Are Traditional POS Systems Dead? Why Metaverse Shopping Will Change the Way You Accept Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 5 min read

Traditional POS systems aren't dead.

They're just not enough anymore.

2026 is the year payment infrastructure finally catches up to how people actually shop: online, in-store, and increasingly, in virtual worlds. If you're still running a legacy terminal that settles in 2-3 business days and charges 2.9% + $0.30 per swipe, you're leaving serious money on the table.

Here's what's changing. And why crypto-native payment rails like Larecoin are becoming the smartest choice for forward-thinking merchants.

The 2026 Payment Reality: Cloud, Real-Time, Multi-Channel

Cloud-based POS systems are now the baseline. Automatic updates. Access from any device. Scalability without buying new hardware every 18 months.

But that's table stakes.

What's actually driving adoption is real-time settlement. FedNow in the US. SEPA Instant in Europe. Funds hit your account in seconds, not days. No more waiting for batch processing. No more cash flow gaps.

The next evolution? SoftPOS technology. Your smartphone becomes the terminal. No dedicated hardware. Just tap and go. Lower overhead. Faster deployment.

Traditional processors like Square and Stripe built their empires on convenience. They're still viable for commodity transactions. But they weren't designed for programmable payments, virtual goods, or immersive commerce.

That's the gap.

Why Interchange Fees Are Killing Your Margins

Let's talk numbers.

Traditional card networks charge 2.5% to 3.5% per transaction. Plus fixed fees. Plus chargeback fees. Plus monthly terminal rentals.

For a $100 sale, you're paying $3+ just to accept payment.

Do that 1,000 times a month? You've handed $3,000 to Visa and Mastercard.

Crypto payments through self-custody rails cut that by more than 50%.

Larecoin's gas-only transfer model means you pay blockchain network fees: typically pennies: instead of percentage-based interchange. No middleman taking a cut. No surprise fees.

For high-volume merchants, the math is brutal. Switching to crypto POS saves five figures annually. Sometimes six.

What NOWPayments and CoinPayments Get Wrong

Most crypto payment gateways treat blockchain like a novelty. Accept Bitcoin. Convert to USD. Settle in 3 days.

That's just a slower, more expensive version of Stripe.

NOWPayments offers multi-coin support. But they still custody your funds. You're trusting a third party with settlement. And their fee structure: 0.5% to 1%: adds up fast when you're processing volume.

CoinPayments has been around since 2013. Solid reputation. But their UX feels dated. Merchants don't want to deal with 15 different wallet addresses. They want one unified dashboard.

Triple-A focuses on stablecoin settlements. That's smart. But they charge enterprise pricing for features that should be standard.

Here's what they all miss: True self-custody. NFT receipts. Built-in accounting tools. And native stablecoin infrastructure.

Larecoin was designed for merchants who want control, not convenience theater.

The Larecoin Advantage: Self-Custody, LUSD, and NFT Receipts

Let's break down what actually matters.

1. Self-Custody Master/Sub-Wallet Architecture

You control your private keys. Always. Larecoin's smart wallet system lets you create sub-wallets for departments, locations, or products. Full visibility. Complete control.

No third party can freeze your funds. No surprise account closures. No terms-of-service lockouts.

2. LUSD: The Stablecoin That Doesn't Collapse

Volatile crypto is great for speculation. Terrible for business accounting.

LUSD (Larecoin USD) is a fully-backed stablecoin that settles instantly. Pegged 1:1 to the dollar. No algorithmic shenanigans. No Terra Luna nightmares.

Accept payments in LUSD. Your customers pay with crypto. You get stable value. Everyone wins.

3. NFT Receipts for Compliance and Loyalty

Every transaction generates an on-chain NFT receipt. Immutable. Verifiable. Perfect for accounting.

Need proof of purchase for a warranty claim? It's on the blockchain. Want to build a loyalty program based on lifetime customer value? The data's already there.

Your CPA will thank you. So will your auditors.

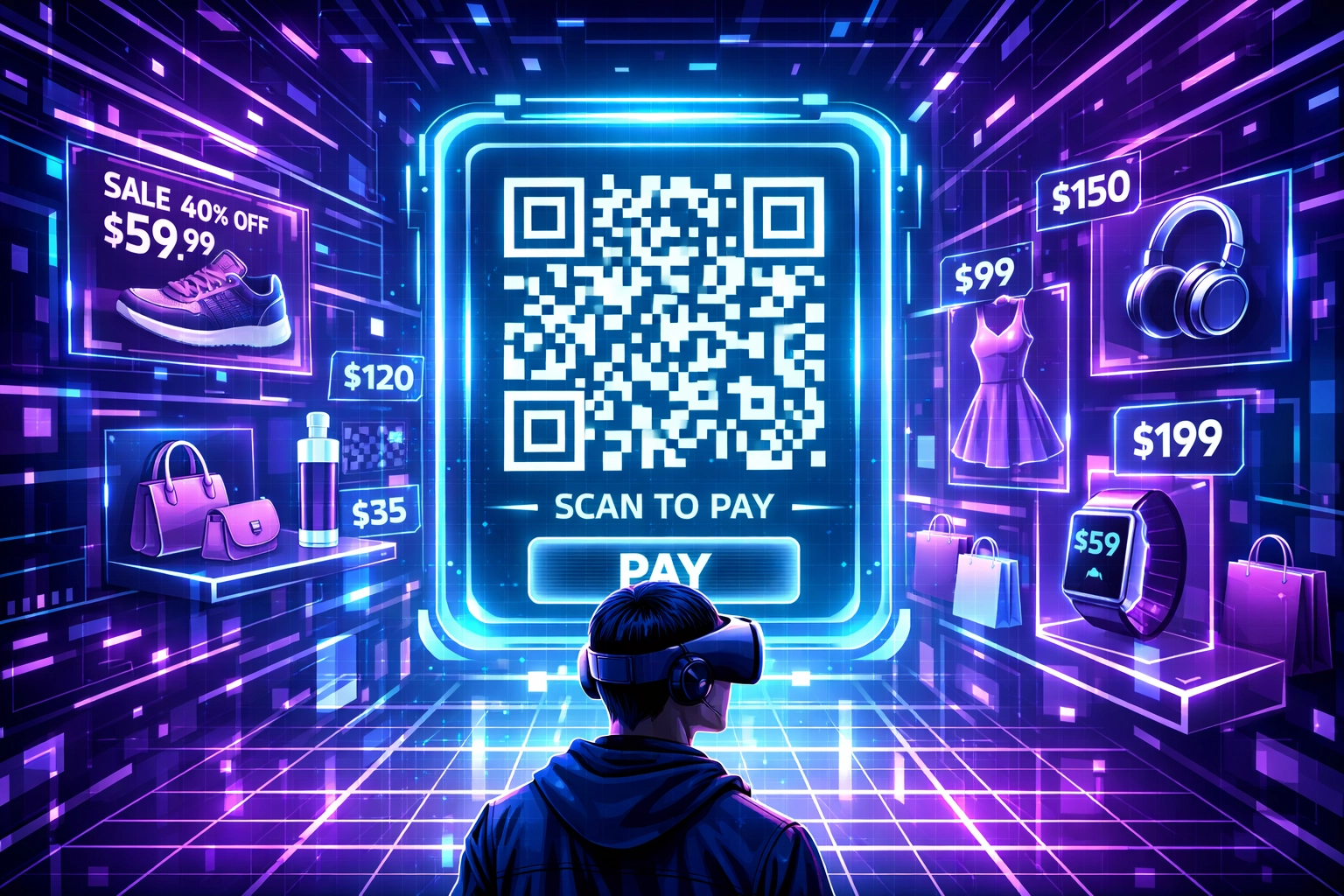

4. QR-Generated POS for Omnichannel Commerce

Physical store. Online shop. Metaverse showroom. Same payment system.

Generate a QR code. Customer scans. Payment settles in seconds. Works everywhere.

No hardware investment. No complex integrations. Just a unified payment rail that follows your business wherever it grows.

Metaverse Shopping: Why Virtual Commerce Needs Crypto Infrastructure

Here's where traditional POS completely breaks down.

Virtual reality shopping doesn't have physical terminals. AR try-before-you-buy doesn't run on Square readers. Social commerce in Discord doesn't integrate with Shopify.

You need platform-agnostic payment profiles that work identically across every channel.

Larecoin's B2B2C metaverse infrastructure handles:

In-world purchases with instant settlement

Cross-platform inventory sync between physical and virtual stores

NFT-based ownership for digital goods

Programmable royalties for creator economies

When a customer buys a virtual product in your metaverse showroom, that transaction needs to:

Settle instantly

Generate a verifiable receipt

Trigger inventory updates

Sync with your accounting system

Work across VR, AR, mobile, and desktop

Traditional payment processors weren't built for this. Crypto rails were.

Compliance Matters: Federal MSB and State MTL Coverage

"Crypto payments sound risky."

Fair concern. The industry has earned its reputation for fly-by-night operations.

That's why Larecoin operates under federal Money Services Business (MSB) registration and maintains Money Transmitter License (MTL) coverage across US states.

Full regulatory compliance. Transparent reporting. AML/KYC infrastructure.

You can accept crypto payments with the same legal confidence as traditional payment processors. Visit our trust page for full licensing details.

This isn't DeFi Wild West chaos. It's institutional-grade infrastructure with crypto-native efficiency.

The Future Is Already Here (It's Just Unevenly Distributed)

By 2027, analysts project $8 billion in metaverse commerce transactions. Virtual goods. Digital real estate. AR shopping experiences.

Early adopters are building the infrastructure now.

Social shopping will dominate. Customers will browse products in VR showrooms. Try on clothing through AR apps. Complete purchases without leaving their social feeds.

Your payment system needs to be ready.

Larecoin's roadmap includes:

AI-powered shopping assistants integrated into merchant portals

Cross-chain bridge support for Ethereum, Solana, and Polygon

Voice-activated payments for VR/AR environments

Programmable spending limits for B2B procurement

This isn't speculative. These features are in testing now.

Making the Switch: What Merchants Need to Know

Transitioning from traditional POS to crypto payments is simpler than you think.

Step 1: Set up your Larecoin merchant account at larecoin.com

Step 2: Generate your QR payment code (takes 2 minutes)

Step 3: Start accepting LARE, LUSD, or bridged stablecoins

Step 4: Access your self-custody wallet dashboard

No months-long integration. No expensive consultants. No hardware investments.

For merchants already processing $50K+ monthly, the fee savings pay for the transition in weeks.

The Bottom Line

Traditional POS systems aren't dead.

But they're expensive, slow, and fundamentally incompatible with the next wave of commerce.

Cloud-based terminals and SoftPOS technology solve some problems. But they still run on legacy financial rails that charge excessive fees and settle on outdated timelines.

Crypto-native payment infrastructure: specifically self-custody systems with built-in stablecoin support, NFT receipts, and omnichannel functionality: is the only architecture designed for 2026 and beyond.

Larecoin combines the efficiency of blockchain settlement with the compliance requirements of traditional finance. Lower fees. Instant settlement. True ownership.

The metaverse is coming. Virtual commerce is already here. Your payment infrastructure needs to evolve.

The question isn't whether traditional POS is dead. It's whether your business can afford to keep using it.

Ready to cut your payment fees by 50%+ and future-proof your checkout system? Explore Larecoin's merchant solutions at larecoin.com or dive into our technical documentation to see how NFT receipts and self-custody wallets transform business operations.

Comments