NOWPayments Vs CoinPayments Vs Larecoin: Which Crypto POS System Gives Small Businesses True Self-Custody in 2026?

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

The Self-Custody Crisis Hitting Small Merchants

Your crypto isn't yours if someone else controls when you can withdraw it.

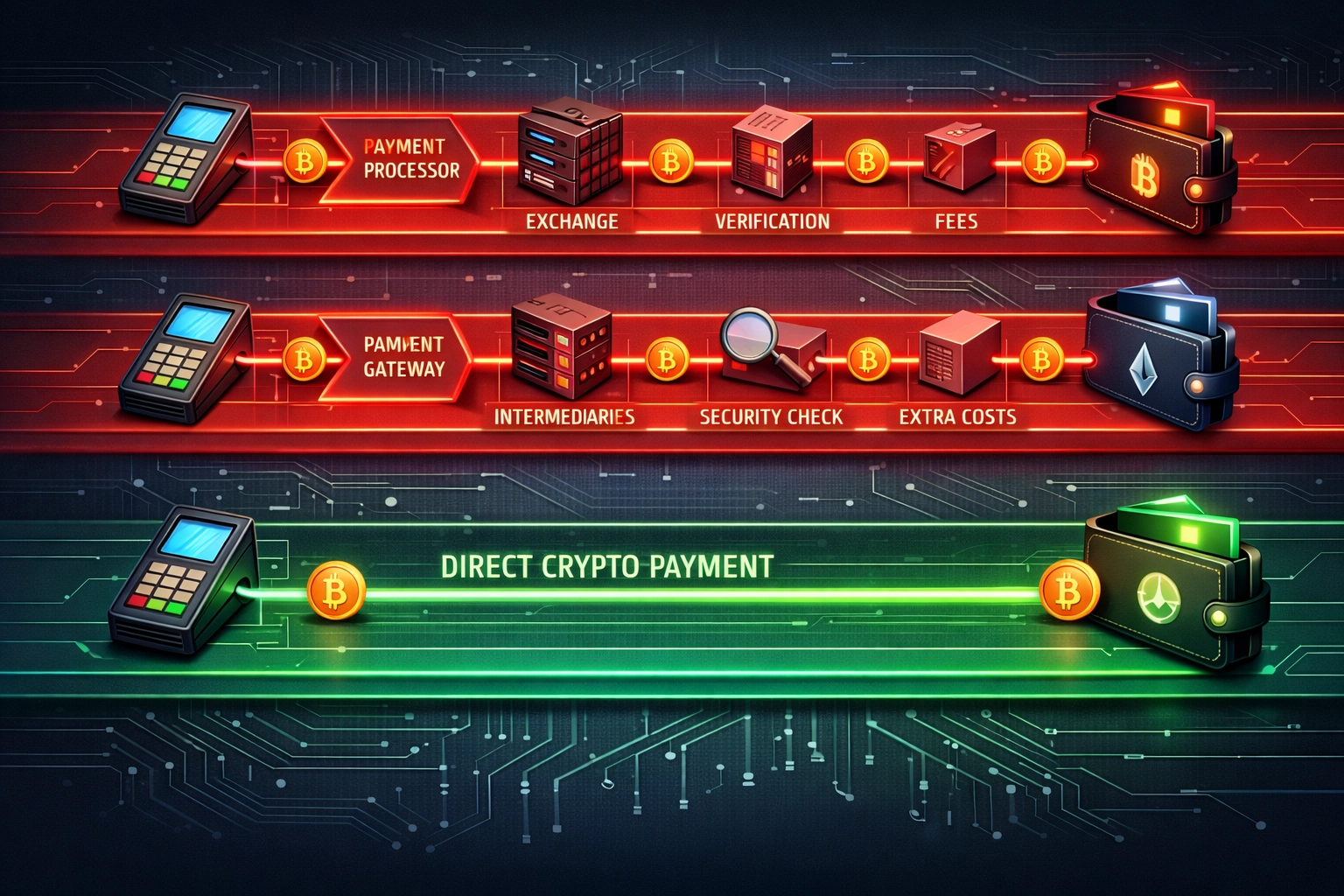

Most "crypto payment processors" in 2026 still operate like traditional banks. They hold your funds. They batch your withdrawals. They freeze accounts without warning.

NOWPayments and CoinPayments dominate the market. Both promise "crypto acceptance." Neither delivers true self-custody.

Here's what small businesses actually get with each platform.

NOWPayments: Custodial Control With Marketing Spin

NOWPayments holds your crypto until YOU initiate a withdrawal.

That's not a payment processor. That's a custodian with extra steps.

The Problems:

Platform dependency for every payout

Withdrawal delays during high-volume periods

Account freeze risks without recourse

Zero blockchain transparency for settlement

KYC gatekeeping for your own funds

They support 150+ cryptocurrencies. Sounds impressive until you realize most merchants need 3-5 options max. The rest creates accounting nightmares.

CoinPayments: Same Story, Different Interface

CoinPayments controls settlement timing on 2,000+ tokens.

More currency options. Same custody problem.

Your funds sit in their system until they decide to release them. Batch processing means delays. Server issues mean frozen payments.

The Reality:

No direct wallet delivery

Intermediary delays on every transaction

Trust-based withdrawal system

Compliance bottlenecks

Platform risk concentration

Both NOWPayments and CoinPayments operate custodial models because they're built on legacy payment architecture. They retrofitted crypto onto traditional processor infrastructure.

Larecoin: Self-Custody By Design

Larecoin delivers funds directly to your wallet. Instantly. Every transaction.

No intermediaries. No withdrawal requests. No custodial control.

How It Works:

Customer pays at your POS

Transaction hits LareBlocks Layer 1

Funds arrive in YOUR wallet immediately

Blockchain verification timestamped on-chain

You control your crypto from the moment payment clears. Zero platform dependency.

The CLARITY Act Advantage

H.R. 3633 classifies digital commodities differently than securities.

Larecoin qualifies as a digital commodity. That means:

Reduced regulatory burden for merchants

No securities licensing requirements

Clear tax treatment for transactions

Simplified compliance frameworks

Protection from SEC overreach

NOWPayments and CoinPayments process dozens of tokens with unclear regulatory status. That risk transfers to YOU as the merchant.

Larecoin's commodity classification under the CLARITY Act eliminates regulatory ambiguity. Your payment processor shouldn't expose you to compliance landmines.

50% Fee Savings: The Real Numbers

Traditional payment processors charge 2.9% + $0.30 per transaction.

NOWPayments: 0.5% - 0.8% depending on volume (still custodial) CoinPayments: 0.5% flat rate (still custodial) Larecoin: 0.2% - 0.4% (with true self-custody)

$10,000 Monthly Revenue Comparison:

Traditional processors: $290 + fees NOWPayments: $50-$80 CoinPayments: $50 Larecoin: $20-$40

That's 50%+ savings versus legacy systems. And 40-60% savings versus custodial crypto processors.

Plus gas fees on LareBlocks are negligible. No withdrawal fees. No custody fees. No surprise charges.

NFT Receipts: Proof of Payment That Actually Matters

Every Larecoin transaction generates an optional NFT receipt.

Blockchain-verified. Timestamped. Immutable.

Use Cases:

Dispute resolution with cryptographic proof

Warranty tracking tied to purchase date

Customer loyalty programs via NFT collection

Tax documentation with on-chain verification

Resale authenticity for high-value items

NOWPayments and CoinPayments provide PDF receipts. Larecoin provides blockchain-verified proof of payment.

One can be forged. The other can't.

LUSD Stablecoin: Price Stability Without Custody Risk

Volatility is crypto's biggest merchant concern.

Accept payment in LARE. Auto-convert to LUSD stablecoin. Still in YOUR wallet.

No custodial exchange needed. No third-party conversion delays. No platform risk.

The Process:

Customer pays 100 LARE

Smart contract auto-swaps to LUSD

Stable value lands in your wallet

Zero price exposure

Traditional processors force you to convert through their systems. Larecoin's swap function operates on-chain through LareBlocks.

Your funds. Your wallet. Your timeline.

LareBlocks Layer 1: Security Through Decentralization

NOWPayments and CoinPayments rely on centralized infrastructure.

Single points of failure. Server downtime. Database vulnerabilities.

Larecoin operates on LareBlocks: a dedicated Layer 1 blockchain built for merchant payments.

Architecture Benefits:

Distributed validator network

No central server dependency

24/7 uptime guarantees

Byzantine fault tolerance

On-chain audit trails

When centralized processors go down, your sales stop. When LareBlocks validators operate across distributed nodes, your payment system stays live.

AI-Powered Metaverse Shopping Integration

2026 isn't just about physical POS terminals.

Larecoin's AI-powered metaverse storefronts let customers shop in virtual environments while paying in LARE or LUSD.

Features:

Virtual product displays with 3D rendering

AI chatbots for customer service

Cryptocurrency checkout in metaverse spaces

Cross-platform inventory management

NFT-based digital goods sales

Check out the full breakdown: 15 Metaverse Shopping Features

NOWPayments and CoinPayments don't even have metaverse integrations planned. They're stuck processing 2D web transactions.

DAO Participation: Merchants As Stakeholders

Custodial processors treat you like a customer.

Larecoin treats you like an owner.

Merchants holding LARE gain DAO voting rights. Propose features. Vote on protocol upgrades. Participate in liquidity pools.

You're not just using a payment processor. You're building the ecosystem.

NOWPayments and CoinPayments are black boxes. Larecoin is open governance.

The Verdict: Self-Custody Wins

Choose NOWPayments if: You need 150 cryptocurrencies and don't mind custodial control.

Choose CoinPayments if: You want 2,000 token options and trust platform withdrawals.

Choose Larecoin if: You want self-custody, 50% fee savings, CLARITY Act protection, NFT receipts, and actual ownership of your crypto.

Most small businesses don't need 150+ currencies. They need reliable settlement, low fees, and control over their funds.

Larecoin delivers all three.

Your crypto. Your wallet. Your business.

Ready to switch? Explore Larecoin's full ecosystem at larecoin.com or dive into merchant solutions in our community discussion hub.

True self-custody starts when you stop asking permission to access your own money.

Comments