How to Reduce Merchant Interchange Fees by 50%+ and Stay Compliant: The LUSD Stablecoin Advantage

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Merchant interchange fees are bleeding your business dry.

2.9% plus $0.30 per transaction adds up fast. Process $100K monthly? You're handing over $2,900+ to payment processors. High-risk merchants pay 5-8% or more.

That's $35,000+ annually disappearing into processing fees.

LUSD stablecoin flips this model completely.

The Traditional Payment Processor Problem

Credit card processors operate on a percentage-based model. The more you sell, the more they take.

Transaction holds last 3-7 days. Your cash sits frozen while processors earn interest.

Chargebacks hit without warning. Frozen accounts. Endless compliance paperwork.

Cross-border payments? Add another 3-5% in currency conversion fees.

NOWPayments and CoinPayments improved the crypto payment experience. But they still charge percentage-based fees ranging from 0.5% to 1.5%. Better than traditional processors, but not revolutionary.

How LUSD Stablecoin Changes Everything

LUSD operates on fixed gas fees instead of percentage-based pricing.

Average transaction cost: $0.50-$15 regardless of transaction size.

Process $1,000 or $100,000. Same fee structure.

The math is simple. Traditional processors take $2,900+ on $100K monthly volume. LUSD's gas-based model costs a fraction of that.

That's 50-90% in fee savings. Every single month.

The Self-Custody Advantage

Larecoin gives merchants direct control through self-custody accounts.

You hold the private keys. No intermediary access. No permission required.

Funds available 24/7/365. Zero withdrawal limits. No account freezes.

Compare this to NOWPayments and CoinPayments. Both require you to create accounts on their platforms. Your funds sit in their custody until withdrawal. Processing delays. Approval requirements. Account restrictions.

Self-custody eliminates these bottlenecks completely.

Instant Settlement That Actually Works

LUSD transactions settle in under 10 minutes.

Traditional processors? 3-7 day holds are standard.

This cash flow difference transforms business operations. Reinvest revenue immediately. Pay suppliers faster. Capitalize on opportunities without waiting.

NOWPayments processes withdrawals daily but requires minimum thresholds. CoinPayments offers faster processing but charges additional withdrawal fees.

Larecoin's model: instant settlement with no withdrawal games.

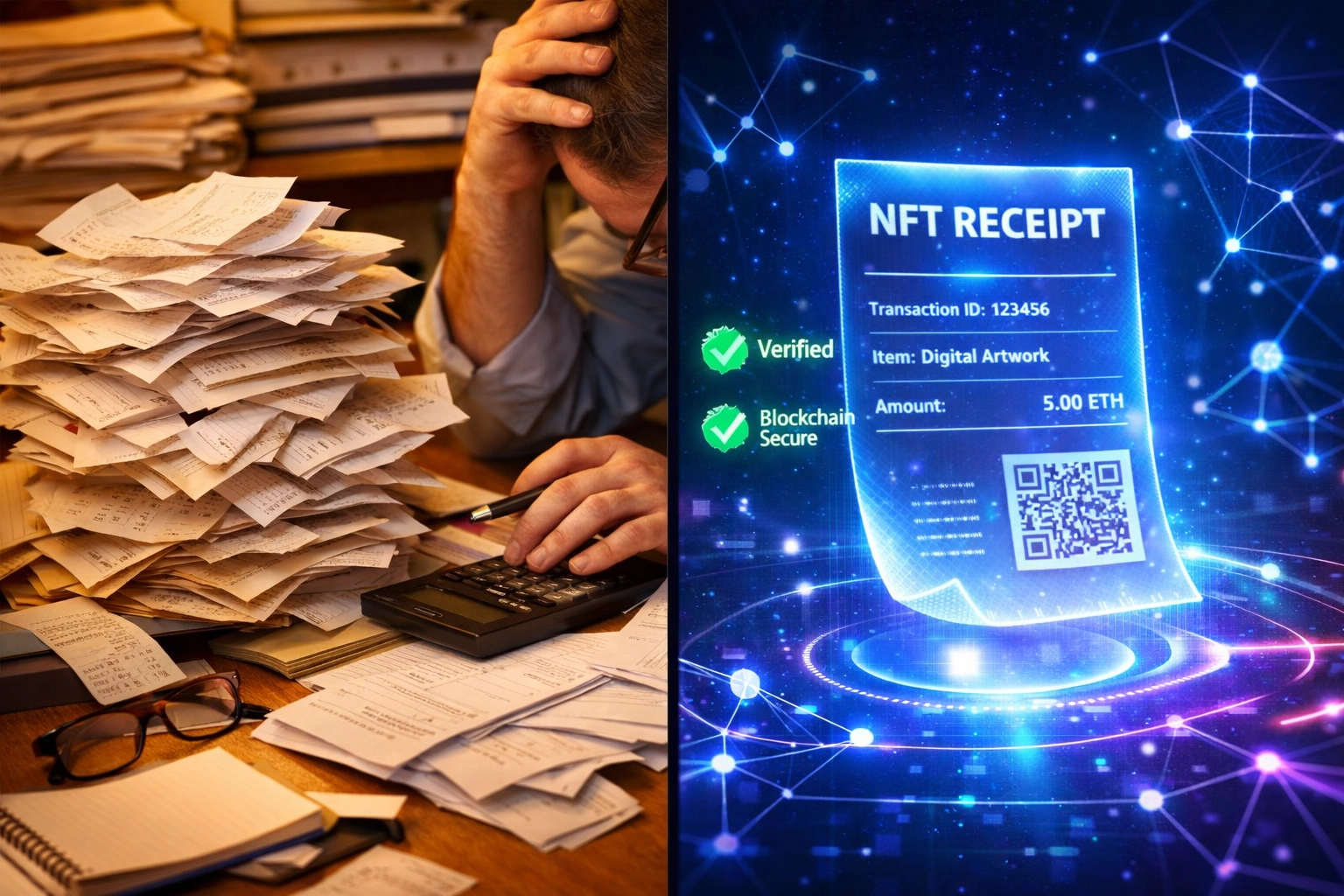

NFT Receipts: Automated Accounting Done Right

Every LUSD transaction generates an immutable NFT receipt.

On-chain timestamping. Automatic reconciliation. Tax-ready documentation.

No manual entry. No reconciliation headaches. No missing receipts at tax time.

This feature alone saves accounting departments hundreds of hours annually. Clean audit trails. Verifiable transaction history. Real-time financial reporting.

Traditional processors offer basic reporting. Crypto alternatives like NOWPayments provide transaction histories. But neither generates blockchain-verified receipts with immutable proof.

NFT receipts are a game-changer for compliance and bookkeeping.

Global Payments Without the Global Fees

Cross-border transactions cost the same as domestic payments with LUSD.

Zero currency conversion fees. No correspondent bank delays. No regional markup variations.

Accept payment from Tokyo, Toronto, or Tel Aviv. Same flat gas fee. Same instant settlement.

Traditional processors add 3-5% for international transactions. Currency conversion fees stack on top. Multi-day settlement delays are standard.

NOWPayments handles 200+ cryptocurrencies across borders. CoinPayments supports global transactions. Both charge percentage-based fees that increase with transaction volume.

LUSD maintains cost parity globally. One fee structure. Worldwide.

Staying Compliant: The MSB and MTL Strategy

Larecoin takes US regulatory compliance seriously.

MSB (Money Services Business) registration. State-by-state MTL (Money Transmitter License) strategy. Full transparency with regulators.

This isn't bank-free chaos. This is structured, compliant Web3 infrastructure.

Traditional processors operate under established financial regulations. That's their competitive advantage. But compliance shouldn't cost 3% per transaction.

Crypto payment processors sometimes operate in regulatory gray areas. Unclear licensing. Uncertain futures.

Larecoin builds compliance into the foundation. US MSB registration. State MTL compliance roadmap. Regulatory partnerships at every level.

You get Web3 efficiency with traditional regulatory clarity.

Visit Larecoin's Trust page for full compliance documentation.

Real Cost Savings Breakdown

Let's run the numbers on a real merchant scenario.

Monthly Volume: $100,000

Traditional Processor (2.9% + $0.30):

Processing fees: $2,900

Hold time: 5 days average

Annual cost: $34,800

NOWPayments (0.5% average):

Processing fees: $500

Custody model: platform-held funds

Annual cost: $6,000

CoinPayments (1% average):

Processing fees: $1,000

Withdrawal fees: additional charges

Annual cost: $12,000+

LUSD via Larecoin (fixed gas model):

Transaction fees: $15 average per transaction

100 transactions monthly: $1,500

Annual cost: $18,000

Even at 100 transactions monthly, you save $16,800 annually versus traditional processors. Compared to NOWPayments, you gain self-custody and instant settlement. Against CoinPayments, you save thousands while maintaining compliance.

Higher transaction volumes increase the savings dramatically. Process 500 transactions monthly? Traditional processors still take $34,800 annually. LUSD's cost stays proportional to transaction count, not transaction value.

The Implementation Reality

Setting up traditional payment processing takes weeks. Credit checks. Bank account verification. Approval delays. Risk assessments.

NOWPayments requires account creation, API integration, and platform onboarding. CoinPayments follows similar processes.

Larecoin's setup time: minutes.

Create a crypto wallet. Integrate the payment gateway. Start accepting LUSD.

No credit checks. No bank account approval. No platform custody.

Pure self-custody from day one.

Why Merchants Are Making the Switch

Fee savings drive initial interest. But the complete package seals the decision.

Self-custody control. Instant settlements. NFT receipt automation. Global payment parity. Rigorous US compliance.

Traditional processors can't match the fee structure. Crypto alternatives can't match the compliance infrastructure. Nobody else combines all these advantages.

The 10-year Larecoin marathon continues. Check out our growing library of Web3 payment insights as we document the payment revolution in real-time.

Getting Started with LUSD Payments

Ready to cut fees by 50%+ while maintaining compliance?

Implementation takes three steps:

Set up a self-custody crypto wallet

Integrate Larecoin's payment gateway

Begin accepting LUSD payments

No approval waiting period. No platform middlemen. No percentage-based fee bleeding.

Join the Larecoin Community to connect with merchants already making the switch. Real experiences. Real savings. Real innovation.

The merchant interchange fee model is broken. LUSD stablecoin fixes it.

Your business deserves better than 2.9% per transaction. The technology exists today. The compliance framework is in place. The savings are waiting.

Welcome to Web3 payments done right. Welcome to Larecoin.

Comments