7 Reasons Your Current Crypto Payment Processor Is Costing You Thousands (And How Larecoin Fixes It)

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 4 hours ago

- 4 min read

Your payment processor is bleeding your business dry.

Every transaction. Every settlement. Every "convenience" fee.

The numbers don't lie. Merchants lose 2-5% per crypto transaction with legacy processors. That's thousands monthly for mid-size operations. Tens of thousands for enterprise.

Time to cut the fat.

Reason #1: Transaction Fees Are Eating Your Margins

Most processors charge 0.5-2% per transaction.

NOWPayments? 0.5% minimum. CoinGate? Up to 1%. CoinPayments? 0.5% plus withdrawal fees.

The math is brutal. A $10,000 monthly payment volume costs you $50-200 just in processor fees. Scale that to $100K monthly? You're hemorrhaging $500-2,000.

Larecoin's fix: Gas-only transfers. You pay blockchain network fees. Period. No middleman markup. No hidden processor cuts.

Real savings: 50-85% reduction in payment processing costs.

Reason #2: You Don't Own Your Funds (Seriously)

Custodial wallets dominate the crypto payment space.

Your processor holds your crypto. You request withdrawals. They approve. Eventually.

This isn't ownership. It's permission-based finance.

The risks:

Platform freezes during market volatility

Withdrawal delays (24-72 hours typical)

Counterparty risk if processor faces regulatory issues

Your funds locked during disputes

Larecoin's solution: True self-custody from payment to settlement. Your keys. Your crypto. Your control. Funds settle directly to your wallet, no intermediary holding period.

Financial sovereignty isn't a buzzword. It's your competitive edge.

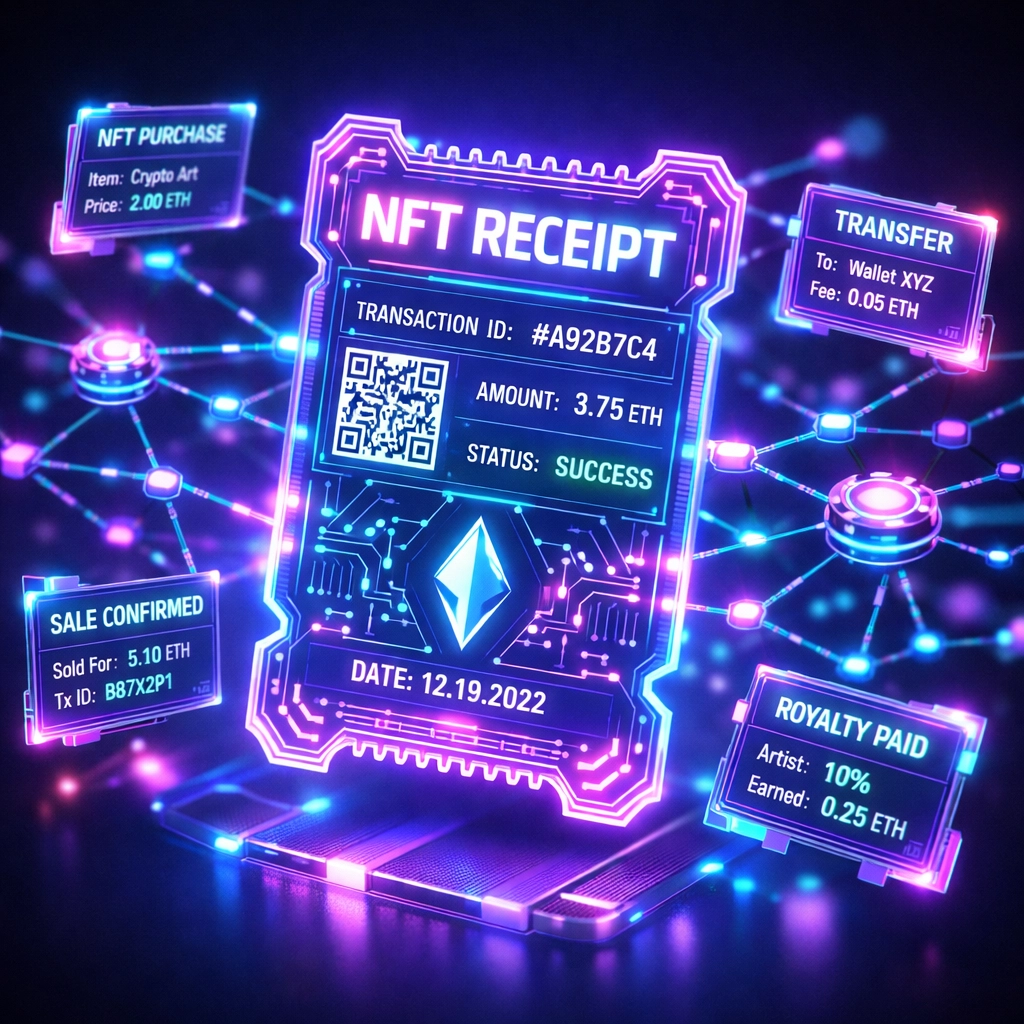

Reason #3: Zero Innovation on Transaction Receipts

Every payment needs a receipt.

Traditional processors send PDFs. Maybe an email confirmation. That's it.

No proof of authenticity. No programmable features. No resale value.

Larecoin flips the script: NFT receipts.

Every transaction generates an immutable, blockchain-verified NFT receipt. Benefits include:

Tamper-proof transaction records

Customer loyalty program integration

Collectible receipts for limited edition purchases

Secondary market potential for rare transaction NFTs

Automated warranty tracking via smart contracts

Transform receipts from throwaway documents into valuable digital assets. Your customers keep them. Trade them. Treasure them.

Reason #4: Stablecoin Selection Is Pathetic

Most processors offer USDT and USDC. Maybe DAI if you're lucky.

But LUSD? The decentralized, algorithmic stablecoin backed by ETH? Rarely supported.

Why LUSD matters for merchants:

LUSD operates without centralized control. No bank freezes. No regulatory seizure risk. Pure DeFi stability.

Unlike USDT (backed by Tether's reserves) or USDC (Circle's banking relationships), LUSD is:

Fully decentralized

Over-collateralized with ETH

Zero counterparty risk

Censorship-resistant

Larecoin supports LUSD natively. Accept payments in the most resilient stablecoin in crypto. Your treasury stays secure even when centralized stables face pressure.

Reason #5: Settlement Times Kill Cash Flow

Next-day settlement is standard. Some processors take 2-3 days.

That's capital sitting idle. Working capital you can't reinvest, can't use for inventory, can't deploy for growth.

The opportunity cost is massive.

Say you process $50K weekly. With 2-day settlement, you have $14,285 constantly locked in limbo. At 10% annual return (conservative for crypto deployment), that's $1,428 lost yearly just to waiting.

Larecoin delivers instant settlement. Payment confirmed? Funds in your wallet. No holding periods. No approval queues.

Deploy capital immediately. Maximize velocity. Compound faster.

Reason #6: Limited Blockchain Support Costs You Customers

Your processor supports Bitcoin and Ethereum. Maybe Litecoin if they're feeling generous.

But Solana? Binance Smart Chain? Polygon? Avalanche?

Customer loss is real.

Web3 users live multi-chain. Their assets spread across ecosystems. If you only accept BTC/ETH, you're turning away Solana maxis, BSC traders, Polygon power users.

Larecoin operates cross-chain. Accept payments on:

Solana (sub-second finality, $0.00025 fees)

Binance Smart Chain (low-cost, high throughput)

Ethereum (maximum liquidity, blue-chip security)

And expanding

Meet customers where they are. Not where your processor limits you.

Reason #7: Fee Transparency Is Non-Existent

Read your processor's fee schedule.

Transaction fees. Network fees. Conversion fees. Withdrawal fees. FX spreads. "Processing charges."

It's intentionally confusing. The complexity hides the real cost.

Example breakdown from typical processors:

0.5% transaction fee

0.1% conversion fee (crypto to fiat)

$10 withdrawal fee

1-3% FX spread on fiat conversion

Potential monthly minimum fees

The advertised "0.5% fee" becomes 2-5% all-in. You discover this after three months of processing.

Larecoin's pricing: Gas fees. That's it. No conversion fees (accept native crypto). No withdrawal fees (self-custody means you already have your funds). No FX spreads (unless you choose to convert to fiat elsewhere).

Transparency drives profitability. Know your costs. Optimize your margins.

The Bottom Line: Switching Saves Thousands

Let's calculate real numbers.

Scenario: $100K monthly payment volume

Traditional processor costs:

Transaction fees (1%): $1,000

Withdrawal fees: $50

FX spreads (fiat conversion): $2,000

Lost opportunity (delayed settlement): $119/month

Total monthly cost: $3,169

Annual cost: $38,028

Larecoin costs:

Gas fees (avg): $150

Total monthly cost: $150

Annual cost: $1,800

Annual savings: $36,228

Scale to $500K monthly volume? You save $181,140 annually.

That's not margin improvement. That's transformation.

Make the Switch

Your current processor thrives on complexity. Hidden fees. Custodial control. Limited options.

Larecoin delivers simplicity. Transparent costs. True ownership. Maximum flexibility.

Check out our complete guide on reducing merchant interchange fees to dive deeper into payment optimization strategies.

The crypto payment revolution isn't coming. It's here.

Stop overpaying. Start owning.

Visit larecoin.com to set up your account in under 10 minutes.

Your margins will thank you.

Comments