Stop Wasting Money on Traditional Payment Processors: Why Receivables Tokens Are the Future of Merchant Freedom

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 3 hours ago

- 5 min read

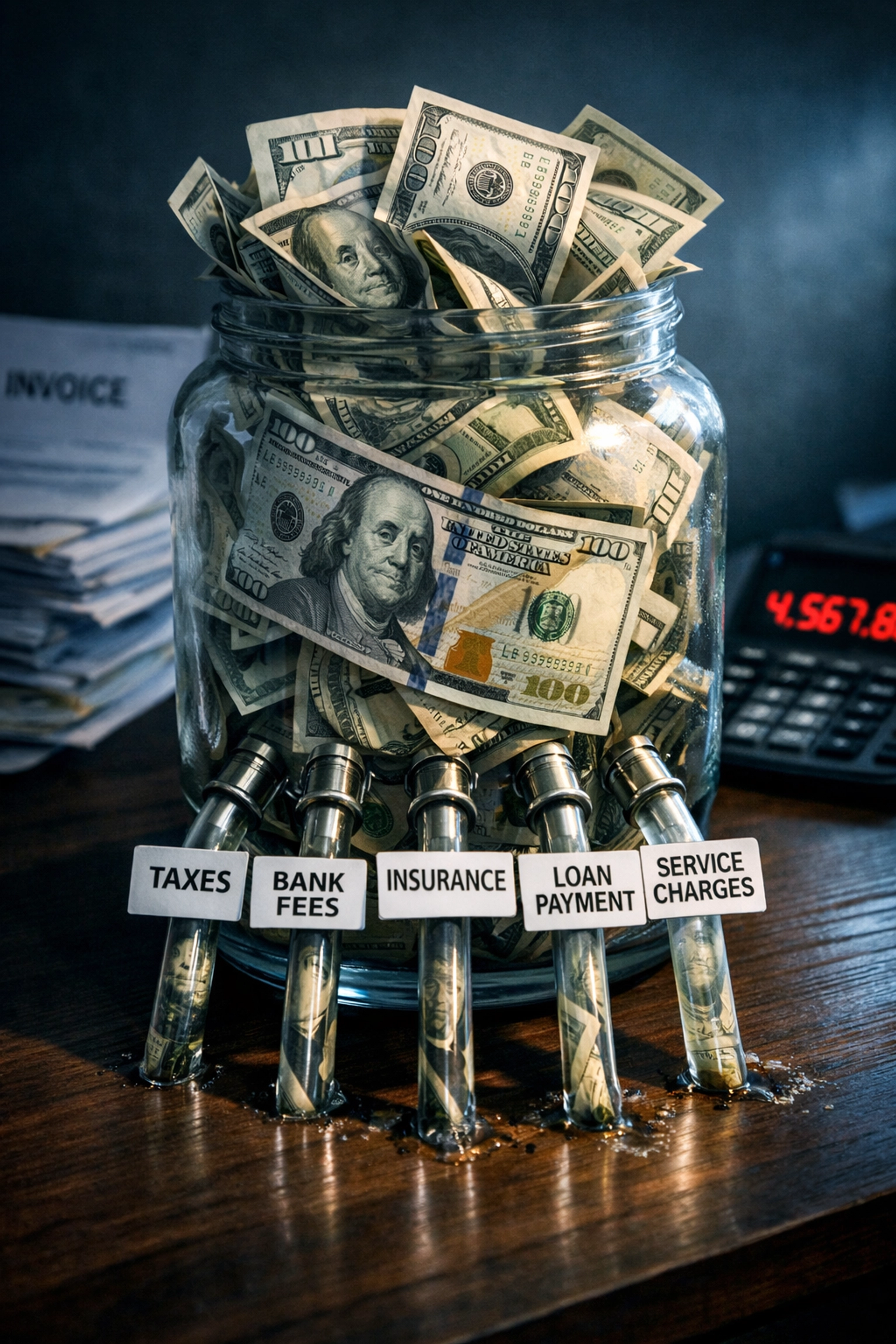

You're bleeding money.

Every single transaction. Every swipe, tap, and click. Traditional payment processors are quietly draining 2-5% of your revenue while holding your funds hostage for days.

The math is brutal. A business processing $500,000 annually loses up to $25,000 in fees alone. Add delayed settlements, account freezes, and chargeback headaches? You're looking at the silent profit killer nobody talks about.

There's a better way. It's called receivables tokens, and it's about to change everything you know about merchant payments.

What the Hell Is a Receivables Token?

Forget everything you know about payment processing.

A receivables token isn't just a digital receipt. It's a blockchain-based programmable proof of payment that eliminates every intermediary between you and your money.

Here's how it works:

Customer pays with LUSD stablecoin or crypto. Transaction hits the blockchain. Receivables token generates automatically. You own it completely through your private keys.

No banks. No processors. No middlemen taking their cut.

The token contains everything: timestamp, amount, item details, wallet addresses, complete transaction metadata. It's your receipt, accounting record, and proof of payment rolled into one immutable blockchain entry.

You control it. Nobody else.

The Traditional Payment Processor Scam

Let's break down what you're actually paying for with traditional processors.

Interchange Fees: 1.5-3.5% per transaction Assessment Fees: 0.13-0.15% Processor Markup: 0.5-1.5% Monthly Gateway Fees: $10-30 PCI Compliance: $50-200/year Chargeback Fees: $20-100 per incident

You're getting nickel-and-dimed to death.

And that's before we talk about:

2-7 day settlement periods (your money held hostage)

Account freezes at processor discretion

Payment holds for "suspicious activity"

Revenue limits and approval requirements

Geographic restrictions

Customer data you'll never own

Every transaction flows through 4-6 intermediaries. Each one takes a cut. Each one adds friction. Each one controls your business more than you do.

How Receivables Tokens Slash Your Costs 85-95%

The numbers don't lie.

Traditional processing: 2.9% + $0.30 per transaction Receivables tokens: Network gas fees only (often under $0.01)

Process $50,000 monthly with traditional methods: $1,450+ in fees Process $50,000 with receivables tokens: $15-75 in gas fees

That's a 95% reduction in payment processing costs.

But the real savings come from what you don't pay:

Zero chargeback fees

Zero monthly gateway fees

Zero PCI compliance costs

Zero account maintenance fees

Zero international transaction fees

Your margin just went vertical.

Instant Settlement Changes Everything

Traditional processors hold your funds for days. They call it "settlement periods." You call it cash flow problems.

Receivables tokens settle instantly.

The moment your customer pays, funds hit your self-custody wallet. No waiting. No holds. No "under review" status.

This isn't just convenient. It's transformative for business operations:

Inventory management: Restock immediately with available cash Supplier payments: Pay net-30 invoices the day they arrive Cash flow forecasting: Know your exact position in real-time Emergency expenses: Access capital when you need it most

You're not begging a processor to release your own money anymore.

Self-Custody Merchant Accounts: True Financial Sovereignty

Here's the paradigm shift.

With traditional processors, you don't have a "merchant account." You have permission to use someone else's system. They own the rails. They make the rules. They can shut you down without explanation.

Self-custody merchant accounts flip this completely.

You hold the private keys. You control the funds. Nobody can freeze your account. Nobody can deny you service. Nobody decides which industries are "acceptable."

This is financial sovereignty in action.

Your receivables tokens live on the blockchain, owned by your wallet, accessible only through your private keys. The system can't ban you because there's no central authority to do the banning.

NOWPayments Alternative: What You're Actually Getting

NOWPayments charges 0.5-1% per transaction plus monthly fees. They custody your funds. They set withdrawal limits. They require KYC documentation.

Receivables tokens cost network gas only. Zero custody. Zero limits. Optional identity verification.

NOWPayments:

0.5% minimum fee

2-7 day settlement to fiat

Custodial model (they hold funds)

Limited stablecoin options

Receivables Tokens:

Gas-only costs (often under $0.01)

Instant settlement

Non-custodial (you hold funds)

Full LUSD stablecoin integration

The difference in merchant freedom is staggering.

CoinPayments Alternative: Beyond Basic Crypto Processing

CoinPayments supports 2,000+ cryptocurrencies. Sounds impressive until you realize it's solving the wrong problem.

Merchants don't need 2,000 payment options. They need low fees, instant settlement, and accounting simplicity.

CoinPayments charges 0.5% per transaction. Requires custody. Offers limited accounting integration. Forces you into their ecosystem.

Receivables tokens give you:

NFT receipts for automated accounting

Direct integration with existing systems

Blockchain-verified transaction records

Complete ownership of payment data

You're not trading one intermediary for another. You're eliminating intermediaries entirely.

NFT Receipts for Accounting: The Hidden Advantage

This is where receivables tokens get wild.

Each token functions as an NFT receipt containing complete transaction metadata. Immutable. Verifiable. Instantly auditable.

Your accountant can verify every sale without touching your bank statements. Tax authorities can audit your books through blockchain verification. No disputes. No questions. Mathematical proof of every transaction.

The accounting benefits compound over time:

Zero receipt organization needed

Automated tax documentation

Instant audit trails

Reduced bookkeeping costs

Simplified reconciliation

You just cut your accounting costs in half while improving accuracy to 100%.

LUSD Stablecoin Benefits: Price Stability Without Centralized Risk

Accepting crypto doesn't mean accepting volatility.

LUSD is a decentralized stablecoin pegged to USD. No central issuer. No bank reserves. No single point of failure.

Tether/USDC Issues:

Centralized control

Bank reserve dependency

Regulatory freeze risk

Blacklist capabilities

LUSD Advantages:

Decentralized collateralization

Protocol-driven stability

Censorship-resistant

Algorithmic peg maintenance

You get dollar stability with crypto freedom. The best of both worlds.

Crypto POS System for Small Business: Setup in Under an Hour

Implementation complexity kills adoption. Receivables tokens solve this.

Setup process:

Create merchant portal account

Generate product QR codes

Customer scans and pays

Receivables token auto-generates

Done

No technical expertise required. No complex integrations. No merchant account applications.

Your crypto POS system is a smartphone and QR codes. That's it.

Small businesses processing $10,000 monthly save $2,900 annually in fees alone. ROI is immediate.

Web3 Global Payments: No Geographic Restrictions

Traditional processors limit where you can operate. Currency conversions eat profits. International fees compound quickly.

Receivables tokens don't care about borders.

Sell to customers in 180+ countries with identical fee structure. LUSD works everywhere blockchain works. No currency conversion. No international transaction fees. No geographic approvals.

Your addressable market just went global overnight.

The Future Is Already Here

Receivables tokens aren't coming someday. They're operational now.

Merchants are slashing fees by 85-95%. Businesses are achieving instant settlement. Companies are operating bank-free for the first time in history.

The question isn't whether receivables tokens work. The question is how long you're willing to keep paying traditional processor fees.

Traditional payment processing was built for the analog era. Card swipes. Phone authorizations. Multi-day settlement periods.

We're living in the digital age. Your payment infrastructure should reflect that.

Make the Switch

Every day you wait is money left on the table.

Calculate your current processing fees. Multiply by 12 months. That's your annual waste.

Now imagine cutting that by 85-95%. What would you do with that capital? Hire another employee? Expand inventory? Finally take a profit distribution?

The path forward is clear. Receivables tokens eliminate intermediaries, reduce fees to gas costs only, and give you complete control of your merchant operations.

Traditional payment processors had their time. That time is over.

Your financial sovereignty starts now. Visit Larecoin and see what merchant freedom actually looks like.

Comments