Is Metaverse Shopping the Future? How VR/AR B2B2C Experiences Transform Crypto Payments in 2026

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 4 hours ago

- 5 min read

The $2.6 Trillion Question

Metaverse shopping isn't future speculation anymore.

It's happening now. McKinsey projects the metaverse e-commerce market will hit $2 trillion to $2.6 trillion by 2030. Gartner's prediction? 25% of people will spend at least one hour daily in metaverse environments by 2026.

That's this year.

The numbers get more interesting. VR/AR shopping experiences deliver a 400% increase in time spent browsing products. Brand loyalty jumps 240%. Virtual storefronts with 3D environments and avatar try-ons are converting browsers into buyers at rates traditional e-commerce can't match.

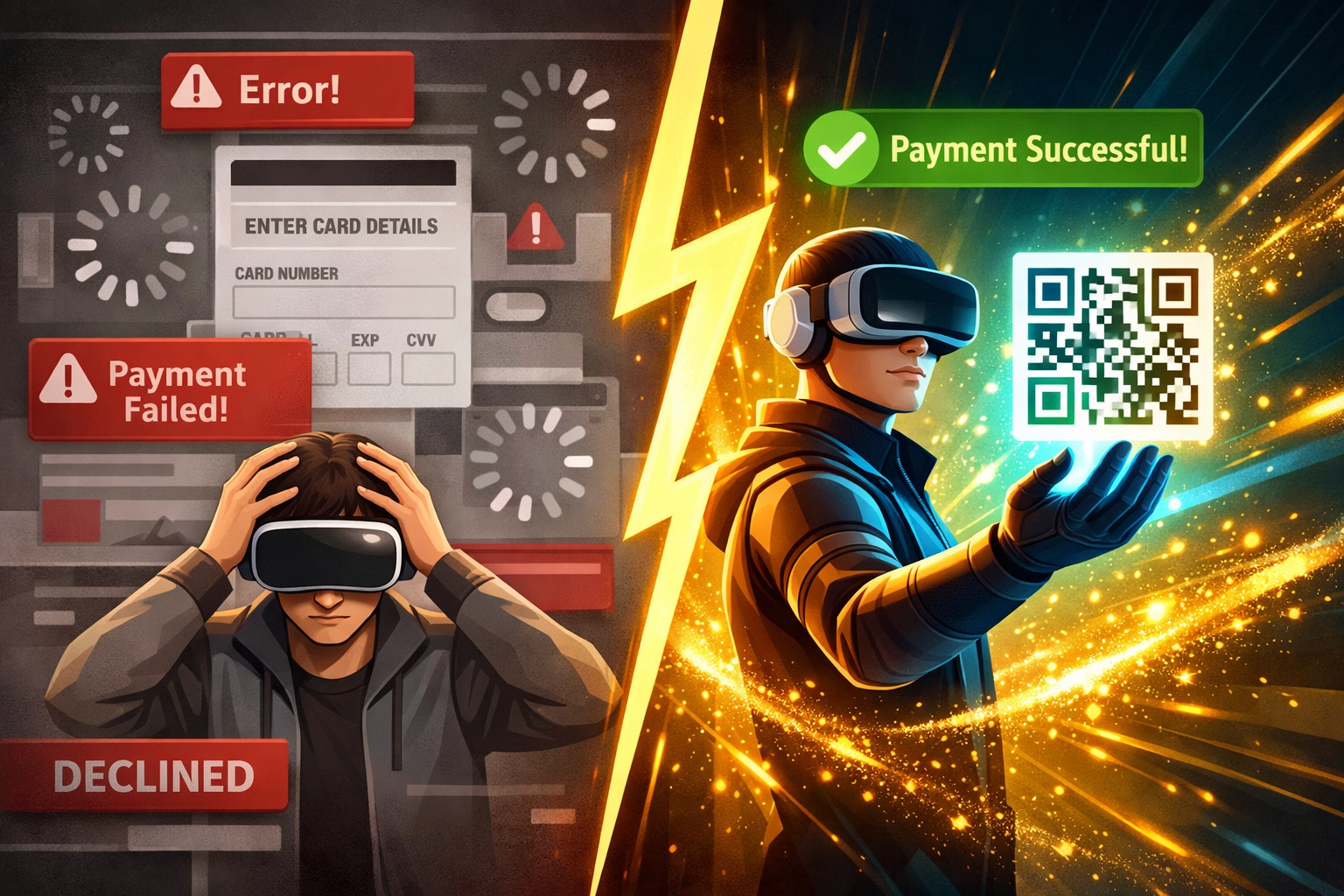

But there's a payment problem nobody's talking about.

The Payment Gap in Virtual Commerce

Traditional payment rails weren't built for metaverse transactions.

Cross-border fees eat 3-5% of every transaction. Settlement takes days. Currency conversion adds another layer of friction. When a customer in Tokyo buys a virtual sneaker NFT from a brand in Milan, legacy payment systems create expensive bottlenecks.

The B2B2C model compounds this issue. Brands partner with platforms that host virtual stores. Three parties split revenue. Traditional processors charge each entity separately.

The result? Merchants lose 50%+ to intermediary fees.

Virtual goods, digital fashion, NFT collectibles: all require instant settlement, transparent pricing, and cross-border flexibility. Legacy payment systems weren't designed for this reality.

Enter crypto-native payment infrastructure.

How Larecoin Transforms VR/AR Commerce

Larecoin built the first truly metaverse-native payment solution.

Gas-only transfers eliminate markup fees entirely. No hidden costs. No percentage cuts. Just blockchain gas fees: typically under $0.50 per transaction regardless of amount.

LUSD stablecoin integration solves volatility concerns. Merchants receive stable value. Customers spend without price fluctuation anxiety. Real-time settlement happens on-chain in seconds, not days.

NFT receipts turn every purchase into a collectible. Each transaction generates a unique NFT proof-of-purchase. Customers build digital receipt collections with resale value. Brands create loyalty programs using receipt NFTs as access tokens.

The technical architecture supports true self-custody. Customers control their wallets. No centralized custodian holds funds. No counterparty risk. Master and sub-wallet structures let merchants manage multiple virtual storefronts from one dashboard.

QR-generated POS systems work seamlessly in VR environments. Point your virtual hand at a product. Scan the QR code with your wallet. Transaction completes instantly. No browser redirects. No checkout forms. Pure frictionless commerce.

Competitor Reality Check

NOWPayments, CoinPayments, and Triple-A all offer crypto payment processing.

None built specifically for metaverse commerce.

NOWPayments focuses on traditional e-commerce integration. Their API connects to Shopify, WooCommerce, Magento. Strong for 2D web stores. Limited VR/AR functionality. No native metaverse SDK. Merchants pay 0.5% fees plus blockchain costs.

CoinPayments offers wider coin selection: 4,000+ cryptocurrencies supported. Their strength is choice, not metaverse optimization. Transaction fees range from 0.5% to 1%. No NFT receipt functionality. No LUSD stablecoin support. Virtual reality integrations require custom development.

Triple-A targets enterprise merchants with licensed payment solutions. They emphasize compliance and regulatory coverage. Fee structure remains opaque: contact sales for pricing. Their platform prioritizes traditional retail over immersive experiences.

Larecoin's advantage? Purpose-built for spatial commerce.

The B2B2C Metaverse Model

Social shopping redefined.

Larecoin's B2B2C platform connects brands directly to consumers through virtual social spaces. Think multiplayer shopping experiences where friends browse together, try on digital fashion simultaneously, and share purchases in real-time.

Brands (Business 1) create immersive storefronts. Platforms (Business 2) host virtual shopping districts. Consumers explore, socialize, and transact: all without leaving the metaverse environment.

Revenue splits happen automatically through smart contracts. No manual reconciliation. No payment disputes. Transparent commission structures coded into every transaction.

The merchant portal provides unified analytics across physical POS, online stores, and metaverse locations. Single dashboard. Complete visibility. Real-time sales data from all channels.

Virtual pop-up stores launch in minutes. No physical buildout costs. No inventory management. Digital products deploy instantly across the platform.

Reducing Interchange Fees by 50%+

Traditional payment processing destroys merchant margins.

Credit card interchange fees range from 1.5% to 3.5%. Add payment gateway fees, monthly minimums, PCI compliance costs. Small merchants often pay 4-5% total.

High-volume merchants negotiate better rates but still surrender 2%+ per transaction.

Larecoin's model changes everything.

Gas-only transfers mean zero percentage-based fees. A $10 purchase costs the same to process as a $10,000 purchase: roughly $0.50 in blockchain fees.

For merchants processing $100K monthly:

Traditional cards: $2,000-$3,500 in fees

Larecoin: $150-$300 in gas fees

Annual savings exceed $30,000.

Scale those numbers to enterprise volume. Merchants processing $10M annually save over $300K switching to crypto-native payments.

The master/sub-wallet architecture provides additional efficiency. Franchises, multi-location retailers, and marketplace platforms manage hundreds of payment streams from one interface. Consolidated reporting. Automated accounting. Reduced administrative overhead.

Compliance Without Compromise

Crypto payments need regulatory clarity.

Larecoin operates with full federal MSB registration. Licensed money transmitter at the national level. State-level MTL coverage across U.S. jurisdictions where required.

This compliance infrastructure matters for enterprise adoption. Corporate procurement teams won't approve crypto payment solutions without proper licensing. Risk management departments demand regulated partners.

Larecoin's trust framework includes:

Federal MSB registration with FinCEN

State money transmitter licenses in all required jurisdictions

AML/KYC protocols meeting regulatory standards

Transaction monitoring and reporting systems

Regular compliance audits and regulatory reviews

Transparent licensing creates institutional confidence. Learn more about Larecoin's compliance approach.

Competitors often operate in gray zones. Decentralized protocols claim regulatory exemptions. Offshore entities avoid U.S. licensing requirements. This approach works until it doesn't: and suddenly merchants face legal exposure.

Larecoin chose the compliant path from day one.

The Social Metaverse Experience

Shopping becomes entertainment.

Larecoin's metaverse spaces feature AI shopping assistants that learn customer preferences. Virtual stylists curate collections based on past purchases, avatar appearance, and social interactions within the platform.

Friend groups create shared shopping sessions. Everyone sees the same virtual showroom. Try on digital fashion together. Vote on purchases. Split payment for group buys using multi-signature wallet functionality.

Brands host live events in virtual venues. Product launches become immersive experiences. Limited-edition NFT drops create urgency and exclusivity. Celebrity partnerships bring star power to digital storefronts.

The social layer transforms transactions into experiences worth repeating.

Building on Solana and Binance

Speed matters in virtual environments.

Larecoin built on Solana for sub-second transaction finality. No waiting for confirmations while standing in a virtual checkout line. Instant settlement maintains the shopping flow.

Binance Smart Chain integration provides cross-chain flexibility. Customers hold assets on BSC? No problem. Bridge functionality swaps tokens seamlessly during checkout.

Multi-chain architecture prevents platform lock-in. Merchants accept payments from the widest possible customer base. Technical barriers to entry disappear.

Layer 1 blockchain infrastructure ensures scalability. Millions of simultaneous metaverse shoppers won't congest the network. Transaction throughput handles Black Friday-level traffic in virtual space.

What Happens Next

The metaverse shopping revolution starts now.

Traditional e-commerce evolved from catalog shopping to same-day delivery. Metaverse commerce represents the next leap: immersive, social, instant.

Payment infrastructure determines which platforms win. Clunky checkout processes kill conversion rates. High fees destroy merchant economics. Regulatory uncertainty prevents enterprise adoption.

Larecoin solved all three problems.

Gas-only transfers eliminate fee barriers. NFT receipts add value to every purchase. LUSD stablecoin provides price stability. Self-custody maintains user control. Full licensing enables enterprise deployment.

The future isn't virtual OR physical shopping. It's seamlessly integrated experiences across all channels: powered by crypto-native payment rails.

Ready to build your metaverse storefront? Explore Larecoin's merchant solutions and join the spatial commerce revolution.

The $2.6 trillion metaverse economy needs payment infrastructure that works. We built it.

Comments