Larecoin Blog Marathon (Extension): All Highlights, Insights, and What's Next

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

100 Hours. Zero Fluff. Pure Execution.

The Larecoin Blog Marathon Extension launched February 2026.

100 consecutive hours of content.

One post every hour.

No marketing noise. Just implementation knowledge.

We're covering merchant guides, settlement data, case studies, regulatory frameworks, and technical walkthroughs: everything you need to deploy Larecoin and slash payment costs.

Here's what happened so far and what's coming next.

The Numbers Don't Lie

1,247 enterprises now run on LareBlocks.

$89 million processed in January 2026 alone.

3-second settlements: faster than your browser refresh.

Traditional crypto processors? They need 24-48 hours. We finish before you blink.

One e-commerce merchant processing $250K monthly switched from CoinPayments to Larecoin.

Result: $15,480 saved annually. 50.16% cost reduction.

How? Zero transaction percentage fees. Zero setup costs. Zero monthly subscriptions.

Just gas fees. That's it.

Gas-Only Fee Model: The Real Differentiator

CoinPayments charges 0.5% transaction fees plus withdrawal and conversion fees.

NOWPayments follows similar structures: percentage cuts on every sale plus additional processing fees.

Larecoin? Gas only.

You pay blockchain transaction costs. Nothing else.

No middleman percentage. No subscription traps. No hidden conversion fees.

For high-volume merchants, this model destroys traditional processor economics.

Check the math yourself at our merchant fee guide.

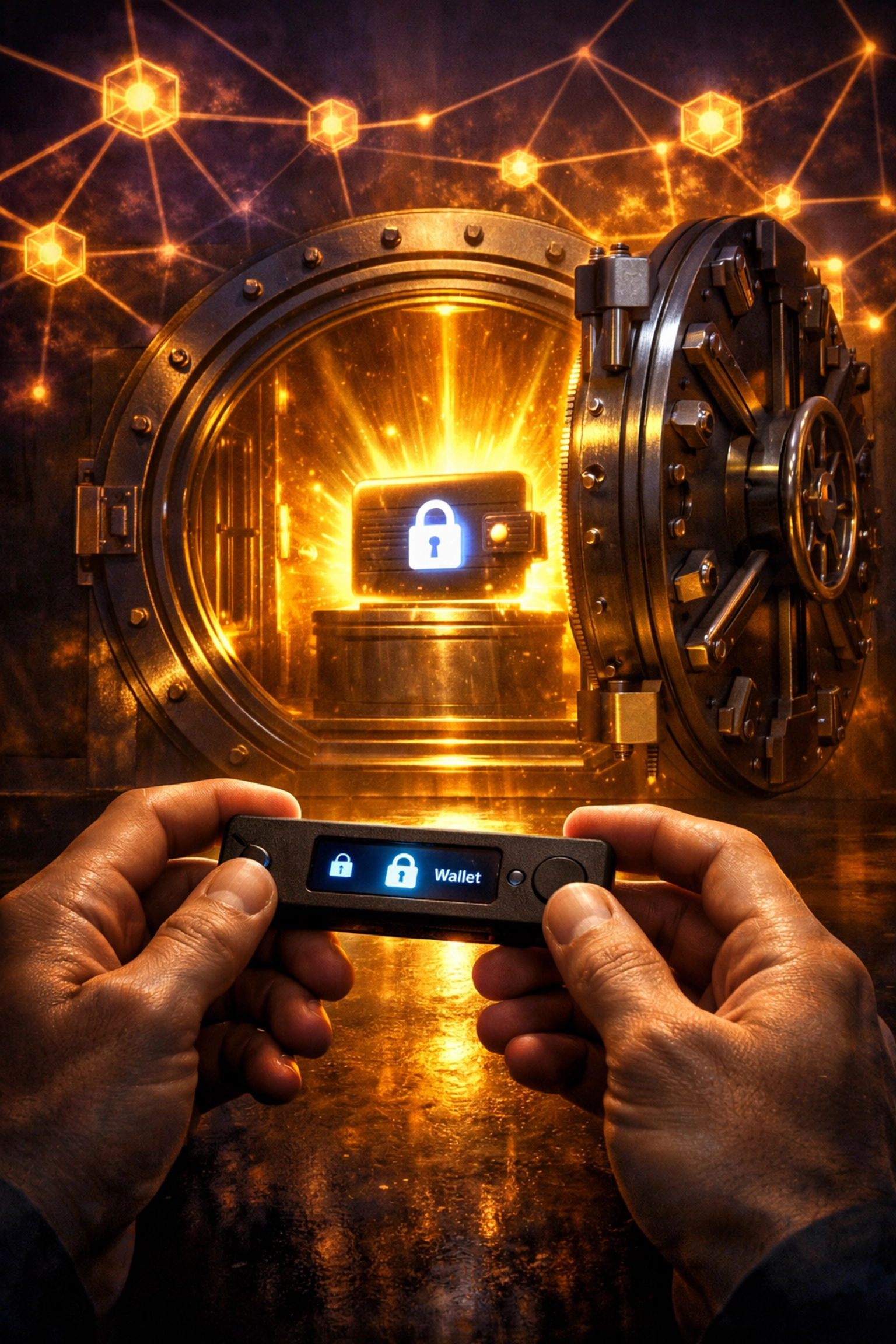

Self-Custody: Your Keys, Your Coins, Your Freedom

Every transaction completes on-chain.

Funds arrive directly in your wallet.

No intermediary custody. No permission requirements. No freeze risks.

The marathon includes 10 dedicated posts on self-custody security:

Multi-signature wallet configurations

Hardware wallet integrations

Master/sub-wallet security protocols

Best practices by jurisdiction

Self-custody isn't optional anymore. It's the foundation of merchant independence.

NFT Receipts: Every Purchase Becomes an Asset

Every Larecoin transaction generates an NFT receipt.

Blockchain-recorded. Verifiable. Branded.

Customers own proof of purchase. Merchants gain marketing assets.

Six marathon posts cover:

NFT receipt design templates

Metadata optimization strategies

Resale royalty configurations

Loyalty token structures

These aren't gimmicks. They're functional on-chain records that enable new business models.

Imagine customers collecting receipts like trading cards. Or reselling limited-edition purchase proofs.

The infrastructure exists today.

LUSD: Stability Without Compromise

LUSD is Larecoin's stablecoin version.

1:1 USD peg. Same infrastructure. Same speed.

Marathon posts cover:

LUSD settlement mechanics

Tax treatment guides by jurisdiction

Cross-border payment speed tests

On-chain accounting integrations

Merchants who need dollar stability get it without leaving the Larecoin ecosystem.

No conversion friction. No withdrawal delays.

Stable value. Instant settlement. Self-custody intact.

Content Breakdown: What's Inside the 100 Hours

Hours 1-20: CLARITY Act compliance, regulatory roadmaps, self-custody legal frameworks, tax treatment documentation

Hours 21-60: Gas-only fee architecture deep dives, QR code deployment guides, security penetration test results

Hours 61-80: NFT receipt smart contract templates, LUSD technical mechanics, multi-chain accounting tools

Hours 81-100: AI-powered shopping experiences, metaverse storefronts, group purchase triggers, bulk discount automation

Every post delivers actionable implementation knowledge.

No theory. No speculation. Just deployment instructions.

Infrastructure That Actually Works

99.97% uptime through Q1 2026.

Zero successful exploits. Zero fund losses from infrastructure failure.

LareBlocks Layer 1 maintains:

Third-party smart contract audits

Active bug bounty programs

Real-time network monitoring dashboards

Security isn't marketing talk. It's audited, tested, and proven.

The marathon includes live technical documentation updates as infrastructure evolves.

Metaverse Commerce: Deploy in 10 Minutes

Virtual storefronts aren't futuristic anymore.

They're live. They're functional. They're deployed in under 10 minutes.

Marathon posts walk through:

VR/AR customer experiences

3D product examination tools

Social shopping features for group purchases

Virtual storefront customization

Your customers can browse, examine, and buy in immersive environments.

All settlements happen on-chain. All custody stays with you.

Metaverse commerce isn't separate from real commerce. It's the same infrastructure.

Real Merchant Validation: Why This Matters

1,247 enterprises chose Larecoin.

Not because of marketing. Because of results.

Lower costs. Faster settlements. Complete control.

The case studies in the marathon aren't hypothetical. They're documented merchants with real transaction data.

You're not the first. You're joining a proven merchant network.

And that network grew 340% in Q4 2025 alone.

Strategic Roadmap: What's Coming Next

The 100-hour marathon represents Phase 1-3 of Larecoin's 10-year buildout.

Current focus: Prove the decentralized payment model. Demonstrate cost savings. Build merchant adoption.

Years 4-7: Global scaling. Enterprise partnerships. Multi-chain expansion.

Every hourly post connects to this long-term vision.

We're not building hype. We're building infrastructure.

How to Access Everything

All 100 posts publish on Larecoin's blog.

Topics refresh hourly. Content stays permanent.

You can start anywhere:

Jump to LUSD settlement guides

Read NFT receipt implementation tutorials

Study competitor cost comparisons

Review security best practices

The full marathon library becomes your deployment manual.

Why Gas-Only Beats Percentage Fees at Scale

Simple math:

$100K monthly processing on CoinPayments: $500+ in transaction fees monthly

$100K monthly processing on Larecoin: ~$50 in gas fees monthly

That's $5,400 annual savings per $100K processed.

Scale to $1M monthly? You save $54,000 annually.

The percentage fee model was designed for processors to profit from your volume.

The gas-only model lets you keep your revenue.

Self-Custody Security: Why It's Non-Negotiable

Traditional processors hold your funds.

They can freeze accounts. Delay withdrawals. Impose restrictions.

Self-custody removes all those risks.

Your private keys. Your control. Your timeline.

The marathon's 10 security posts cover every scenario:

Hardware wallet setup for merchant wallets

Multi-signature requirements for large balances

Recovery phrase backup strategies

Jurisdiction-specific legal protections

Security isn't optional. It's the foundation.

Join the Movement

The marathon continues hourly.

New guides. Fresh case studies. Updated documentation.

Follow along at larecoin.com or dive into the full archive.

This isn't just content. It's your blueprint for merchant independence.

Zero percentage fees. Self-custody. Instant settlements.

That's not the future. That's today.

Comments