Are You Still Paying 3% Merchant Fees? Here's How Self-Custody Accounts Cut Processing Costs to Gas-Only

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The 3% Problem Nobody Talks About

Every time a customer swipes their card, you lose money.

Not just a little. A lot.

Traditional payment processors charge 2.9% + $0.30 per transaction. On a $100 sale, that's $3.20 gone before you even count inventory costs.

Scale that up. A small business processing $10,000 monthly loses $320. A medium-sized merchant handling $100,000? You're hemorrhaging $3,200 every single month.

That's $38,400 annually. Just vanished.

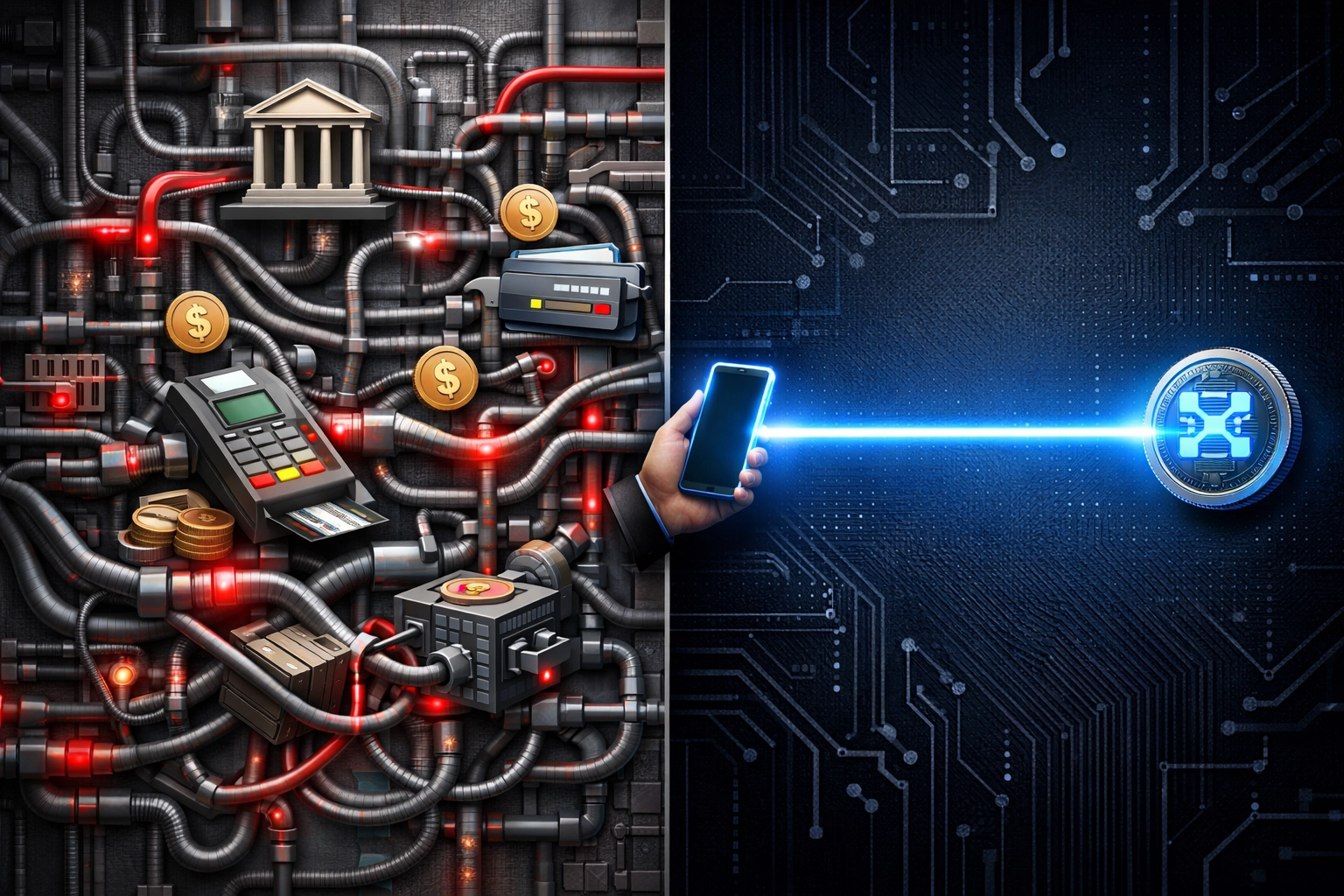

Why Traditional Payments Cost So Much

Let's break down where your money actually goes.

Traditional payment processing involves five separate intermediaries:

Issuing bank (customer's bank)

Card network (Visa, Mastercard)

Payment processor

Payment gateway

Acquiring bank (merchant's bank)

Each one takes a cut.

Every. Single. Transaction.

They claim it's for "security" and "fraud protection." Really? In 2026, we're still paying 1960s-era infrastructure costs?

Enter Self-Custody Merchant Accounts

Self-custody changes everything.

Instead of routing payments through five intermediaries, blockchain technology creates a direct path from customer to merchant.

No middlemen. No permission needed. No one skimming off the top.

With platforms like Larecoin, merchants control their funds completely. The crypto sits in your wallet. Not a processor's account. Not a holding pattern. Yours.

The only cost? Network gas fees.

On most transactions, that's $0.20 to $1.00. Sometimes less.

The Real Numbers: Traditional vs. Self-Custody

Let's do the math on a $100 sale:

Traditional Credit Card Processing:

Base transaction: $100

Processor fee (2.9%): $2.90

Fixed fee: $0.30

Total cost: $3.20

Self-Custody Crypto Payment (Larecoin):

Base transaction: $100

Gas fee: ~$0.50

Total cost: $0.50

That's 84% savings per transaction.

Now multiply that across your monthly volume:

Monthly Revenue | Traditional Fees | Self-Custody Fees | Annual Savings |

$10,000 | $320/month | $50/month | $3,240/year |

$100,000 | $3,200/month | $500/month | $32,400/year |

$1,000,000 | $32,000/month | $5,000/month | $324,000/year |

For high-volume merchants, that's literally life-changing money.

How Larecoin Makes Self-Custody Simple

Traditional self-custody had problems. Complicated setup. Volatile prices. No accounting tools.

Larecoin solved all of it.

LUSD Stablecoin Integration

Accept payments in LARE or LUSD. LUSD pegs to the US dollar, eliminating volatility risk. Your $100 sale stays $100 tomorrow.

No more checking crypto prices every hour.

NFT Receipts for Accounting

Every transaction generates an NFT receipt. Immutable. Timestamped. Permanent.

Your accountant will actually thank you. Tax season becomes straightforward instead of a nightmare.

These NFT receipts include:

Transaction amount

Date and time

Product details

Customer wallet (if needed)

Tax calculations

Everything your bookkeeper needs. All on-chain.

Receivables Token Technology

Future payments? Invoice financing? Larecoin's receivables token system lets you tokenize expected payments.

Convert future revenue into liquid assets. No bank approval needed.

That's financial sovereignty.

Comparing Self-Custody Solutions

Not all crypto payment platforms offer true self-custody. Let's compare.

NOWPayments Alternative

NOWPayments processes payments but holds your funds in their custody. You request withdrawals. They process them "within 24 hours."

That's not self-custody. That's just another middleman.

Larecoin? Instant settlement to your wallet. Zero withdrawal delays.

CoinPayments Alternative

CoinPayments charges 0.5% per transaction. Better than 3%, sure. But still a fee.

Plus they require KYC verification that can take weeks. And they can freeze your account anytime.

Larecoin's self-custody model? No account to freeze. No permission needed. Your keys, your crypto, your business.

Triple-A Comparison

Triple-A targets enterprise clients with "managed" crypto solutions. Translation: they custody your funds.

Their fee structure? Not even publicly listed. You need a "quote."

Larecoin's gas-only pricing? Transparent. Predictable. Posted on-chain for everyone to verify.

The Chargeback Nightmare Ends

Here's something nobody talks about: chargebacks.

Traditional payment processors allow customers to dispute charges for up to 180 days. Sometimes longer.

Every chargeback costs you:

The original sale amount

$15-$25 chargeback fee

Time fighting the dispute

Potential account termination if your rate climbs too high

Crypto transactions? Immutable and irreversible.

No chargebacks. Ever.

The customer confirms payment. The blockchain settles. Done.

For digital goods merchants, this alone justifies switching to self-custody accounts.

Global Payments Without the Global Fees

Traditional international payments destroy profit margins.

Wire transfers cost $25-$50 per transaction. Currency conversion adds 3-5%. Processing takes 3-7 business days.

Self-custody crypto payments? Same cost regardless of location.

Customer in Tokyo? Same gas fee as someone in Toronto.

Your Nigerian supplier needs payment? Send LUSD instantly. Settles in seconds. Costs under $1.

No SWIFT codes. No correspondent banks. No currency conversion fees.

Just direct, peer-to-peer, global commerce.

Setting Up Self-Custody in Minutes

Traditional merchant accounts require:

Credit checks

Business documentation

Bank verification

3-7 day approval process

Monthly minimums

Contract commitments

Larecoin setup:

Create wallet (2 minutes)

Generate payment QR code (30 seconds)

Start accepting payments

Total time: Under 5 minutes.

No credit check. No approval process. No monthly fees.

Visit Larecoin merchants to get started today.

The Crypto POS Revolution for Small Business

Point-of-sale systems used to cost thousands. Monthly fees added hundreds more.

Larecoin's crypto POS system? Browser-based and free.

Works on any device:

Tablet

Smartphone

Laptop

Desktop

Just load the web app. Display the QR code. Customer scans and pays.

Instant settlement to your self-custody wallet. NFT receipt generated automatically.

No hardware costs. No monthly subscriptions. No percentage fees.

Perfect for small businesses tired of payment processor gouging.

Financial Sovereignty Is Bank-Free Business

Banks control traditional merchant accounts completely.

They can:

Freeze your account without warning

Hold funds for "review"

Terminate service for "high risk" industries

Require personal guarantees

Report all transactions to authorities

Self-custody eliminates bank control entirely.

Your business. Your money. Your decisions.

Operating in a "high risk" category like CBD or supplements? Doesn't matter. No one can shut you down.

International sales to sanctioned countries? The blockchain doesn't care about politics.

This is true financial sovereignty.

The Bottom Line on Merchant Interchange Fees

Traditional merchant interchange fees are a relic.

Built in the 1960s. Optimized for analog infrastructure. Maintained because merchants had no alternative.

Now you do.

Self-custody accounts slash processing costs from 3% to gas-only. That's 84-95% savings depending on transaction size.

For a business processing $100,000 monthly, that's $32,400 saved annually.

Same business. Same customers. Massively better margins.

The technology exists today. The infrastructure works perfectly. Early adopters are already seeing results.

Ready to Cut Your Processing Costs?

Stop paying 3% fees for last century's infrastructure.

Self-custody accounts give you:

Gas-only transaction costs

NFT receipts for accounting

LUSD stablecoin stability

Zero chargebacks

Global payment acceptance

Complete financial sovereignty

Larecoin makes it simple. Setup takes minutes. No approval process. No monthly fees.

Check out the Larecoin payment solutions and start keeping more of what you earn.

Your future self will thank you when you're not hemorrhaging thousands monthly to payment processors.

The Web3 payment revolution is here. Time to join it.

Comments