The Ultimate Guide to Larecoin's Enterprise Ecosystem: NFT Receipts, LUSD Stablecoin, and Charity-Linked Payments

- [[[Free!!]<<<<]] Watch: 스포르팅 - 토트넘 Live Stream 13 September 2022

- 2 hours ago

- 4 min read

Enterprise payment infrastructure just got a major upgrade.

Traditional processors? They're charging 2-3% on every transaction. Converting to crypto through NOWPayments or CoinPayments? Still 0.5-1% platform fees.

Larecoin takes a different approach. Gas-only model. No platform cuts. No hidden charges.

Let's break down what makes this ecosystem work.

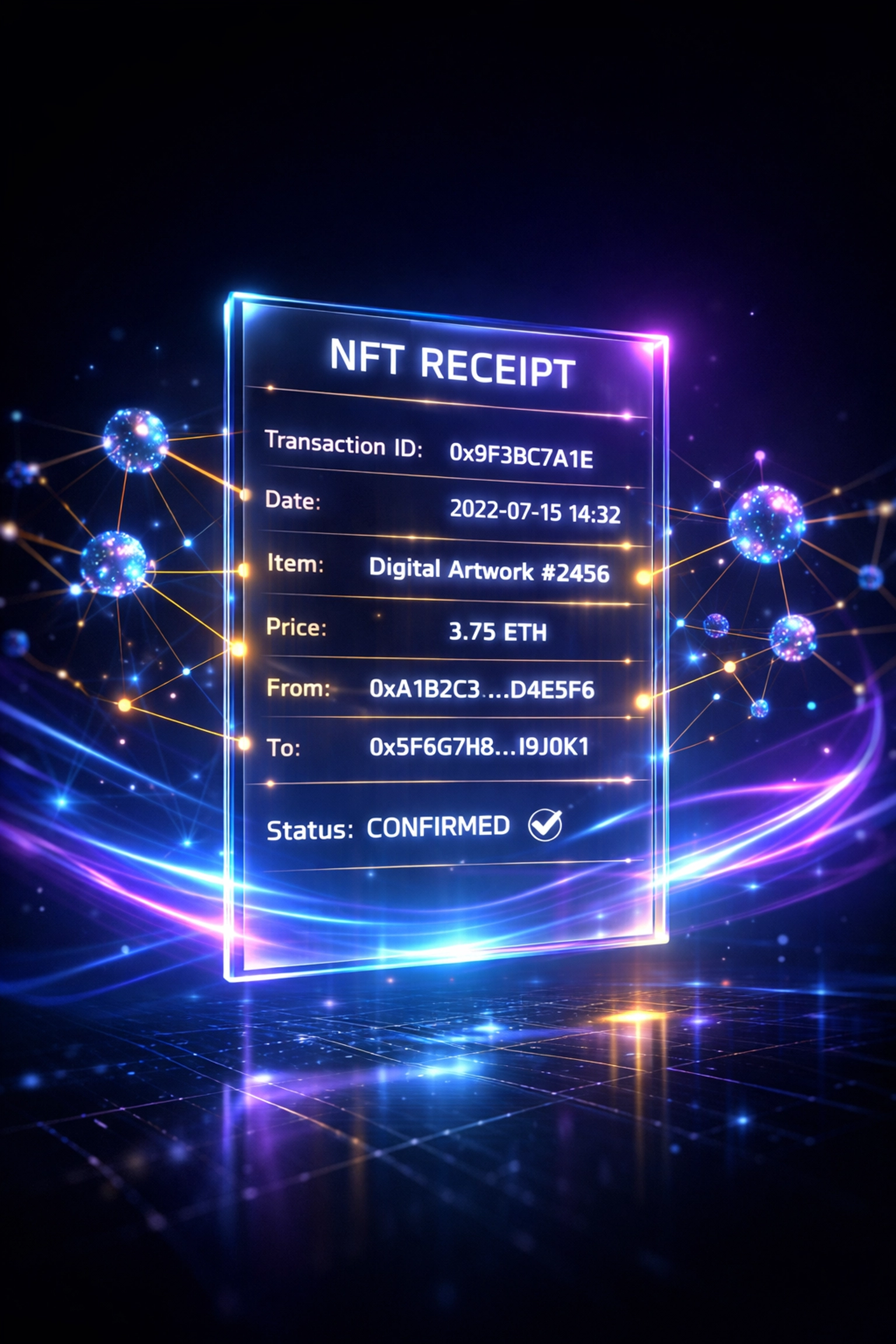

NFT Receipts: Beyond Transaction Records

Every payment generates an NFT receipt.

Stored permanently on LareBlocks. Verifiable. Immutable. Transparent.

But here's where it gets interesting: these aren't just digital copies of paper receipts.

What NFT receipts actually do:

Create permanent blockchain records for every transaction

Enable customers to verify charitable contributions in real-time

Build engagement layers between merchants and customers

Provide audit trails without centralized intermediaries

Transform receipts into ecosystem participation tools

Think about the traditional receipt model. Paper gets thrown away. Email receipts get buried. Nobody looks at them again.

NFT receipts flip that script.

Customers can access transaction history forever. Merchants get independent verification without relying on payment processors. Finance teams audit everything through LareScan without manual reconciliation.

Zero trust required. Everything's on-chain.

LUSD Stablecoin: The Volatility Solution

Crypto volatility kills enterprise adoption.

You can't run a business when your treasury fluctuates 10% daily. Pricing becomes impossible. Accounting turns into a nightmare.

LUSD solves this.

Price-stable. Pegged to USD. Operates within the same wallet infrastructure as LARE tokens.

LUSD enables:

Consistent pricing across all channels

Multi-currency support in a single wallet system

Zero volatility exposure for merchants

Instant liquidity without conversion delays

Enterprise-grade financial operations

Merchants hold LARE and LUSD simultaneously. Master wallet controls both. Sub-wallets access either or both currencies based on permissions.

The beauty? Everything settles instantly. Same-second settlement. Zero internal fees.

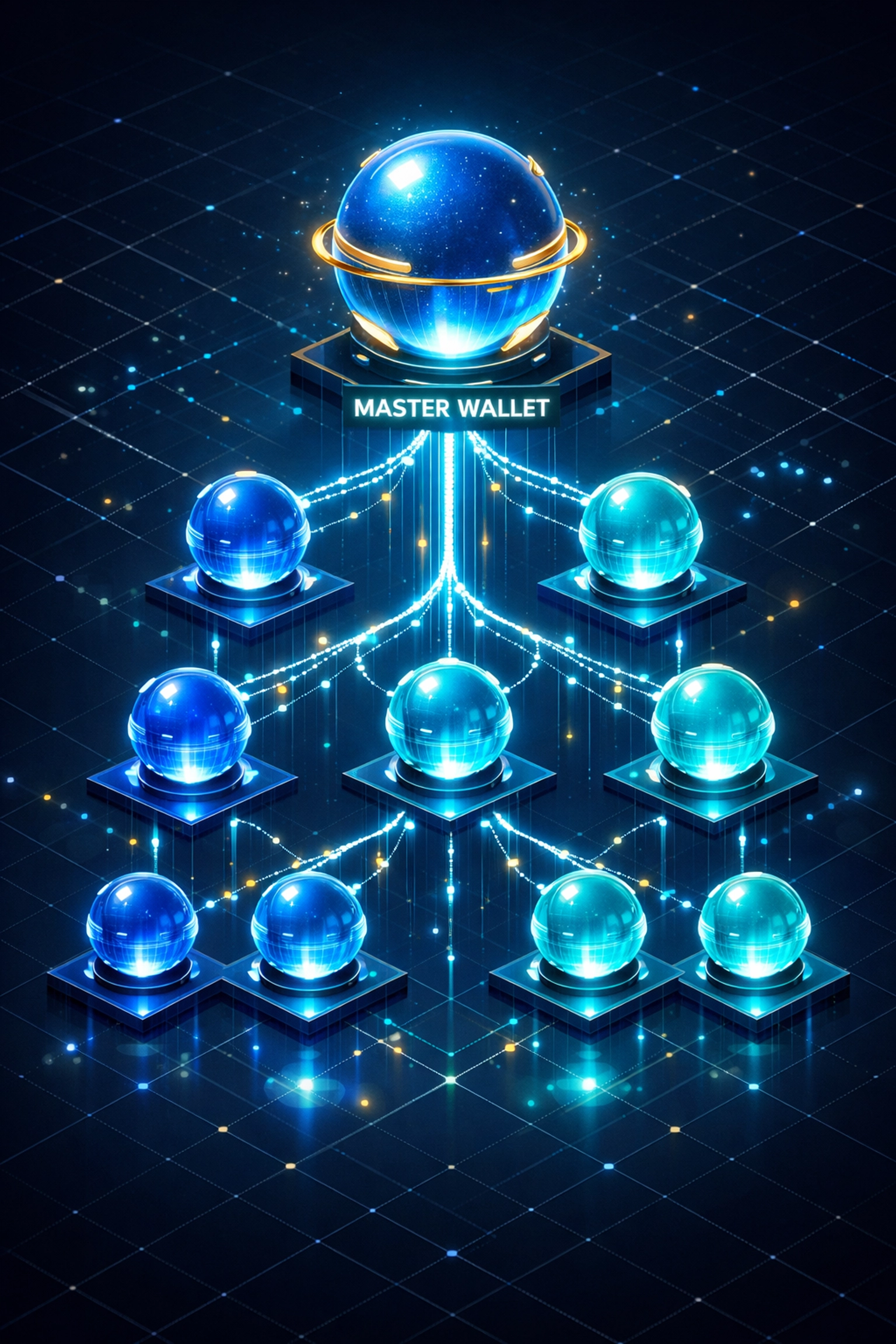

Master/Sub-Wallet Architecture: Enterprise Control Meets Decentralization

This is where Larecoin's enterprise solution really shines.

Traditional business banking forces you into rigid structures. Corporate cards with limited tracking. Branch accounts that require manual reconciliation. Zero visibility into real-time cash flow.

Larecoin's wallet system changes everything.

Master Wallet Functions:

Central treasury control

Full organizational oversight

Permission-based access management

Real-time visibility across all operations

Zero-fee internal transfers

Sub-Wallet Capabilities:

Individual location independence

Customizable spending limits

Department-specific access

Project-based fund allocation

Instant settlement between wallets

Multi-location businesses can mirror their organizational structure exactly. Headquarters maintains master control. Regional offices operate sub-wallets. Individual stores run their own wallets within permission parameters.

Every transaction visible. Every transfer instant. Every record auditable through LareScan.

No waiting for end-of-day batch processing. No reconciliation headaches. No trust required.

Charity-Linked Payments: Transparent Social Impact

Customers increasingly care where their money goes.

Traditional donation systems are black boxes. You contribute. Maybe you get a receipt. Rarely do you see actual impact.

Larecoin's infrastructure enables complete transparency.

How charity-linked payments work:

Every transaction can include optional charitable contributions. Those contributions get recorded as NFT receipts. Customers verify exactly where funds went through LareBlocks.

Merchants can set up automatic donation percentages. Customers see the social impact of their purchases. Charities receive verified, traceable contributions.

All on-chain. All verifiable. All transparent.

No intermediaries taking cuts. No question marks about where donations ended up. Just direct, verifiable social impact.

LareBlocks & LareScan: The Infrastructure Backbone

LareBlocks operates as Layer 1 blockchain infrastructure.

Dual functionality: community features meet enterprise-grade operations.

LareBlocks delivers:

Independent blockchain architecture

NFT receipt storage

Transaction verification

Community governance integration

Cross-chain compatibility

LareScan provides the visibility layer. Complete transaction transparency. Full auditability. Zero centralized trust requirements.

Finance teams access real-time data. Merchants verify payments independently. Customers track their transaction history forever.

Everything visible. Nothing hidden. Total transparency without third-party intermediaries.

Cross-Chain Operations: Maximum Flexibility

LARE tokens work across BSC, Ethereum, Polygon, and Solana.

Automatic bridging. Customers pay on their preferred network. Merchants receive on theirs.

No manual conversions. No friction. No delays.

Cross-chain benefits:

Network flexibility for all participants

Reduced gas fees through network optimization

Broader customer reach across blockchain ecosystems

Seamless user experience regardless of preferred chain

Future-proof infrastructure as new chains emerge

Fee Structure: The Real Competitive Advantage

Let's talk numbers.

Traditional processors: 2-3% per transaction Crypto converters (NOWPayments, etc.): 0.5-1% platform fees Larecoin: Gas-only. Zero platform cuts.

That's 50%+ fee reduction. Minimum.

For a business processing $1M annually:

Visa/Mastercard: $20,000-$30,000 in fees

Crypto converters: $5,000-$10,000 in fees

Larecoin: ~$2,000 in gas fees

The math isn't complicated.

But here's the kicker: you're not just saving fees. You're gaining instant liquidity. Zero volatility exposure through LUSD. Complete custody control. Real-time auditability.

Traditional processors can't compete on any of these dimensions.

Community Governance: Merchant Voice Matters

DAO governance gives merchants actual decision-making power.

Not surveys. Not feedback forms. Actual votes on protocol upgrades, feature priorities, and ecosystem decisions.

Token holders shape the platform. More adoption creates more value. More value attracts more merchants. More merchants drive higher transaction volume.

Self-reinforcing network effects at work.

Integration and Setup

Getting started takes minutes, not months.

Master wallet setup. Sub-wallet deployment. Permission configuration. Done.

No extensive IT integration. No months-long implementation timelines. No complex onboarding processes.

Point-of-sale systems integrate through simple APIs. E-commerce platforms connect via plugins. In-store payments work through QR codes.

Enterprise-grade infrastructure. Consumer-simple deployment.

The Enterprise Ecosystem in Action

Imagine a retail chain with 50 locations.

Headquarters maintains the master wallet. Each store operates a sub-wallet with spending limits. Regional managers oversee groups of stores. Finance teams audit everything in real-time through LareScan.

Customer makes a purchase. Payment settles instantly. NFT receipt generated. If they opted into charitable donation, that's recorded and verifiable on-chain.

Store manager needs to transfer funds to corporate. Zero fees. Same-second settlement. Full audit trail.

Month-end accounting? Already done. Every transaction visible. Every record permanent. Zero manual reconciliation.

That's the Larecoin enterprise ecosystem in practice.

What's Next

The 10-year marathon continues. This is post number [X] of 100 covering Larecoin's complete ecosystem.

NFT receipts. LUSD stability. Master/sub-wallet architecture. Charity-linked transparency. LareBlocks infrastructure. Cross-chain flexibility. Gas-only fees.

Enterprise payment infrastructure rebuilt from the ground up.

Traditional processors had their moment. That moment's over.

Welcome to the next generation of business payments. Welcome to Larecoin.

Comments