructure. NOWPayments and CoinPayments aggregate existing networks. Larecoin built purpose-designed architecture for merchant payments.

CLARITY Act compliance favors purpose-built solutions.

Liquidity Benefits Under New Framework

Digital commodity classification improves market liquidity.

CFTC-regulated exchanges now have clear authority to list qualified tokens. Institutional investors gain regulatory certainty. Trading volumes increase.

Higher liquidity means:

Tighter bid-ask spreads for merchants

More predictable conversion rates

Reduced slippage on large transactions

Better pricing for instant settlement

Merchants accepting Larecoin benefit from improved liquidity conditions across the entire ecosystem.

Implementation Timeline for Merchants

The CLARITY Act creates immediate opportunities.

Getting started takes minutes:

Set up self-custody wallet (3-minute process)

Integrate payment API (developer-friendly documentation)

Start accepting LUSD and LARE tokens

Receive NFT receipts automatically

No lengthy application process. No credit checks. No account approval delays.

Regulatory clarity enables frictionless onboarding.

The Bottom Line for Smart Merchants

The CLARITY Act established digital commodities as legitimate payment infrastructure.

Larecoin positioned to capitalize on this framework:

Commodity classification: Clear CFTC oversight

50% fee savings: Real cost reduction vs legacy systems

LUSD stablecoin: Regulatory-compliant stability

NFT receipts: Immutable transaction records

LareBlocks Layer 1: Purpose-built merchant infrastructure

Self-custody security: Merchants control their funds

Competitors like NOWPayments and CoinPayments still rely on aggregated networks and custodial models.

Larecoin built different.

The regulatory environment now rewards this approach.

Merchants who adopt early gain competitive advantage. Lower processing costs. Better customer experiences. Future-proof infrastructure.

Ready to Transform Your Payment Stack?

The CLARITY Act made crypto payments legitimate.

Larecoin makes them practical.

Explore the complete merchant guide to see detailed implementation strategies.

Join the 100-post marathon for weekly insights on Web3 payment optimization.

Start saving 50% on processing fees today.

The regulatory clarity you've been waiting for? It's here.

Comments