Are Traditional Payment Processors Dead? How LareBlocks + AI Shopping Are Rebuilding Commerce in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 5 min read

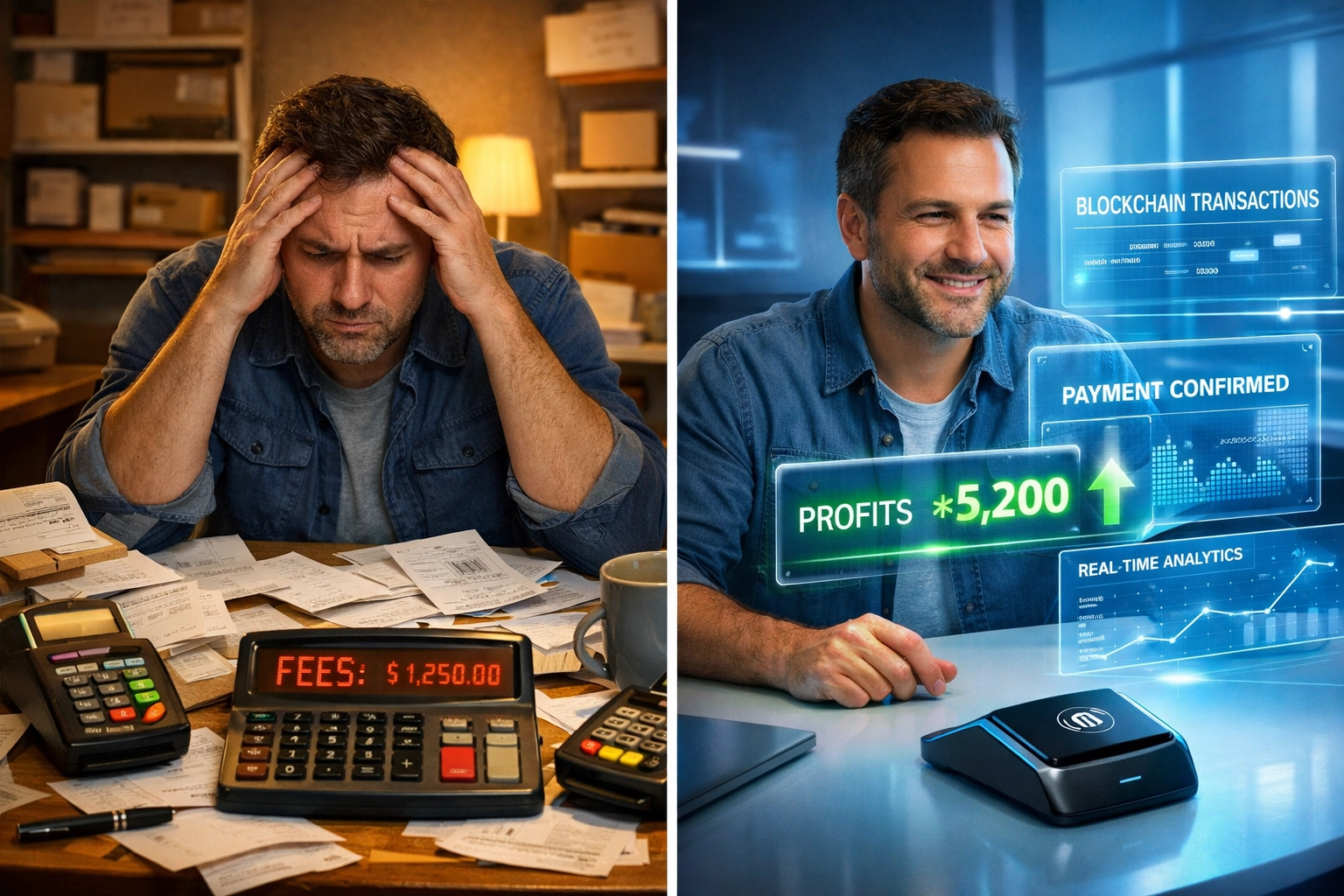

Let's be real. Traditional payment processors aren't technically dead. But they're limping. Hard.

2026 isn't the year Visa and Mastercard disappear. It's the year merchants realize they've been overpaying for outdated infrastructure that can't handle modern commerce: metaverse transactions, AI-powered shopping, instant cross-border settlements, and programmable money.

The old guard charges 2.9% + $0.30 per transaction. They take 3-5 business days for settlements. They can't handle NFT receipts. They shut down when crypto is mentioned.

That's where LareBlocks comes in.

The Problem With Legacy Payment Rails

Traditional processors were built for a world that doesn't exist anymore.

Think about it:

Single geographic market integrations that require months of dev work

No failover when providers go down (and they do)

Zero flexibility for crypto payments

Merchant fees that eat 3%+ of every transaction

No programmable logic for loyalty, donations, or dynamic pricing

Companies like NOWPayments and CoinPayments tried to bridge the gap. They offered crypto acceptance. But their fees? Still crushing merchants at 1%+ with minimum charges. CoinPayments hits you with 0.5% + network fees. Triple-A charges similar rates plus setup costs.

LareBlocks cuts those fees in half.

LareBlocks: Layer 1 Infrastructure Built Different

LareBlocks isn't a payment processor sitting on top of someone else's blockchain. It's a full Layer 1 blockchain purpose-built for commerce.

Here's what that means:

Custom blockchain optimized for payments. Not for DeFi speculation. Not for NFT art projects. For actual commerce at scale.

LareScan explorer gives merchants and customers full transparency. Every transaction. Every wallet. Every smart contract. Fully auditable and verifiable in real-time.

Master/Sub-wallet architecture lets businesses manage multiple departments, locations, or franchises under one ecosystem. Finance teams can finally consolidate crypto treasury management without juggling 47 different wallet seeds.

NFT receipts as standard. Every purchase generates a programmable receipt that can include warranties, loyalty points, access tokens, or future discounts. This isn't a gimmick: it's infrastructure for the next decade of customer relationships.

50% lower fees than competitors. LareBlocks charges half of what NOWPayments, CoinPayments, and Triple-A do. That's not marketing spin. That's Layer 1 efficiency passed directly to merchants.

AI Shopping: Not Hype, Infrastructure

AI shopping in 2026 isn't about chatbots recommending products. It's about autonomous commerce agents executing purchases on behalf of users.

Picture this:

Your AI agent knows you need running shoes. It scans 50,000 SKUs across the metaverse and physical retail. It finds the best price, checks inventory, verifies authenticity through blockchain provenance, and executes the transaction using LUSD stablecoin.

All in 3 seconds.

LareBlocks enables this through:

AI/ML search integration that crawls product listings, pricing data, and merchant reputations across our B2B2C metaverse ecosystem. Merchants get discovered. Buyers get precision.

LUSD stablecoin removes volatility from AI transactions. Your agent isn't making decisions based on whether Bitcoin is up or down 8% today. It's operating in stable, predictable units tied to USD.

Push-to-Card services let users convert crypto earnings instantly to fiat debit cards. Your metaverse storefront made $4,000 in LARE tokens today? Push it to your business Visa card and pay your suppliers. Zero friction.

Smart contract automation for B2B2C flows. Manufacturers, wholesalers, and retailers all get paid automatically when goods move through supply chains. No invoices. No 90-day payment terms. Instant settlement.

The 1.5% That Changes Everything

Every transaction on LareBlocks automatically donates 1.5% to charity.

Not as a marketing campaign. Not as an opt-in feature. Baked into the protocol.

This isn't feel-good fluff. It's structural innovation. While Visa donates $0.00 per transaction and NOWPayments offers nothing, LareBlocks embeds social impact at the infrastructure level.

For merchants, this means:

Automatic ESG compliance

Marketing differentiation (tell customers their purchase fed 10 families)

Tax benefits in jurisdictions recognizing crypto donations

Brand loyalty from Gen Z and Millennial buyers who actually care

For the ecosystem, it means millions flowing to verified nonprofits without intermediaries taking cuts. Transparent on-chain. Auditable forever.

CLARITY Act: Why Regulatory Compliance Matters Now

The CLARITY Act (H.R. 3633) passed in 2025 changed everything for crypto payments.

Before CLARITY:

Merchants risked IRS audits for accepting crypto

Tax reporting was a nightmare

Banks shut down accounts at the first sign of digital assets

After CLARITY:

Clear definitions for what constitutes securities vs. commodities

Safe harbor for payment tokens like LARE and LUSD

Standardized reporting frameworks

LareBlocks was architected with CLARITY compliance from day one. That means:

No regulatory surprises. Merchants aren't gambling on whether their payment processor gets classified as a money transmitter or security dealer.

Banking integration. Traditional financial institutions can now work with LareBlocks without compliance nightmares. That unlocks lending, insurance, and treasury services.

Multi-jurisdiction operability. CLARITY set the template other countries are copying. LareBlocks works in 47 countries because our compliance infrastructure is portable.

For merchants tired of crypto's Wild West reputation, this is the difference between "interesting technology" and "viable business infrastructure."

Merchant Tools That Actually Solve Problems

LareBlocks doesn't just process payments. It gives merchants infrastructure that legacy processors can't match.

NFT Receipts

Every sale generates a unique NFT

Embed warranties, return policies, or future discounts

Customers can resell receipts (proving authenticity)

Build loyalty programs without centralized databases

Master/Sub-Wallets

Manage 10, 100, or 1,000 locations from one dashboard

Automatic revenue splitting between franchisees

Real-time treasury visibility

No more reconciling separate crypto accounts

LUSD Stablecoin Integration

Accept payments without volatility risk

Price products in dollars, receive dollars (in LUSD)

Convert to fiat instantly via Push-to-Card

No learning curve for accounting teams

Metaverse Storefronts

Deploy virtual retail spaces in minutes

AI agents browse your inventory 24/7

Cross-chain compatibility (customers pay with any token)

Physical goods ship automatically via smart contracts

Want more detail on metaverse commerce? Check out our 15 features small businesses need in 2026.

The Real Question: Can Traditional Processors Adapt?

They're trying.

Visa is experimenting with stablecoin settlements. Mastercard is piloting blockchain transaction verification. PayPal launched crypto checkout (with 1.5%+ fees).

But here's the problem: legacy infrastructure can't be retrofitted.

You can't take a system built for magnetic stripe cards in the 1970s and bolt on AI shopping agents. You can't add programmable NFT receipts to centralized databases. You can't embed charitable donations into card networks controlled by 47 intermediaries.

LareBlocks started from zero in 2024. Every line of code written for Web3 commerce. Every protocol decision optimized for 2026 realities.

That's not a two-year advantage. That's a generational lead.

What This Means For Your Business

If you're a merchant still using traditional processors:

You're overpaying. Cut fees in half by switching to LareBlocks infrastructure.

You're underleveraging. NFT receipts, AI shopping discovery, and metaverse storefronts are competitive advantages sitting on the table.

You're missing buyers. Gen Z and crypto-native consumers want to spend digital assets. If you don't accept them, competitors will.

You're invisible to AI agents. The fastest-growing segment of "buyers" in 2026 are autonomous AI shopping assistants. They can't find you if you're not on Web3 rails.

If you're building a crypto payment startup:

Don't compete with NOWPayments or CoinPayments directly. They're already legacy. Build on LareBlocks and inherit Layer 1 infrastructure, compliance frameworks, and merchant tools out of the box.

Focus on vertical solutions. LareBlocks handles the plumbing. You handle industry-specific UX for restaurants, SaaS, or e-commerce.

The Honest Answer

Are traditional payment processors dead?

No. But they're becoming irrelevant for anyone building for the next decade.

LareBlocks + AI shopping aren't replacing Visa tomorrow. They're building parallel infrastructure that's faster, cheaper, more programmable, and socially responsible.

By 2028, the question won't be "should I accept crypto?" It'll be "why am I still paying 3% to legacy processors when LareBlocks charges half that and gives my customers better experiences?"

The future of commerce isn't coming. It's already here.

Want to see it yourself? Explore the ecosystem at larecoin.com or dive into merchant tools and infrastructure at larecoin.com/trust.

Traditional processors had a good run. Time for what's next.

Comments